ryad22

1-2年

Could you outline the primary advantages and disadvantages of trading with MUFG?

From my perspective as a long-term forex trader, MUFG’s strengths stem mainly from its established reputation and strict regulatory oversight. With over twenty years in the financial sector and well-known regulatory licenses from both the UK’s Financial Conduct Authority (FCA) and the Labuan Financial Services Authority (LFSA) in Malaysia, I see clear indications that MUFG is a legitimate and highly regulated entity. The backing of Mitsubishi UFJ Financial Group, which operates globally and is listed on major stock exchanges, further supports its credibility. In terms of services, MUFG offers a breadth typical of a major institution, including investor services, asset management, and real estate solutions.

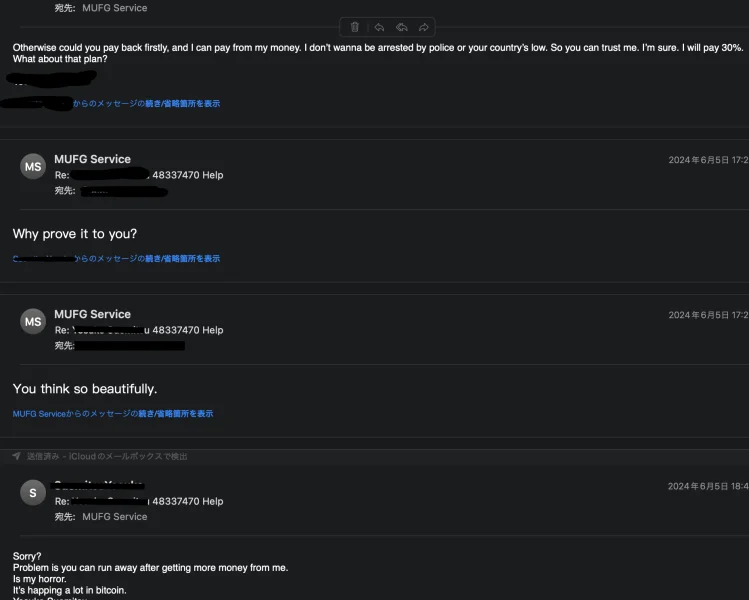

However, caution is warranted. The WikiFX risk management index for MUFG is currently at zero, which is a notable concern for me. Personal security and operational transparency are paramount when dealing with significant funds, and I noticed field reports indicating that an official office presence could not be confirmed in London. Additionally, the available user reviews point to unresolved withdrawal issues, which for me is a serious red flag and underscores the importance of only trading what I can afford to lose. Communication appears limited, with no direct telephone support channels advertised, which can complicate timely problem resolution. In summary, while MUFG’s decades-long presence and strong regulatory status provide reassurance, practical operational concerns and reported user issues mean I proceed very cautiously if considering them as a broker.

Bhavani Durga K

1-2年

Is automated trading with Expert Advisors (EAs) available on MUFG's trading platforms?

