FlipTrade Group: Forex Scam Exposed in Nigeria

Scam alert: FlipTrade Group stole $611 from a Nigerian trader on Feb 2nd via rigged trading contests, no withdrawals. Unregulated broker exposed on WikiFX—learn the case, report, and trade safely now!

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:Founded in 2001, Admiral Markets, also called Admirals, is an online forex brokerage company offering financial services to its clients across the globe. However, as of June 24, 2022, WikiFX has received several complaints against Admiral Markets have reached 4 in the past 3 months. Mr. Shen, who is from China, recently lost about rmb180,000 on a failed investment in Admiral Markets, which gives other investors a serious alert. WikiFX wants to remind you of the potential risks when you plan to invest in this broker shortly.

About Admiral Markets

Founded in 2001, Admiral Markets, also called Admirals, is an online forex brokerage company offering financial services to its clients across the globe. Admiral Markets offers a large range of market instruments, including Forex, Commodities, Indices, Stocks, ETFs, Bonds, Cryptocurrencies, etc. Admiral Markets is a regulated broker. For over 20 years, its fantastic all-around experience contributes to its unshakable status.

Admiral Markets has consistently scored well on WikiFX. However, as of June 24, 2022, WikiFX has received several complaints against Admiral Markets have reached 4 in the past 3 months. There has been a sharp rise in negative ratings associated with Admiral Markets. The biggest problem is that customers are unable to withdraw money from their accounts. Admiral Markets has been plagued by customer complaints since the oil flash crash in late April. Although the oil flash crash itself was a historical incident, Admiral Markets' response and mishandling of such an emergency have damaged its reputation. Mr. Shen, who is from China, recently lost about rmb180,000 on a failed investment in Admiral Markets, which gives other investors a serious alert. WikiFX wants to remind you of the potential risks when you plan to invest in this broker shortly.

The exposure of a victim

On WikiFX, the Exposure consists of feedback from traders. A bad track record of brokers can be checked via Exposure. WikiFXs Exposure function helps you get feedback from other traders and remind you of the risks before it starts. We want to use the case of Mr. Shen as an example to help you understand the current situation of Admiral Markets.

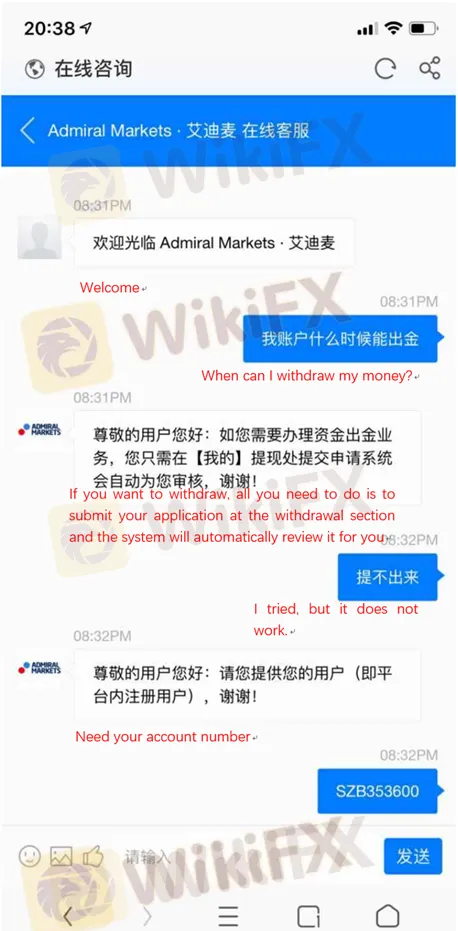

Mr. Shen invested in this broker since 2020. However, he invested around 180,000RMB in this broker. However, when Mr. Shen contacted Admiral Markets and asked to withdraw money from his account. Unpredictably, Mr. Shen cannot take his money back.

