회사 소개

| au Kabucom Securities리뷰 요약 | |

| 설립 | 1997 |

| 등록 국가/지역 | 일본 |

| 규제 | FSA |

| 제품 및 서비스 | 주식, 마진, 거래 (시스템/일반), 공모주 청약 (IPO)/공개 매출 (PO), ETF/ETN/REIT, 무수수료 ETF (수수료 면제 ETF), 소액주식 (1주 미만 주식), 투자신탁, 외환 마진 거래 (FX), 선물/옵션 거래, 외국채권, 외화 채권 MMF, CFD (주식 365) |

| 데모 계정 | / |

| 레버리지 | / |

| 스프레드 | / |

| 거래 플랫폼 | Au Kabucom FX 앱 |

| 최소 입금액 | / |

| 고객 지원 | 라이브 채팅 |

| 전화: 0120 390 390, 05003-6688-8888 | |

| 이메일: cs@kabu.com | |

| 소셜 미디어: Twitter, Facebook. Instagram, Line, YouTube | |

au Kabucom Securities은 온라인 중개업체로, 미쓰비시 UFJ 금융 그룹 (MUFG 그룹)의 온라인 금융 서비스의 핵심 회사입니다. 이 비즈니스는 증권 거래, 중개, 제공 및 판매에 관여하고 있습니다. 다른 금융 서비스와 함께 은행 대리 및 외환 마진 거래를 제공합니다.

장점과 단점

| 장점 | 단점 |

| FSA 규제 | 거래 조건에 대한 제한된 정보 |

| 신뢰할 수 있는 계열사를 가진 기업 | |

| 다양한 거래 제품 및 서비스 | |

| 라이브 채팅 지원 |

au Kabucom Securities이 신뢰할 수 있는가요?

네, Au Kabucom은 현재 금융 서비스 기관 (FSA)에 의해 규제되며 소매 외환 라이센스 (No.61)를 보유하고 있습니다.

| 규제 국가 | 규제 기관 | 현재 상태 | 규제 업체 | 라이센스 유형 | 라이센스 번호 |

| 금융 서비스 기관 (FSA) | 규제됨 | au Kabucom Securities株式会社 | 소매 외환 라이센스 | 関東財務局長(金商)第61号 |

