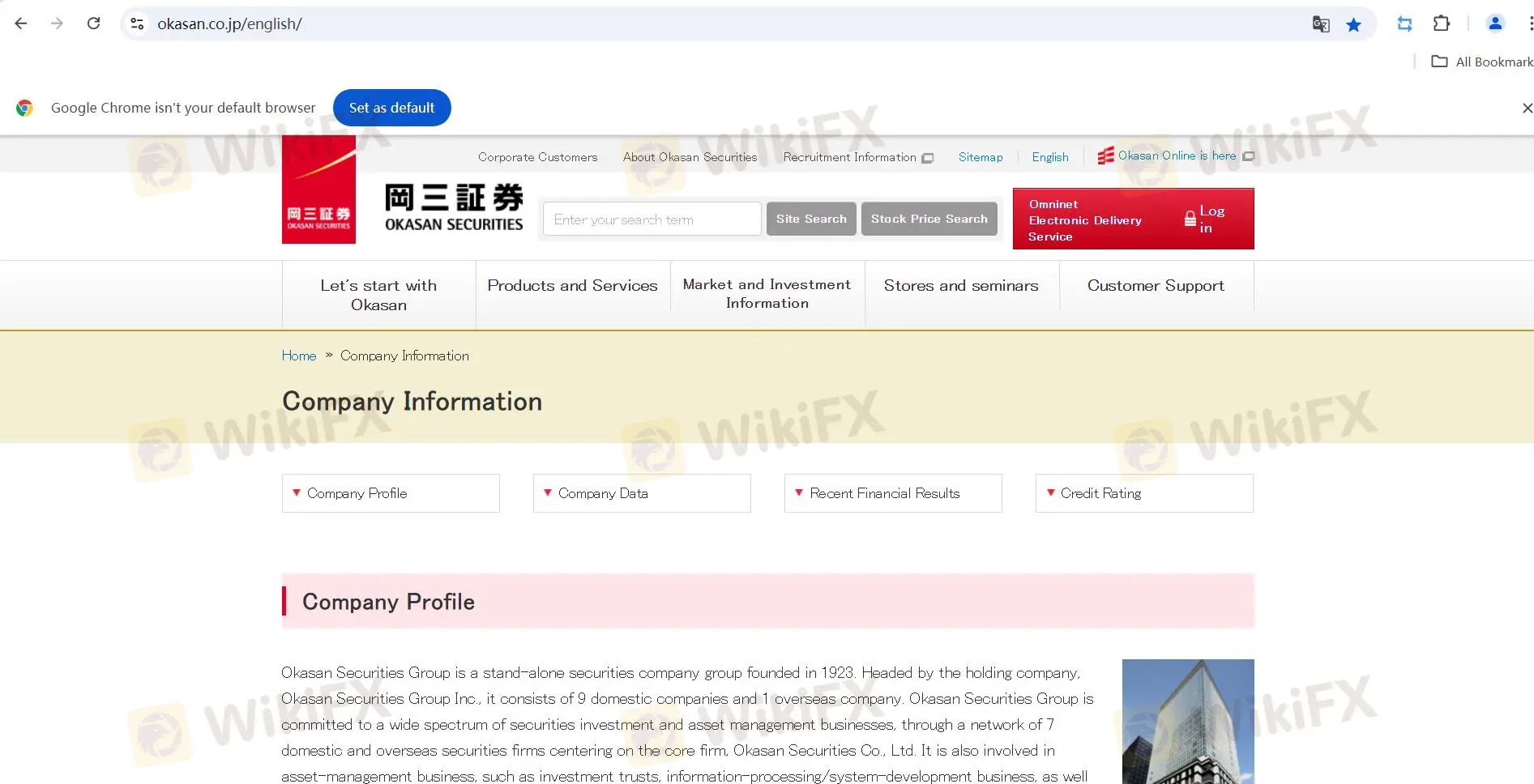

公司简介

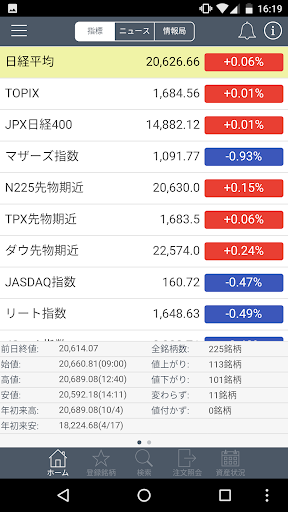

| 冈三证券评论摘要 | |

| 成立时间 | 1996 |

| 注册国家/地区 | 日本 |

| 监管机构 | FSA |

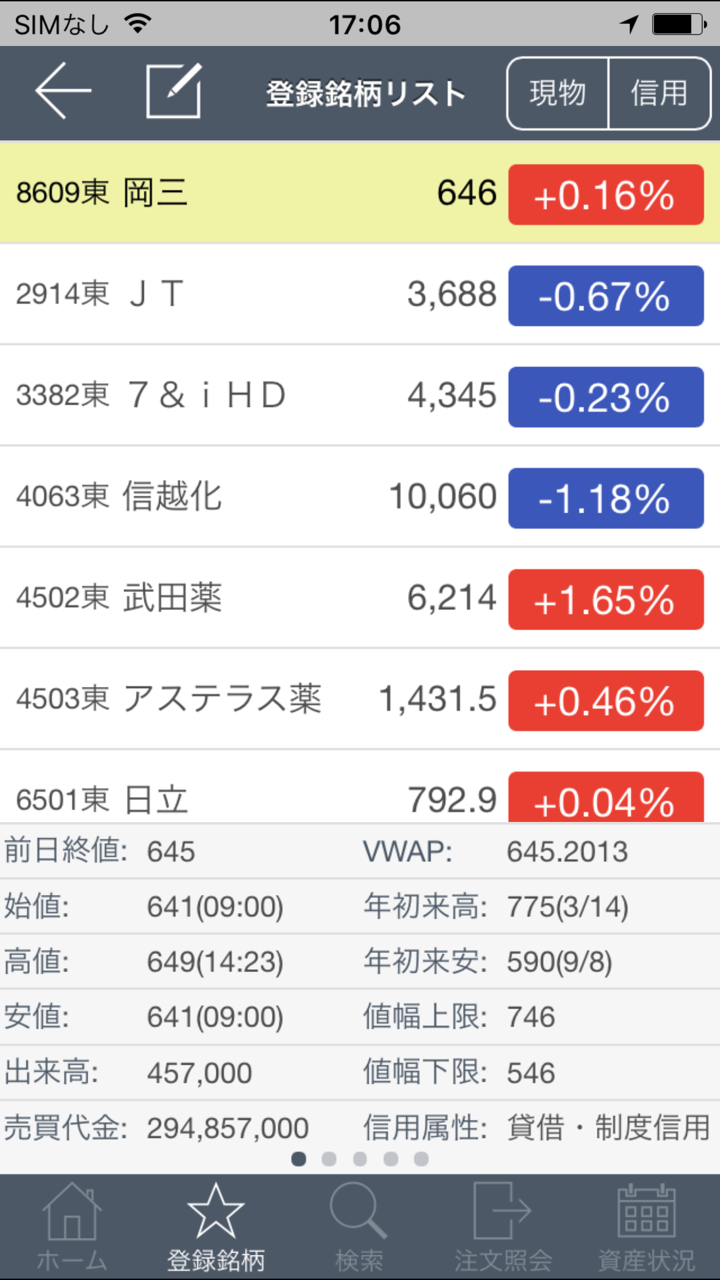

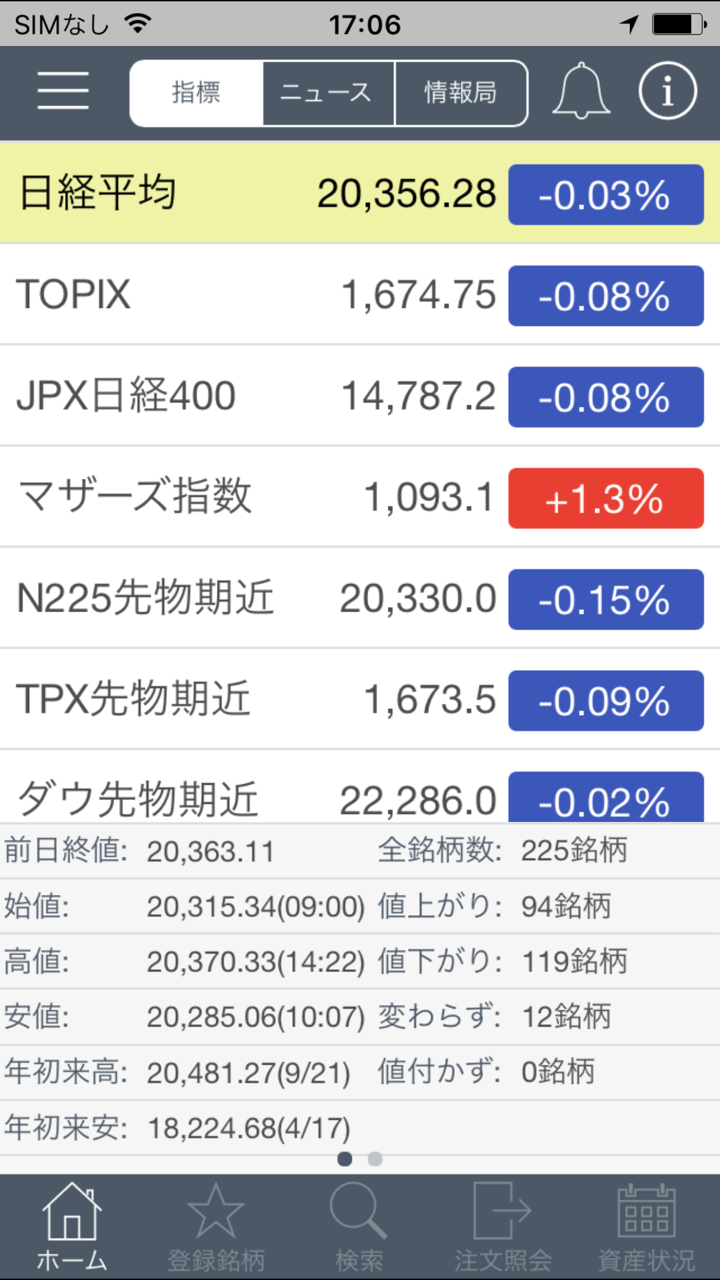

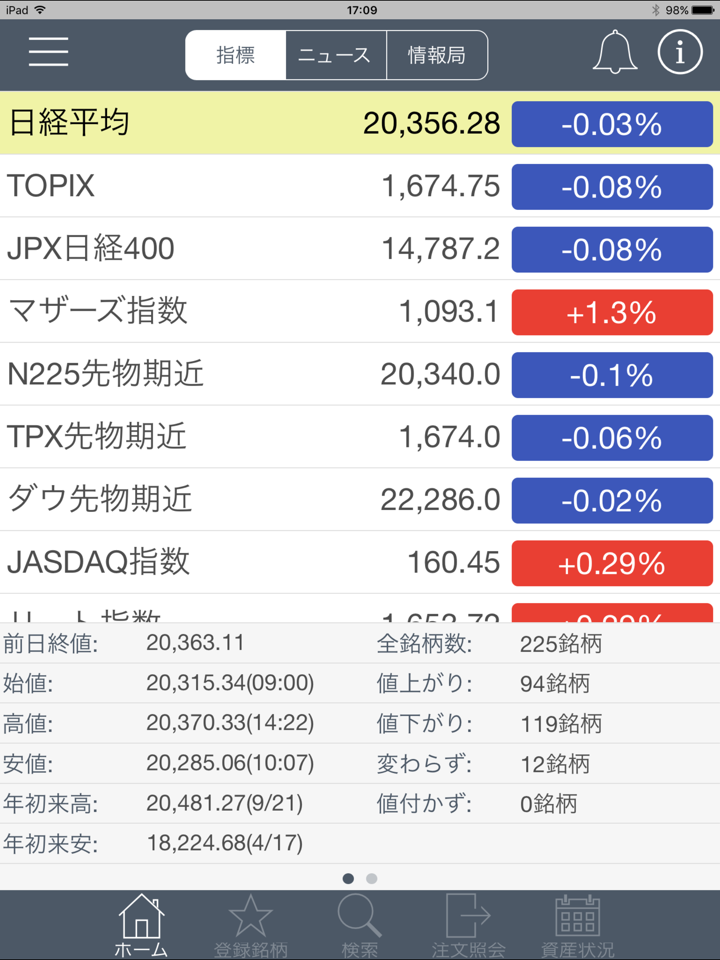

