Описание компании

| HoxtonWealth Обзор | |

| Основана | 2023 |

| Страна/Регион регистрации | Великобритания |

| Регулирование | Отсутствует регулирование |

| Инвестиционные решения | Управляемые портфели, Инвестирование с низкими издержками, Планирование пенсии, Альтернативные инвестиции и Этическое инвестирование |

| Платформа/Приложение | Приложение Hoxton Wealth |

| Поддержка клиентов | Форма обратной связи |

| Телефон: +1 737 249 9620 | |

| Физический адрес: 111 Конгресс-авеню, офис 500, Остин, Техас, 78701, Соединенные Штаты | |

| 101 Хадсон-стрит, Джерси-Сити, Нью-Джерси, 07302, Соединенные Штаты | |

Информация о HoxtonWealth

HoxtonWealth была основана в 2023 году и базируется в Великобритании. Она предлагает пять инвестиционных решений и приложение Hoxton Wealth в качестве торговой платформы. Однако компания не имеет регулирования.

Плюсы и минусы

| Плюсы | Минусы |

| Предлагает пять типов инвестиционных решений | Отсутствие регулирования |

| Предлагаются различные финансовые услуги |

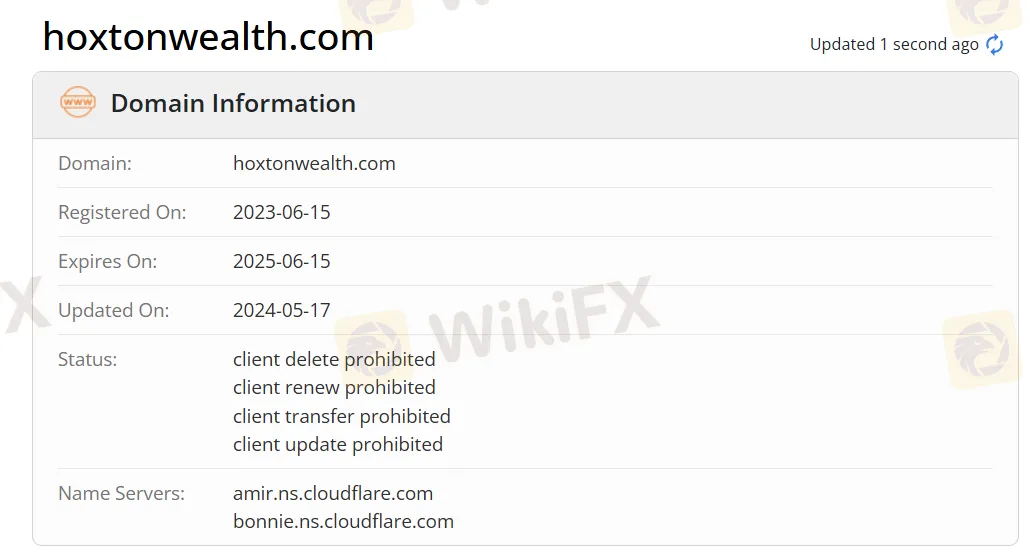

Является ли HoxtonWealth легитимной?

HoxtonWealth не имеет регулирования, и ее домен hoxtonwealth.com был зарегистрирован 15 июня 2023 года и должен истечь 15 июня 2025 года.

Инвестиционные решения

Hoxton Wealth предлагает пять инвестиционных решений. Это Управляемые портфели, Инвестирование с низкими издержками, Планирование пенсии, Альтернативные инвестиции и Этическое инвестирование.

Финансовые услуги

Hoxton Wealth предлагает широкий спектр финансовых услуг, включая планирование пенсии, инвестиционные консультации, налоговую поддержку, юридические и страховые решения, консультирование по инвестициям в недвижимость, планирование наследства и передачу богатства. Они также предоставляют консультации по вопросам, связанным с пенсией в Великобритании.

