公司簡介

| Wisdom Financial Service 評論摘要 | |

| 成立年份 | 2023 |

| 註冊國家/地區 | 聖露西亞 |

| 監管機構 | FCA(已超出) |

| 市場工具 | 外匯和差價合約交易(股票、指數、石油、黃金) |

| 模擬帳戶 | / |

| 槓桿 | 最高可達1:1000 |

| 點差 | 從0.1點(標準帳戶) |

| 交易平台 | APP |

| 最低存款金額 | $1 |

| 客戶支援 | 聯繫表格 |

| 電話:+66867741450 | |

| 電子郵件:admin@wisdomfinancialservice.com | |

| 社交媒體:Facebook、Instagram、Twitter | |

| 區域限制 | 美國 |

Wisdom Financial Service於2023年在聖露西亞註冊,是一家專注於外匯和差價合約市場的經紀商。它提供3種類型的帳戶,最低存款金額為$1,最高槓桿為1:1000。它曾經受到英國金融行為監管局(FCA)的監管,但許可證已超出,這意味著可能存在潛在風險。

優點和缺點

| 優點 | 缺點 |

| 多樣的可交易資產 | 市場新進入者 |

| 多種投資計劃 | 超出FCA許可證 |

| 靈活的槓桿比例 | 無MT4或MT5 |

| 無佣金 | 未知的付款方式 |

| 低最低存款金額 | 不允許美國客戶 |

| 多種客戶支援渠道 |

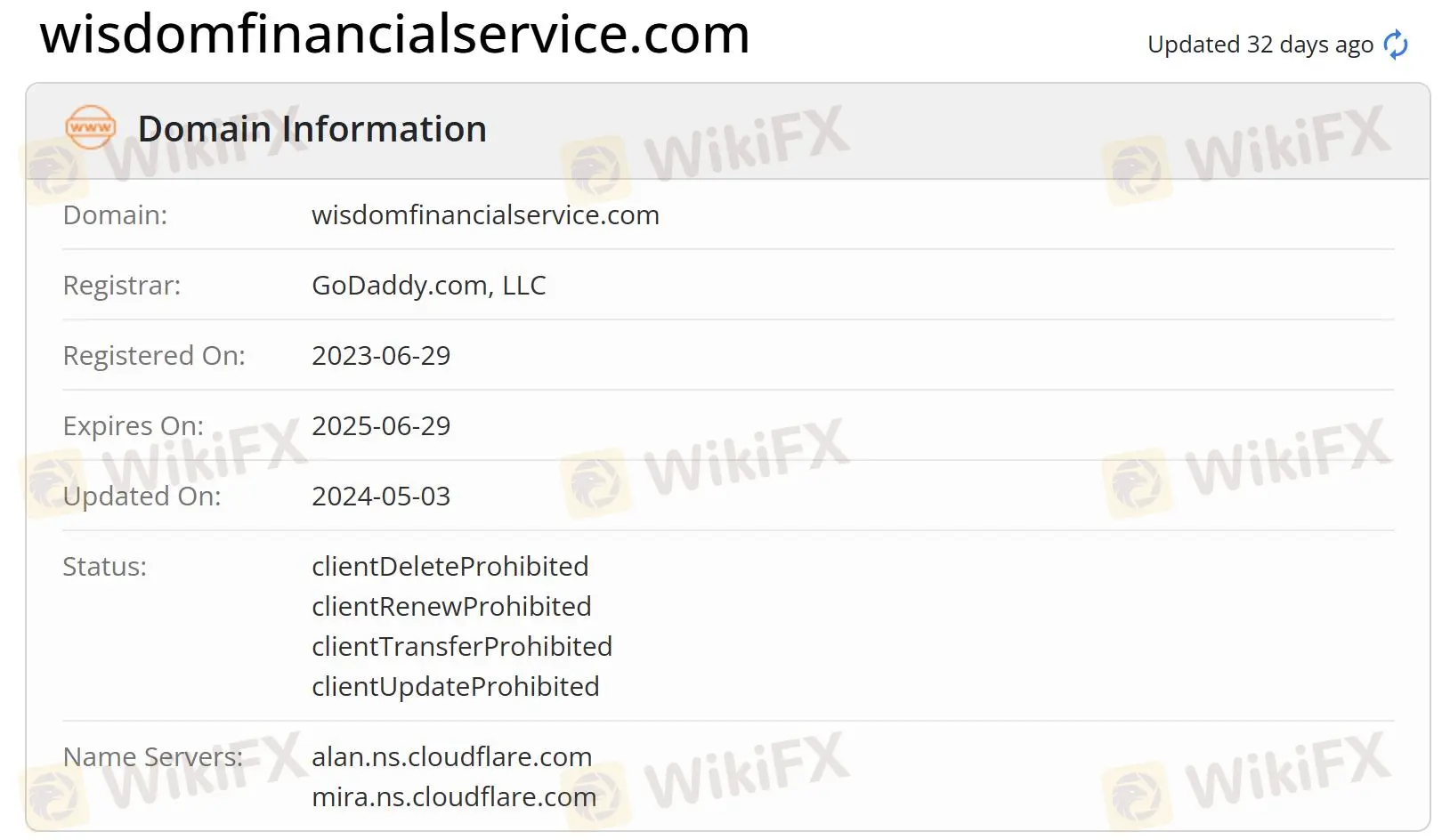

Wisdom Financial Service是否合法?

