公司简介

| LIMIT PRIME 评论摘要 | |

| 成立时间 | 2017 |

| 注册国家/地区 | 黑山共和国 |

| 监管 | SCMN |

| 市场工具 | 外汇、大宗商品、指数、股票、金属 |

| 模拟账户 | ✅ |

| 杠杆 | 最高达1:100 |

| 点差 | 浮动 |

| 交易平台 | MT5 |

| 最低存款 | €100 |

| 客服支持 | 电话:+382 68 036 998 |

| 电子邮件:info@limitprime.com | |

| 地址:Ulica 8 marta bb, objekat 14E, Podgorica | |

| 社交媒体:Facebook、Instagram、LinkedIn、YouTube | |

LIMIT PRIME 信息

LIMIT PRIME 是一家受监管的经纪公司,提供各种交易工具和灵活的付款选项,适合有经验的交易者。其优势包括高度的安全和透明的手续费;然而,潜在的缺点可能是不活跃的账户手续费和缺乏友好的初学者平台。

优缺点

| 优点 | 缺点 |

| 监管良好 | 类型有限账户 |

| 免佣金 | |

| 分离账户 | |

| 负债保护 | |

| 提供模拟账户 | |

| 支持MT5 | |

| 多种付款方式 | |

| 多种交易工具 |

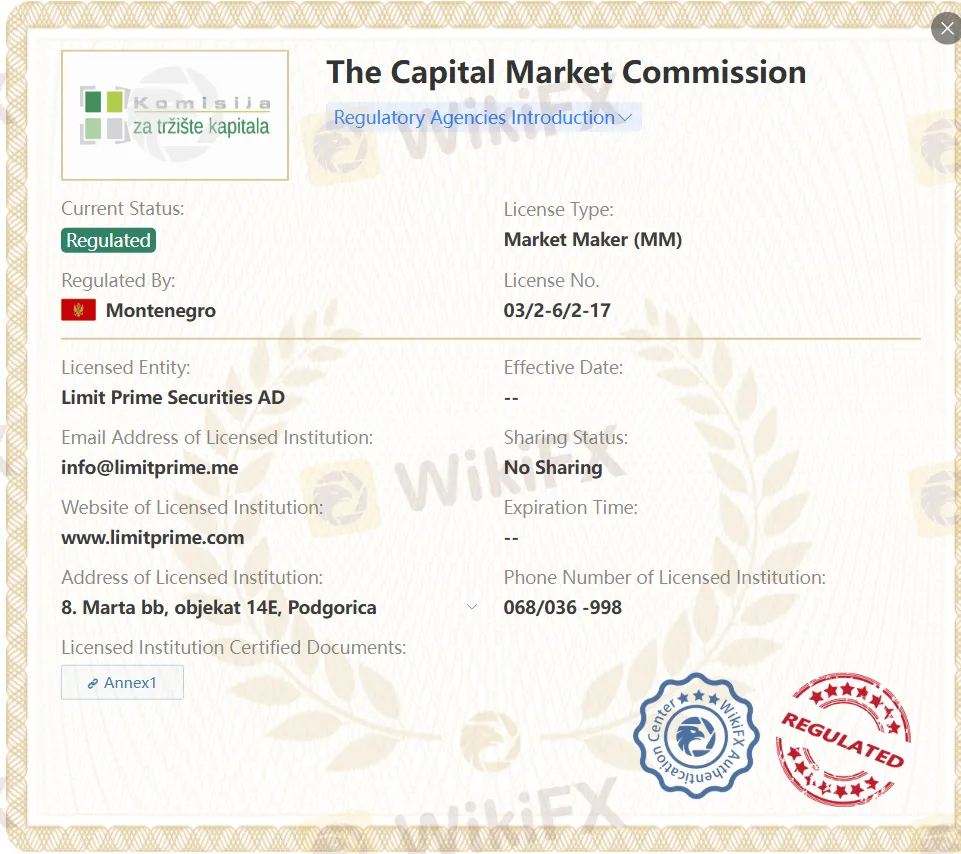

LIMIT PRIME 是否合法?

