公司简介

| SMBC Nikko 评论摘要 | |

| 成立时间 | 2010 |

| 注册国家/地区 | 日本 |

| 金融产品和服务 | 资产管理咨询、并购和融资解决方案、研究服务 |

| 监管 | FSA |

| 客户支持 | 电话、地址 |

SMBC Nikko 信息

SMBC Nikko 受 FSA 监管,现已成为 SMBC 集团的一部分,是一家专注于改善客户服务的全方位经纪商。他们的战略重点包括在日本扩大资产管理业务,并通过提供高质量的金融产品扩展全球业务,成为首选证券经纪商。然而,他们的官方网站上没有提供包括交易手续费、存款和提款在内的大量信息。

优点和缺点

| 优点 | 缺点 |

|

|

|

|

SMBC Nikko 是否合法?

SMBC Nikko 在日本由金融服务机构(FSA)颁发的零售外汇牌照监管,牌照号码为关东财务局长(金商)第2251号。

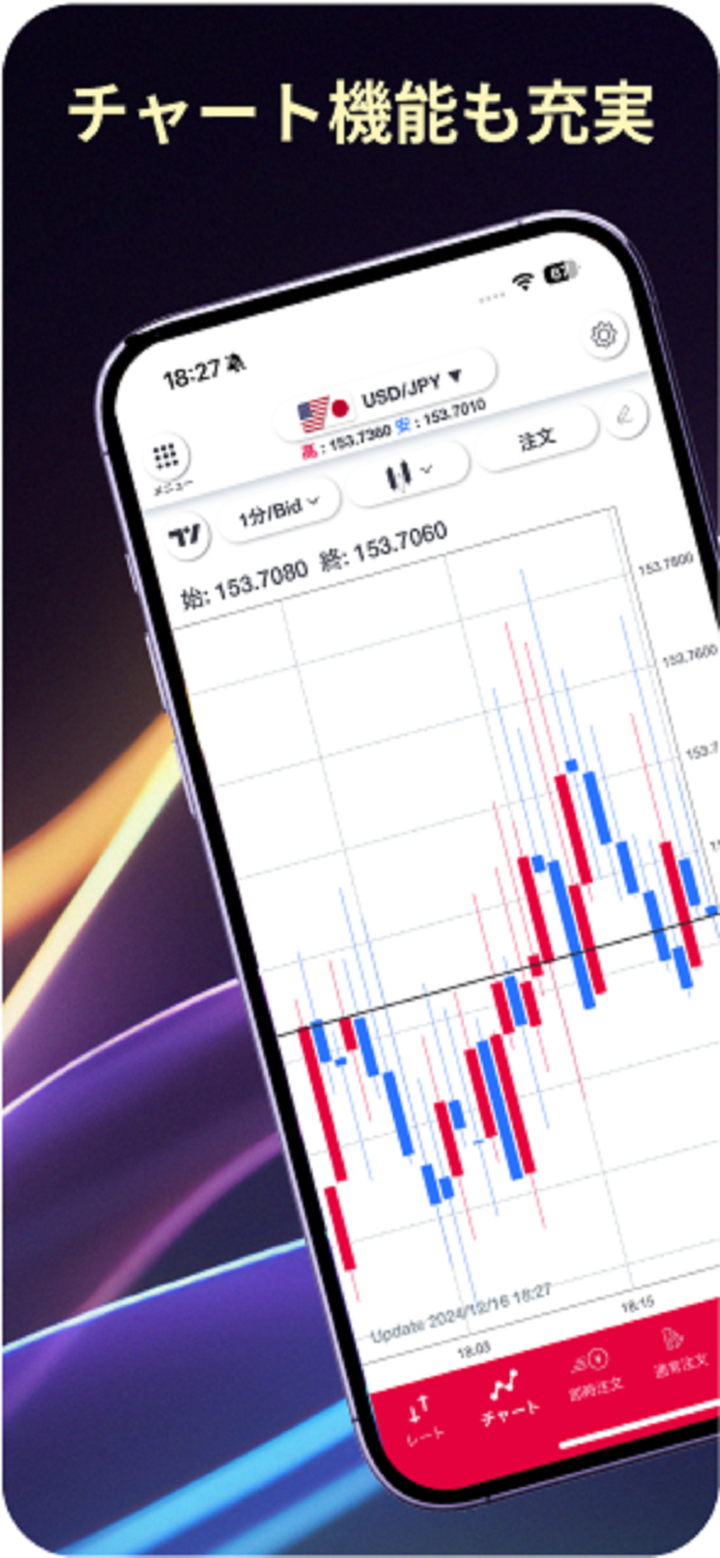

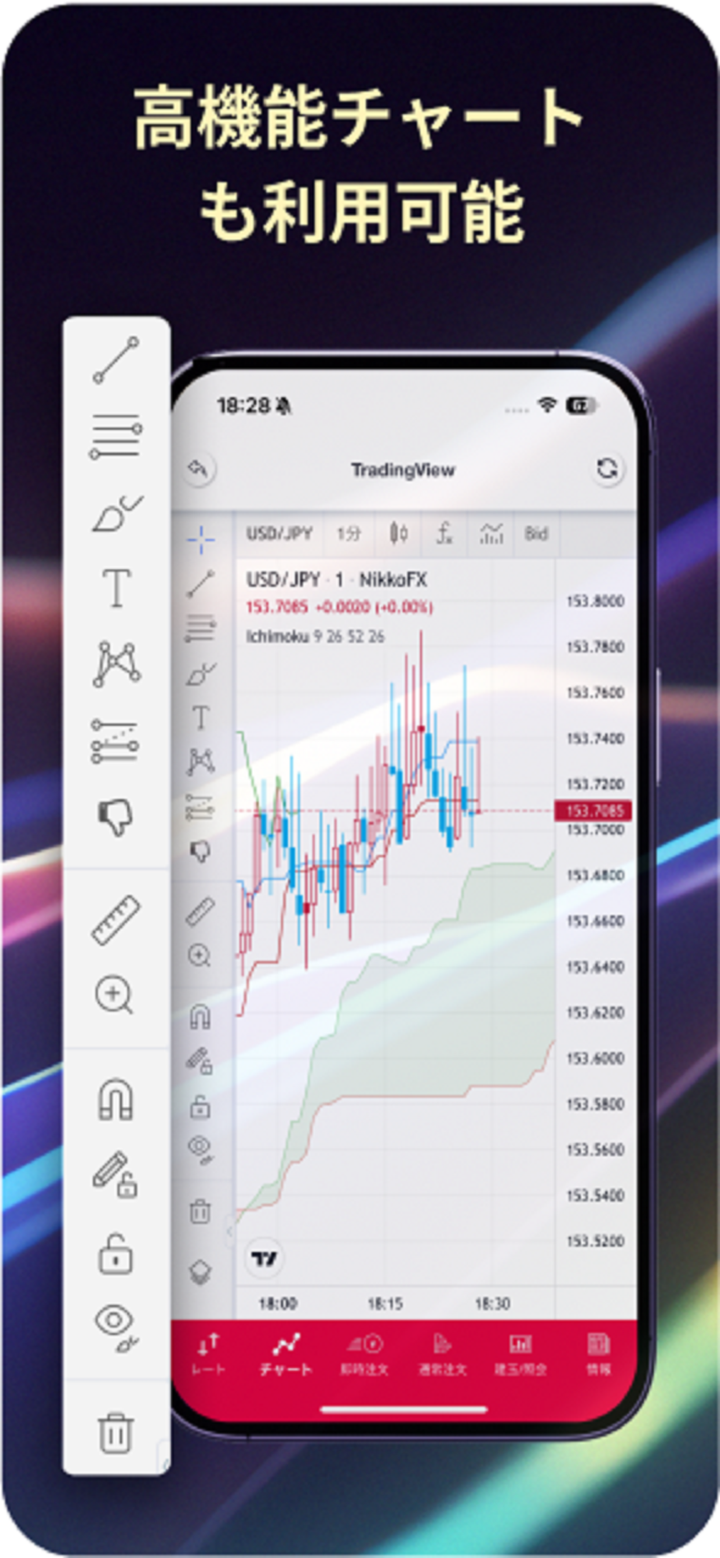

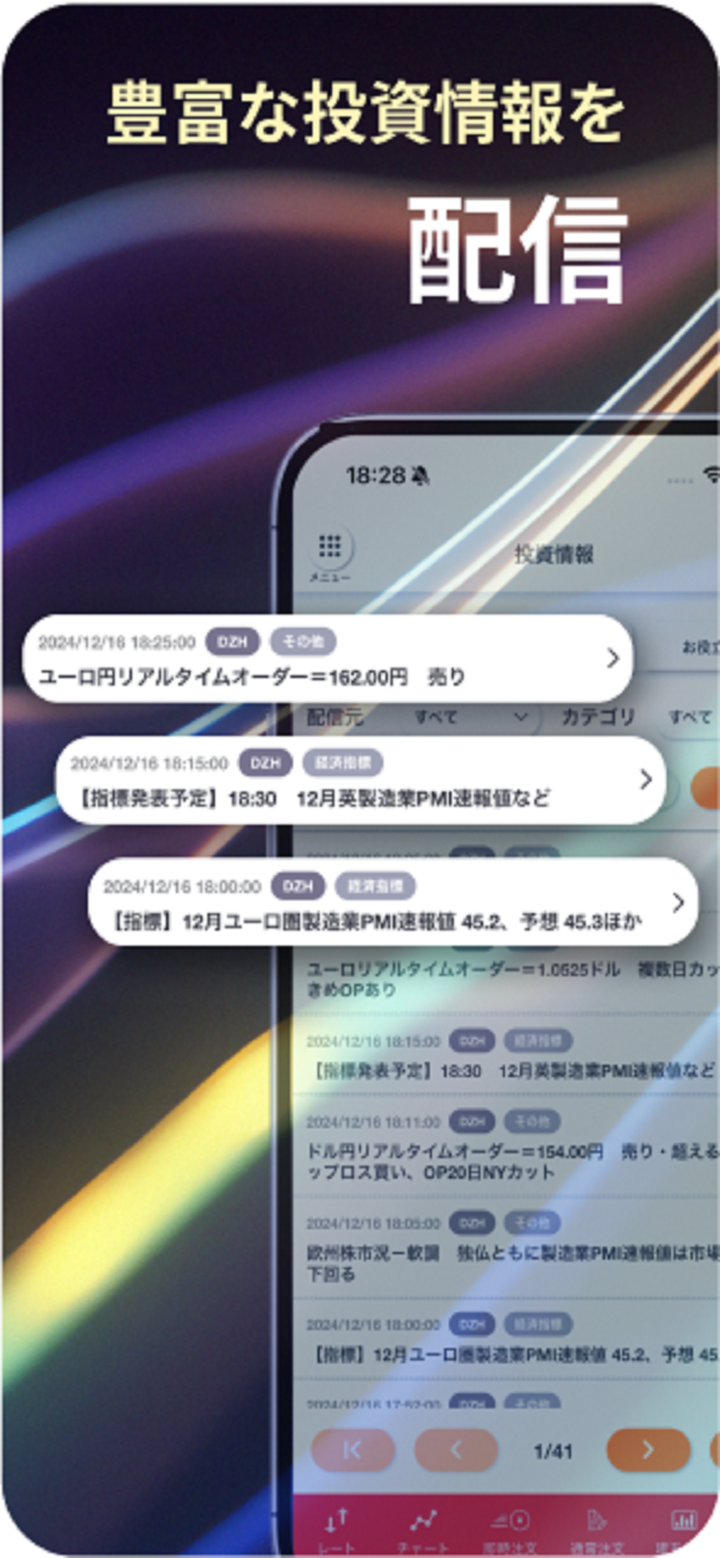

金融产品和服务

SMBC Nikko 的历史可以追溯到1918年,现已成为 SMBC 集团的一部分。作为一家全线经纪商,他们致力于提升服务质量和范围,支持客户,并利用更广泛的企业集团的能力。他们优先发展日本的资产管理业务,加强全球业务,包括跨境并购和海外融资,并开发顶级产品,旨在成为客户首选的证券经纪商。

教育

SMBC Nikko 积极推动金融和经济教育,作为其作为金融服务公司的使命的一部分。这一承诺体现在诸如日航家庭欢乐体验日等活动中,年轻学生及其家人可以了解经济。此外,该公司还为学生和成年人提供参观和研讨会,以加深他们对金融和证券公司的理解,包括参观东京证券交易所。