Company Summary

General Information

Founded in 2008, DEGIRO is a European brokerage company based in Amsterdam, offering relevant services for the professional market. Since 2013, Degiro started to offer its online brokerage services to retail clients, allowing them access to security exchanges in the globe. Investors can buy and sell some popular and common securities, stocks, fixed income, bonds, options, mutual funds through electronic trading platform or by phone. From 2014 to 2015, DEGIRO began to expand to offer its platform across other European countries. DEGIRO launched its English version platform in the United Kingdom on 11 June 2015 and in 2019, Flatex AG ( a German online broker) announced to acquire 100% of DEGIRO, but keep the existing DEGIRO brand. They closed the “transaction of acquiring 100% of DEGIRO shares” in July 2020.

Products & Service

With DEGIRO, traders or investors can get access to a wide selection of investment products through its advanced trading platform. You can choose your preferable investment portfolio from stocks, ETFs, Bonds, Futures, Options, Structured Products, Funds, Crypto Trackers, and more. DEGIRO promises that you can trade with these products at a low cost.

Fees Applied

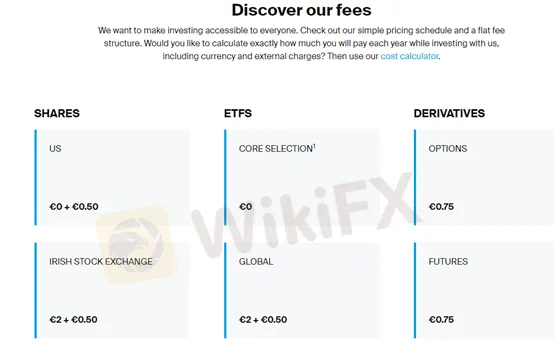

For US stocks, this company does not charge commission, but external handling costs of €0.50 per trade applied. This fee applies for all products except ETF core selection. Besides, currency, connectivity or external products and spreads costs may apply.

Other Fees

DEGIRO charges no deposit and withdrawal fee, inactivity fee, custody fee. And currency conversion applies a fee of 0.25%.

How to open an account?

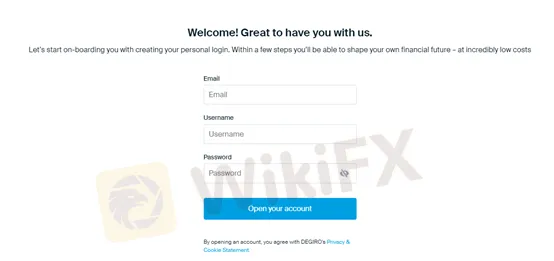

Opening an investing account with Degiro is a fast and easy process. You just need to fill out some of your basic contact details, such as your name, email address in the following form, taking less than two minutes to register your new account.

Bonus

DEGIRO will reimburse your transaction fee up to €100 if you activate your account before the 30th of June 2022. To be eligible for this offer, newcomers need to make a first deposit to validate the account, with the minimum deposit from €0.01, and activate their DEGIRO account.

Trading Platforms

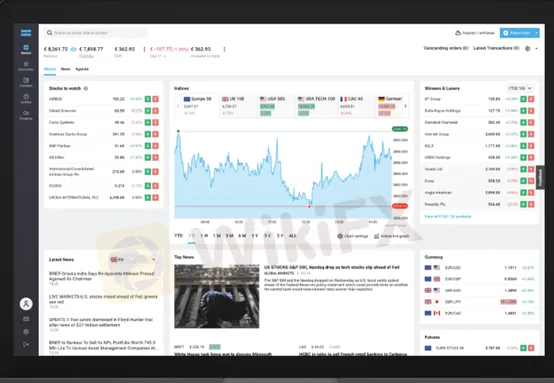

DEGIROs powerful trading platform allows you to get access to your portfolio, streaming quotes, market news, and extensive order capabilities. Some features and functionalities of this platform include the following:

User-friendly-quick order window is always accessible and allows you to place order based on a number of stocks or desired order value.

High-Customized-you can create your preferable list, read the news related to your portfolio and get inspired for new investing opportunities.

Get access to global markets-you can choose from different order types for your transactions.

Payment Methods

Funds can be transferred into your DEGIRO account directly from your registered bank account via a manual bank transfer. Deposit can be only made from your registered bank account. Manual bank transfers can take up 2-3 working days to appear in your DEGIRO account. DEGIRO

Concerning withdrawal, you cannot withdraw funds that are currently invested. Generally, withdrawal take up to 2-4 working days to be completed. Please note that it is not possible to withdraw funds which are currently invested. Only uninvested cash-the funds held in your Cash Account can be withdrawn.

Educational Resources

DEGIRO offers a series of educational resources to help investors quickly acquaint themselves with this broker, and they include a Knowledge Center, Investors Academy, as well as a blog section.

Customer Support

The DEGIRO customer support team can be reached through telephone at +31202613072 (opening from 7am to 9pm), or you can also send your questions 24 hours a day, 7 days a week though email: clients@degiro.ie. Whats more, you can also follow this company on some social media platforms such as Linkedin, Facebook, Twitter, and Instagram.

FX1264507080

Tunisia

This broker has really been helpful in my trading journey so far, I was blessed the day I joined this family. Having wasted lots of money trading on other brokers that are unreliable, finally found DEGIRO and I feel like they are just what every other trader needs. Thanks for everything so far.

Positive

丰收果

New Zealand

The reason why I recommend this broker is that they charge zero commissions for US Shares, and Selected ETFs. However, I have to say, their support team sucks, waiting for a long time to give me response…

Neutral

FX1104291322

Singapore

After trading for a while, I feel that this company is reliable, but why does wikifx say that it has no regulatory information? Do I have to withdraw all my money?

Neutral

野狼34238

Hong Kong

I have been working with degiro for weeks now and it turned out that my money is safe and sound. I earned a little, well, not much, but more than putting it in a bank. This broker also has disadvantages, such as the absence of MT4-MT5, reduced payment methods, but for now everything is going well for me and these drawbacks are not so serious.

Positive