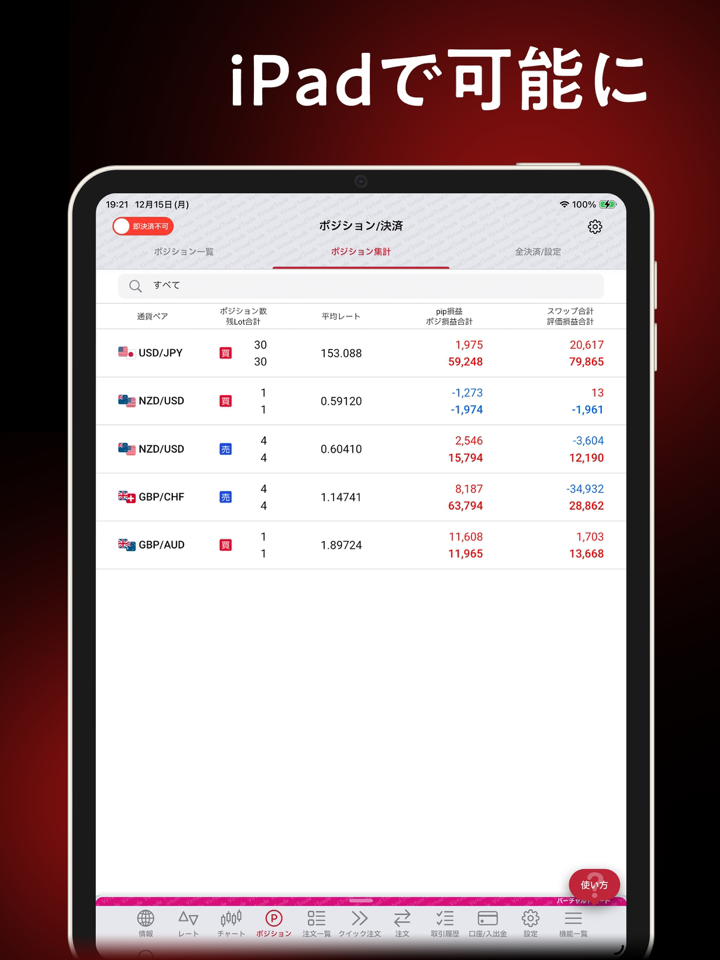

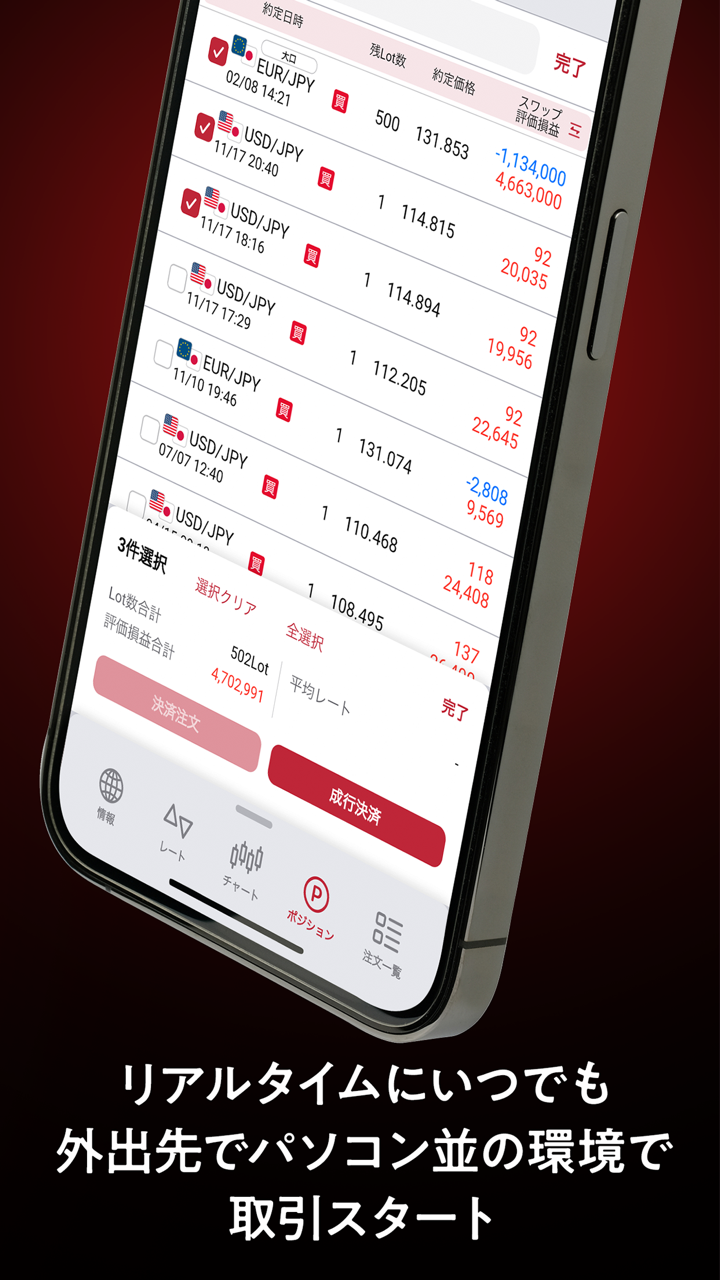

| 市场工具 | 贵金属、股票和股份、ETF、债券、投资信托、保险 |

| 模拟账户 | 未提及 |

| 杠杆 | 未提及 |

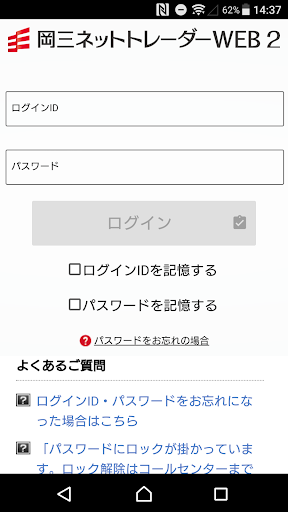

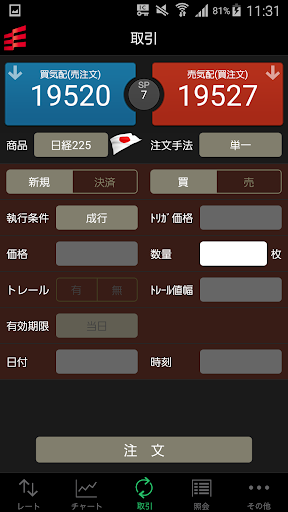

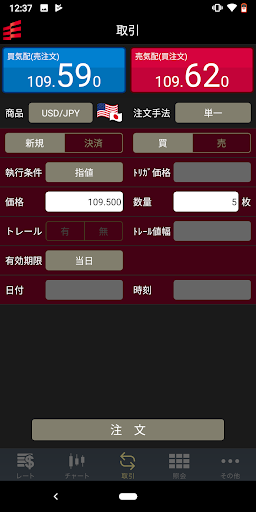

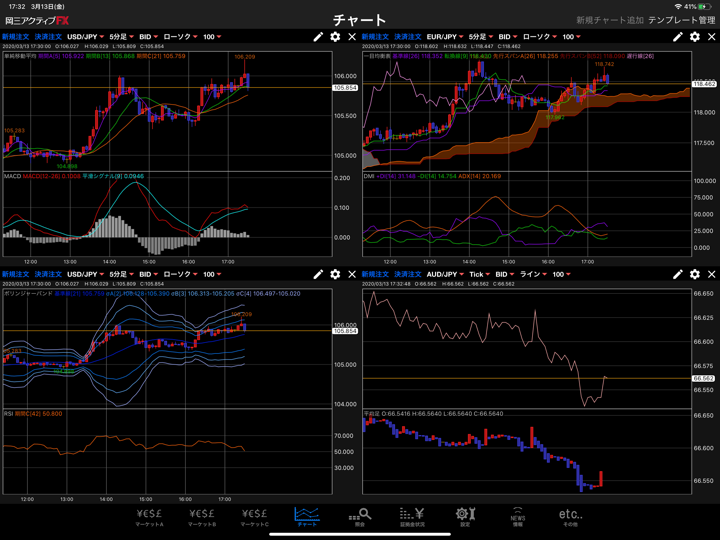