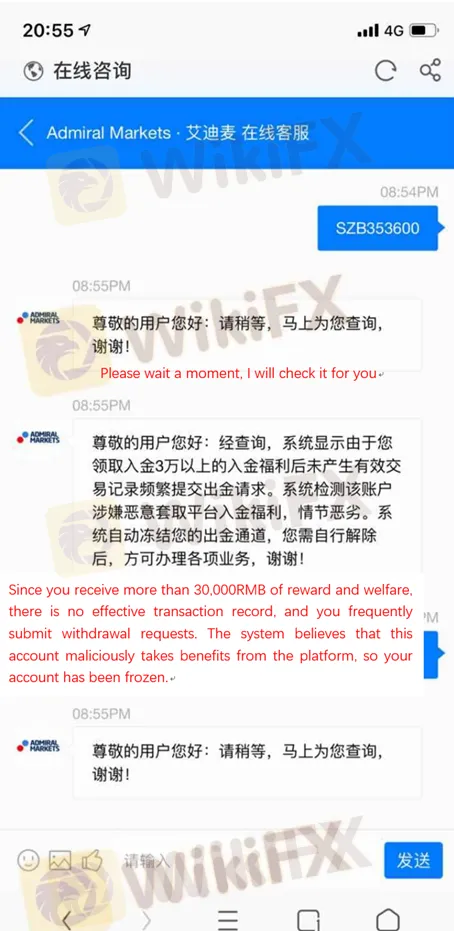

Admiral Markets asked Shen to provide the number of his account. After checking, Admiral Markets refused to withdraw funds because Shen was suspected of maliciously defrauding the welfare of the platform and frequently asked for withdrawing funds. Additionally, Admiral Markets decided to suspend Mr. Shens account.

