公司簡介

| 申銀萬國 評論摘要 | |

| 成立年份 | 2007 |

| 註冊地區 | 中國 |

| 監管 | CFFEX |

| 市場工具 | 商品期貨、金融指數期貨、債券期貨、商品期權、金融指數期權、ETF期權、現貨ETF |

| 模擬帳戶 | ✅ |

| 交易平台 | 申萬期貨APP、博易雲、快速交易終端v2、申銀萬國期貨無限易 |

| 最低存款 | / |

| 客戶支援 | 電話:021-5058-8811 |

| 傳真:021-5058-8822 | |

申銀萬國 資訊

申銀萬國成立於2007年,是一家中國期貨經紀商,持有中國金融期貨交易所頒發的0131號牌照。它提供廣泛的期貨、期權和現貨市場服務,以及面向零售和機構交易者的先進平台。

優缺點

| 優點 | 缺點 |

| 受CFFEX監管 | 主要專注於中國國內市場 |

| 多樣的可交易工具 | 複雜的費用結構 |

| 多個專業交易平台 |

申銀萬國 是否合法?

是的,申銀萬國 受監管。它持有中國金融期貨交易所(CFFEX)頒發的期貨牌照,牌照號碼為0131。這表明該公司在中國進行與期貨相關的業務時受到正式監管。

我可以在 申銀萬國 交易什麼?

ShenYin & WanGuo 提供多種不同的交易產品,如期貨、期權和現貨合約,在許多中國交易所上進行交易。客戶可以交易大宗商品、金融指數、金屬、能源、農產品和 ETF。

