公司简介

| Straits Futures Indonesia评论摘要 | |

| 成立时间 | 未提及 |

| 注册国家/地区 | 印度尼西亚 |

| 监管 | 由BAPPEBTI许可 |

| 市场工具 | 商品、期货、期权、外汇 |

| 模拟账户 | ✅ |

| 交易平台 | Straits Direct、CQG Desktop、Straits Quick Trade |

| 客户支持 | 实际地址:金边市Boeung Keng Kang区63号176栋Amass Central Tower大厦 |

Straits Futures Indonesia信息

Straits Futures Indonesia(SFI)是印度尼西亚的商品和期货交易平台。它受BAPPEBTI监管。除了为商品生产商和高净值客户提供风险管理选择外,该机构还提供适合自主交易和经纪人协助交易的工具和平台。

优点和缺点

| 优点 | 缺点 |

| 由BAPPEBTI许可 | 没有费用结构信息 |

| 专注于商品的专业服务 | 没有账户类型信息 |

| 提供3个平台 |

Straits Futures Indonesia是否合法?

| 类别 | 详情 |

| 监管状态 | 受监管 |

| 许可证类型 | 零售外汇许可证 |

| 监管机构 | 印度尼西亚-BAPPEBTI |

| 许可机构 | PT. Straits Futures Indonesia |

| 许可证号码 | 43/BAPPEBTI/09/2015 |

我可以在Straits Futures Indonesia交易什么?

Straits Futures Indonesia提供许多可交易的资产,主要集中在商品和期货市场。

| 可交易工具 | 支持 |

| 商品 | ✔ |

| 期货 | ✔ |

| 期权 | ✔ |

| 外汇 | ✔ |

| 股票 | ❌ |

| 指数 | ❌ |

| 加密货币 | ❌ |

账户类型和费用

Straits Futures Indonesia没有提及账户类型和费用结构的具体信息。

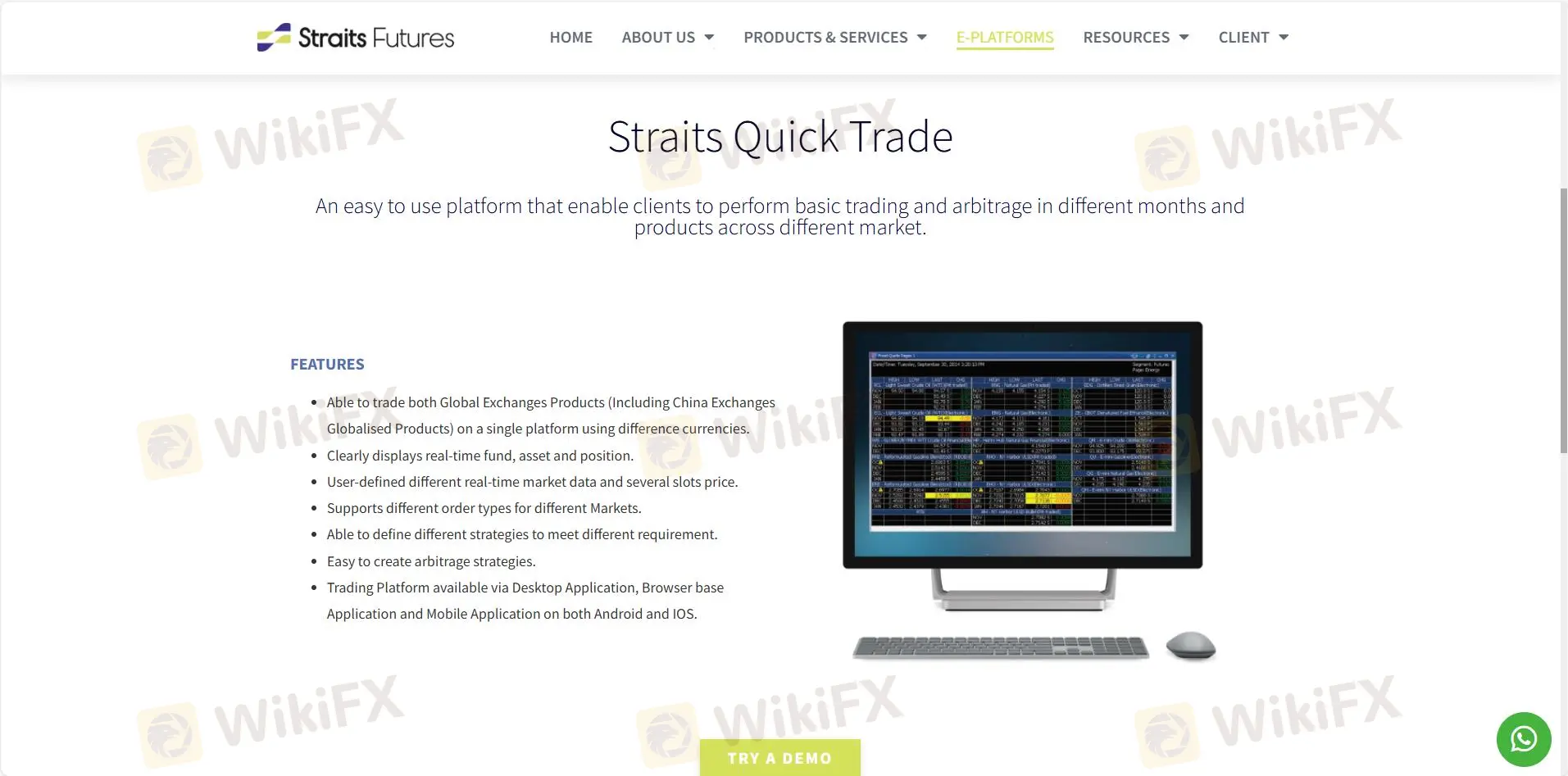

交易平台

Straits Futures Indonesia为其用户提供了3个交易平台。

| 交易平台 | 支持 | 可用设备 | 适用于 |

| Straits Direct | ✔ | 桌面,移动设备 | 所有级别 |

| CQG Desktop | ✔ | 桌面 | 经验丰富的交易者 |

| Straits Quick Trade | ✔ | 桌面,浏览器,移动设备 | 寻求简单的交易者 |

存款和取款

Straits Futures Indonesia没有提及存款和取款手续费或最低存款要求。