T.RowePrice Information

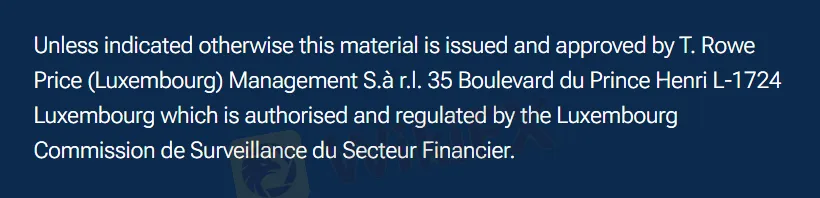

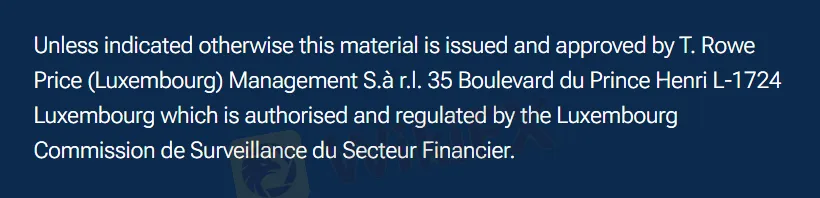

T. Rowe Price offers a comprehensive range of investment products to individual investors, financial advisors, institutions, and consultants, including stocks, fixed income, multi-asset strategies, private equity, private credit, target-date funds, and impact investing. Although the official website mentions authorization by the Luxembourg Financial Supervisory Authority, the actual regulatory jurisdiction is currently limited to Hong Kong. Key information such as account types, fee structures, and deposit/withdrawal procedures is not publicly disclosed. Investors should thoroughly verify the legitimacy and transparency of the platform before making any decisions.

Pros & Cons

Is T.RowePrice Legit?

Although T. Rowe Price claims to be authorized and regulated by the Luxembourg Financial Supervisory Authority. It is regulated by the Securities and Futures Commission of Hong Kong, with license number AVY670.

