Resumo da empresa

| FFG Securities Resumo da Revisão | |

| Fundação | 2007 |

| País/Região Registrada | Japão |

| Regulação | FSA |

| Instrumentos de Mercado | Ações, Títulos, ETFs, REITs, Fundos de Investimento |

| Conta Demo | ❌ |

| Plataforma de Negociação | FFG Securities App, Negociação na Internet FFG |

| Depósito Mínimo | / |

| Suporte ao Cliente | Telefone: 092-771-3836 |

| Endereço: 9F, Sede do Banco de Fukuoka, Fukuoka | |

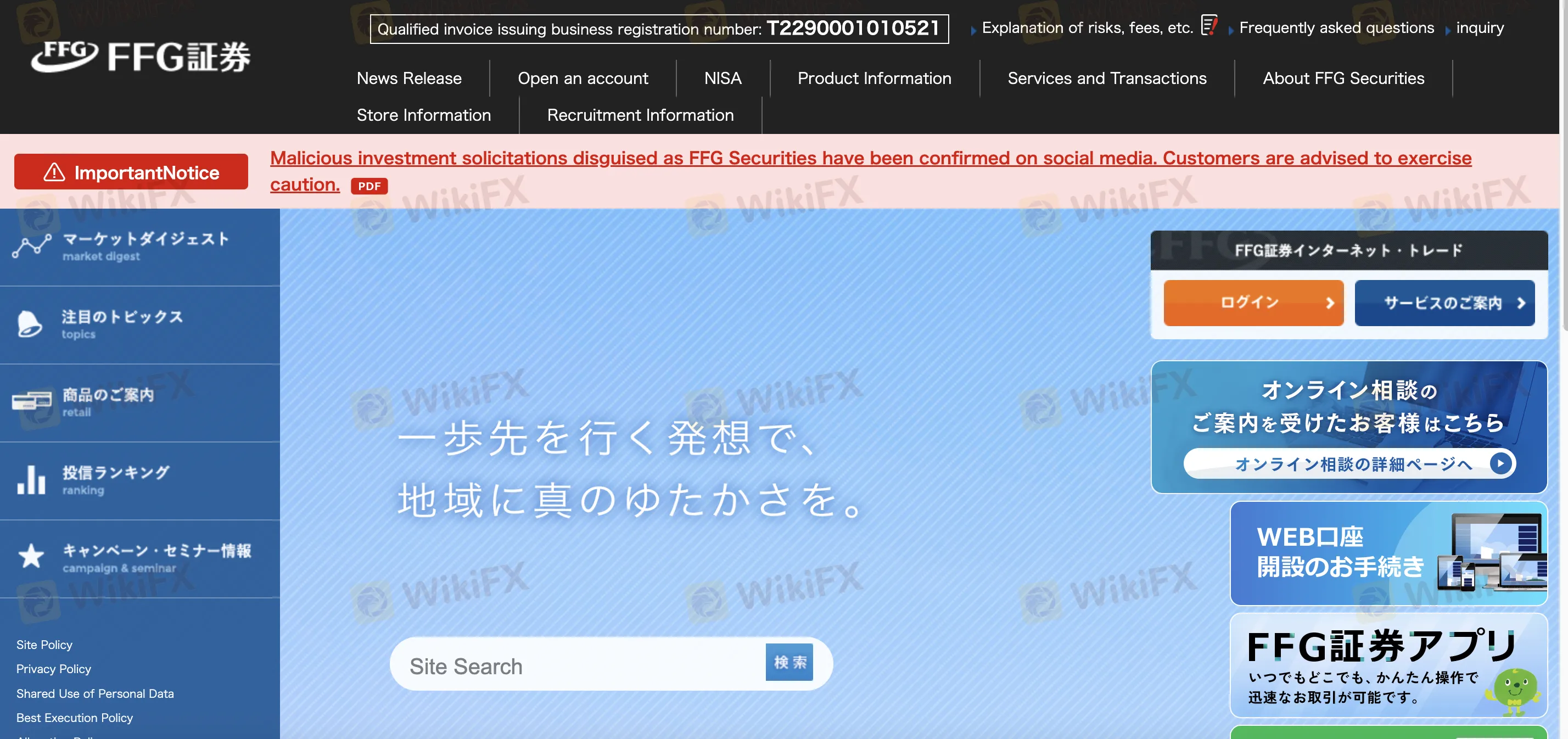

Informações sobre FFG Securities

Fundada em 2007, FFG Securities Co., Ltd. é uma empresa de serviços financeiros japonesa regulamentada pela FSA. Fornece acesso a fundos de investimento, ETFs, títulos, ações dos EUA e domésticas. Embora os sistemas de negociação móvel e pela internet sejam acessíveis, a falta de MT4/MT5 e os altos custos offline podem ser uma desvantagem para aqueles com orçamento limitado.

