Company Summary

| BullsEye Review Summary | |

| Founded | 2017 |

| Registered Country/Region | Marshall Islands |

| Regulation | No regulation |

| Market Instruments | Forex, cryptos, indices, stocks, commodities |

| Demo Account | ❌ |

| Islamic Account | ✅ |

| Leverage | Up to 1:1000 |

| Spread | From 1 pip (STP Micro/Classic accounts) |

| From 0 pips (ECN, ECN Pro, Prime accounts) | |

| Trading Platform | MetaTrader 4 (MT4) |

| Minimum Deposit | $10 |

| Customer Support | Live Chat |

| Tel: +442032907311 | |

| Email: support@bullseyemarkets.com | |

BullsEye Information

BullsEye Markets, formed in 2017 and registered in the Marshall Islands, is an unregulated broker that offers access to over 175 products, including forex, cryptocurrency, indices, stocks, and commodities. It offers different account types for both novices and advanced traders. However, it does not provide a demo account and lacks top-tier regulatory control.

Pros and Cons

| Pros | Cons |

| Wide range of account types (STP, ECN, Prime) | No regulation |

| Supports MT4 platform | No demo account provided |

| No deposit/withdrawal fees |

Is BullsEye Legit?

No, BullsEye is unregulated. Although the corporation is registered in the Marshall Islands, it does not have any regulatory authorization or control from the local authorities.