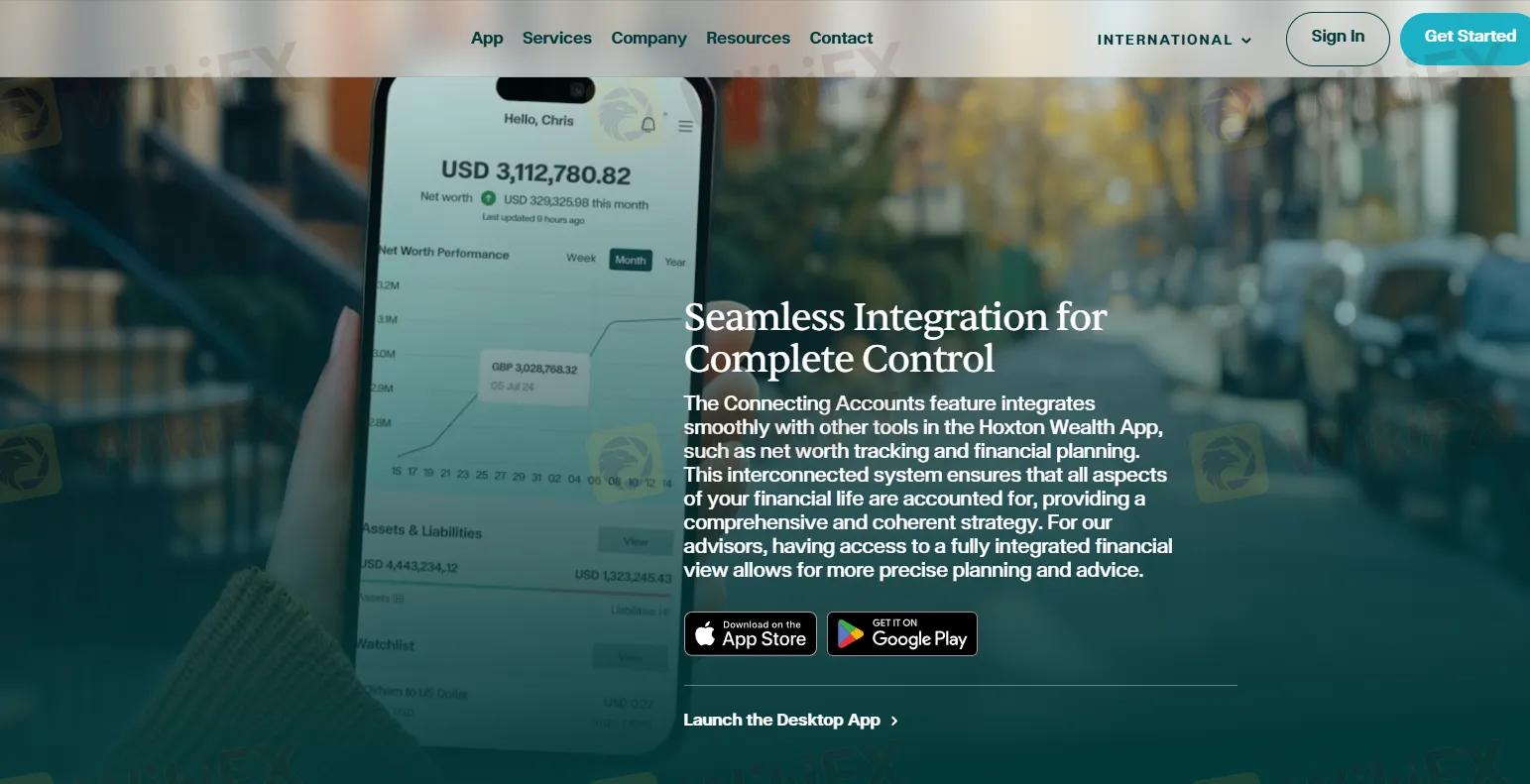

Торговая платформа

Торговая платформа Hoxton Wealth - это Приложение Hoxton Wealth. Оно может подключаться к различным финансовым счетам без ограничений по валюте, институту или региону, и предоставляет отслеживание чистой стоимости в реальном времени. Это приложение можно загрузить из Apple App Store и Google Play, а также оно является приложением для настольного компьютера.