Wisdom Financial Service曾經受到英國金融行為監管局(FCA)的監管,但已超出。此外,目前的狀態顯示禁止進行客戶轉移和更新等活動。因此,建議謹慎考慮,因為可能存在潛在風險。

| 監管機構 | 當前狀態 | 監管國家 | 許可證類型 | 許可證號碼 |

| 英國金融行為監管局(FCA) | 超出 | 英國 | 普通商業註冊 | 15895105 |

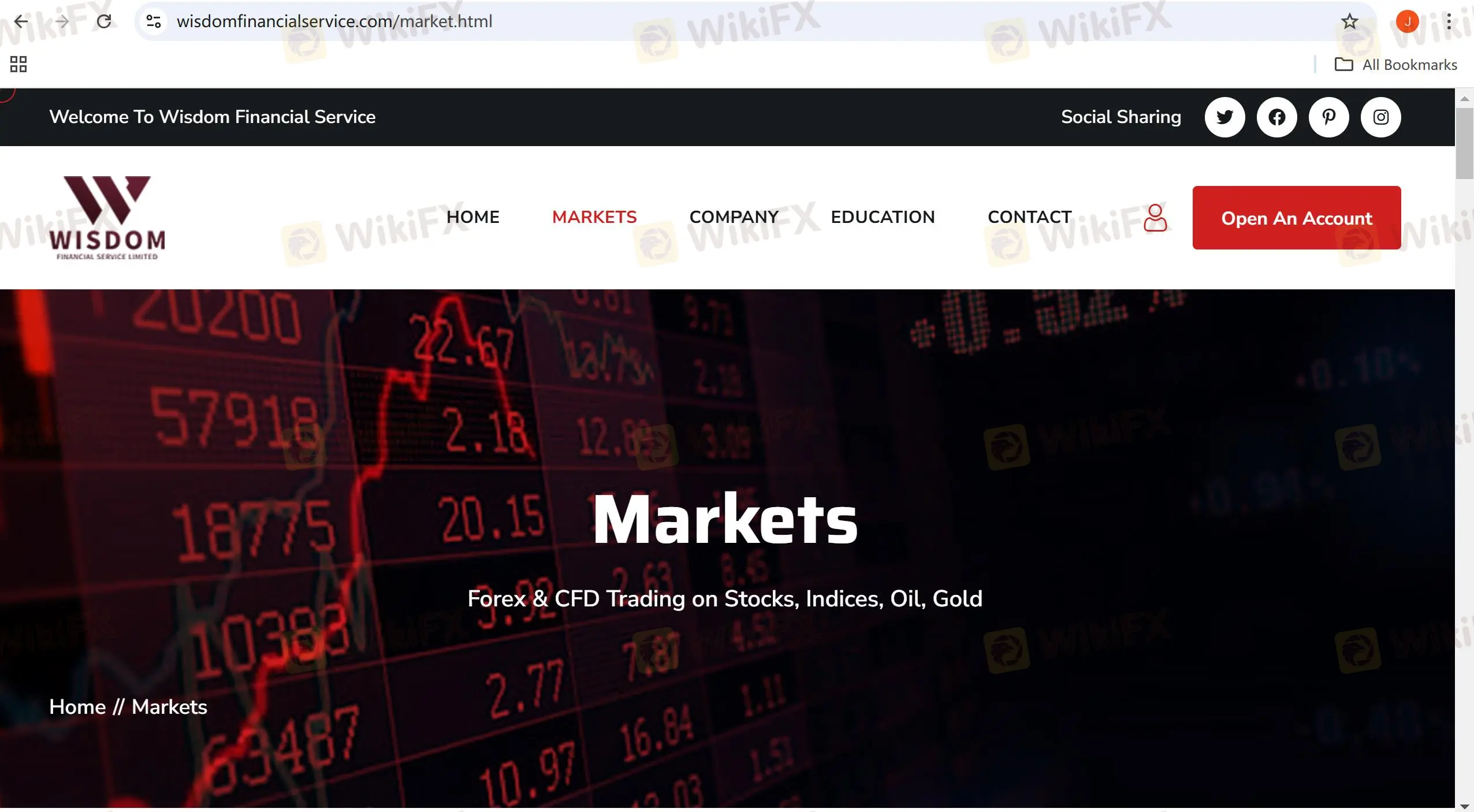

Wisdom Financial Service可以交易什麼?