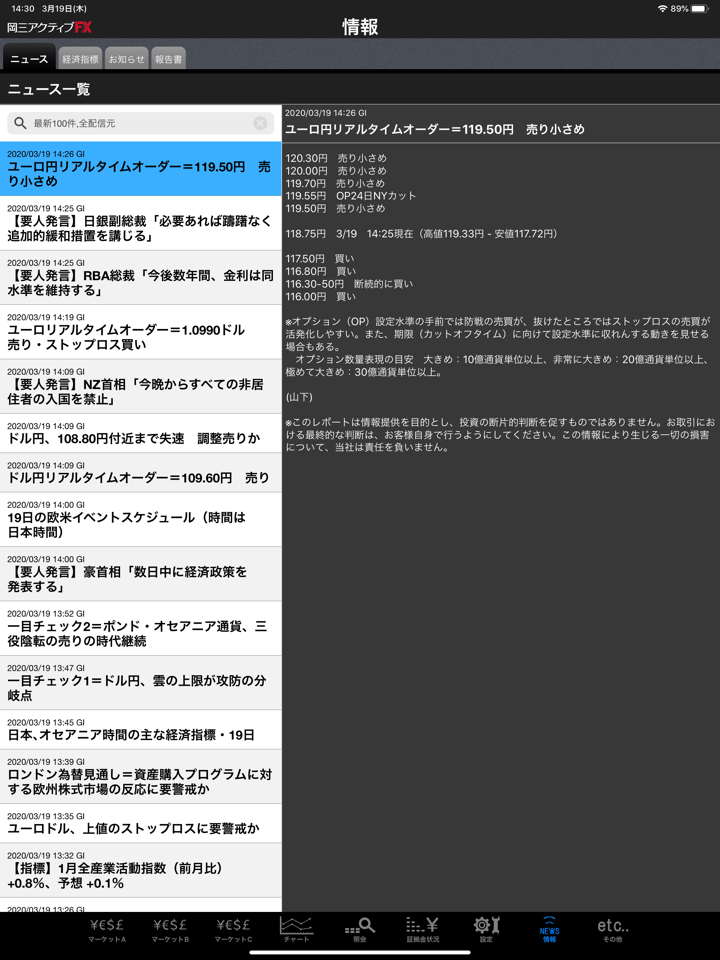

| 交易平台 | 未提及 |

| 最低存款 | 未提及 |

| 客户支持 | 电话:0120-186988,03-6386-4482 |

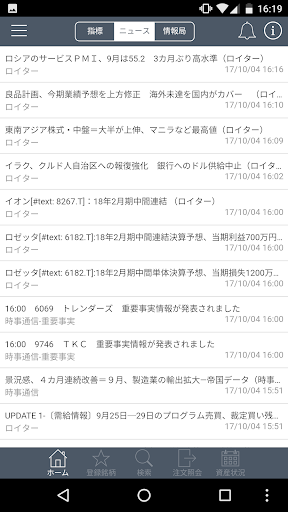

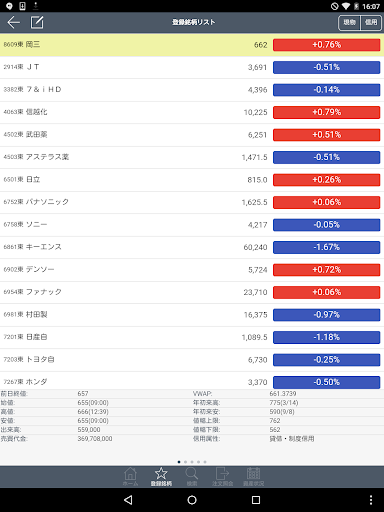

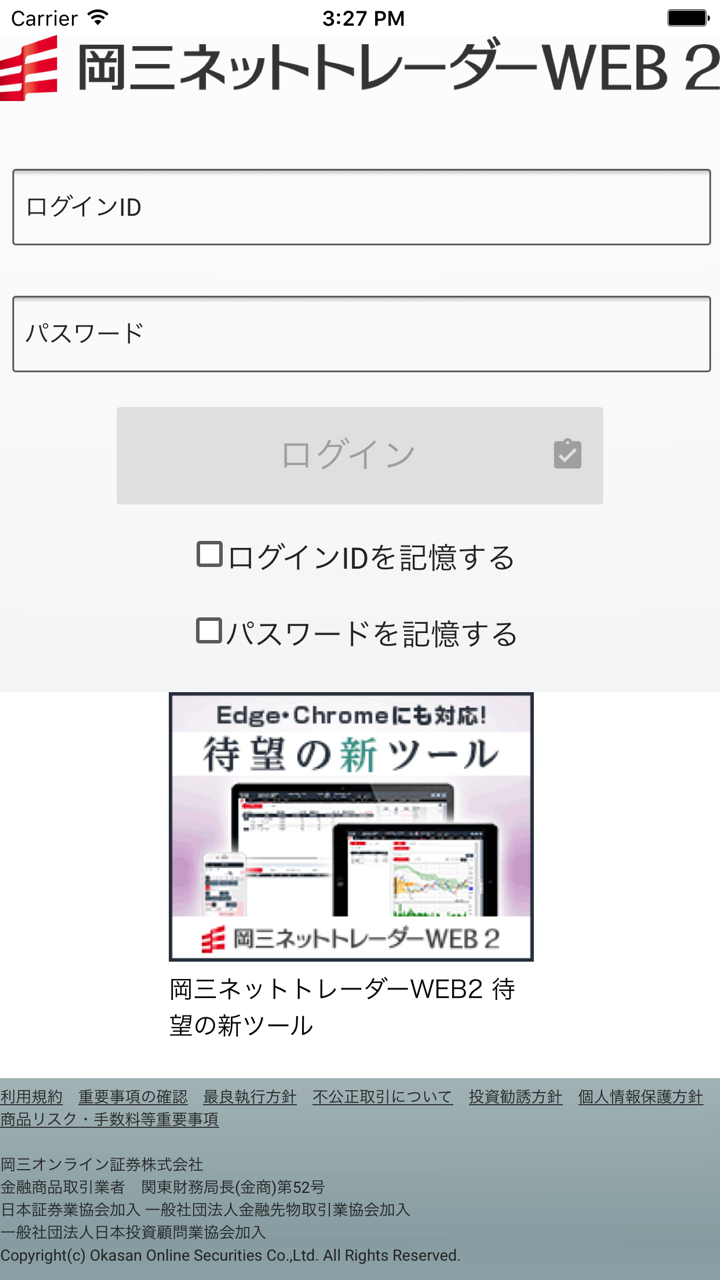

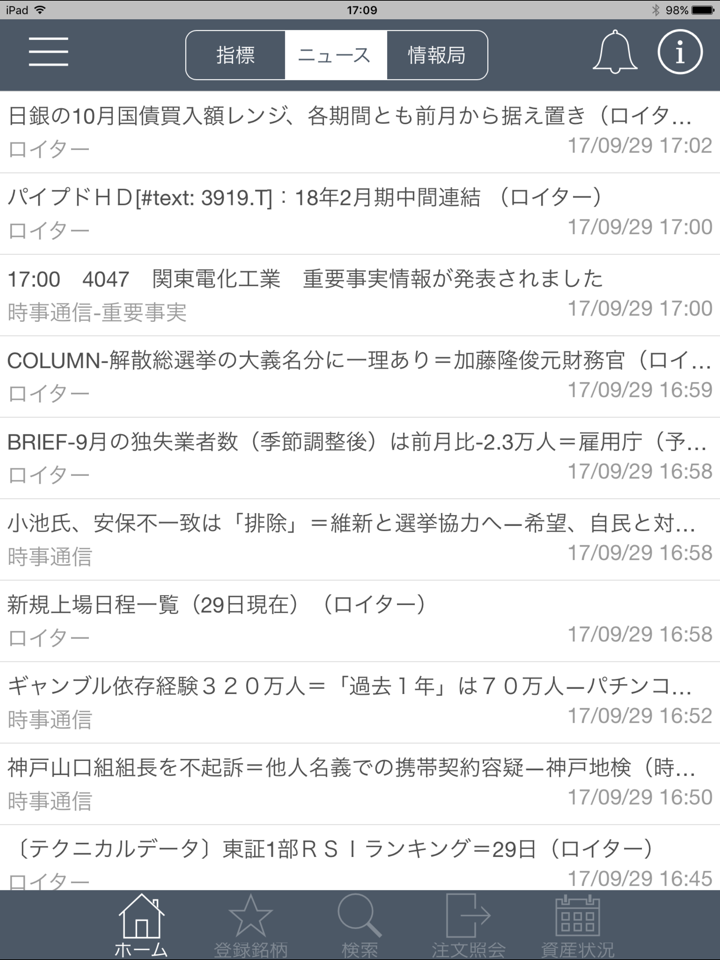

