GmtFX Flagged for Operating Without Authorisation as Regulatory and Risk Signals Mount

GmtFX has been flagged by Swiss regulators for operating without authorisation. WikiFX data shows no license, low safety scores, and elevated investor risk.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Those who fall victim to investment scams often experience severe financial hardships.

Despite heightened regulatory safeguards, traders lose thousands of dollars to scammers almost every year. Con artists will use anything from social media adverts to phoney websites to dupe investors out of their money. This article explains why we think TradeRyt is a scam concern.

TradeRyt - A Quick Overview

TradeRyt (https://traderyt.com/) is an investment company based in the United States. The company claims to have a team of financial experts who aid individual investors in making profitable trades and investments over the Internet. With 600K+ investors onboarded across the globe and completing 1200+ projects over seven years, the firm boasts affordable investment plans for forex and crypto enthusiasts. The minimum investment required to sign up with the company starts at $1K. Notably, the fund's management company doesn't talk about its regulation status and how it protects clients' money from intruders and markets' volatility.

Is TradeRyt Regulated?

No! TradeRyt isn't regulated. The company neither lists any compliance certificate nor talks about its regulations status within the country. Brokers, exchanges or investment firms operating inside the USA must hold a license from the National Futures Association (NFA) or Commodity Futures Trading Commission (CFTC). However, the firm claims to have been under FCA's supervision, which doesn't make any sense.

Are My Funds Safe With TradeRyt?

No! We don't think so. Since the company doesn't hold any regulations, the team behind the setup can eat your funds without ever being held responsible for their actions. The worst part is that there is no option for recourse.

Why Do We Believe Trade Ryt Is A Scam?

The absence of regulation is the first sign that raised our concerns about the firm's legitimacy. Moreover, when we tried to contact the broker to ask about its regulation status, the company's response was weird.

Secondly, the company promises unrealistic returns, which is yet another red flag that makes the firm suspicious. For instance, it claims to offer a 1.57% daily return for around 14 days on a $5500 investment, making your capital grow by $1200. If that's true, why doesn't the firm share the verified performance of its successful customers?

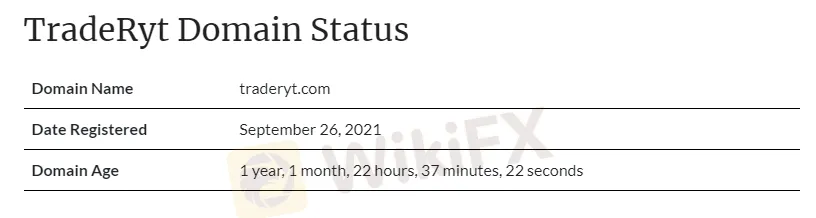

The organization claims to have 6K+ customers onboarded and undergone 12K+ transactions so far. However, it has yet to have a single review from its clients on reputable platforms like WikiFX. Further, the investment firm's domain age is just a year old which reveals another lie of the company for being in operation for seven years.

Lastly, the U.S. Securities and Exchange Commission (SEC) has blacklisted the firm for operating within the country without authorization.

How TradeRyt Scam Investors?

TradeRyt first asks clients to select from the different investment plans and deposit the required amount. After receiving clients' funds, it starts daunting customers to add more funds to avoid becoming liquidated. Clients have reported the company doesn't release their funds in any case.

Bottom Line

Brokers and investment firms that operate outside of the regulatory framework are exempt from reporting requirements to any governing institutions. If you fall for any of their scams, you will lose your money forever. Therefore, you must exercise extreme caution when signup with a brokerage firm and should always ensure to verify its regulations status with concerned authorities.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

GmtFX has been flagged by Swiss regulators for operating without authorisation. WikiFX data shows no license, low safety scores, and elevated investor risk.

A close look at ZarVista's regulatory status shows major red flags that mark it as a high-risk broker for traders. This analysis goes beyond the company's marketing materials to examine the real substance of its licenses, business structure, and operating history. The main issues we will explore include its dependence on weak offshore regulation, a large number of serious user complaints, and worrying details about its corporate identity. It is also important to note that ZarVista previously operated under the name Zara FX, a detail that provides important background to its history. This article aims to deliver a complete, evidence-based breakdown of the ZarVista license framework and its real-world effects, helping traders understand the serious risks involved before investing.

Warning: Multibank Group faces multiple allegations of scams in Vietnam, the UAE, and Italy. Reports include blocked withdrawals, confiscated profits, and fraudulent practices. Stay vigilant and protect your funds.

When traders think about choosing a new broker, two main questions come up: Is ZarVista safe or a scam? And what are the common ZarVista complaints? These questions get to the heart of what matters most—keeping your capital safe. This article gives you a detailed look at ZarVista's reputation using public information, government records, and real experiences from people who used their services. Our research starts with an important fact that shapes this whole review. WikiFX, a website that checks brokers independently, gives ZarVista a trust score of only 2.07 out of 10. This very low rating comes with a clear warning: "Low score, please stay away!" The main reason for this low score is the large number of user complaints. This finding shows that ZarVista might be risky to use. To get the complete picture, we will look at the broker's government approval status, examine the specific complaints from users, check any positive reviews to be fair, and give you a final answer based on fact