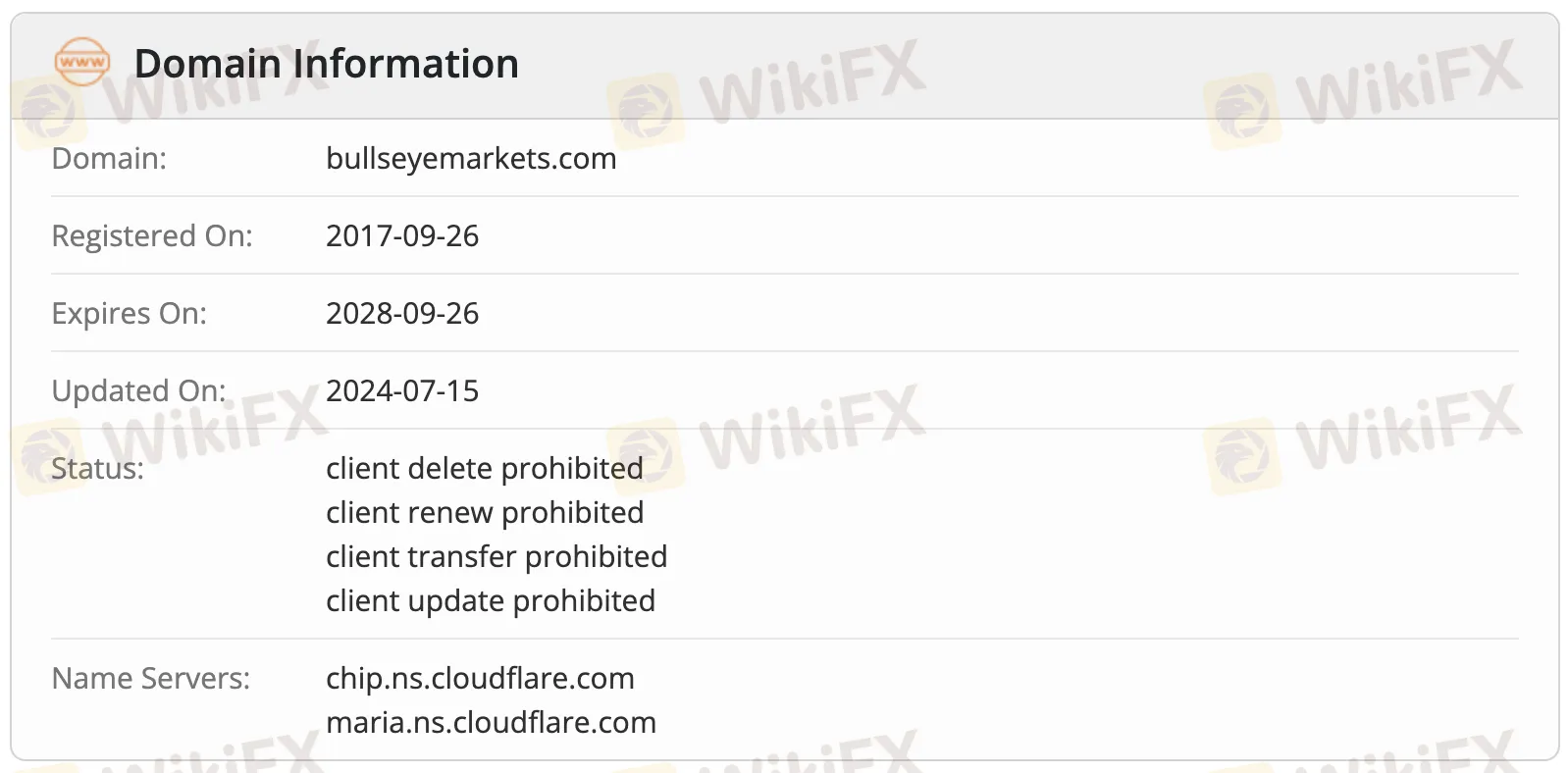

According to Whois lookup, the domain bullseyemarkets.com was registered on September 26, 2017 and will expire on September 26, 2028. The domain was last updated on July 15, 2024, and is presently in protected mode, which prevents client deletion, renewal, transfer, or update, guaranteeing administrative control is firmly maintained.

What Can I Trade on BullsEye?

BullsEye Markets offers access to over 175 financial instruments, including 60+ forex currency pairs, cryptocurrencies, global indices, stocks, and major commodities like oil and precious metals.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| Cryptos | ✔ |