LIMIT PRIME 是一家受监管的经纪公司。Limit Prime Securities 受MIFID II监管,ESMA监管,由黑山共和国资本市场管理局许可和监管。

| 监管国家 | 监管机构 | 监管状态 | 受监管实体 | 许可类型 | 许可证号码 |

| 资本市场委员会(SCMN) | 受监管 | Limit Prime Securities AD | 做市商(MM) | 03/2-6/2-17 |

我可以在LIMIT PRIME上交易什么?

这些是可以在LIMIT PRIME上交易的工具:40种外汇、大宗商品、指数、股票和金属。

| 交易资产 | 可用 |

| 外汇 | ✔ |

| 大宗商品 | ✔ |

| 指数 | ✔ |

| 股票 | ✔ |

| 金属 | ✔ |

| 加密货币 | ❌ |

| 债券 | ❌ |

| 期权 | ❌ |

| 基金 | ❌ |

| 交易所交易基金 | ❌ |

账户类型

LIMIT PRIME提供模拟账户,允许交易者在不冒真金风险的情况下测试该平台。

LIMIT PRIME提供一种实盘账户:标准账户。当客户开始交易时,他们必须最低支付100欧元,这将自动将他们分类为标准交易组。

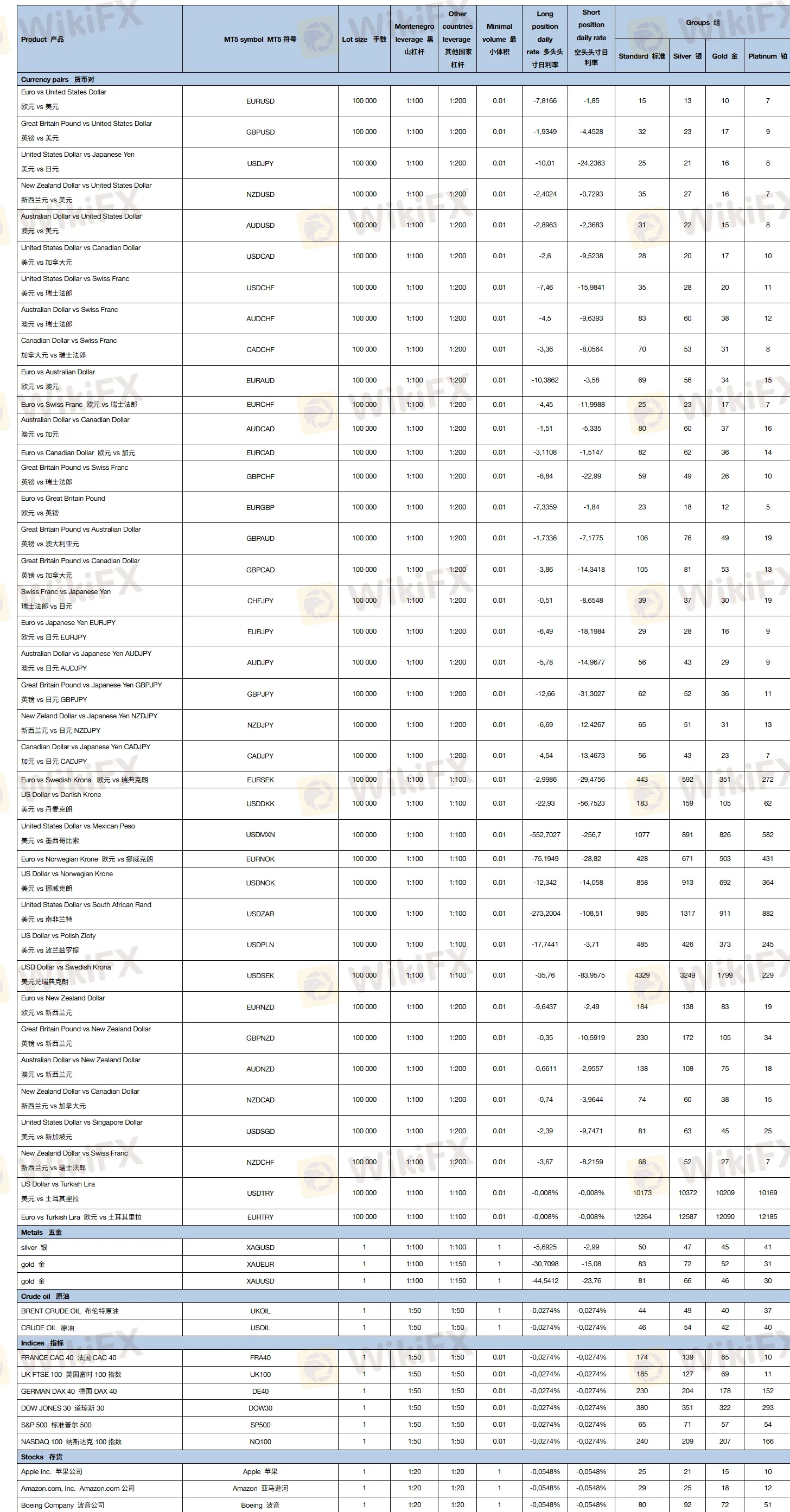

杠杆