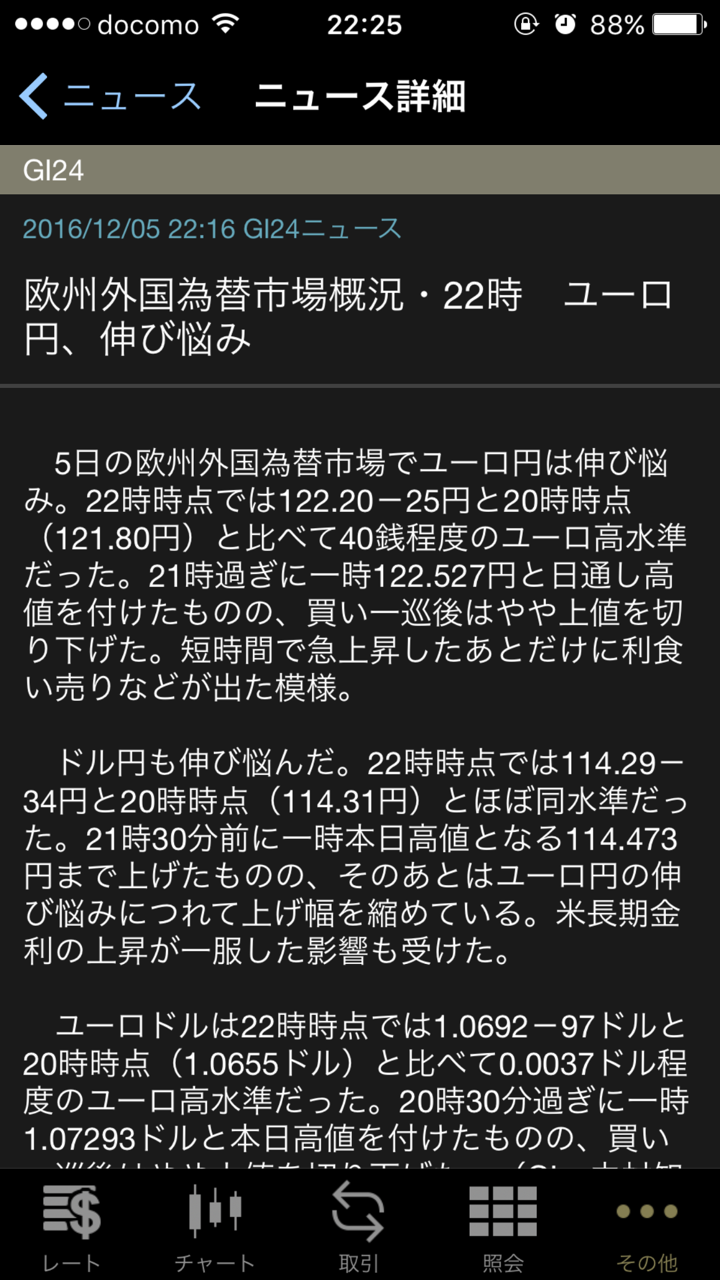

Okasan Securities Co., Ltd(“Okasan Securities”)是日本Okasan Securities Group Co., Ltd.的核心公司,为投资者提供多个交易渠道和一系列金融产品和服务。Okasan Securities在日本各地拥有约60个分支机构,推广基于社区的咨询销售,并在纽约和上海设有代表处。

优点和缺点

| 优点 | 缺点 |

| 悠久的历史 | 有限的客户支持渠道 |

| 广泛的证券投资 | 不透明的交易条件 |

| 清晰的费用结构 |

冈三证券是否合法?

