Company Summary

| POSTFINANCE Review Summary | |

| Founded | 1997 |

| Registered Country/Region | Switzerland |

| Regulation | Not regulated |

| Market Instruments | Forex, Crypto, ETFs, Stocks, Index funds, Structured products |

| Demo Account | ❌ |

| Trading Platform | E-finance (web), PostFinance App (iOS/Android), PostFinance EBICS App |

| Min Deposit | Not mentioned |

| Customer Support | Hotline: +41 58 44814 14 |

| Online chat | |

POSTFINANCE Information

POSTFINANCE is a Swiss-based financial institution offering personal banking, savings, investment products, and insurance solutions. While it provides ETF and crypto plans, it lacks features of a traditional online trading broker such as leverage, spreads, and demo trading.

Pros and Cons

| Pros | Cons |

| Offers a wide range of personal finance tools | Not regulated as a trading platform |

| Supports crypto, ETFs, and investment funds | No leverage, spreads, or advanced trading tools (e.g. MT4/MT5) |

| Strong mobile and web-based banking access | No demo or Islamic trading accounts |

Is POSTFINANCE Legit?

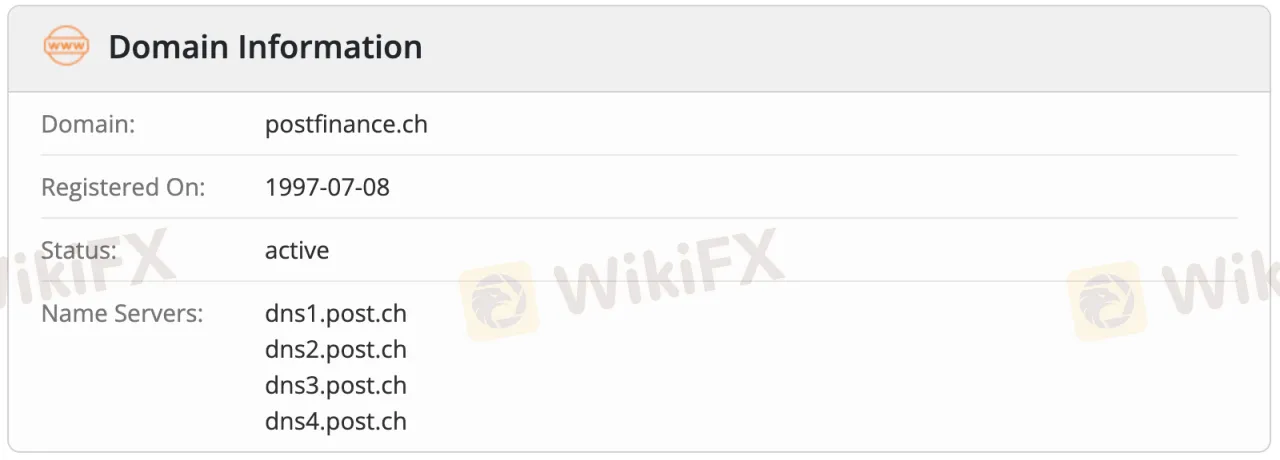

No, POSTFINANCE is not regulated as a forex or CFD broker in Switzerland, its registered country. It also lacks licenses from major financial regulators such as the FCA (UK), ASIC (Australia), CySEC (Cyprus), or NFA (US).

According to the WHOIS domain lookup, the domain postfinance.ch was registered on July 8, 1997, and its current status is active.

What Can I Trade on POSTFINANCE?

