مقدمة عن الشركة

| HoxtonWealth ملخص المراجعة | |

| تأسست | 2023 |

| البلد/المنطقة المسجلة | المملكة المتحدة |

| التنظيم | لا يوجد تنظيم |

| حلول الاستثمار | حلول الحقائب المُدارة، الاستثمار بتكلفة منخفضة، تخطيط التقاعد، الاستثمارات البديلة، والاستثمار الأخلاقي |

| المنصة/التطبيق | تطبيق Hoxton Wealth |

| دعم العملاء | نموذج الاتصال |

| الهاتف: +1 737 249 9620 | |

| العنوان الفعلي: 111 شارع كونغرس، جناح 500، أوستن، تكساس 78701، الولايات المتحدة | |

| 101 شارع هدسون، جيرسي سيتي، نيوجيرسي 07302، الولايات المتحدة | |

معلومات HoxtonWealth

تأسست HoxtonWealth في عام 2023 ومقرها في المملكة المتحدة. تقدم خمس حلول استثمارية وتطبيق Hoxton Wealth كمنصتها التجارية. ومع ذلك، الشركة غير منظمة.

الإيجابيات والسلبيات

| الإيجابيات | السلبيات |

| تقدم خمسة أنواع من حلول الاستثمار | لا يوجد تنظيم |

| تقدم خدمات مالية متنوعة |

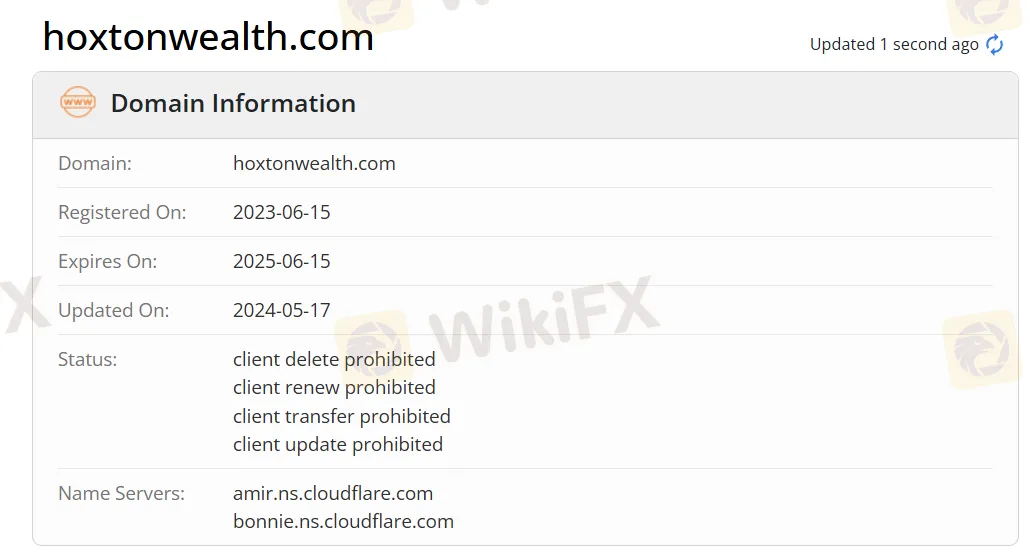

هل HoxtonWealth شرعية؟

HoxtonWealth هي غير منظمة، وتم تسجيل نطاقها hoxtonwealth.com في 15 يونيو 2023، ومن المقرر أن ينتهي في 15 يونيو 2025.

حلول الاستثمار

تقدم Hoxton Wealth خمس حلول استثمارية. وهي الحقائب المُدارة، الاستثمار بتكلفة منخفضة، تخطيط التقاعد، الاستثمارات البديلة، والاستثمار الأخلاقي.

خدمات مالية

تقدم Hoxton Wealth مجموعة واسعة من الخدمات المالية، بما في ذلك تخطيط التقاعد، نصائح الاستثمار، دعم الضرائب، حلول قانونية وتأمينية، استشارات استثمار العقارات، وتخطيط الإرث ونقل الثروة. كما تقدم إرشادات بشأن مسائل مثل التقاعد الرسمي في المملكة المتحدة.