| 可交易工具 | 支援 |

| 大宗商品期貨 | ✔ |

| 金融指數期貨 | ✔ |

| 債券期貨 | ✔ |

| 大宗商品期權 | ✔ |

| 金融指數期權 | ✔ |

| ETF 期權(上海/深圳) | ✔ |

| 現貨 ETF | ✔ |

| 外匯 | × |

| 股票 | × |

| 加密貨幣 | × |

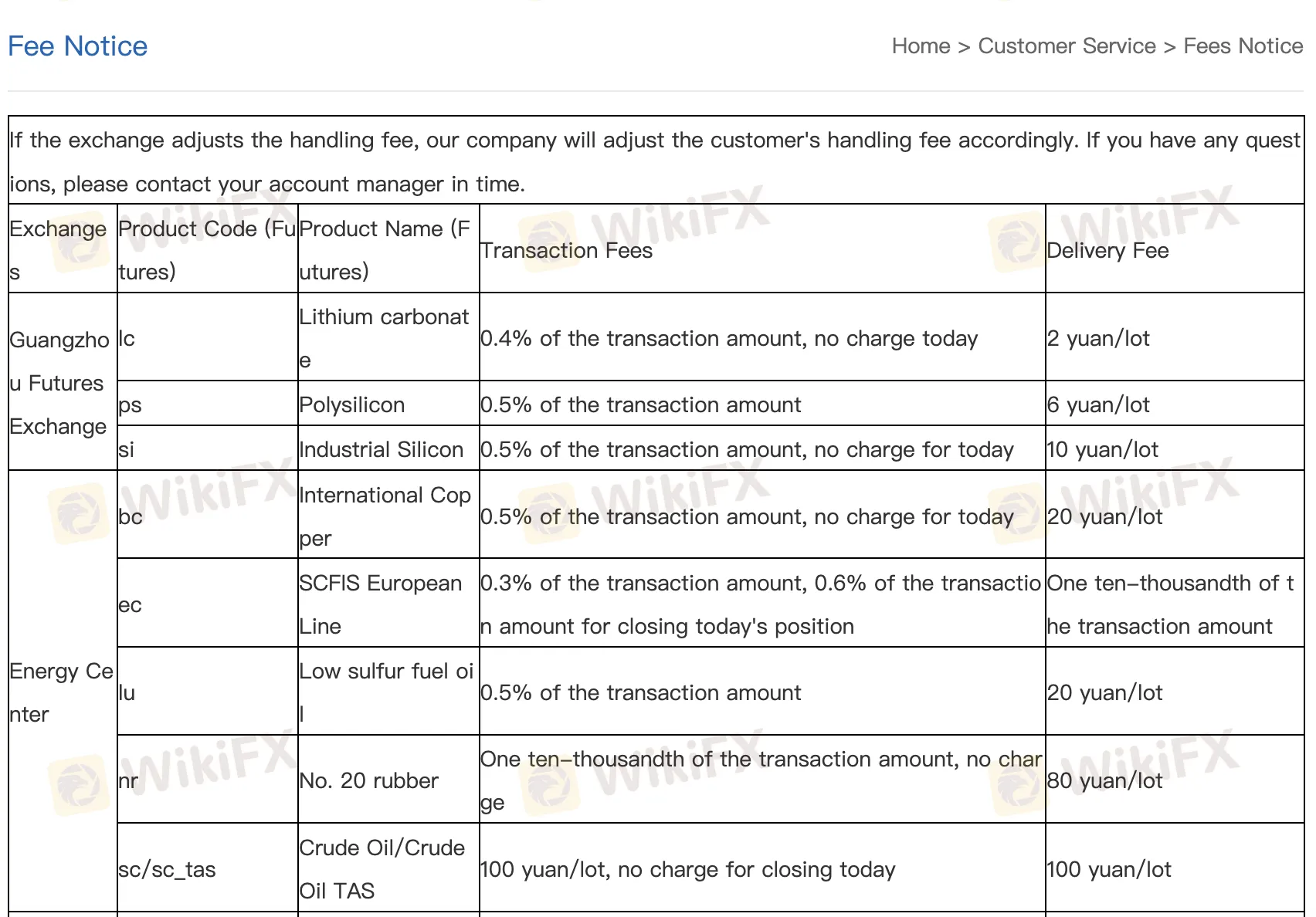

申銀萬國 費用

整體而言,申銀萬國 的費用與行業標準相比被認為是適中的。交易成本因產品和交易所而異,但通常遵循中國期貨市場設定的標準價格。然而,一些工具有特別優惠,如免除結算費用,這可能降低活躍交易者的成本。

| 費用類型 | 典型收費示例 |

| 交易費(期貨) | 交易金額的 0.25% – 1.15% 或固定 ¥5–¥100/手 |

| 交割費(期貨) | 每手 ¥2 – ¥200 |

| 交易費(期權) | 每手 ¥1 – ¥75 |

| 執行/履行費(期權) | 每手 ¥2.5 – ¥750 |

| ETF 期權費 | 每手 ¥8(買入/賣出 開倉/平倉),執行費 ¥10 |

| ETF 現貨費 | 交易金額的 0.003045 |

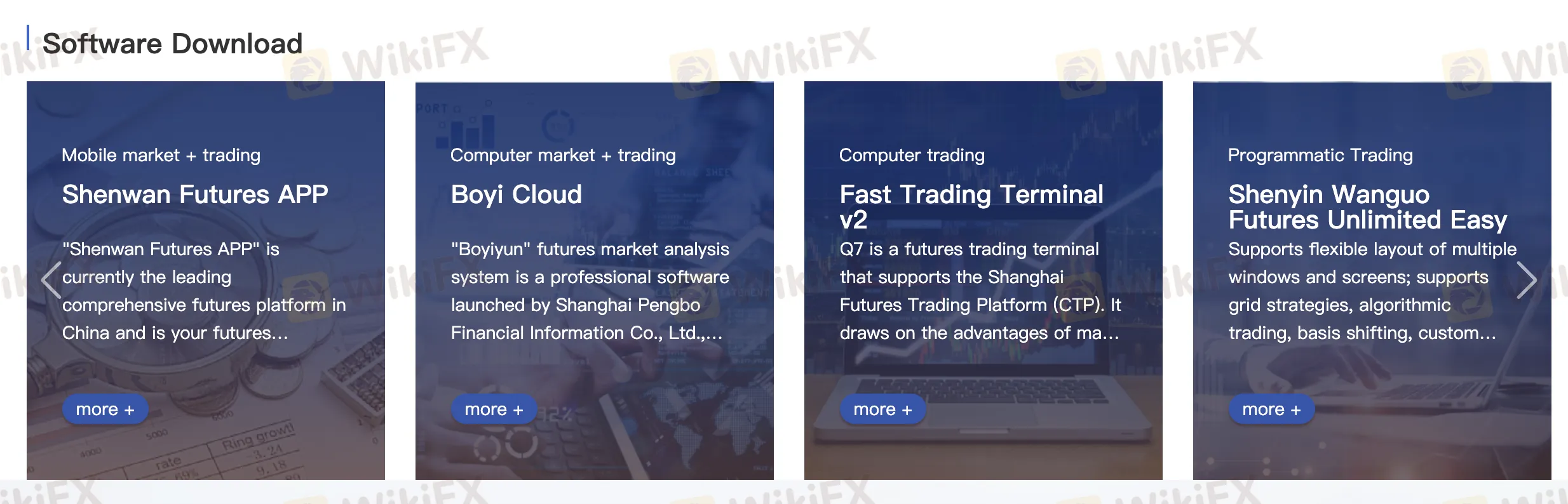

交易平台

| 交易平台 | 支援 | 可用設備 |

| 申萬期貨 APP | ✔ | iOS、Android |

| 博易雲 | ✔ | Windows |

| 快速交易終端 v2 | ✔ | Windows |

| 申銀萬國期貨無限易 | ✔ | Windows |