GmtFX Flagged for Operating Without Authorisation as Regulatory and Risk Signals Mount

GmtFX has been flagged by Swiss regulators for operating without authorisation. WikiFX data shows no license, low safety scores, and elevated investor risk.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:The hack came just hours after Sam Bankman-Fried resigned as CEO Speculation is rife of an 'inside job'

The FTX drama continues.

Take Advantage of the Biggest Financial Event in London. This year we have expanded to new verticals in Online Trading, Fintech, Digital Assets, Blockchain, and Payments.Just hours after FTX crypto exchange filed for Chapter 11 bankruptcy and Sam Bankman-Fried resigned as CEO, over $600 million disappeared from FTX wallets within a matter of hours with no explanation as to why.

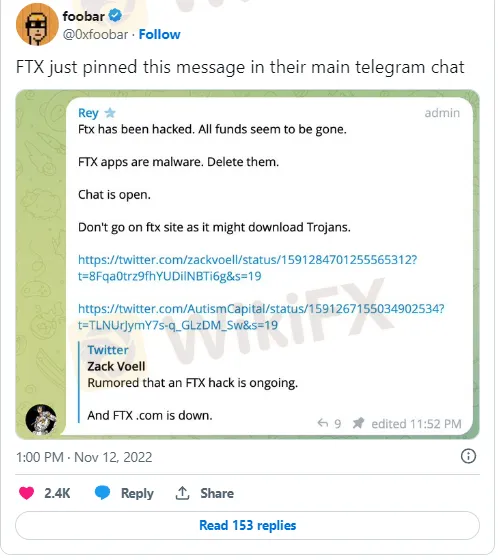

Amid the Friday night confusion, there was speculation that the draining of wallets into a single account was the action of a liquidator or even a regulator. However, shortly after, it was confirmed on the FTX official Telegram channel (now pinned by FTX General Counsel Ryne Miller) that the hundreds of millions of dollars being siphoned off was indeed the action of a hack, as the FTX.com website came offline.

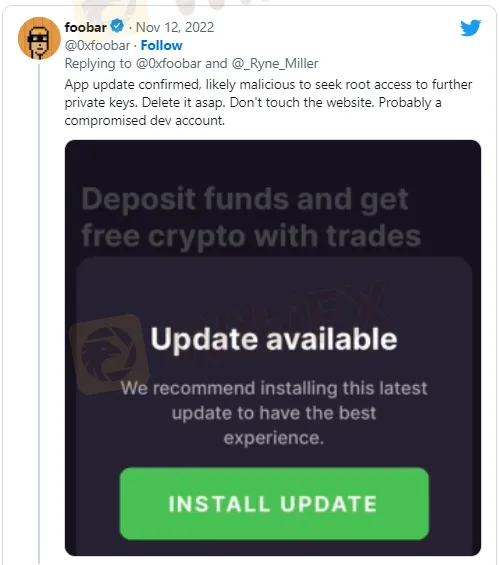

Both FTX and FTX US appear to be affected by what is speculated to be the result of a Trojan, with users of both exchanges reporting balances of $0 in their accounts. Reports are emerging of SMS messages and emails being sent by FTX to customers to log into the app and website, which are infected with a trojan and enabled the hack.

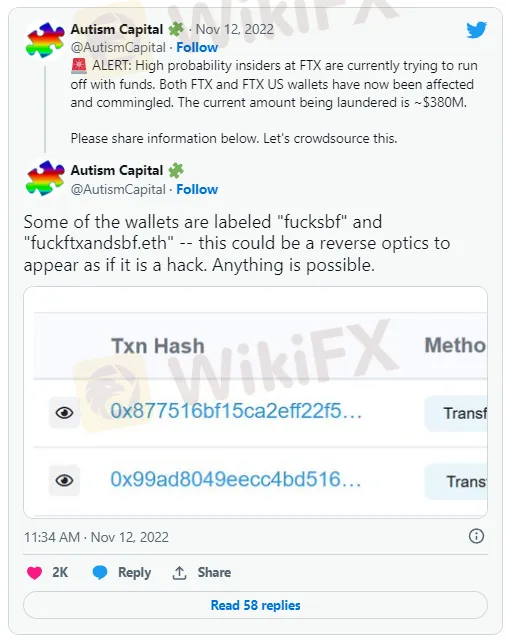

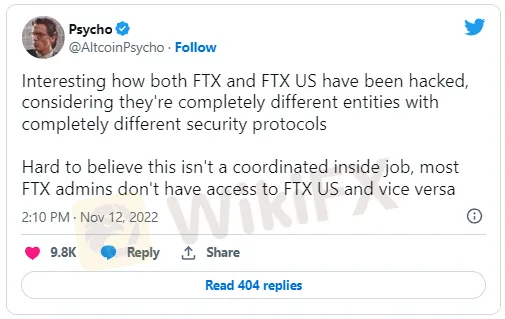

With the attack and account draining appearing to be ongoing at the time of writing, speculation is rife on what is happening and where the money is going. Accusations of an 'inside job' quickly gathered steam on social media.

It does not take Sherlock Holmes to link the draining of accounts to the recently resigned CEO, Sam Bankman-Fried who took to Twitter on Thursday to explain and apologize for his actions. Twitter sleuths were quick to point out why they thought it “hard to believe this isn't a coordinated inside job.”

With the attack understood to be ongoing and details emerging all the time, approximately $1 billion is believed to be drained so far. All FTX and FTX US users are being advised NOT to visit the app or website and delete the app altogether.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

GmtFX has been flagged by Swiss regulators for operating without authorisation. WikiFX data shows no license, low safety scores, and elevated investor risk.

A close look at ZarVista's regulatory status shows major red flags that mark it as a high-risk broker for traders. This analysis goes beyond the company's marketing materials to examine the real substance of its licenses, business structure, and operating history. The main issues we will explore include its dependence on weak offshore regulation, a large number of serious user complaints, and worrying details about its corporate identity. It is also important to note that ZarVista previously operated under the name Zara FX, a detail that provides important background to its history. This article aims to deliver a complete, evidence-based breakdown of the ZarVista license framework and its real-world effects, helping traders understand the serious risks involved before investing.

Warning: Multibank Group faces multiple allegations of scams in Vietnam, the UAE, and Italy. Reports include blocked withdrawals, confiscated profits, and fraudulent practices. Stay vigilant and protect your funds.

When traders think about choosing a new broker, two main questions come up: Is ZarVista safe or a scam? And what are the common ZarVista complaints? These questions get to the heart of what matters most—keeping your capital safe. This article gives you a detailed look at ZarVista's reputation using public information, government records, and real experiences from people who used their services. Our research starts with an important fact that shapes this whole review. WikiFX, a website that checks brokers independently, gives ZarVista a trust score of only 2.07 out of 10. This very low rating comes with a clear warning: "Low score, please stay away!" The main reason for this low score is the large number of user complaints. This finding shows that ZarVista might be risky to use. To get the complete picture, we will look at the broker's government approval status, examine the specific complaints from users, check any positive reviews to be fair, and give you a final answer based on fact