مقدمة عن الشركة

| nabtradeملخص المراجعة | |

| تأسست | منذ 2-5 سنوات |

| البلد/المنطقة المسجلة | أستراليا |

| التنظيم | غير منظم |

| منصة التداول | nabtrade(سطح المكتب/الجوال) |

| LinkedIn, Twitter, YouTube, Facebook | |

معلومات nabtrade

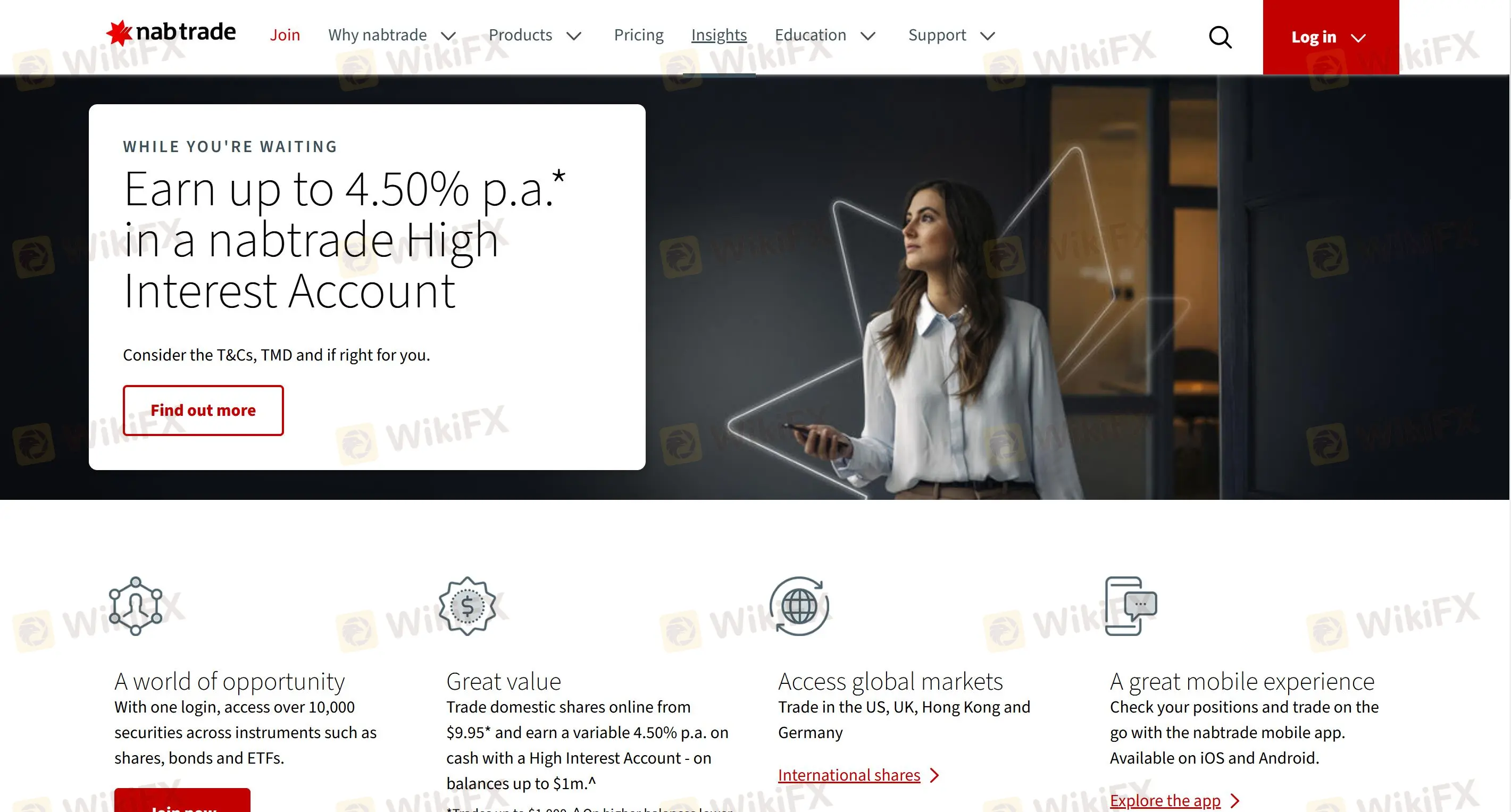

nabtrade هي منصة استثمارية توفر مجموعة متنوعة من المنتجات وفئات الأصول مثل الأسهم والدخل الثابت والنقدية والاستثمارات المدارة. كما تقدم قرض رهن NAB بشروط مرنة تتراوح بين 3 و 10 سنوات، بدءًا من 20,000 دولار، وخصم خاص بنسبة 2.0%. يمكن للعملاء استدانة الأموال للاستثمار في العديد من الخيارات، بما في ذلك الأوراق المالية المدرجة في بورصة أستراليا، والأسهم الدولية، وصناديق الاستثمار المدارة.

