Company Summary

| Atlanta Capital Markets Review Summary | |

| Founded | 1-2 years |

| Registered Country/Region | United Kingdom |

| Regulation | Not regulated |

| Market Instruments | Forex, Indices, Precious metals, Share CFDs, Energies, Cryptocurrencies |

| Demo Account | Available |

| Leverage | Up to 1:500 |

| Spread | From 0 pip |

| Trading Platform | AAT, MT5, MT4 |

| Min Deposit | $100 |

| Customer Support | Phone: +44 0 20 2266 9720Email: support@acmimarkets.comAddress: ACMMarkets UK HQ 78 Basinghall str., City of London, EC2V 5BQ, UK |

Atlanta Capital Markets Information

Atlanta Capital Markets is an unregulated brokerage firm registered in the United Kingdom. The company offers a range of investment options including forex, indices, precious metals, share CFDs, energies, cryptocurrencies through its advanced trading platforms such as AAT, MT5 and MT4.

Pros and Cons

| Pros | Cons |

| Leverage options available (up to 1:500) | No valid regulatory certificates |

| Various trading platforms (AAT, MT5, MT4) | Shared CFDs are only available on ECN accounts |

| Demo account available | Higher spreads for STP accounts |

Is Atlanta Capital Markets Legit?

Atlanta Capital Markets is currently in a state of no effective supervision. Therefore, there is a high risk of investment with Atlanta Capital Markets.

What Can I Trade on Atlanta Capital Markets?

Atlanta Capital Markets offers more than 180 tradable instruments. It provides traders the opportunity to trade Forex, Indices, Precious metals, Share CFDs, Energies, and Cryptocurrencies.