该平台的杠杆可达1:100。杠杆是指借入资金进行投资以放大投资回报的行为。它使投资者能够用较少的自有资金实现更大规模的投资,从而在投资收益高时获得更大的回报。

费用

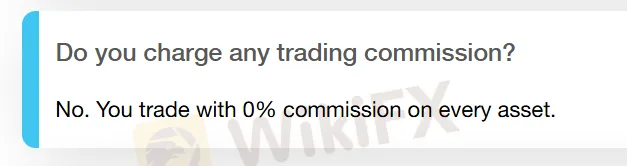

直接成本:公司不向客户收取任何交易佣金。

每当夜间有持仓时,隔夜利息将从客户的账户中扣除。

间接成本:所有未进行任何交易以及在账户批准日期起三个月内未进行至少一笔交易的客户被视为不活跃账户。对于不活跃账户的每笔提款将收取20美元的佣金。

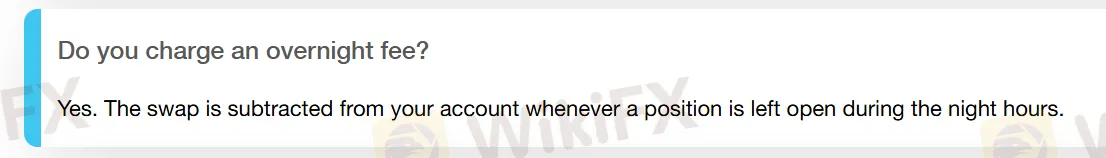

LIMIT PRIME是一家受监管的公司,其客户享有负债保护。这意味着客户的账户不会被提取比实际拥有的资金更多的资金。

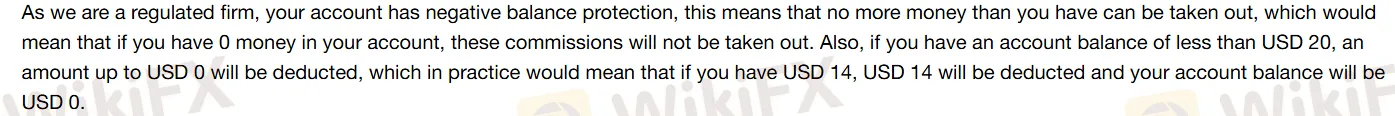

交易平台

MT5 是全球最受欢迎的交易平台之一。这是一个先进的平台,支持多种金融产品的交易,提供自动交易系统、技术工具和复制交易功能。

| 交易平台 | 支持 | 可用设备 | 适合 |

| MT5 | ✔ | 桌面,移动,Web | 经验丰富的交易者 |

| MT4 | ❌ | / | 初学者 |

存款和取款

LIMIT PRIME 提供以下支付方式:银行转账,万事达卡,Skrill,Neteller,Visa 和美国运通。