| 监管国家 | 监管机构 | 监管实体 | 许可证类型 | 许可证号码 | 当前状态 |

| FSA | 冈三证券株式会社 | 零售外汇许可证 | 関東財務局長(金商)第53号 | 受监管 |

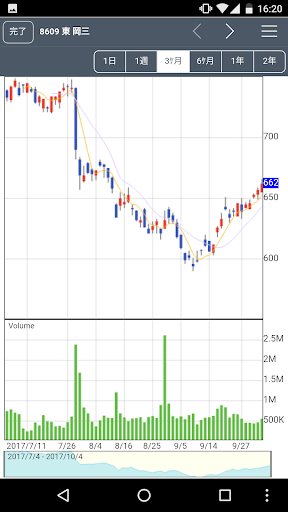

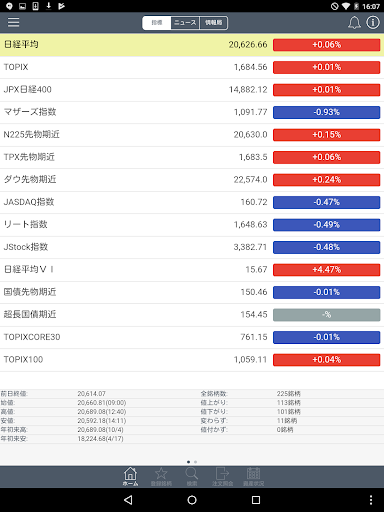