Prós e Contras

| Prós | Contras |

| Regulado pela FSA no Japão | Sem contas de demonstração ou islâmicas |

| Ampla variedade de instrumentos domésticos e estrangeiros | Taxas altas para transações presenciais |

| Taxas com desconto para pedidos apenas pela internet | Depósito mínimo não divulgado |

| Suporta ações dos EUA e negociação de margem | |

| Tempo de operação longo |

FFG Securities é Legítimo?

Sim, FFG Securities Co., Ltd. (FFG証券株式会社) é regulamentado. Possui uma Licença de Forex de Varejo emitida pela Agência de Serviços Financeiros (FSA) do Japão, com o número de licença 福岡財務支局長(金商)第5号.

O Que Posso Negociar na FFG Securities?

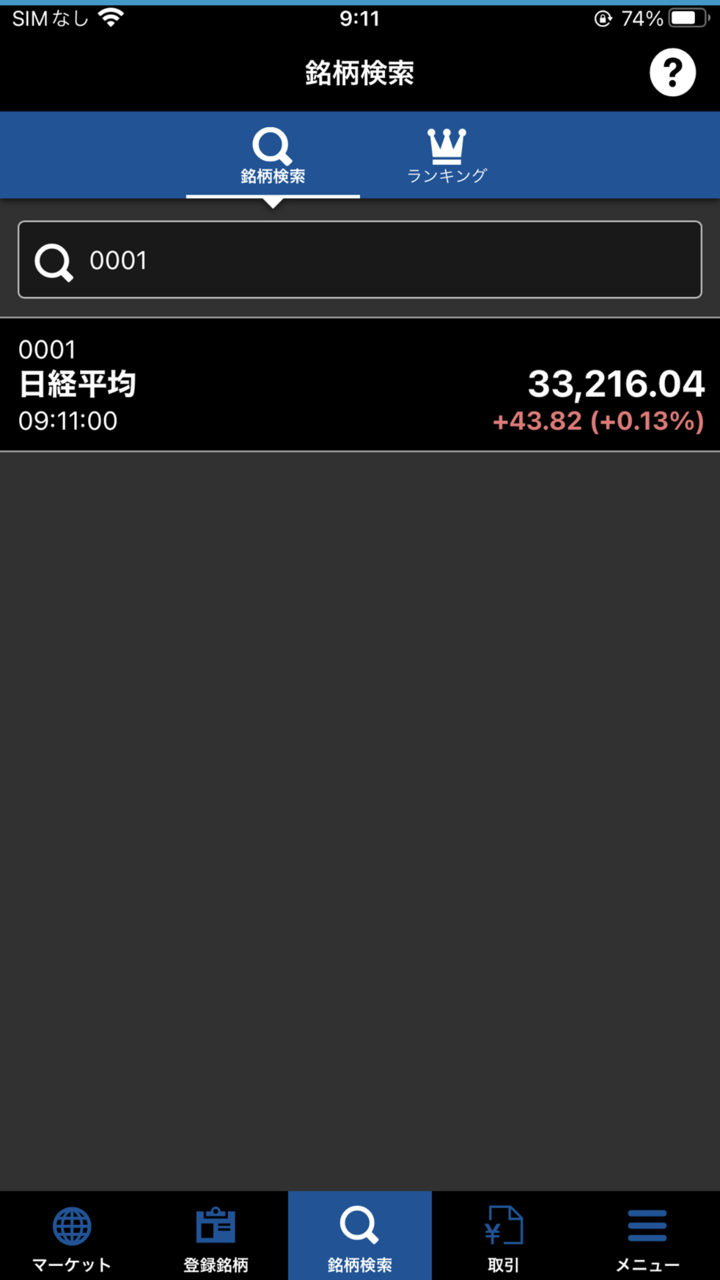

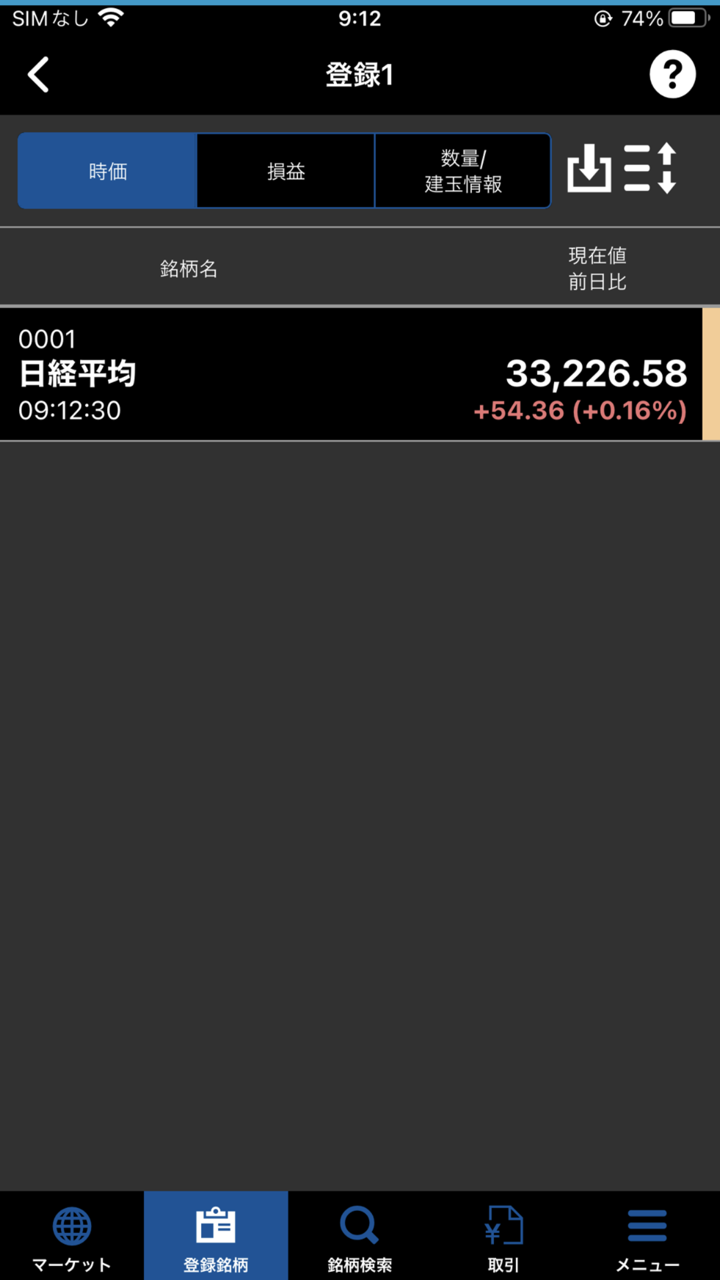

Incluindo ações, títulos, ETFs, REITs e fundos de investimento, FFG Securities oferece uma ampla gama de instrumentos financeiros domésticos e estrangeiros. Também permite negociação de margem e fornece um aplicativo móvel para dados de mercado e negociação em tempo real.

| Ativos de Negociação | Suportado |

| Ações | ✔ |

| Títulos | ✔ |

| ETFs | ✔ |

| REITs | ✔ |

| Fundos de Investimento | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Índices | ❌ |