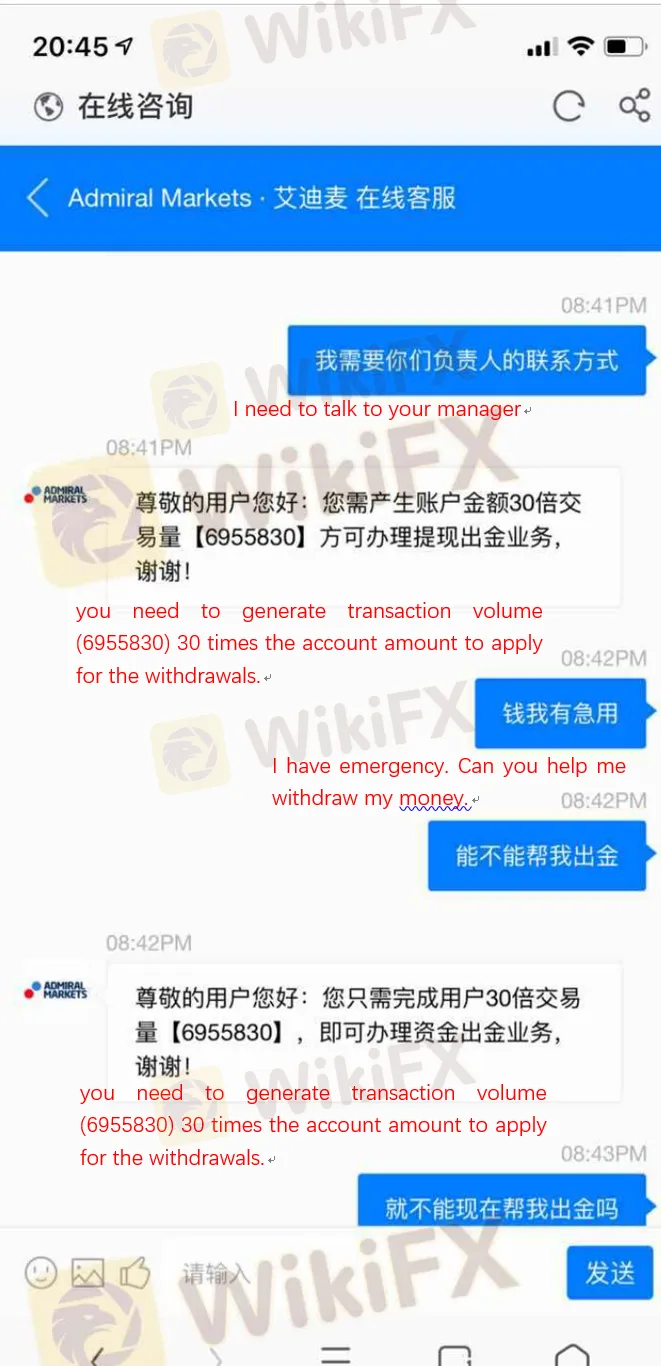

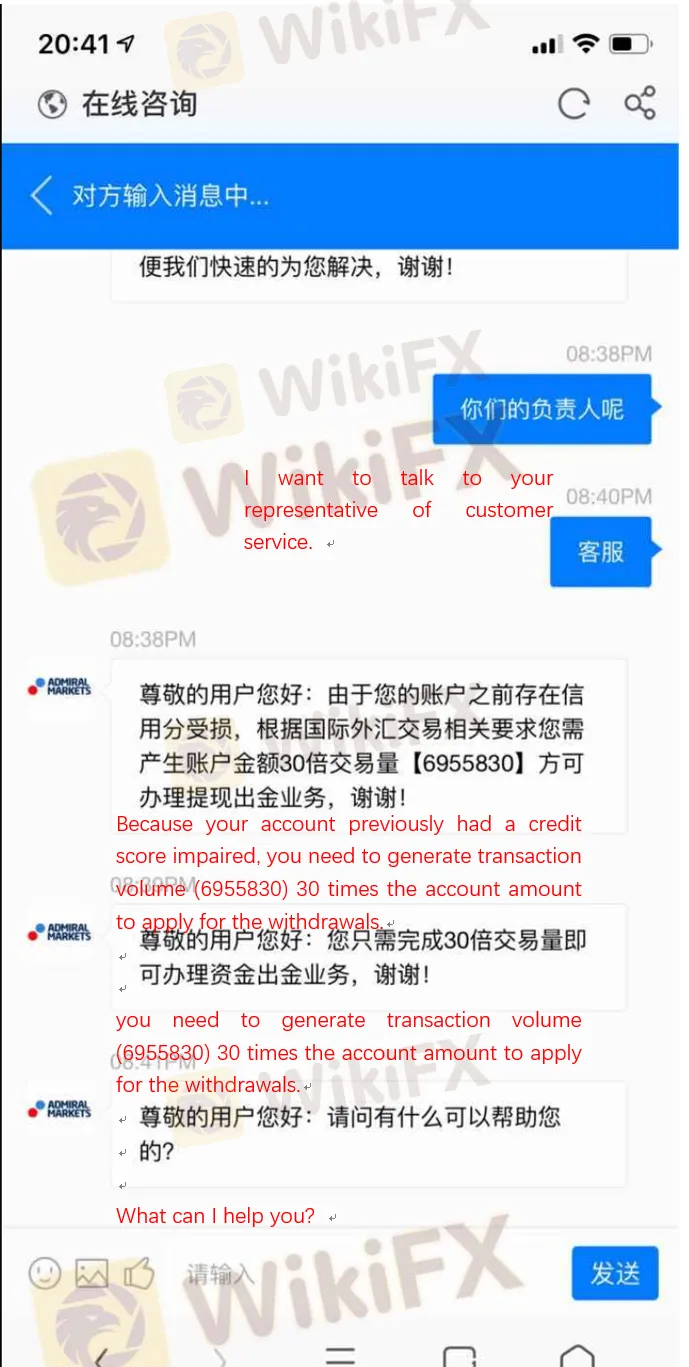

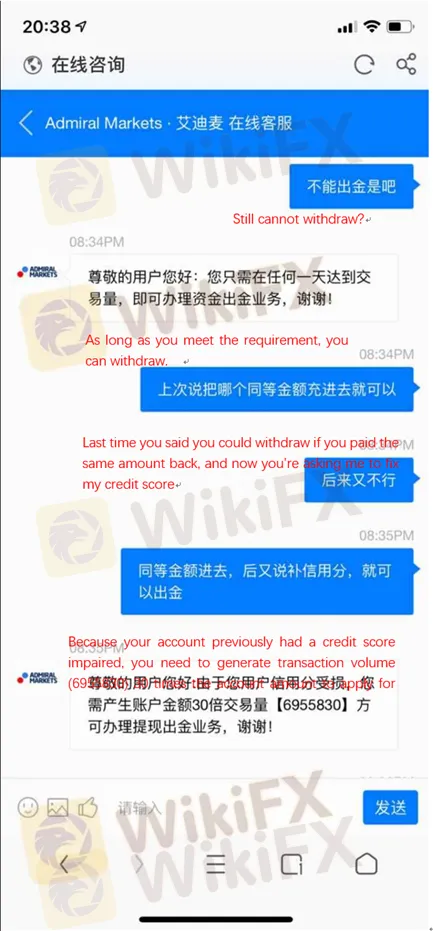

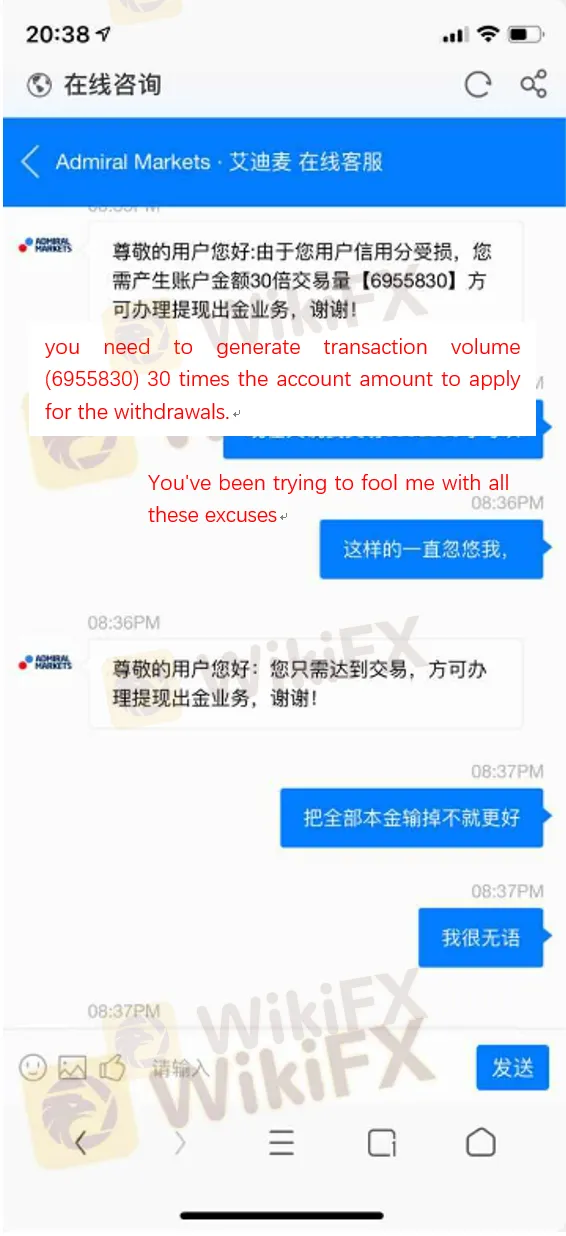

Mr, Shen wanted to talk to the manager of this broker. However, Admiral Markets refused his request. Moreover, Admiral Markets asked Mr. Shen to generate a transaction volume 30 times the account amount to apply for the withdrawals.

In addition, Admiral Markets said Mr. Shen needs to fix his credit score if he wants to take his money back.

According to the above, we can see that Admiral Markets uses a variety of excuses to forbid Mr.Shen to withdraw his investment.

Conclusion

Although Admiral Markets is a famous solid broker in the forex markets, we can not ignore the risks. After all, what happened to Mr.Shen could happen to any of us. We must be vigilant when investing in a broker.

WikiFX is actively reaching out to the victim, hoping to find more evidence to help him resolve the problem. Please stay tuned for more information.

WikiFX will keep track of developments, providing instant updates on individual traders and helping investors avoid unscrupulous brokers. If you want to know whether a broker is safe or not, be sure to open WikiFXs official website or download the WikiFX APP to evaluate the safety and reliability of this broker!

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Scam alert: FlipTrade Group stole $611 from a Nigerian trader on Feb 2nd via rigged trading contests, no withdrawals. Unregulated broker exposed on WikiFX—learn the case, report, and trade safely now!

Trive scam warning: clients in Mexico, India & Hong Kong report stolen funds and blocked withdrawals. Protect yourself—read exposure cases now.

Plus500 forex trading scam alert: multiple cases of blocked withdrawals. Read the warnings and safeguard your money!

WikiFX Elite Club Focus is a monthly publication specially created by the WikiFX Elite Club for its members. It highlights the key figures, perspectives, and actions that are truly driving the forex industry toward greater transparency, professionalism, and sustainable development.