| Indices | ✔ |

| Stocks | ✔ |

| Bonds | ✘ |

| Options | ✘ |

| ETFs | ✘ |

Account Type

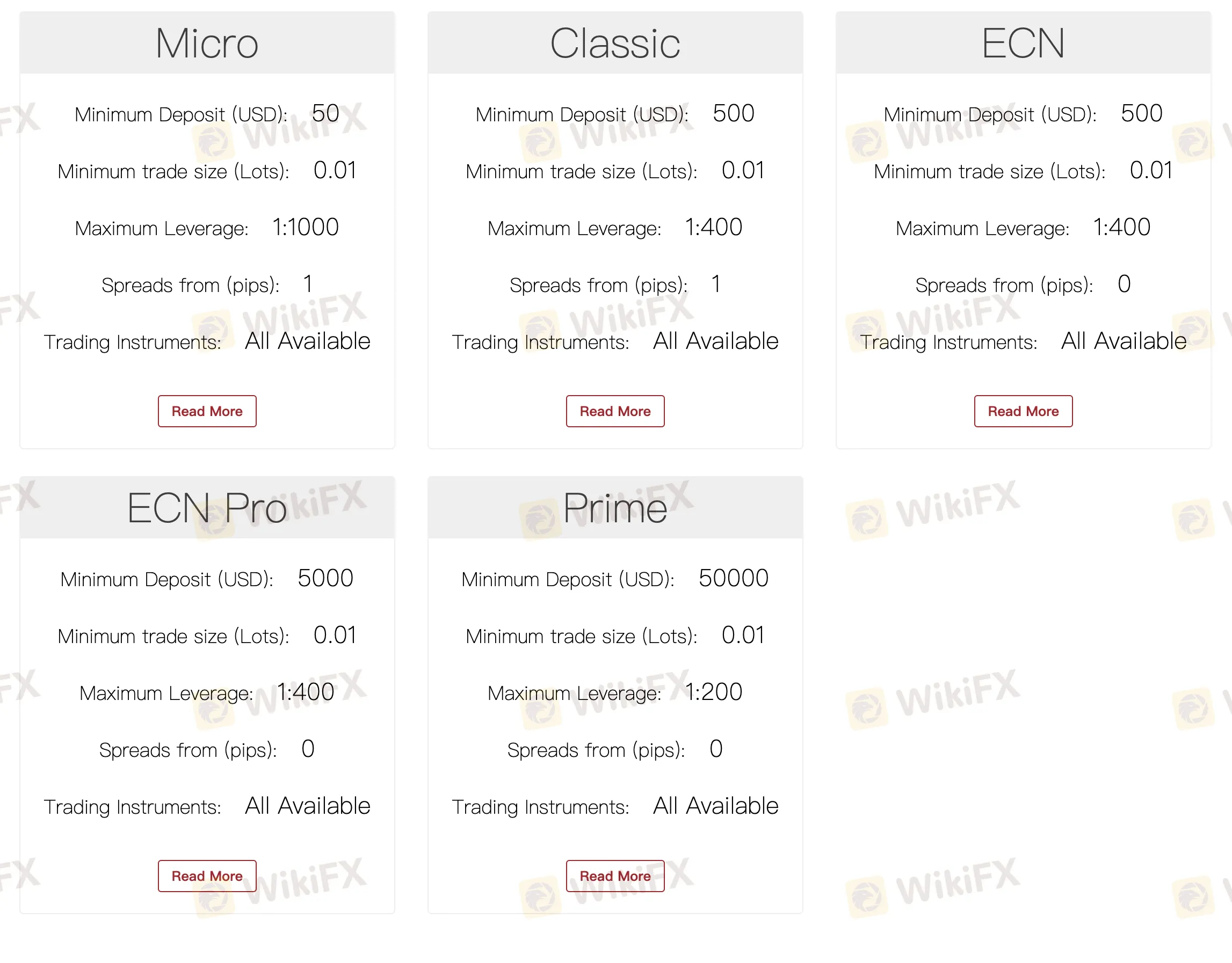

BullsEye has five different live account types: STP Micro, STP Classic, ECN, ECN Pro, and Prime. All accounts have access to the whole spectrum of trading instruments, with variations in minimum deposit, leverage, and spreads to suit novice, advanced, and professional traders. Islamic (swap-free) accounts are offered, however, no demo account is stated.

| Account Type | Minimum Deposit | Minimum Trade Size (Lots) | Maximum Leverage | Spread from | Suitable for |

| Micro | $50 | 0.01 | 1:1000 | 1 pip | Beginners, small traders |

| Classic | $500 | 1:400 | Intermediate traders | ||

| ECN | $500 | 0 pips | Traders wanting tight spreads | ||

| ECN Pro | $5,000 | Advanced, high-volume traders | |||

| Prime | $50,000 | 1:200 | Institutional, VIP traders |

Leverage

BullsEye Markets provides leverage up to 1:1000, allowing traders to manage large positions with a little deposit.

BullsEye Fees

Compared to other companies in the same field, BullsEye Markets' overall costs are reasonable. Their spreads are competitive, but they vary by account type.

| Account Type | Spread from | Commission |

| Micro | 1 pip | 0 |

| Classic | ||

| ECN | 0 pips | ✓ |

| ECN Pro | ||

| Prime |

Non-Trading Fees

| Non-Trading Fees | Amount |

| Deposit Fee | 0 (except wire transfers below $500) |

| Withdrawal Fee | Wire transfers: depend on bank; |

| Credit cards & e-wallets: 0 | |

| Inactivity Fee | Not mentioned |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MetaTrader 4 (MT4) | ✔ | Desktop (Windows, Mac), Mobile, Web | Beginners |