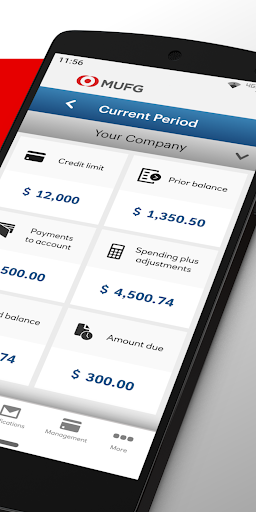

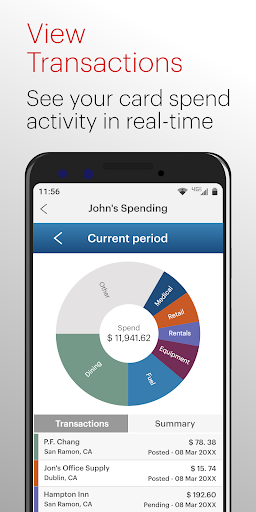

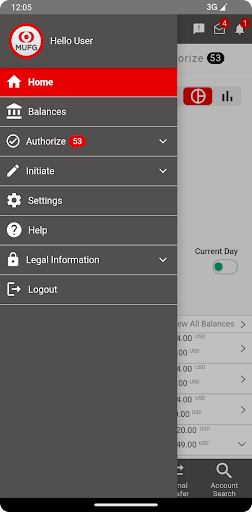

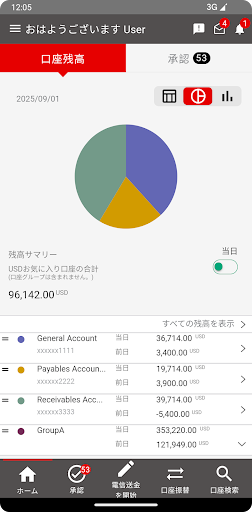

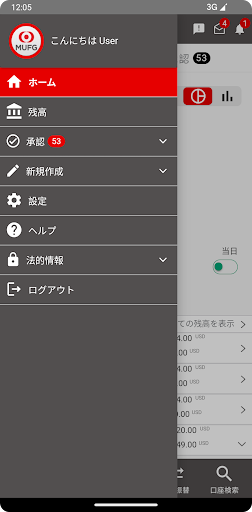

As someone with years of forex trading experience, I always scrutinize broker platform compatibility with automated strategies before choosing where to trade. With MUFG, I noted that they provide access to both MT4 and MT5 servers—platforms renowned for their robust support of automated trading through Expert Advisors (EAs). For me, this means that, in principle, MUFG’s infrastructure should technically allow the deployment of EAs, as both MetaTrader 4 and MetaTrader 5 are widely trusted in the industry for automated trading capabilities, advanced charting, and algorithmic scripting.

However, I exercise caution and advise others to do the same before proceeding. While WikiFX’s data confirms that MUFG offers self-developed platforms and mentions sound system services for their full-license MetaTrader environments, there is no explicit broker statement about EA-specific restrictions or permissions. In my experience, regulations, risk controls, or broker-specific policies can sometimes impact how freely EAs may function or whether certain strategies (like high-frequency trading) are fully permitted. Additionally, the risk management index for MUFG is notably low, which raises questions about how protective their systems are regarding automated malfunction or misuse.

Given these observations, my conservative recommendation is to directly consult MUFG’s client agreement and support channels—though I did notice direct contact options are limited—before deploying EAs. Verifying any nuanced restrictions or requirements can help avoid unexpected issues and give more confidence in running automated strategies. In summary, the technical foundation for EA trading appears to be present with MUFG, but diligent confirmation and ongoing oversight are both prudent and necessary steps from my professional perspective.

Broker Issues

Platform

Account

Leverage

Instruments

RichN

1-2年

Which types of payment options does MUFG offer for making deposits and withdrawals, such as credit cards, PayPal, Skrill, or cryptocurrencies?