| Tradable Instruments | Supported |

| Commodities | ❌ |

| Indices | ✔ |

| Currencies | ❌ |

| Crypto currencies | ✔ |

| Shares CFDs | ✔ |

| Forex | ✔ |

| Energies | ✔ |

| Precious metals | ✔ |

| Futures | ❌ |

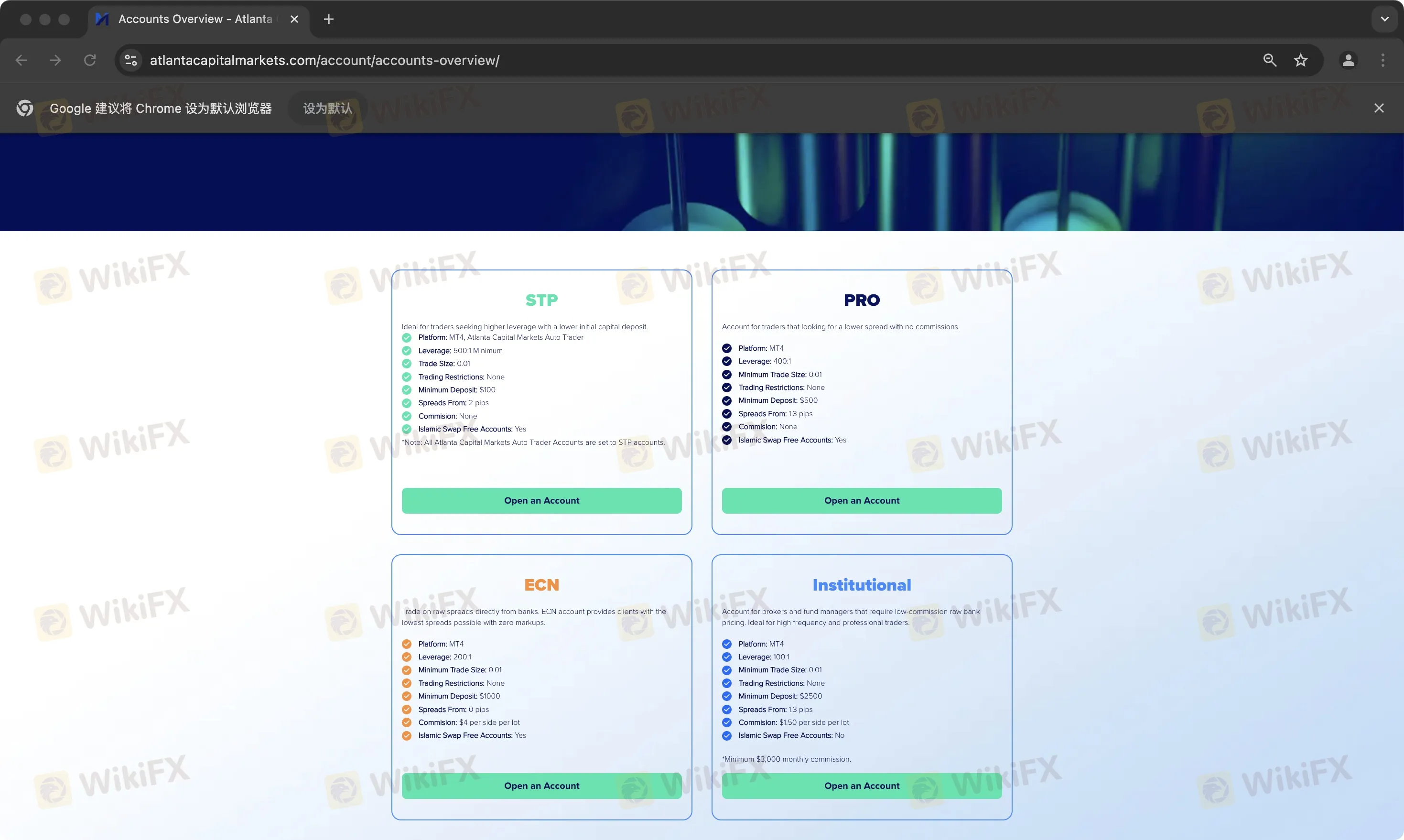

Account Types

Atlanta Capital Markets offers four live account types, namely STP account, PRO account, ECN account and Institutional account.

In addition, Atlanta Capital Markets also offers demo accounts.

Besides, shared CFDS are only available for ECN accounts.

| Account Type | STP | PRO | ECN | Institutional |

| Minimum Trade Size | 0.01 | 0.01 | 0.01 | 0.01 |

| Trading Restrictions | None | None | None | None |

| Minimum Deposit | $100 | $500 | $1,000 | $2,500 |

| Spreads From | 2 pips | 1.3 pips | 0 pips | 1.3 pips |

| Commission | None | None | $4 per side per lot | $1.50 per side per lot |

| Islamic Swap Free Accounts | Yes | Yes | Yes | No (minimum $3,000 monthly commission) |

Leverage

The leverage ratio varies between different account types, with 500:1 for STP accounts, 400:1 for PRO accounts, 200:1 for ECN accounts, and 100:1 for Institutional accounts

| Account Type | STP | PRO | ECN | Institutional |

| Leverage | 500:1 | 400:1 | 200:1 | 100:1 |

Atlanta Capital Markets Fees

STP, PRO, ECN and Institutional accounts are different in terms of speads. STP spreads start at 2.0, PRO spreads start at 1.3, and ECN account spreads start at 0.0. Institutional account spreads start at 1.3 pips. STP and PRO commissions are free. Fees for ECN accounts and institutional accounts are 4 and 1.5 respectively. Finally, STP, PRO, ECN accounts are swap-free, except for institutional accounts.

| Account type | Fees |

| STP | Spreads From 2.0 pips, commission-free, swap-free |

| PRO | Spreads From 1.3 pips, commission-free, swap-free |

| ECN | Spreads From 0.0 pips, commission: $4 per side per lot, swap-free |

| Institutional | Spreads From 1.3 pips, commission: $1.50 per side per lot, no swap-free |

Trading Platform

Atlanta Capital Markets offers its proprietary platform, namely the Atlanta Capital Markets Automated Trader (AAT). This platform is designed for novice traders or traders who do not have time to trade. Other popular platforms such as MT5 and MT4 are also available here.

| Trading Platform | Supported | Available Devices | Suitable for |

| Atlanta Capital Markets Auto Trader | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

| MT5 | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

| MT4 | ✔ | Windows, MAC, IOS, Android | Investors of all experience levels |

Deposit and Withdrawal

Atlanta Capital Markets offers clients nine options for deposit and withdrawal . Financing via Swift, Dragonpay or credit and debit cards (Zotapay) may take up to 1 business day. Other deposit options support instant financing.