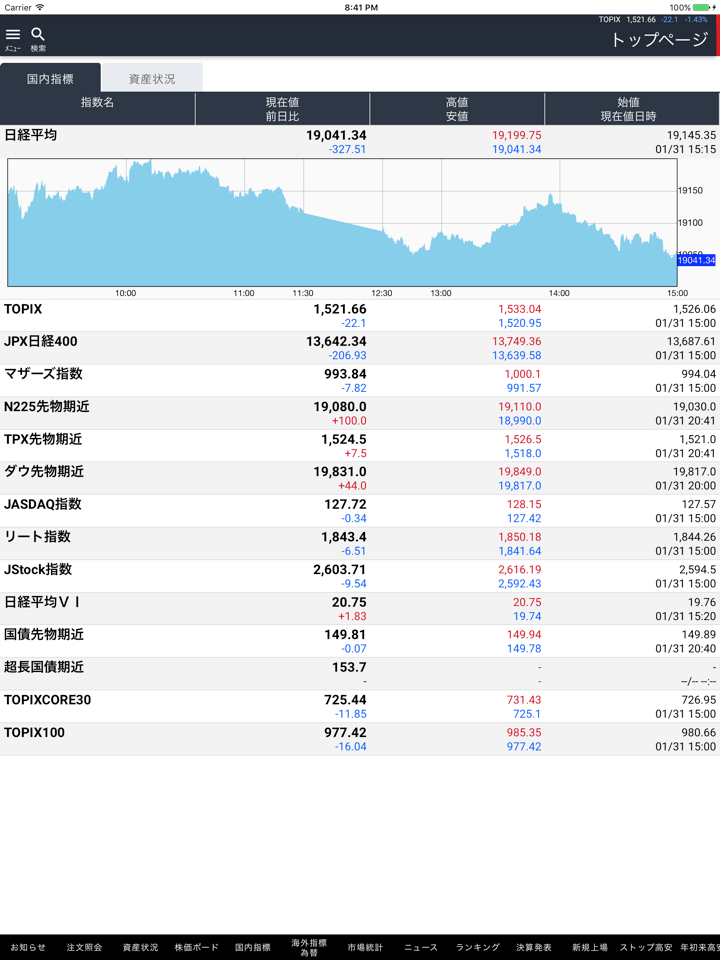

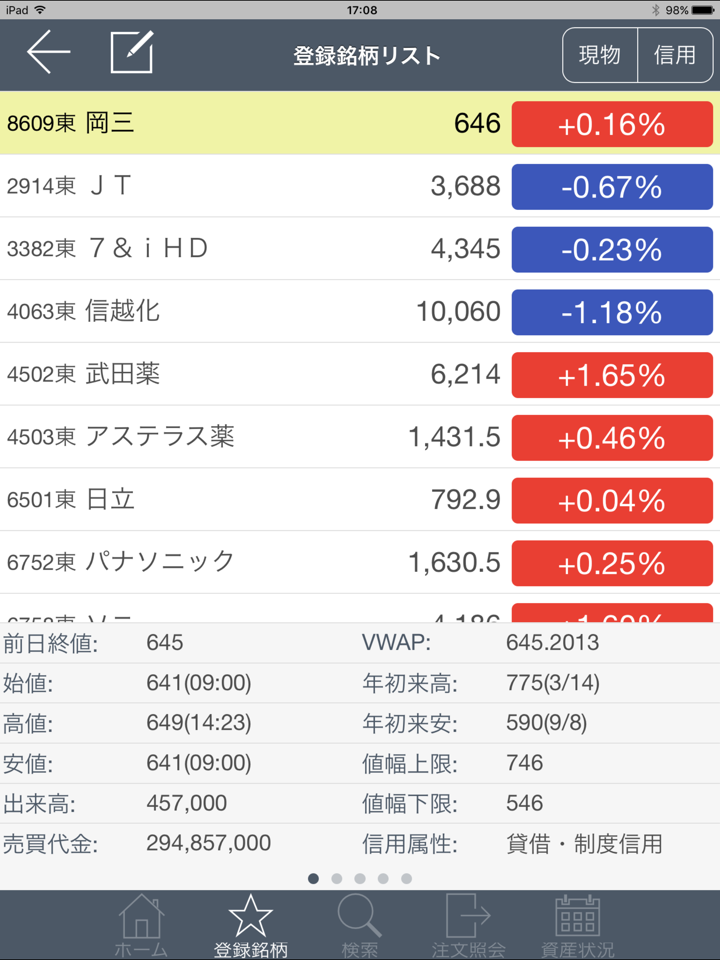

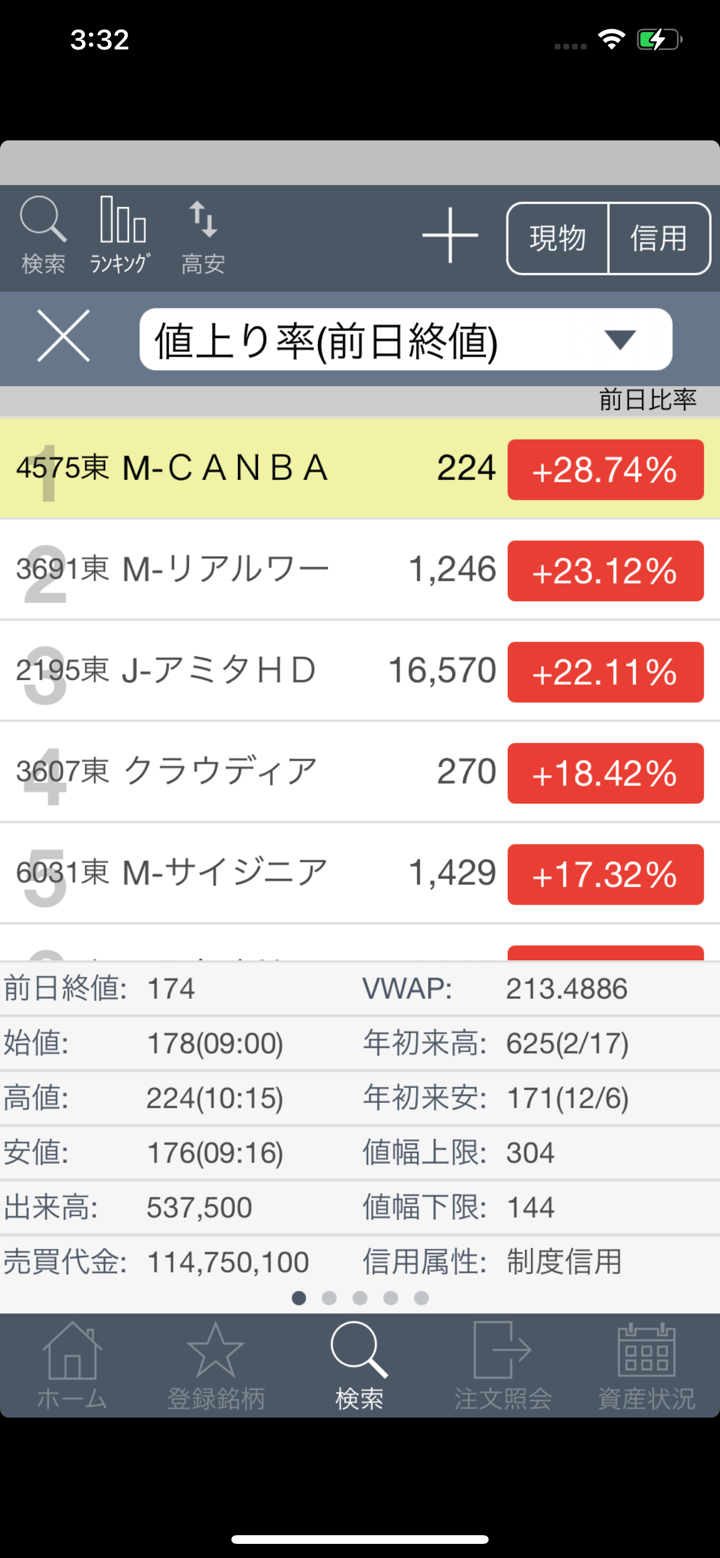

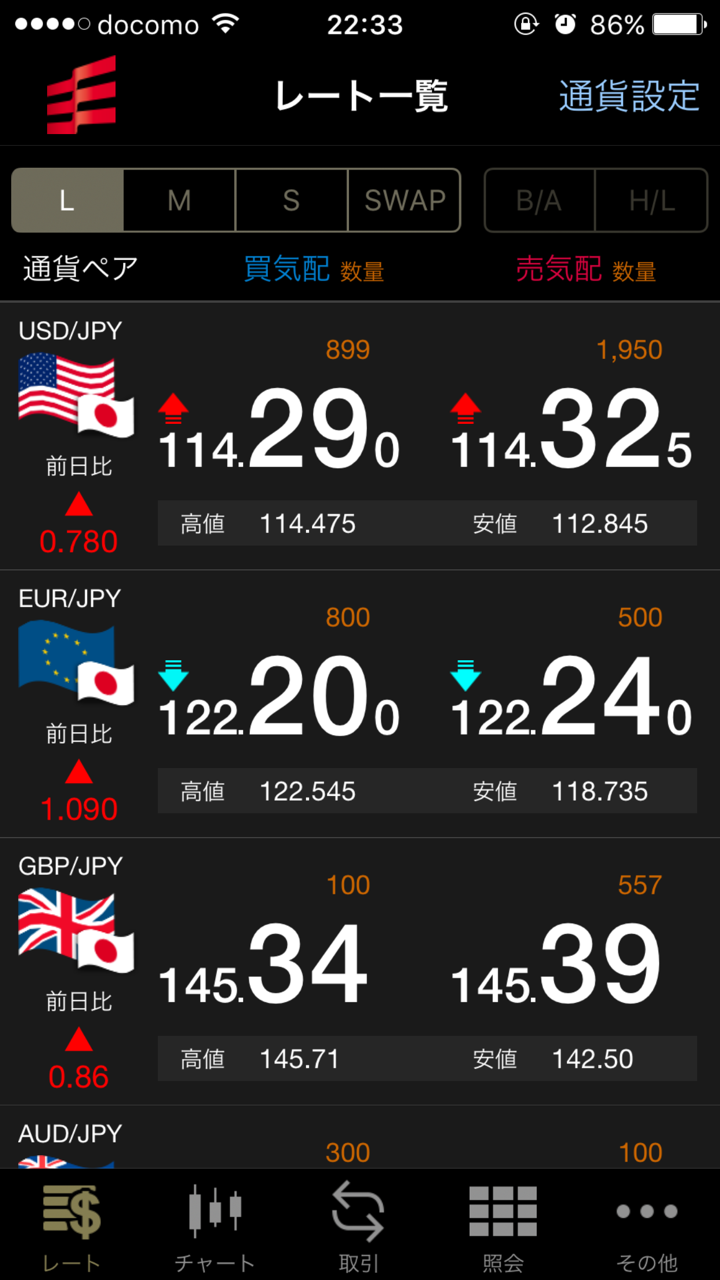