تقدم nabtrade التداول عبر الإنترنت للأسهم المحلية والدولية بأسعار تبدأ من 9.95 دولارًا* (الأسهم الدولية بالإضافة إلى صرف العملات الأجنبية)

بالإضافة إلى ذلك، تستخدم nabtrade حساب فائدة عالية يمكن أن يحقق معدل نقدي متغير بنسبة 4.50% سنويًا - حتى رصيد أقصى قدره 1 مليون دولار. افتح حساب نقدي يقدم أسعار فائدة تتراوح بين 0.5%-1.85% سنويًا لتسوية المعاملات المحلية والدولية.

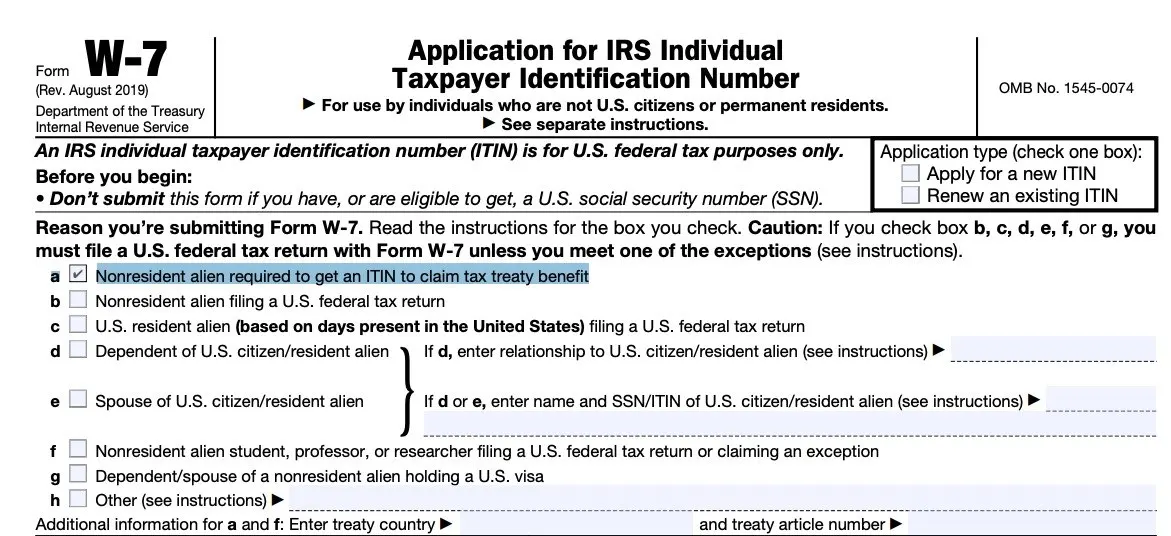

هل nabtrade شرعي؟

nabtrade غير منظم، مما يجعله أقل أمانًا من المنظم.

نوع الحساب

يمكن لكل عميل جديد في nabtrade فتح حساب تداول محلي وحساب تداول دولي وحساب نقدي شامل، مع إمكانية الوصول إلى خدمات إضافية بما في ذلك حساب فائدة عالية في nabtrade، وآراء nabtrade IRESS، وقروض رهن NAB، وخدمة إعداد وإدارة SMSF.

| نوع الحساب | مدعوم |

| حساب تداول محلي | ✔ |

| حساب تداول دولي | ✔ |

| حساب نقدي شامل | ✔ |

منصة التداول

تقدم nabtrade منصة مملوكة لها لل سطح المكتب والجوال، مما يتيح لك الوصول المباشر إلى مجموعة من المنتجات بما في ذلك الأسهم المحلية والدولية وصناديق المتداولة في البورصة والسندات وغيرها، كل ذلك من حساب واحد.

| منصة التداول | مدعوم | الأجهزة المتاحة | مناسب لـ |

| nabtrade | ✔ | سطح المكتب/الجوال | جميع المستثمرين |