Withdrawals are processed within 24 hours on weekdays. Depending on the withdrawal method, the funds will usually reach your account within a few hours.

| Deposit Options | Min. Deposit | Fees | Processing Time |

| Credit & Debit Card (VISA, Mastercard) | N/A | No Commission | Instant funding |

| Bank Transfer (SWIFT) | N/A | No deposit fees charged from ACM Markets. Atlanta Capital Markets will cover your International fees up to 50 USD for deposit greater than 10,000 USD | 1 business day |

| Neteller | N/A | No Commission | Instant funding |

| Skrill | N/A | No Commission | Instant funding |

| Local Bank Transfer (PayTrust88) | N/A | No Commission | Instant funding |

| Credit & Debit Card | N/A | No Commission | Instant funding |

| Dragonpay | N/A | No Commission | 1 business day |

| Credit & Debit Card (Fasapay, Zotapay) | N/A | No Commission | Instant funding |

| Credit & Debit Card (Zotapay) | N/A | No Commission | 1 business day |

| Withdrawal Options | Min. Withdrawal | Fees | Processing Time |

| Credit & Debit Card (VISA, Mastercard) | N/A | No Commission | Within 24 hours |

| Bank Transfer (SWIFT) | N/A | No Commission | Within 24 hours |

| Neteller | N/A | No Commission | Within 24 hours |

| Skrill | N/A | No Commission | Within 24 hours |

| Local Bank Transfer (PayTrust88) | N/A | No Commission | Within 24 hours |

| Credit & Debit Card | N/A | No Commission | Within 24 hours |

| Dragonpay | N/A | No Commission | Within 24 hours |

| Credit & Debit Card (Fasapay, Zotapay) | N/A | No Commission | Within 24 hours |

| Credit & Debit Card (Zotapay) | N/A | No Commission | Within 24 hours |

FX3968801262

Vietnam

On 17/07/2025, I executed a Sell CFD trade for ZINC on MT5 through Atlanta Capital Markets (ACM): Volume: 50 lots Execution price: 2705 Just 30 minutes later, the order was automatically closed at 2745, while the market price at that time was fluctuating around 2706–2707. Result: a loss of 100.000 USD, and the account was completely "wiped out". 1. Request for Explanation I have submitted a formal request to ACM for clarification on: The order matching mechanism of their system. The actual spread and liquidity at the time of order closure. System logs and technical processing. Status: ACM has failed to provide a complete response despite the deadline passing, raising suspicions of intentionally withholding information. 2. Suspicious Indicators Based on comparisons with independent price data: The closing price showed abnormal discrepancies from the market. No clear reason was given for the automatic order closure. Lack of transparency regarding liquidity data. These factors align with patterns of price manipulation or staged scenarios to appropriate assets. 3. Call to the Community I urge fellow traders to: Share similar incidents.

Exposure

FX3337314102

Vietnam

This platform, everyone stay away from it, it's a scam, interfering with accounts causing losses. I lost nearly 30k on this platform. The platform automatically adjusts the lot size of trading accounts. I traded stocks and the platform automatically adjusted them to 50 lots of gold. So everyone, stay away from this platform.

Exposure

Phương Trần

Hong Kong

Today is October 23, 2024. At 9:55 PM, when I placed a buy order at 2716, the exchange pushed the price up to 2721. While my account was almost burning, even though the current price was 2716, when I checked my placed orders, oh no, the price was at 2712. The exchange manipulated the price by 9 pips and then I blew up my account. On another note, first, the exchange's IB will contact me, then inquire and lead me into a group called Quang Huy Trading. At first, there will be no conditions. Occasionally, they will give me a signal to enter a trade. And that trade will be profitable. After feeding me a few times, they will kick me out of the group. The exchange's IB will contact me and ask me to open an account, contribute capital to receive additional bonuses, and be accompanied by an expert to increase the chances of winning trades. Everything seemed normal until I couldn't withdraw money from my account. I placed a withdrawal order. The exchange sent an email stating that it would be processed within 24 hours, but after waiting for 2-3 days, there was no response. I waited from one day to another and didn't receive a single penny. I seriously accuse this exchange. Everyone should avoid it!