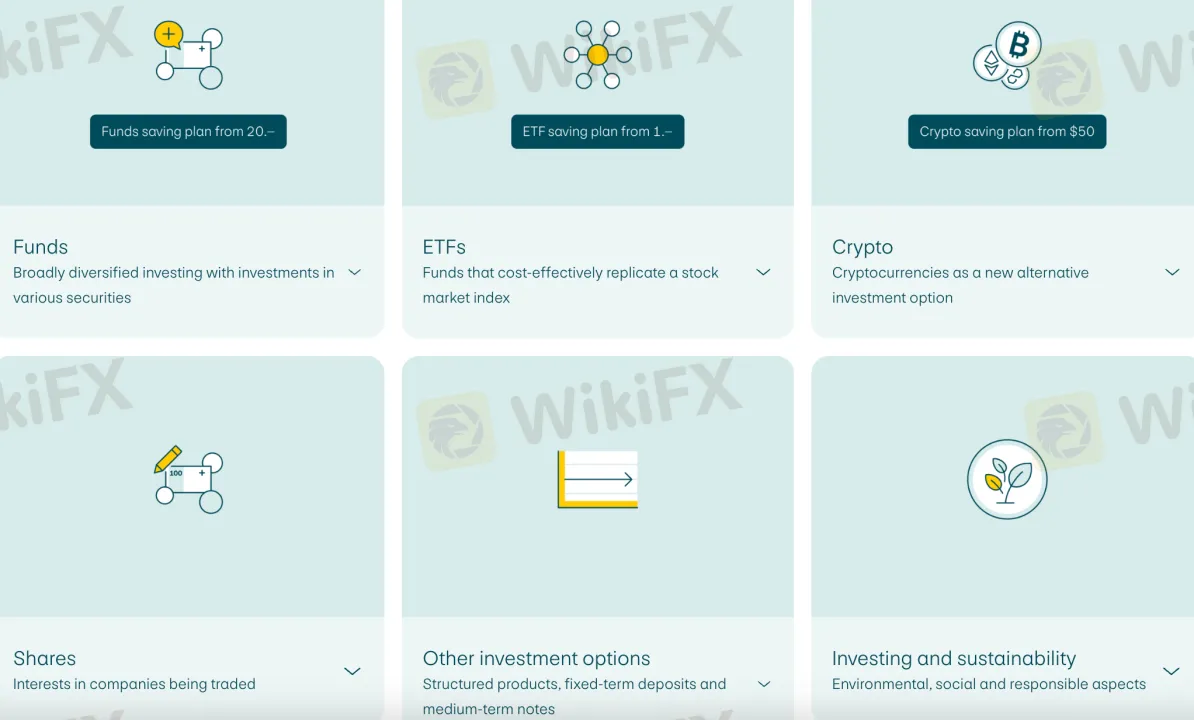

POSTFINANCE provides access to diversified investment options such as forex, fund savings plans (from CHF 20), crypto savings plans (from $50), ETFs, and individual stocks.

| Tradable Instruments | Supported |

| Forex | ✅ |

| Commodities | ❌ |

| Crypto | ✅ |

| CFD | ❌ |

| Indexes | ✅ |

| Stocks | ✅ |

| ETF | ✅ |

Account Types

POSTFINANCE provides several banking packages and accounts suited to various life phases and requirements. There are no trading-specific live accounts, demo accounts, or Islamic (swap-free) accounts mentioned. Rather than for trading, the organization offers banking packages that fit personal financial and savings requirements.

| Account Type | Target Group | Key Features |

| Smart / SmartPlus | Adults and couples | Complete banking package with accounts, cards, and e-finance |

| SmartYoung / SmartStudents | Youth up to 20 / Students up to 30 | Preferential terms, free account management, educational support |

| SmartKids | Children up to 11 | Introductory financial tools for children |

| Private Account (CHF / EUR / FX) | Adults | Everyday payments, pension, and international transactions in multiple currencies |

| Savings Account | Adults | Secure saving with interest |

| Youth / Student Savings Accounts | Children, youth, students | Higher interest, free management, suited for early-stage savers |