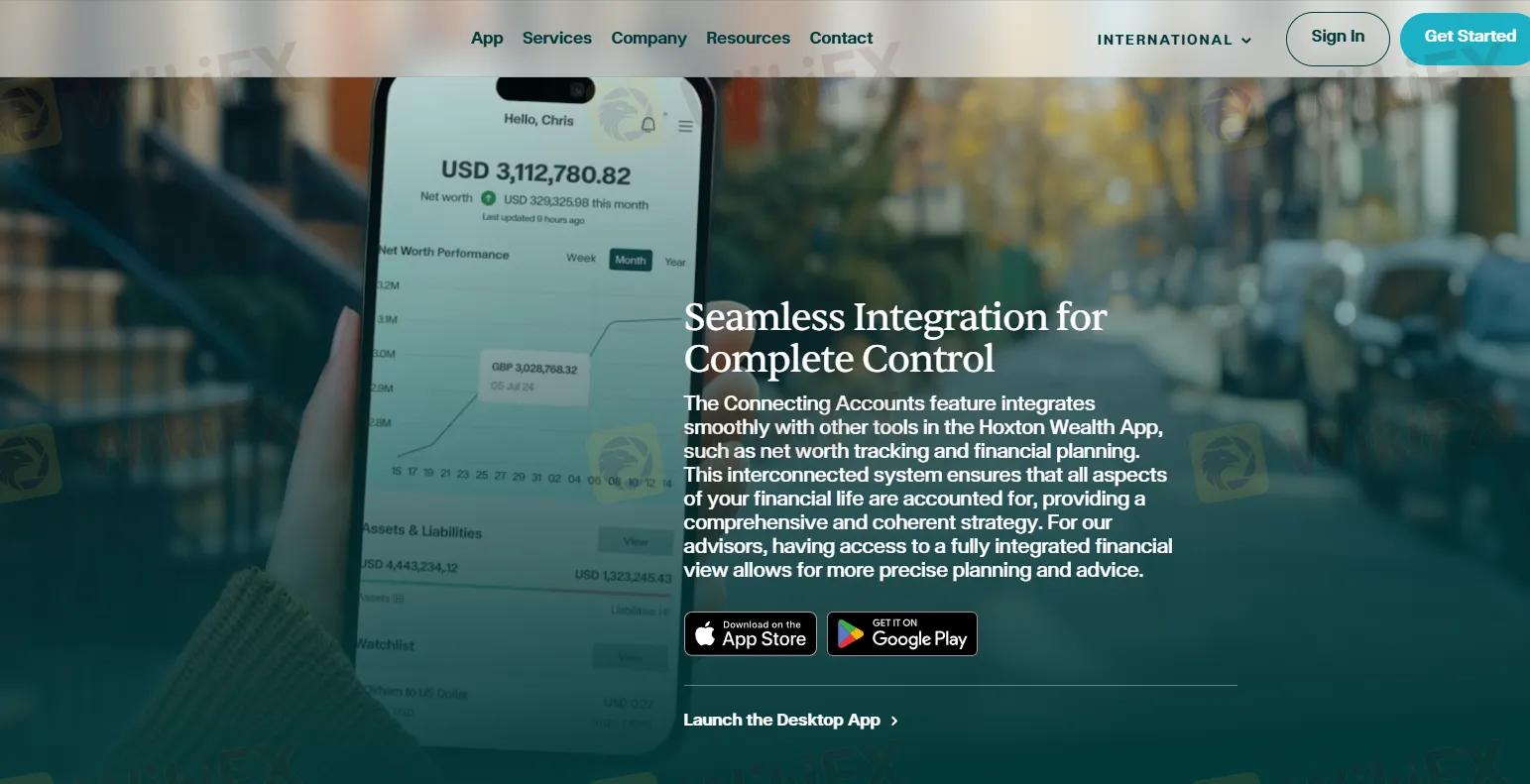

منصة التداول

منصة التداول الخاصة بـ Hoxton Wealth هي تطبيق Hoxton Wealth. يمكنها الاتصال بمختلف الحسابات المالية دون قيود من العملة أو المؤسسة أو المنطقة، وتوفير تتبع صافي القيمة في الوقت الحقيقي. يمكن تنزيل هذا التطبيق من متجر التطبيقات لنظام التشغيل آبل وجوجل بلاي، وهو أيضًا تطبيق سطح المكتب.