Exposure

Trung1252

Vietnam

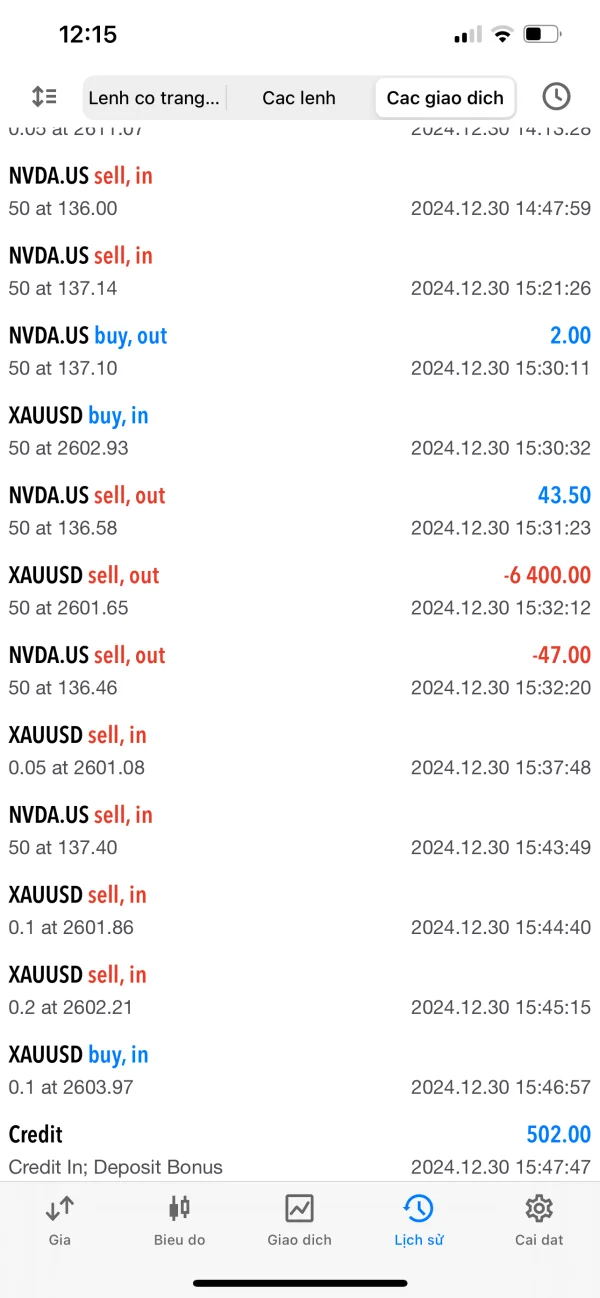

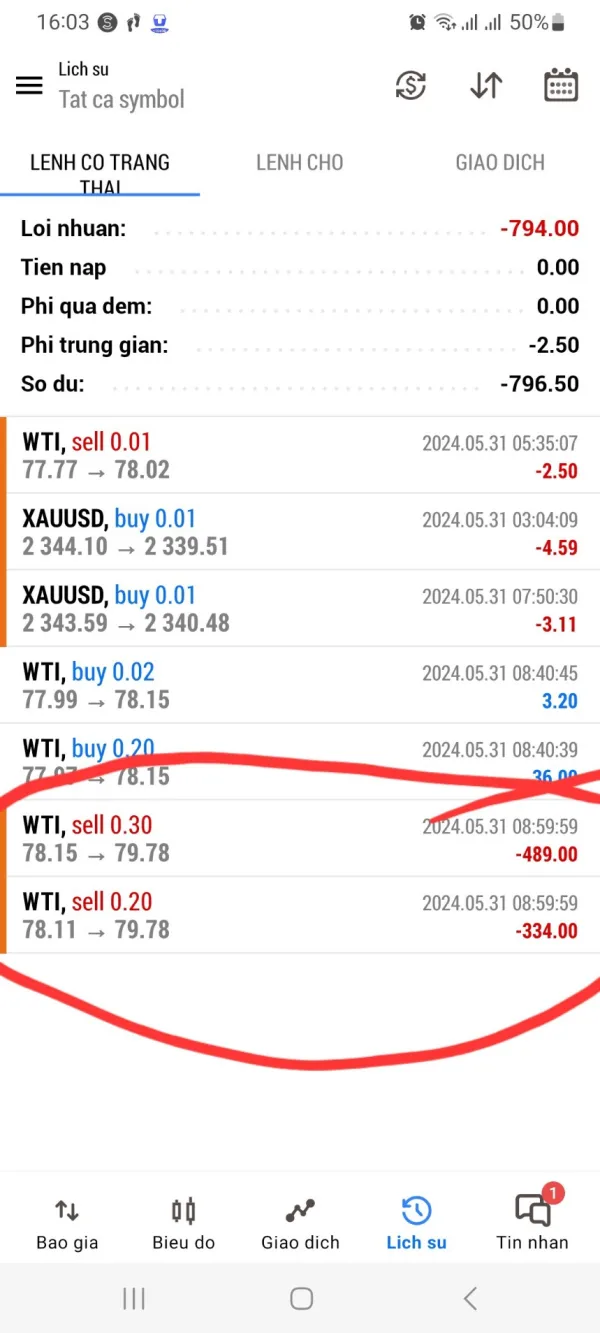

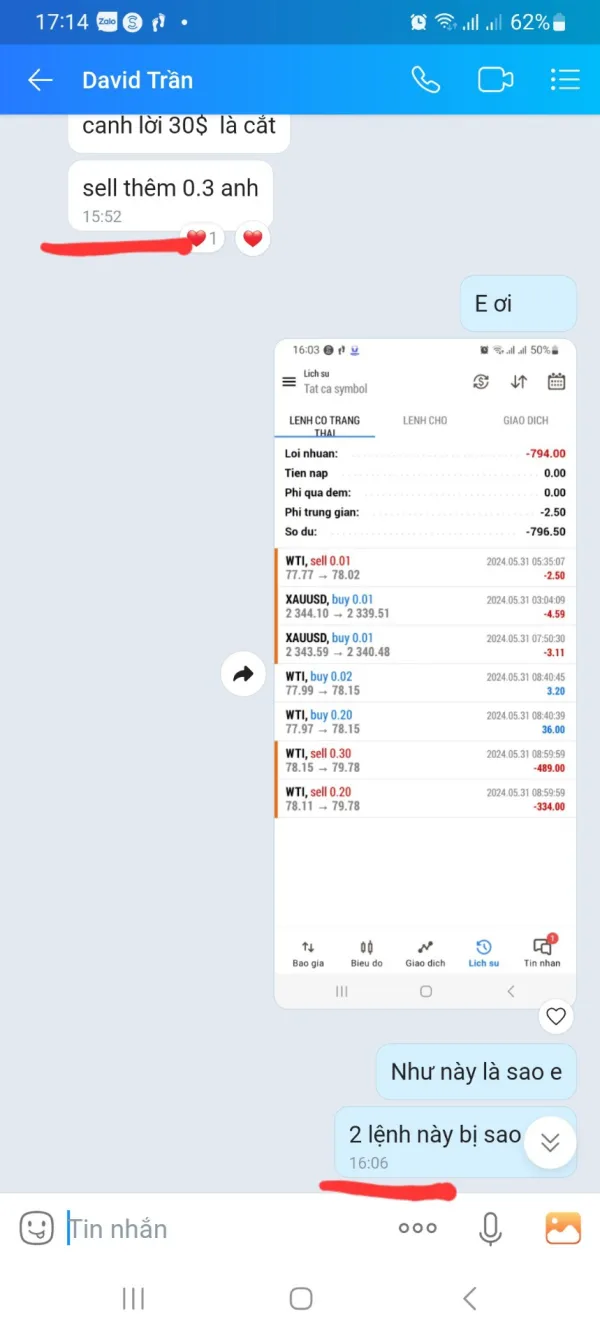

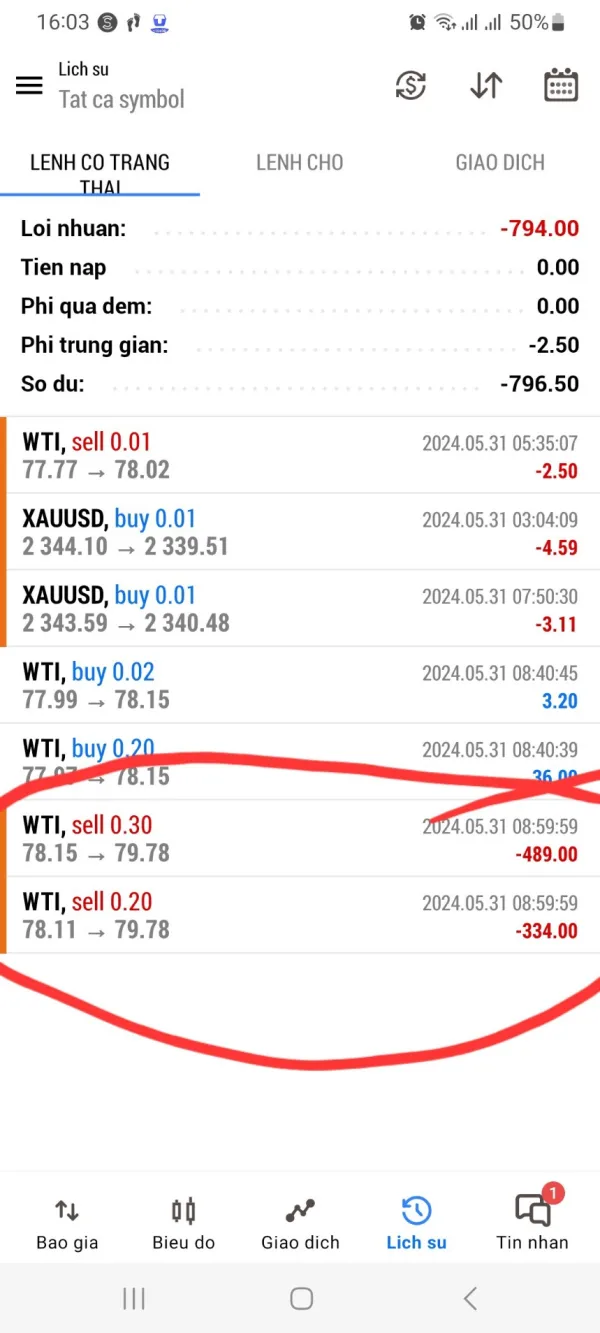

On May 31, 2024, I placed 2 oil sell orders on the ACM exchange; the volume was 0.2 and 0.3 at the corresponding prices of 78.11 and 78.15. The stoploss was set at 78.40. At this time, my account had about 800 USD. If the SL was reached, I would lose about 35-40 USD for each order. However, after about 10 minutes, I went back to my account to check and saw that these 2 orders had been pushed up to the price of 79.78 and the account was negative by nearly 800 USD. But in fact, the oil price on the market at that time was only at 78.28 and had not reached SL. After that, the oil price dropped sharply. I do not know how the ACM exchange adjusted so that my 2 orders jumped to such a