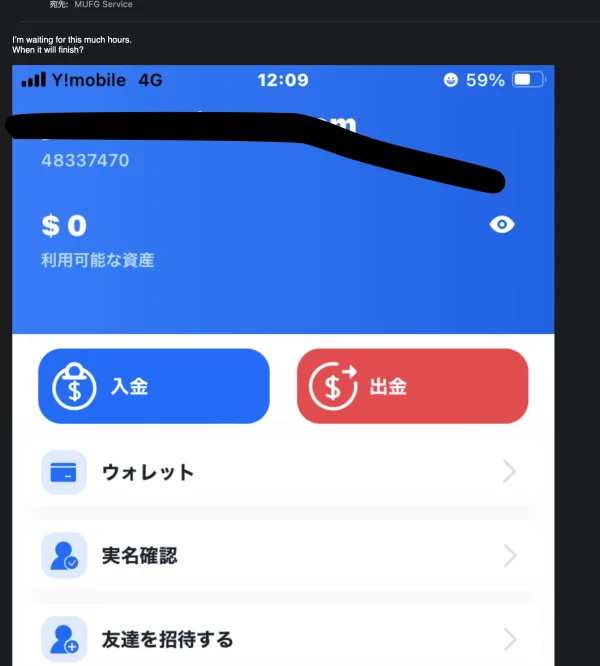

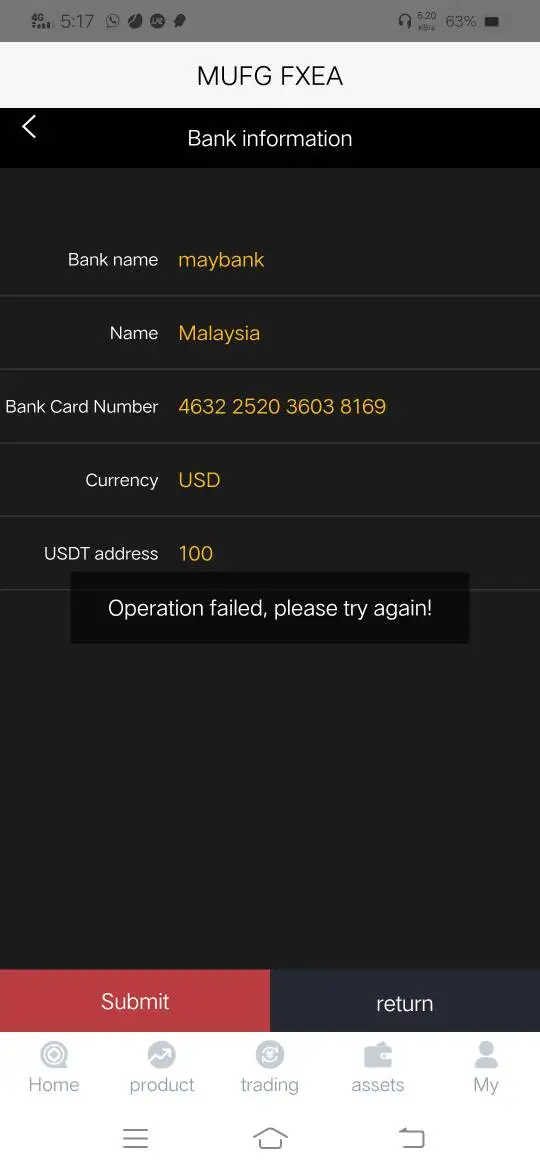

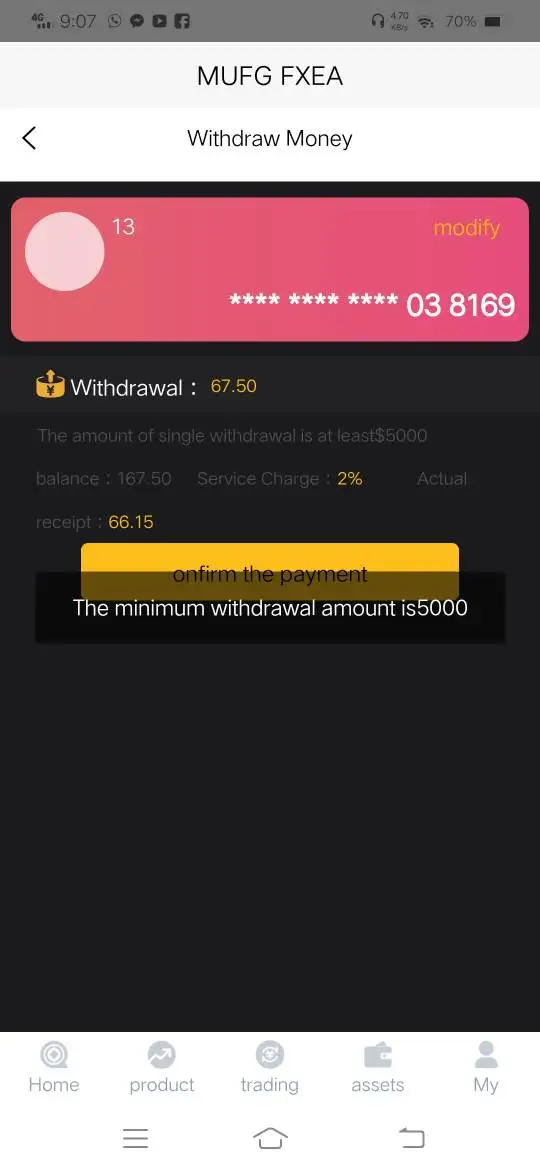

In my experience researching and evaluating brokers, I pay close attention to the details about deposit and withdrawal methods, as these are critical to both convenience and security. With MUFG, despite its long history and well-regulated status under both the FCA and LFSA, I found that their WikiFX profile does not specify particular payment methods such as credit cards, PayPal, Skrill, or cryptocurrencies for funding or withdrawing from trading accounts. For me, this lack of clear information is noteworthy because transparent disclosure of funding options is standard among top-tier brokers and crucial for planning my trading operations.

Given MUFG’s global banking background and comprehensive range of financial services, I would normally expect a variety of mainstream banking options, possibly emphasizing bank wire transfers given the brand’s institutional scale. However, without concrete disclosure, I cannot confirm if they support e-wallets or digital currencies. I also noticed some concerning user feedback related to withdrawal issues, which increases my caution.

Therefore, before considering MUFG for my trading, I would strongly recommend directly contacting their customer support for up-to-date and specific information on available deposit and withdrawal channels. I believe it is vital not to assume the availability of favored payment options without confirmation, particularly given the importance of smooth and secure access to one’s funds in forex trading.

Broker Issues

Withdrawal

Deposit

Abu00saeed

1-2年

