公司簡介

| CAPITARIA評論摘要 | |

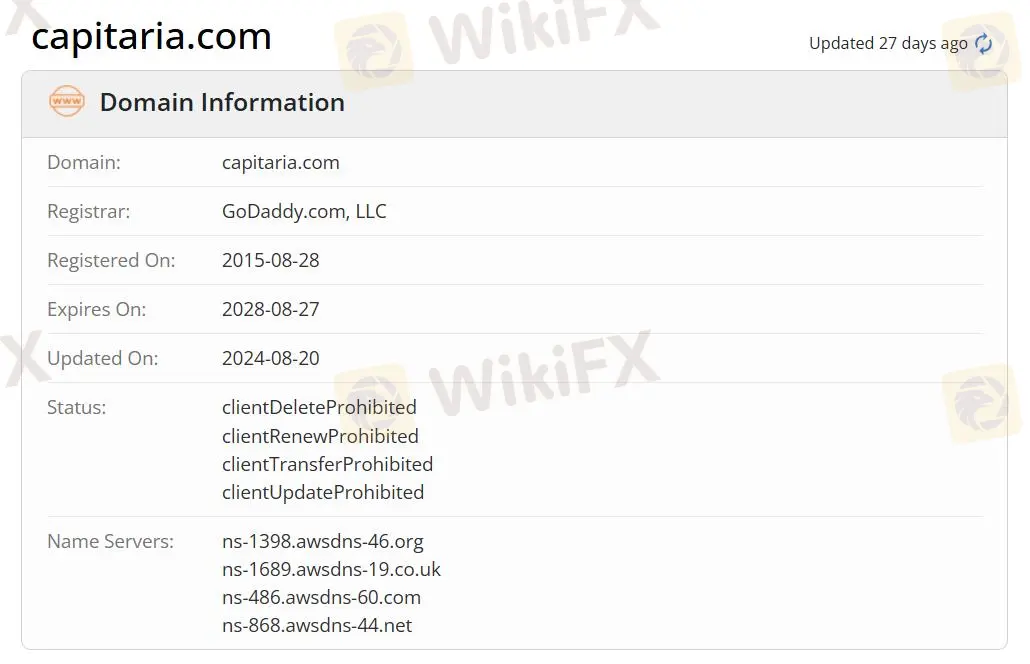

| 成立日期 | 2015-08-28 |

| 註冊國家/地區 | 智利 |

| 監管 | 未受監管 |

| 市場工具 | 外匯/股票/ETF/商品/股票指數。 |

| 模擬帳戶 | ✅ |

| 槓桿 | 最高可達1:100 |

| 點差 | / |

| 交易平台 | MT5(電腦/手機/網頁) |

| 最低存款 | 6000美元 |

| 客戶支援 | 電子郵件:hola@capitaria.com |

| Instagram/Facebook/Twitter/LinkedIn/YouTube | |

| 電話:+56 2 2592 6600 | |

| 電話:+51 944 737 651 | |

| 電話:+598 2623 6583 | |

| 電話:+52 55 4947 3878 | |

CAPITARIA 資訊

CAPITARIA 是一家在智利、秘魯、烏拉圭和墨西哥設有辦事處的跨國經紀商。可交易的工具包括外匯、ETF、商品和股票指數。該經紀商還提供兩種帳戶,最高槓桿為1:100,無佣金或費用。最低存款為6000美元。由於其未受監管的狀態,CAPITARIA 仍然存在風險。

優點和缺點

| 優點 | 缺點 |

| 最高槓桿可達1:100 | 未受監管 |

| 多種可交易工具 | 未提供具體費用信息 |

| 可使用MT5 | |

| 提供模擬帳戶 |

CAPITARIA 是否合法?

CAPITARIA 未受監管,相比受監管的經紀商,風險較高,儘管它聲稱受到智利金融分析局(UAF)的監管。

我可以在 CAPITARIA 上交易什麼?

CAPITARIA 提供400多種市場工具,包括外匯、股票、ETF、商品和股票指數。

| 可交易工具 | 支援 |

| 外匯 | ✔ |

| 商品 | ✔ |

| 股票 | ✔ |

| ETF | ✔ |

| 股票指數 | ✔ |

| 股票 | ✔ |

| 加密貨幣 | ❌ |

| 貴金屬 | ❌ |

| 債券 | ❌ |

| 共同基金 | ❌ |

帳戶類型

CAPITARIA 提供兩種免費開戶的帳戶類型:專業和高級。有足夠預算的交易者可以開設高級帳戶。此外,模擬帳戶主要用於讓交易者熟悉交易平台和教育目的。每個人還可以通過複製頂級交易者的成功來賺錢。

| 帳戶類型 | 專業 | 高級 |

| 最低投資額 | 6000美元 | 30000美元 |

| 開戶費用 | $0 | $0 |

| 存款/提款費用 | $0 | $0 |

| 維護費用 | $0 | $0 |

| 槓桿 | 1:100 | 1:100 |

槓桿

最大槓桿為1:100,意味著利潤和損失放大100倍。

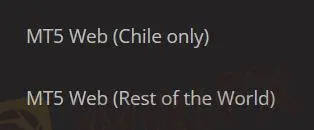

交易平台

CAPITARIA 與權威的MT5交易平台合作,該平台可在電腦、手機和網頁上使用。有豐富經驗的交易者更適合使用MT5進行各種交易策略和實施EA系統。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| MT5 | ✔ | 電腦/手機/網頁 | 有經驗的交易者 |

存款和提款

最低投資額必須為6000美元或以上。CAPITARIA 接受Webpay、Visa、MasterCard、銀行轉帳、電匯等方式進行存款和提款。98%的提款在4小時內完成。

使用信用卡或借記卡進行存款可能會產生最高2.5%的處理費,該費用將從存入金額中扣除。對於墨西哥用戶,使用信用卡或電子轉帳進行存款時,信用卡費用為3%,電子轉帳費用為2% + $1。