high price while the market price was going down. Because of this adjustment of ACM exchange, my 2 orders that should have been profitable turned negative and led to my account being burned immediately. I sent an email to the exchange to request a solution but did not receive a response. Knowing that the possibility of recovering money is very low, I still hope to receive support and warn investors to stay away from the ACM exchange.

Exposure

Trung1252

Vietnam

I started trading on ACM on April 4, 2024. My MT5 ID is 8000198, and my capital is 1000 USD. I am mainly trading gold and oil. On May 31, 2024, I placed two sell orders for WTI oil with volumes of 0.2 and 0.3 at prices of 78.11 and 78.15, with SL set at 78.40. Right now, the trend is down. About 10 minutes after placing the order, I checked and saw that my account was liquidated because the price of 2 oil orders jumped to 79.78 (as shown below), completely ignoring the SL I had placed. It is worth mentioning that the actual price on the market right now is much below the SL level (only about 78.24). Normally, oil prices fluctuate very little and do not have a price gap like gold, so it is unreasonable for the price of these two orders to go against the actual price and gap over the SL level. After discovering the incident, I immediately contacted the exchange support to complain but did not receive an answer, even though at a glance I knew that these two orders were errors. I also sent an email to the customer support inbox on the homepage, but there was no response either. It proves that ACM intentionally intervened in prices to go against the market, causing customers' accounts to be liquidated, and had no intention of supporting customers. We recommend boycotting this broker.

Exposure