Wisdom Financial Service 提供多種產品,包括外匯、股票、指數、原油和黃金。

| 可交易工具 | 支援 |

| 外匯 | ✔ |

| 差價合約 | ✔ |

| 股票 | ✔ |

| 指數 | ✔ |

| 原油 | ✔ |

| 黃金 | ✔ |

| 加密貨幣 | ❌ |

| 債券 | ❌ |

| 期權 | ❌ |

| 交易所交易基金 | ❌ |

投資計劃

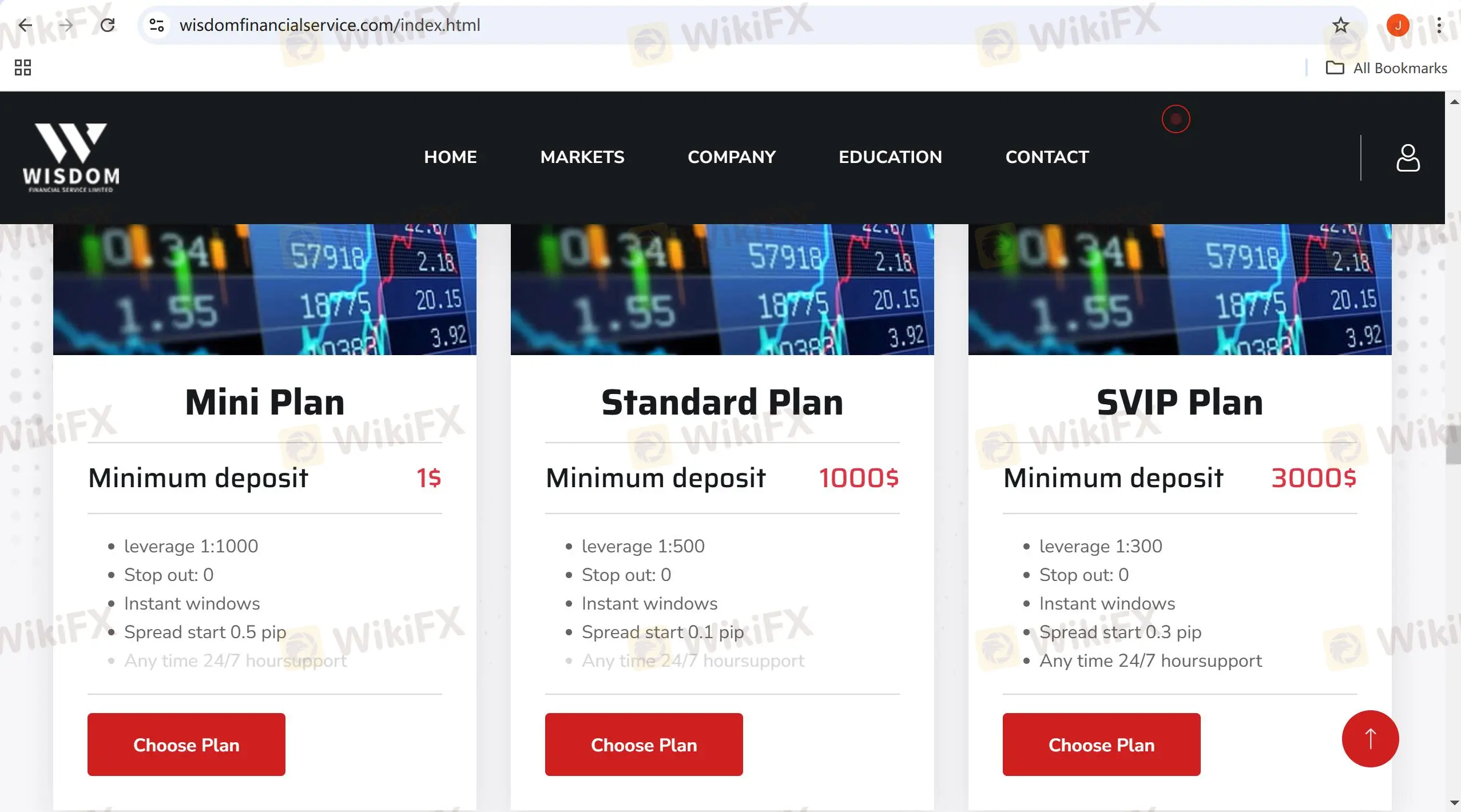

Wisdom Financial Service 提供3種帳戶類型,包括迷你計劃、標準計劃和超級VIP計劃。

| 投資計劃 | 最低存款 |

| 迷你 | $1 |

| 標準 | $1,000 |

| 超級VIP | $3,000 |

槓桿

| 投資計劃 | 最大槓桿 |

| 迷你 | 1:1000 |

| 標準 | 1:500 |

| 超級VIP | 1:300 |

請記住,槓桿越大,失去已存資金的風險就越大。槓桿的使用既有利也有弊。

費用

| 投資計劃 | 點差 | 佣金 |

| 迷你 | 從0.5點 | ❌ |

| 標準 | 從0.1點 | |

| 超級VIP | 從0.3點 |

交易平台

Wisdom Financial Service 使用自己的交易APP,但並未提供有關該APP的詳細信息。

| 交易平台 | 支援 | 可用設備 | 適合對象 |

| APP | ✔ | 手機 | / |

| MT4 | ❌ | / | 初學者 |

| MT5 | ❌ | / | 經驗豐富的交易者 |