Company Summary

| VIBHS Review Summary | |

| Founded | 2013 |

| Registered Country/Region | United Kingdom |

| Regulation | FCA |

| Market Instruments | Forex, Indices, Commodities, and ETF CFDs |

| Demo Account | ✅ |

| Leverage | Up to 1:30 |

| EUR/USD Spread | 1.6 pips (Standard account) |

| Trading Platform | MT4 |

| Minimum Deposit | / |

| Customer Support | Email: sales@vibhsfinancial.co.uk |

| Tel: +44 (0)20 7709 2038 | |

| Live chat | |

VIBHS Information

VIBHS Financial Ltd, established in the UK in 2013 and regulated by the UK FCA, offers trading in forex, indices, commodities, and ETF CFDs through the MT4 platform. They provide Standard and Pro account types, along with demo accounts, with leverage up to 1:30 and varying spreads and commissions.

Pros and Cons

| Pros | Cons |

| Regulated by FCA | Deposit and withdrawal fees |

| Demo accounts available | Applies swap fees |

| Diverse tradable assets | Unclear information on minimum deposit |

| MT4 supported | |

| Live chat support | |

| Long operation time |

Is VIBHS Legit?

VIBHS has a Straight Through Processing (STP) license regulated by the Financial Conduct Authority (FCA) in the United Kingdom with a license number of 613381.

| Regulated Authority | Current Status | Licensed Entity | Regulated Country | License Type | License No. |

| Financial Conduct Authority (FCA) | Regulated | VIBHS Financial Ltd | UK | Straight Through Processing (STP) | 613381 |

What Can I Trade on VIBHS?

VIBHS offers trading in various markets, including forex, indices, commodities, and ETF CFDs, providing access to many financial instruments.

| Tradable Instruments | Supported |

| Forex | ✔ |

| Commodities | ✔ |

| ETF CFDs | ✔ |

| Indices | ✔ |

| Stocks | ❌ |

| Cryptocurrencies | ❌ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type & Fees