| Criptomoedas | ❌ |

| Opções | ❌ |

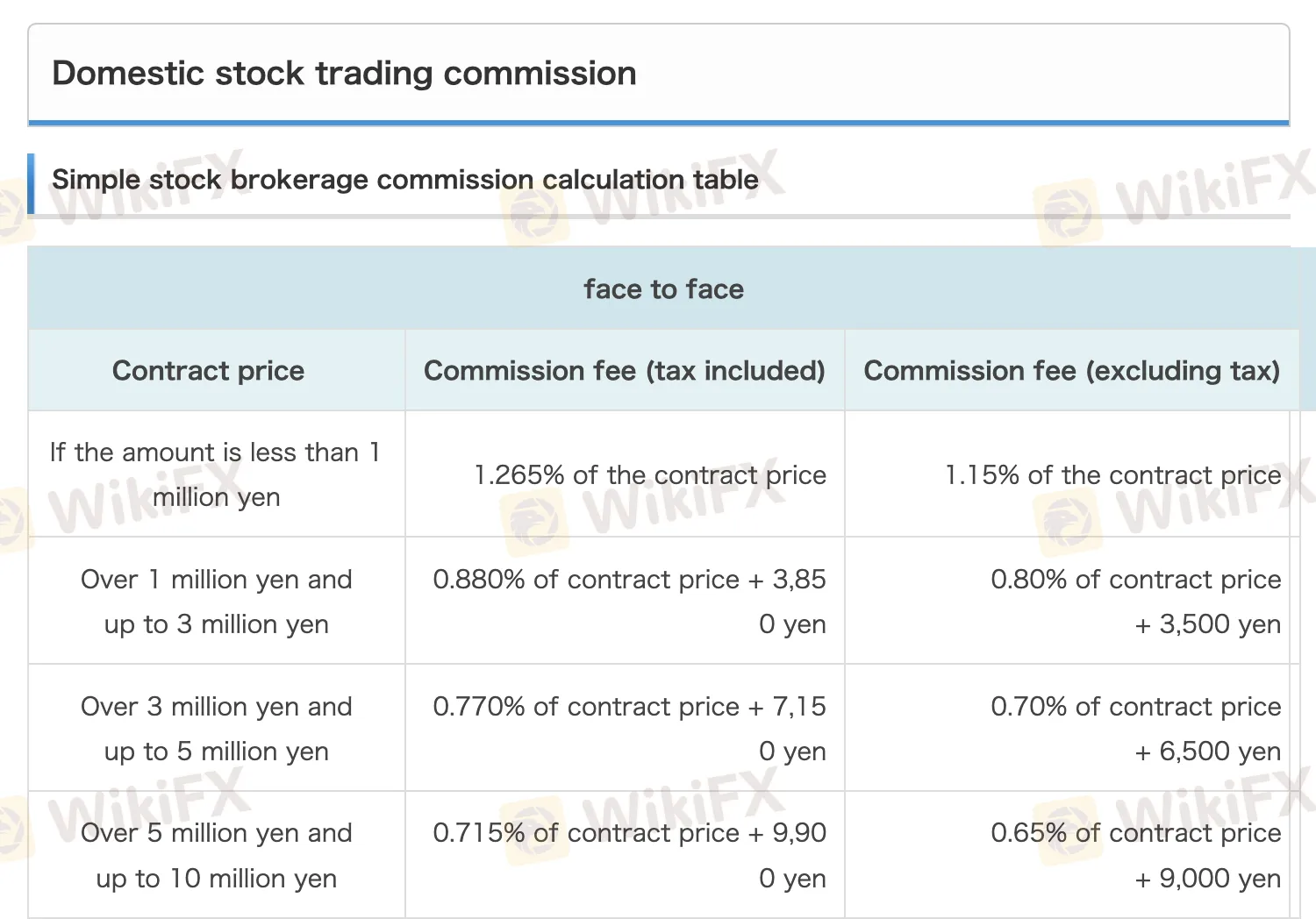

Taxas FFG Securities

As taxas da FFG Securities são relativamente altas em comparação com corretores online padrão, especialmente para transações presenciais e tamanhos de contrato grandes. No entanto, descontos significativos (até 90%) são aplicados à negociação exclusivamente online, tornando-a mais econômica para os usuários digitais.

| Tipo de Taxa | Detalhe |

| Negociação de Ações Domésticas | Até 1,265% do preço do contrato (presencial); desconto de 90% para online |

| Taxa Mínima de Comissão | Presencial: ¥2,750; Online: ¥275 |

| Negociação de Margem | Compra de juros: 1,97% a.a.; Taxa de empréstimo de ações (curta): 1,15% |

| Ações Estrangeiras | 1,10% para <¥1M; 0,33% + ¥218,900 para >¥100M |

| Obrigações Conversíveis (CB) | 1,10% para <¥1M; 0,165% + ¥765,600 para >¥1B |

| Fundos de Investimento | Varia por produto; Descontos online disponíveis (até 10% de desconto) |

| Taxas de Gerenciamento de Conta | Doméstico: Gratuito; Estrangeiro: Gratuito |

| Taxas de Transferência (Ações) | Começa em ¥1,100 (1 unidade ou menos); limitado a ¥6,600 |