What is the highest leverage MUFG provides for major forex pairs, and how does their leverage policy differ for other types of assets?

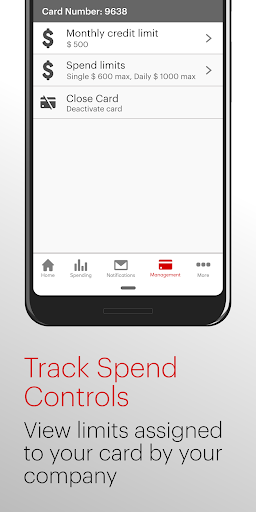

Based on my research and trading experience with major industry brokers, getting clear, public details about MUFG’s maximum leverage—especially for major forex pairs—can be challenging. From what I could gather, official disclosures about MUFG’s specific leverage offerings are not published directly on their public sources or via WikiFX’s analysis. This raises a flag for me; as a trader, transparency about leverage is crucial when managing risk, particularly with a global institution like MUFG.

Given that MUFG is regulated by both the UK’s Financial Conduct Authority (FCA) and Labuan Financial Services Authority (LFSA) in Malaysia, I expect their leverage parameters to comply with region-specific regulations. Under the FCA, leverage on major forex pairs is typically capped at 30:1, as a matter of consumer protection. However, brokers operating under Labuan might offer higher leverage, but that information isn’t explicitly confirmed for MUFG in the context provided.

When it comes to other asset types, such as minor and exotic forex pairs or CFDs, established regulatory norms usually require even stricter leverage limits due to greater volatility and risk. However, again, MUFG doesn’t specify these details in the information available. For me, this lack of clarity would require directly contacting their support team before considering any significant trading activity, as responsible risk management hinges on knowing leverage and margin requirements. I always prefer to proceed cautiously until these fundamentals are fully documented.

Broker Issues

Platform

Account

Instruments

Leverage