Products & Services

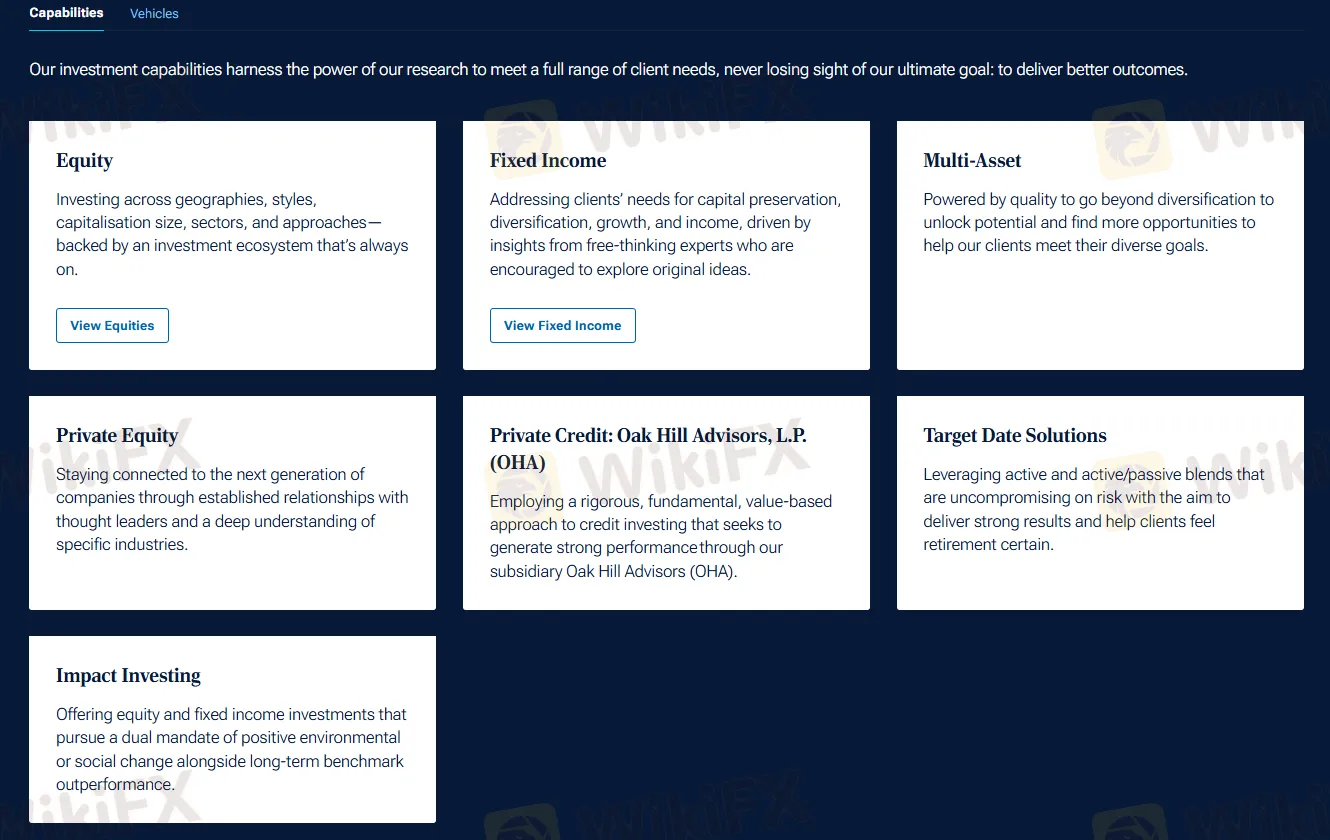

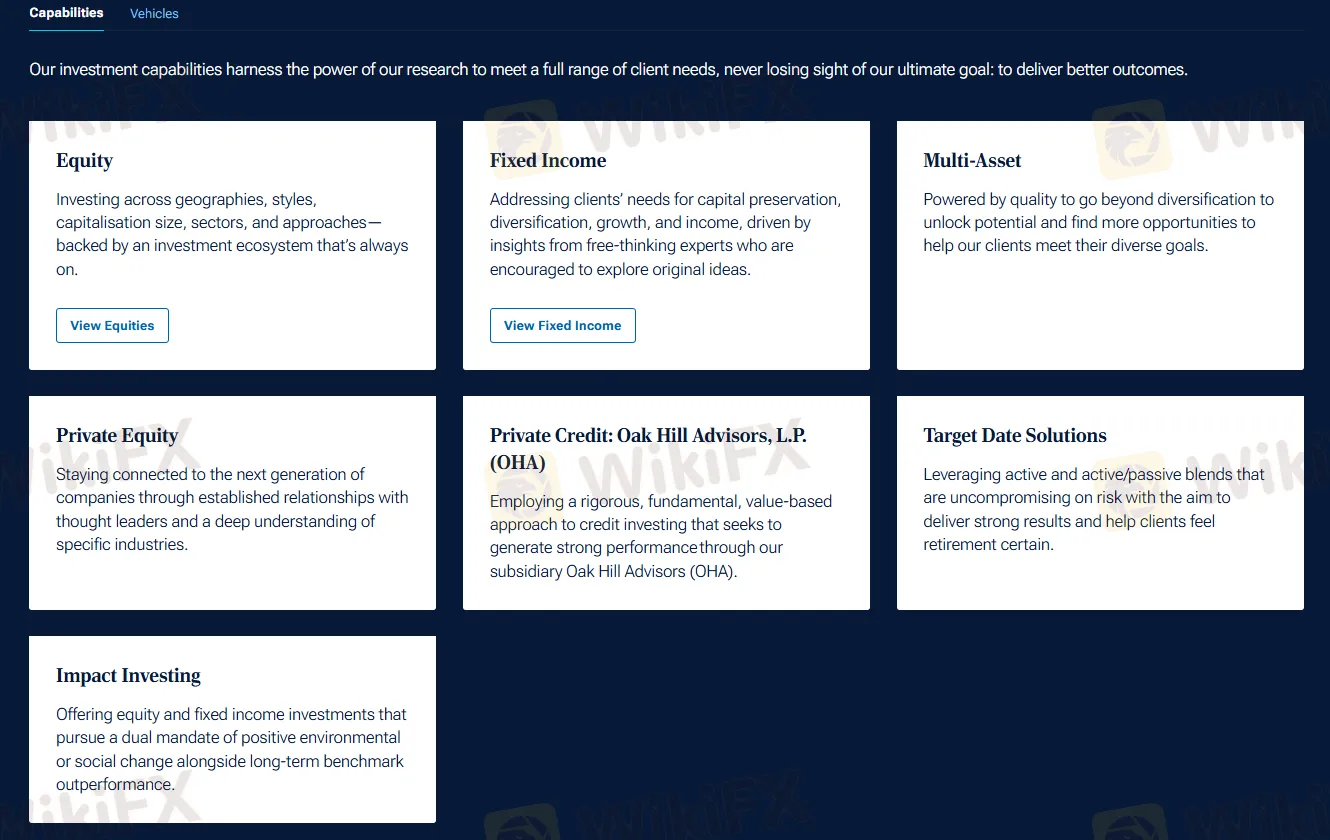

T. Rowe Price offers a comprehensive range of investment products and services, catering to individual investors, financial advisors, institutional investors, and consultants, with invesment services available for equity, fixed income, multi-asset, private equity, private credit (Oak Hill Advisors, L.P. (OHA)), target date solutions, and impact investing.