| Entrega em Papel (Materiais para Acionistas) | ¥660 por ação |

Plataforma de Negociação

| Plataforma de Negociação | Suportado | Dispositivos Disponíveis |

| Aplicativo FFG Securities | ✔ | iOS, Android |

| Negociação na Internet FFG | ✔ | PC, Mac, web, mobile |

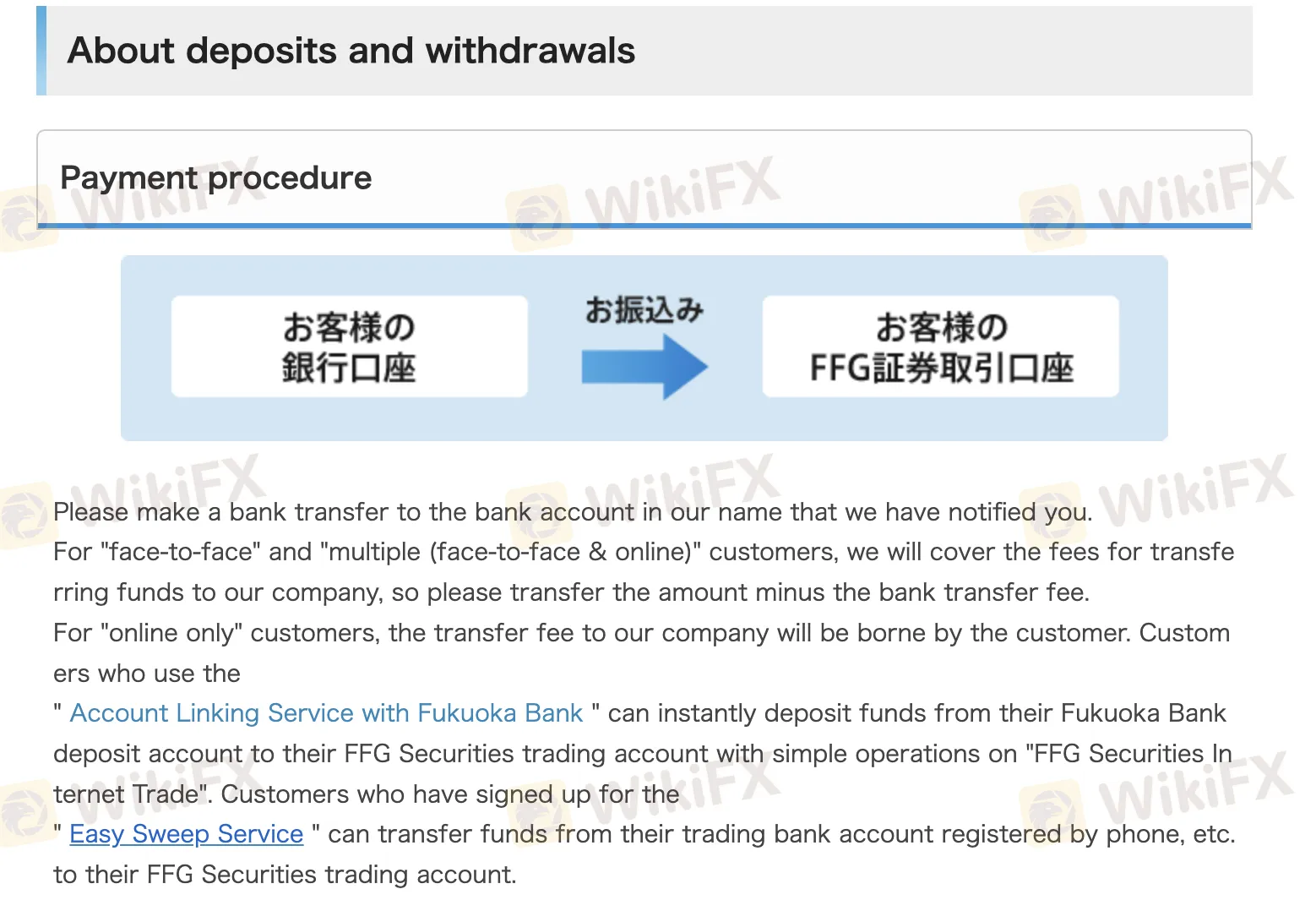

Depósito e Saque

FFG Securities não cobra taxas para depósitos ou saques para clientes presenciais ou híbridos (presencial e online). No entanto, os clientes exclusivamente online devem arcar com a taxa de transferência de depósito.

| Método de Pagamento | Taxas | Tempo de Processamento |

| Transferência Bancária (Presencial/Híbrido) | ❌ | No mesmo dia se antes do meio-dia |

| Transferência Bancária (Exclusivamente Online) | ✔ | Pode ser no próximo dia útil |

| Vínculo de Conta do Banco de Fukuoka | ❌ (via conta vinculada) | Instantâneo |