| MetaTrader 5 (MT5) | ✘ | — | Experienced traders |

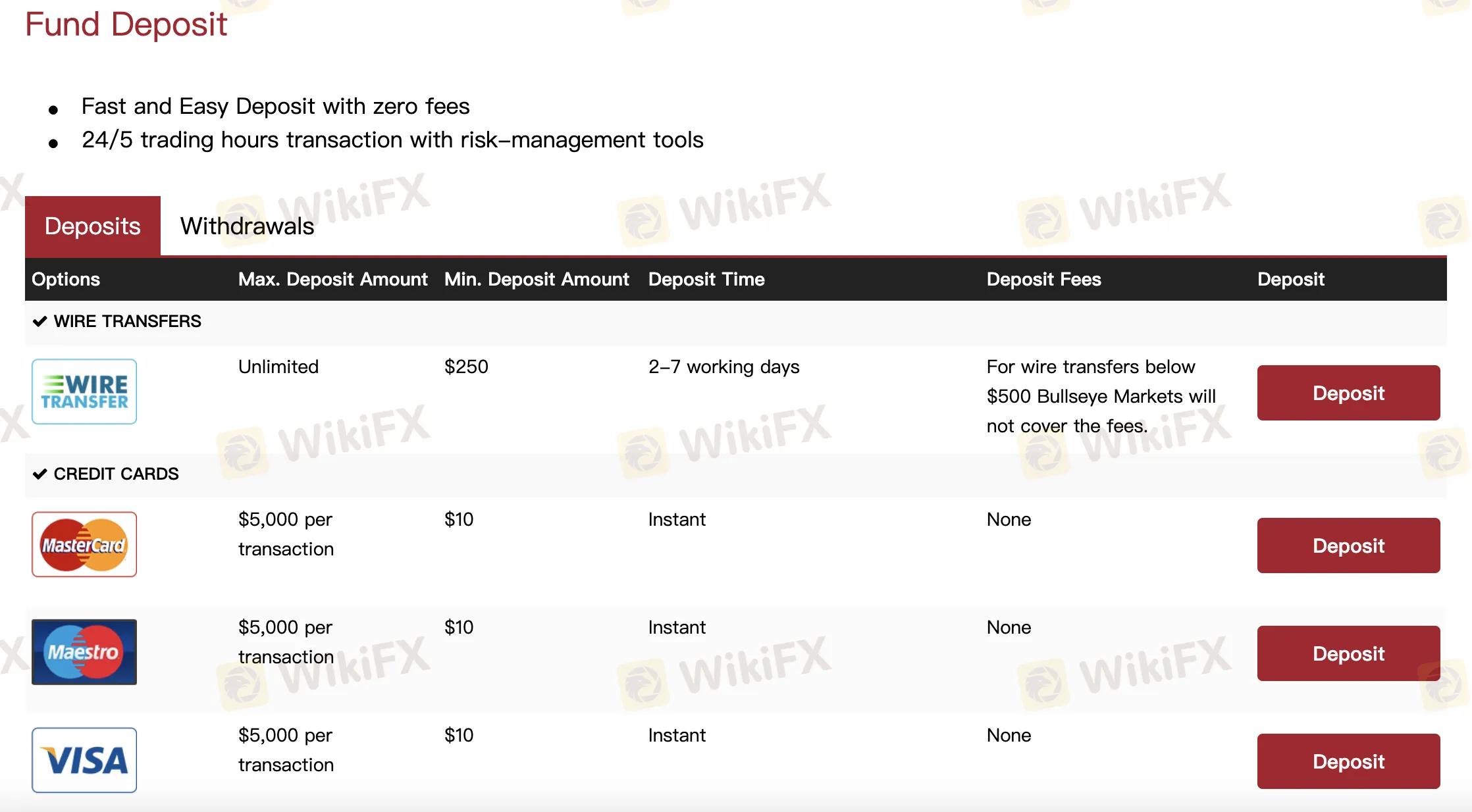

Deposit and Withdrawal

BullsEye Markets does not charge deposit or withdrawal fees (except for wire transfers below $500, where the bank fees are not covered). The minimum deposit starts at just $10.

Deposit Options

| Deposit Options | Minimum Deposit | Deposit Fees | Deposit Time |

| Wire Transfer | $250 | Fees below $500 not covered | 2–7 working days |

| MasterCard | $10 | 0 | Instant |

| Maestro | |||

| Visa | |||

| Visa Electron | |||

| American Express | |||

| Bitcoin | Up to 10 minutes | ||

| Skrill | Instant | ||

| Neteller |

Withdrawal Options

| Withdrawal Options | Minimum Withdrawal | Withdrawal Fees | Withdrawal Time |

| Wire Transfer | $250 | Depends on bank | 2–7 working days |

| MasterCard | $10 | 0 | |

| Maestro | |||

| Visa | |||

| Visa Electron | |||

| American Express | |||

| Skrill | Up to 24 hours | ||

| Neteller |