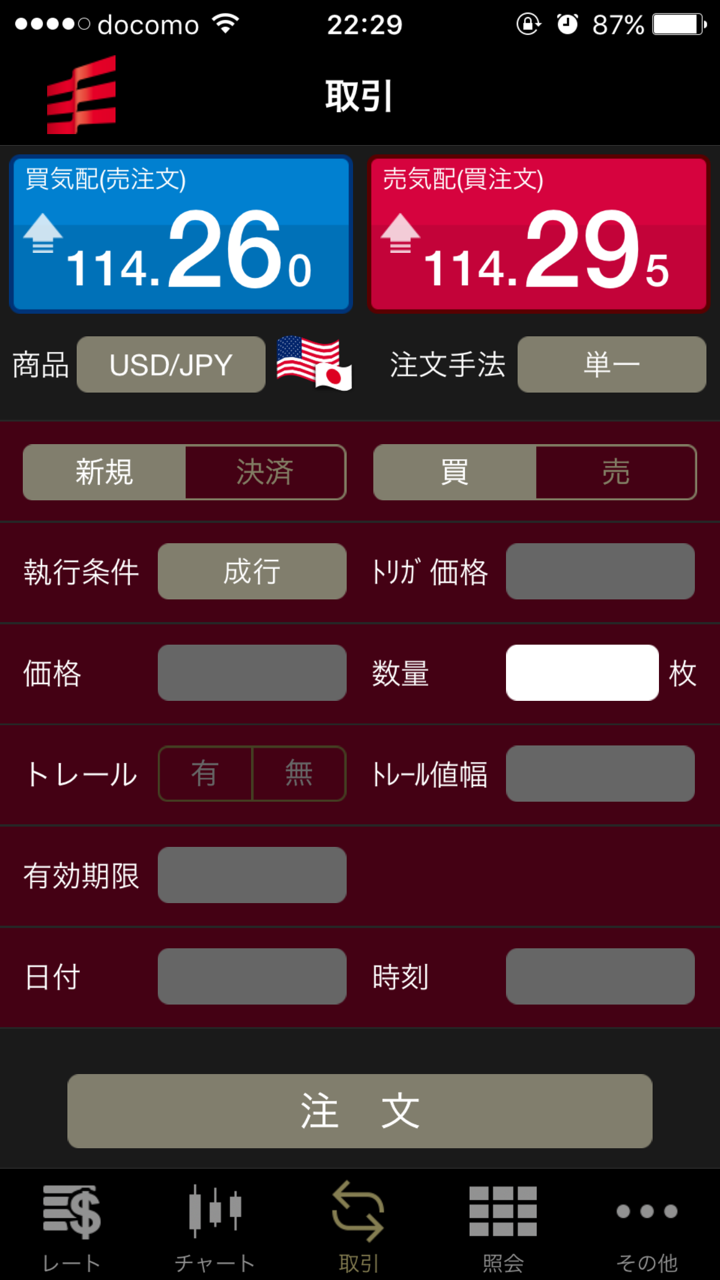

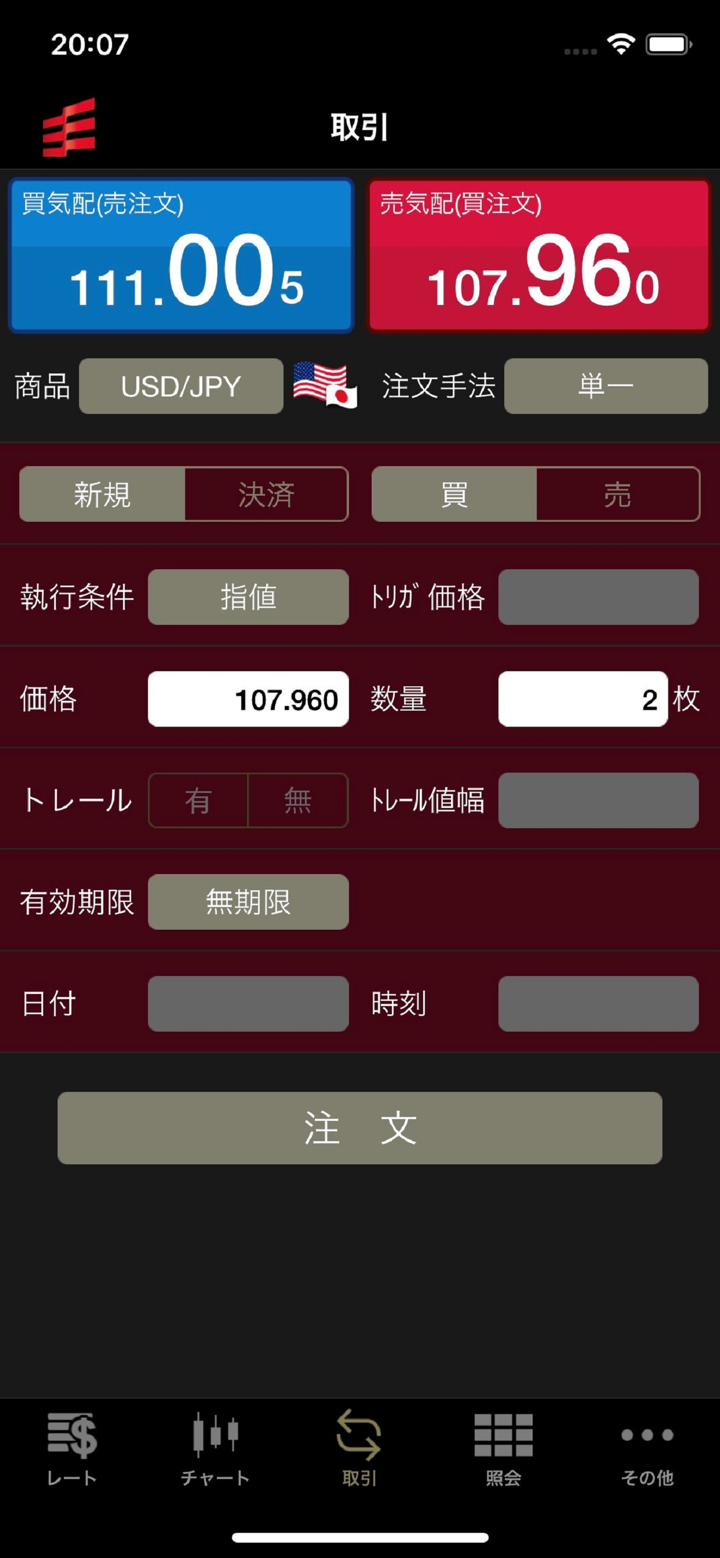

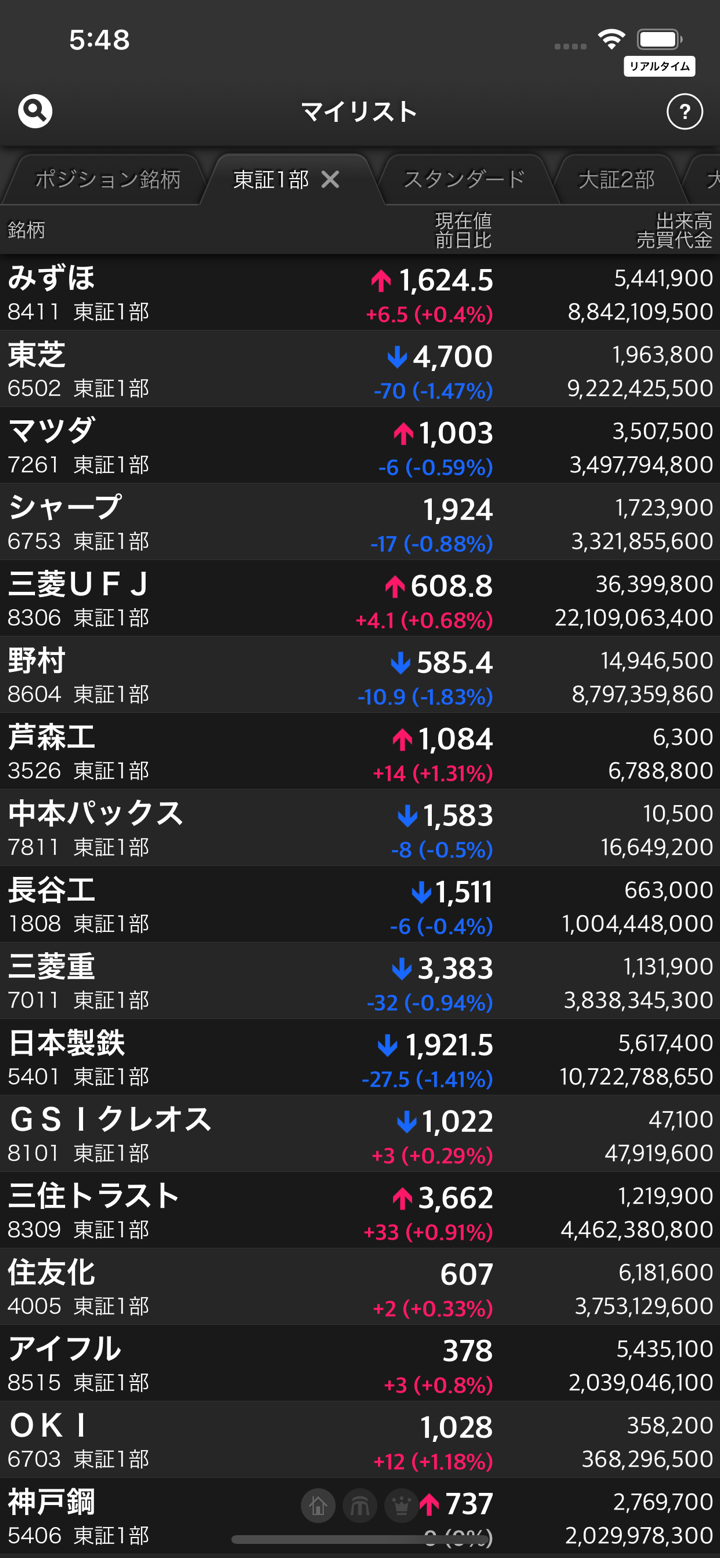

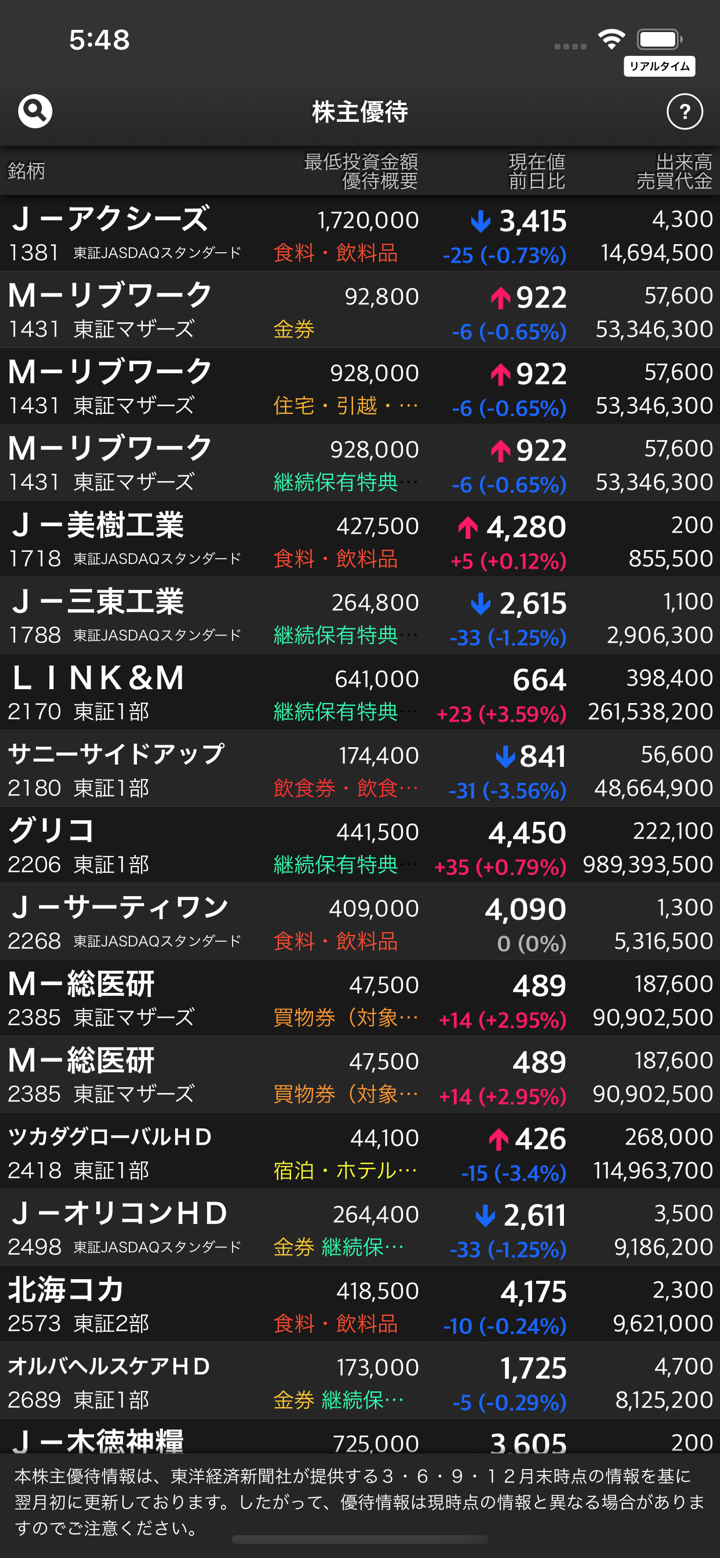

冈三证券可以交易什么?

