Company Summary

| DAH CHANG FUTURES Review Summary | |

| Founded | 5-10 years |

| Registered Country/Region | China |

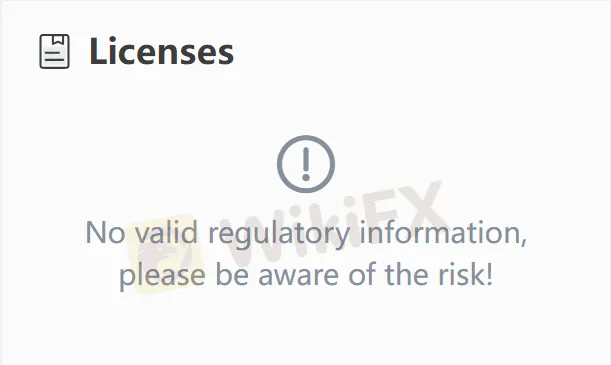

| Regulation | Unregulated |

| Products and Services | Futures |

| Customer Support | (02)2960-1066 |

| Futures Customer Service Hotline: (02) 2960-6889 | |

| dcnf@twinsun.com.tw | |

| Fax: (02)2965-7707 | |

DAH CHANG FUTURES Information

DAH CHANG FUTURES, that is, Dachang Futures, provides customers with comprehensive futures trading services. Its business scope covers both domestic and international futures trading, and professional futures consultants tailor trading strategies such as “swing trading” and “day trading” for customers. However, currently, it is difficult to obtain clear information indicating that it is supervised by relevant authoritative institutions on its official website.

Pros and Cons

| Pros | Cons |

| Diverse Financial Services | Unregulated |

| Nationwide business layout | Innovation that needs to be improved |

| Insufficient differentiation in services |

Is DAH CHANG FUTURES Legit?

There is no information on the official website indicating that DAH CHANG FUTURES is regulated. It is recommended that investors give priority to choosing futures companies that are under regulatory supervision.

What Services does DAH CHANG FUTURES provide?

DAH CHANG FUTURES mainly provides futures-related businesses both at home and abroad. In addition, futures consultants tailor-made “swing trading” and “day trading” strategies for customers. Futures, as opposed to spot goods, refer to standardized contracts in which both parties to the transaction agree in advance on a specific date in the future (the delivery date) to buy or sell a certain quantity of specific commodities or financial assets at a pre-agreed price. These contracts are traded within specialized futures exchanges.

DAH CHANG FUTURES Fees

The official website of DAH CHANG FUTURES does not provide fee information. Investors may be concerned about the existence of hidden fees. It is recommended that they contact the customer service before making investments to learn about the fee information of different businesses.