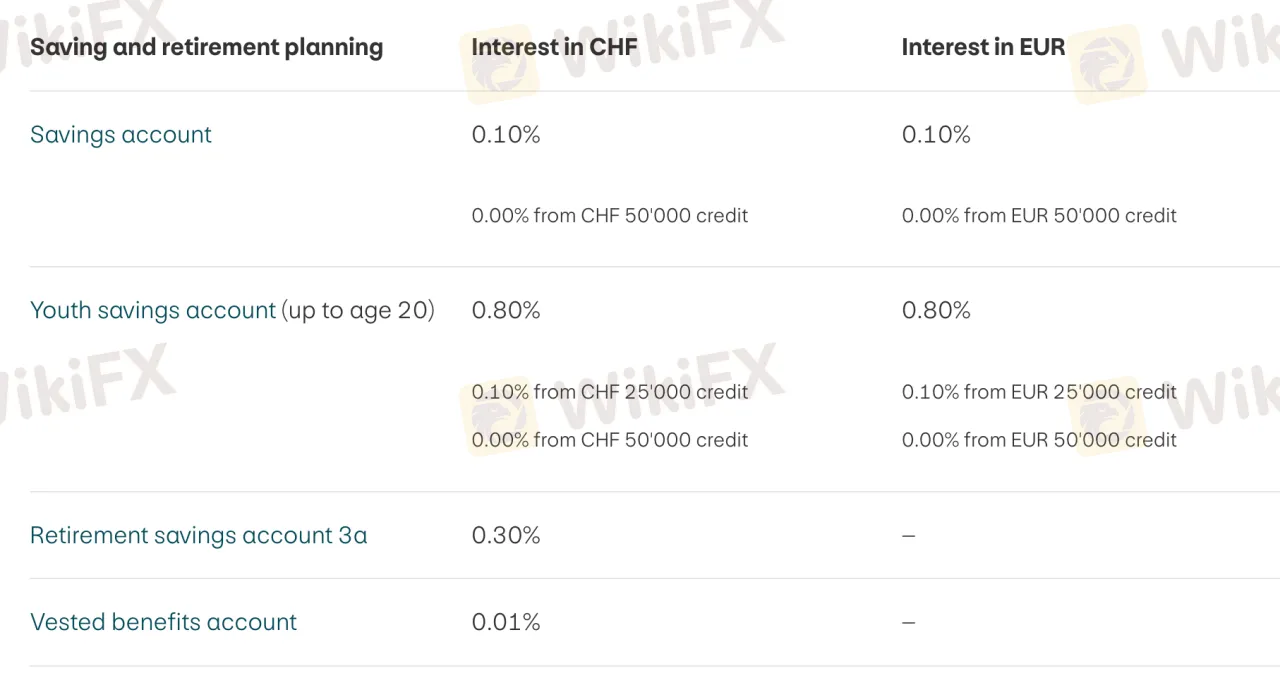

POSTFINANCE Fees

POSTFINANCE's fee and interest structure is relatively low to moderate compared to standard retail banking benchmarks in Switzerland and Europe. Savings and youth accounts offer some interest benefits, while standard private accounts have no interest returns. Especially for consumers with good credit, mortgage rates are reasonable.

| Account Type / Product | Interest in CHF | Interest in EUR | Notes |

| Savings Account | 0.10% (0.00% above CHF 50,000) | 0.10% (0.00% above EUR 50,000) | Standard savings account |

| Youth Savings Account | 0.80% (0.10% above CHF 25,000 / 0.00% > CHF 50K) | 0.80% (0.10% above EUR 25,000 / 0.00% > EUR 50K) | Up to age 20 |

| Retirement Savings (3a) | 0.30% | – | Tax-advantaged savings |

| Vested Benefits Account | 0.01% | – | For retirement asset preservation |

| Private Account (CHF/EUR) | 0.00% | 0.00% | No interest offered |

| Youth Account (up to age 20) | 0.25% (0.00% above CHF/EUR 25,000) | 0.25% (0.00% above CHF/EUR 25,000) | Daily banking account |

| Student Account (18–30) | 0.25% (0.00% above CHF/EUR 25,000) | 0.25% (0.00% above CHF/EUR 25,000) | Includes credit card, no fees |

| Private Account in Foreign Currency | No interest | – | Multicurrency use |

| Gift Savings Account | Not listed | – | Special use account |

| Negative Balance Fee | 9.50% debit interest | – | Applies to overdrafts |

Trading Platform

POSTFINANCE offers its own digital banking tools rather than conventional trading platforms. Clients can access and manage their finances 24/7 through e-finance (web-based) and the PostFinance App available on iOS and Android. For business users, the PostFinance EBICS App supports technical integrations and payment processing.

| Trading Platform | Supported | Available Devices | Suitable for What Kind of Traders |

| E-finance | ✔ | Web (desktop browser) | Everyday users managing personal or business banking online |

| PostFinance App | ✔ | iOS, Android | Mobile users needing 24/7 access to banking and investments |

| PostFinance EBICS App | ✔ | iOS, Android (for businesses) | Business clients using automated and secure data exchange |

| MetaTrader / TradingView | ❌ | – | Not supported – no traditional trading platforms for traders |

Deposit and Withdrawal

POSTFINANCE does not explicitly mention charging fixed deposit or withdrawal fees on its consumer-facing services. However, international and currency-related transactions may involve third-party or processing fees. The platform does not specify a strict minimum deposit or minimum withdrawal amount for regular account services.

Deposit & Withdrawal Methods

| Method | Min. Deposit | Fees | Processing Time |

| Domestic Bank Transfers | Not mentioned | Typically free | Same day or next day |

| QR-bill / eBill | Not mentioned | Free | Immediate or same day |

| Standing Orders / Direct Debit | Not mentioned | Free | As scheduled |

| SEPA Direct Debit (EUR Zone) | Not mentioned | May vary (low cost) | 1–2 business days |

| International Transfers | Not mentioned | May incur third-party fees | 1–5 business days |

| Card Payments (Debit/Credit) | Not mentioned | May vary by provider | Instant or within a day |