| 交易资产 | 可用 |

| 外汇 | ❌ |

| 贵金属 | ✔ |

| 大宗商品 | ❌ |

| 指数 | ❌ |

| 能源 | ❌ |

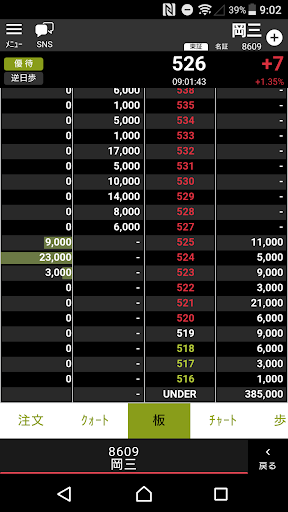

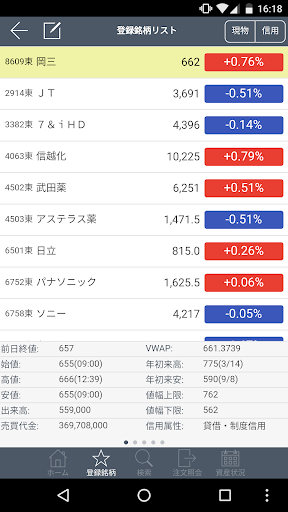

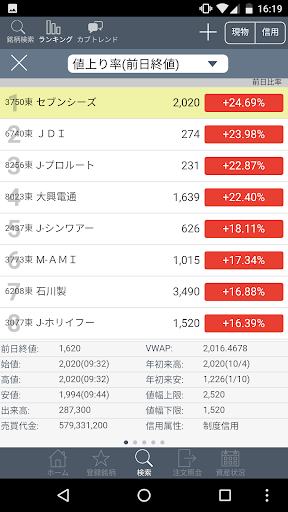

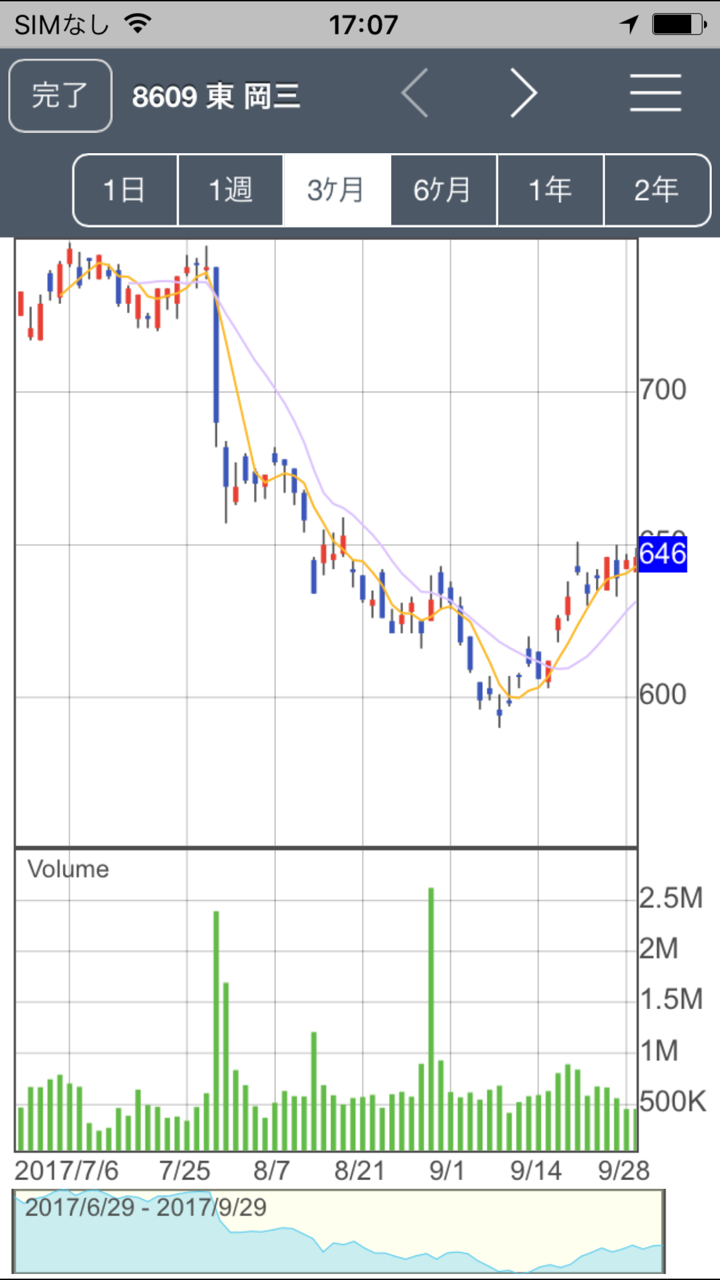

| 股票/股份 | ✔ |

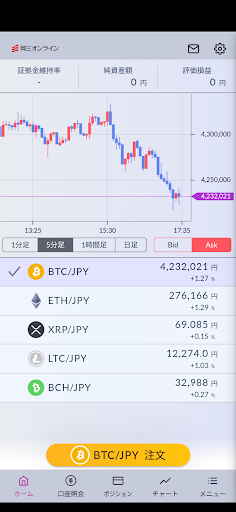

| 加密货币 | ❌ |

| 期权 | ❌ |

| 基金 | ❌ |

| ETFs | ✔ |

| 债券 | ✔ |

| 投资信托 | ✔ |

| 保险 | ✔ |

费用

冈三证券为其可交易产品提供透明的费用结构。

例如,国内股票(股票、ETF、J-REIT等)

标准费用计算

| 合同价格 | 分行账户 | 在线交易账户 | Omni Net |

| 100万日元以下 | 合同价格的1.26500% | 合同价格的0.88550% | 合同价格的0.63250% |

| 超过100万日元,不超过300万日元 | 合同价格的0.93500% + 3,300日元 | 合同价格的0.65450% + 2,310日元 | 合同价格的0.46750% + 1,650日元 |

| 超过300万日元,不超过500万日元 | 合同价格的0.82500% + 6,600日元 | 合同价格的0.57750% + 4,620日元 | 合同价格的0.41250% + 3,300日元 |

| 超过500万日元,不超过700万日元 | 合同价格的0.77000% + 9,350日元 | 合同价格的0.53900% + 6,545日元 | 合同价格的0.38500% + 4,675日元 |

| 超过700万日元,不超过1000万日元 | 合同价格的0.71500% + 13,200日元 | 合同价格的0.50050% + 9,240日元 | 合同价格的0.35750% + 6,600日元 |

| 超过1000万日元,不超过3000万日元 | 合同价格的0.55000% + 29,700日元 | 合同价格的0.38500% + 20,790日元 | 合同价格的0.27500% + 14,850日元 |

| 超过3000万日元,不超过5000万日元 | 合同价格的0.22000% + 128,700日元 | 合同价格的0.15400% + 90,090日元 | 合同价格的0.11000% + 64,350日元 |

| 超过5000万日元 | 合同价格的0.11000% + 183,700日元 | 合同价格的0.07700% + 128,590日元 | 合同价格的0.05500% + 91,850日元 |

手续费的上下限

| 分行账户 | 在线交易账户 | Omni Net | |

| 最高金额 | 275,000日元 | 275,000日元 | 275,000日元 |

| 下限金额 | 2,750日元 | 2,200日元 | 1,980日元 |

注意:

- 折扣:使用“一般证券账户”的客户可享受固定5%的折扣,但企业客户除外。

- 佣金费用:

- 对于合同价格低于最低金额的现货交易销售,佣金将为合同价格的88.0%(含税)。

- 如果超过最高金额,将收取最高费用(含税)。

- 如果计算出的佣金低于最低金额,将收取最低费用(含税)。

- 税费包含:计算的手续费包括消费税,任何小于一日元的小数金额将向下取整。

存款和取款

冈三证券 断言,使用 冈三证券 卡进行存款和取款时,所有手续费都由 冈三证券 承担。

| 选项 | 最低金额 | 费用 | 处理时间 |

| 冈三证券 卡 | 未提及 | 由 冈三证券 承担 | 未提及 |

| 银行转账 | 未提及 | 未提及 | 未提及 |

| 外币 | 未提及 | 未提及 | 未提及 |

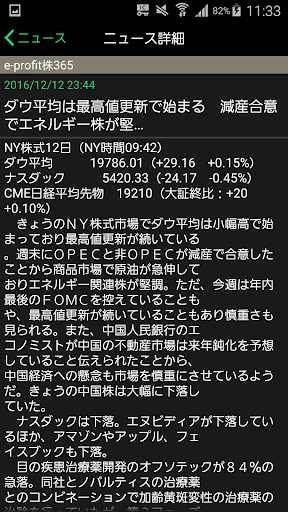

客户服务

冈三证券 的客户服务时间为9:00至18:00,周末和节假日不可用。

| 联系渠道 | 详细信息 |

| 0120-186988, 03-6386-4482 | |

| 总部:日本东京都中央区日本桥室町2-2-1 | |

| 兜町办公室:日本东京都中央区日本桥兜町1-4 |

问答

冈三证券 是否合法?

是的。它受到金融服务机构的监管。

冈三证券 是否适合初学者?

是的。它拥有监管许可证、多种可交易产品和独特的费用结构。

风险警示

请确保您了解所涉及的风险,并注意本评论中提供的信息可能会因公司服务和政策的常数更新而发生变化。