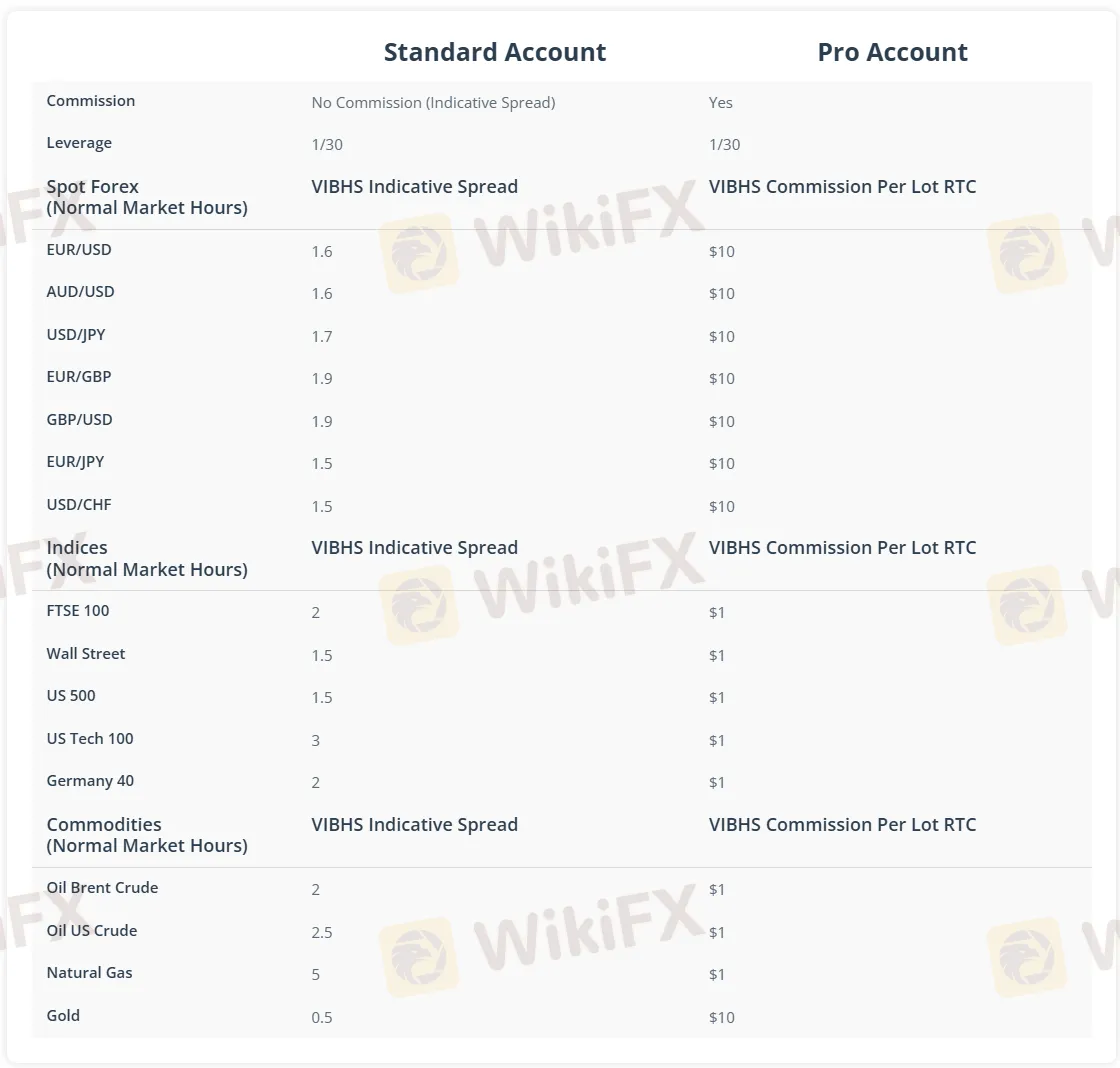

VIBHS offers Standard Account with spreads and no commission, and Pro Account which charges commission fees. They also offer demo accounts.

| Account Type | Maximum Leverage | EUR/USD Spread |

| Standard Account | 1:30 | 1.6 pips |

| Pro Account | / |

Leverage

VIBHS offers leverage up to 1:30. Traders need to consider carefully before investing and bear in mind that high leverage is likely to bring high potential risks.

| Assets | Maximum Leverage |

| Major currency pairs | 30:1 |

| Non-major currency pairs, gold and major indices | 20:1 |

| Commodities other than gold and non-major equity indices | 10:1 |

| Individual equities and other reference values | 5:1 |

VIBHS Fees

- Spread & Commission:

VIBHS offers Standard accounts with variable spreads and no commission, while Pro accounts feature tighter spreads plus a commission fee.

| Assets | Standard Account | Pro Account |

| Spreads | Commission | |

| EUR/USD | 1.6 pips | $10 |

| EUR/GBP | 1.9 pips | |

| GBP/USD | ||

| FTSE 100 | 2 pips | $1 |

| US 500 | 1.5 pips | |

| Oil Brent Crude | 2 pips | |

| Oil US Crude | 2.5 pips | |

| Natural Gas | 5 pips | |

| Gold | 0.5 pips | $10 |

- Overnight Financing Charges:

VIBHS applies swap fees to positions held past the daily rollover time (5 pm NY / 10:59 pm London), which can be positive or negative based on the trade direction, and non-activity fees may also apply. Contract specifications in the trading terminal detail symbol contract sizes.

- Deposit & Withdrawal Fees:

VIBHS charges varying fees for deposits and withdrawals, including potential bank/card transaction fees, 1.50% for EU transactions, 1.80% for non-EU transactions, and bank transfer fees ranging from £15 to £40.

| Payment | Fees |

| EU transactions | 1.50% |

| Non-EU transactions | 1.80% |

| Bank Transfer | From £15 to £40 |

Trading Platform

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | PC and Mobile | Beginners |

| MT5 | ❌ | / | Experienced traders |

Deposit and Withdrawal

VIBHS has varying deposit/withdrawal fees (e.g., 1.5-1.8% for EU/non-EU transactions, £15-£40 for bank transfers) and typically processes these within 24 hours, offering UK clients bank transfers (including GBP, USD, EUR, PLN, AUD via Barclays) and card options.