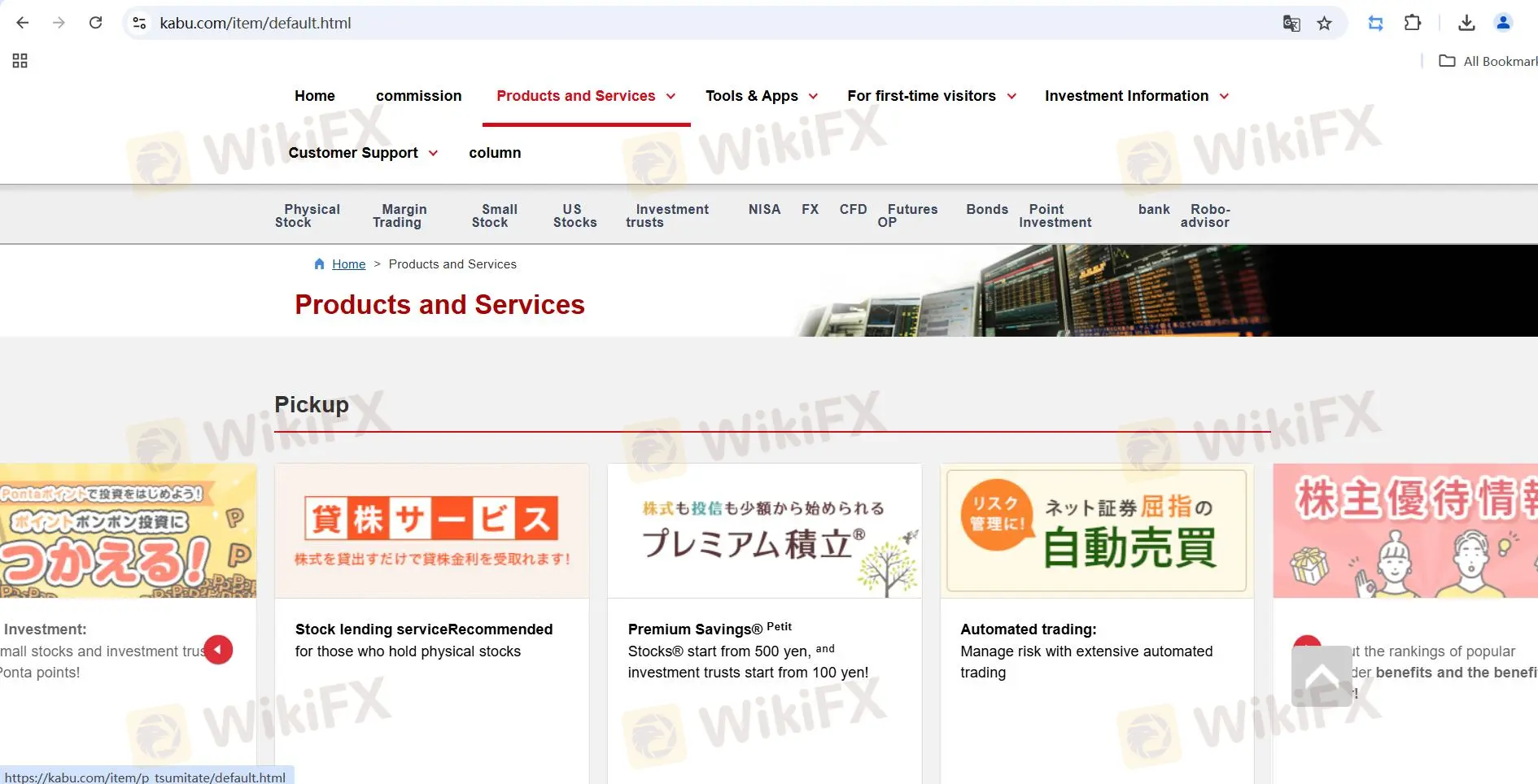

제품 및 서비스

| 제품 및 서비스 | 제공 가능 |

| 주식 | ✔ |

| 마진 거래 (시스템/일반) | ✔ |

| 공모주 청약 (IPO)/공개 판매 (PO) | ✔ |

| ETF/ETN/REIT | ✔ |

| 수수료 면제 ETF (수수료 면제 상장 투자 펀드) | ✔ |

| 작은 주식 (1주 미만의 주식) | ✔ |

| 공개 매수 제안 (TOB) | ✔ |

| 투자 신탁 | ✔ |

| 외환 (외환 마진 거래) | ✔ |

| 선물/옵션 거래 | ✔ |

| 채권 (외국 채권) | ✔ |

| 외화 기준 MMF | ✔ |

| CFD (주식 365) | ✔ |

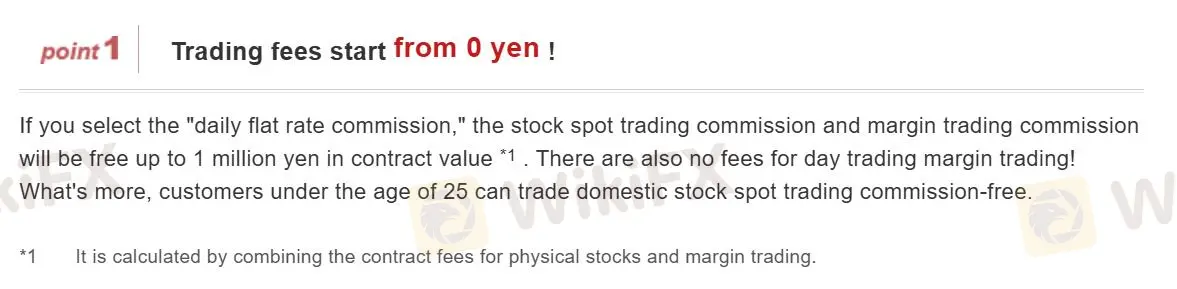

수수료

au Kabucom Securities은 수수료 면제 외환 거래를 제공하며, 거래 비용은 스프레드에 포함됩니다.

그러나 Au Kabucom은 다른 제품 거래에 대해 수수료를 부과합니다. 예를 들어 주식 거래 수수료는 다음과 같습니다.

주식 거래 수수료 (Petit (Kabu®) 및 프리미엄 누적 (Petit (Kabu® )) 제외)

| 계약 가격 (JPY) | 물리적 수수료 (세금 포함) | 대량 우대 요금제 |

| 0 엔에서 50,000 엔 이하 | 55 엔 | ❌ |

| 50,000 엔에서 100,000 엔 미만 | 99 엔 | |

| 100,000 엔에서 200,000 엔 미만 | 115 엔 | |

| 200,000 엔에서 500,000 엔 미만 | 275 엔 | |

| 500,000 엔에서 1,000,000 엔 미만 | 535 엔 | |

| 1 백만 엔 이상 | 계약 금액 × 0.099% (세금 포함) + 99 엔 [최대: 4,059 엔] |

참고:

- 위의 수수료는 실행 조건(시장 주문, 한도 주문, 자동 거래 등)과 관계없이 적용됩니다.

- 계산(수수료 계산 또는 소비세 계산) 결과가 소수 부분인 경우 내림 처리됩니다.

- 전화 거래의 경우, 운영자 수수료로 2,200엔(세금 포함)이 별도로 추가됩니다.

- 주식 취득권 매매 수수료는 위에서 언급한 실물 주식 매매 수수료와 동일합니다.

- NISA(비과세 소규모 투자) 계좌 내에서의 거래에는 수수료가 없습니다.

- 가격 범위 상한(상승 정지)이 기간 지정 주문으로 인해 변경되고 사용 가능 금액이 부족한 경우, 주문은 강제로 취소됩니다.

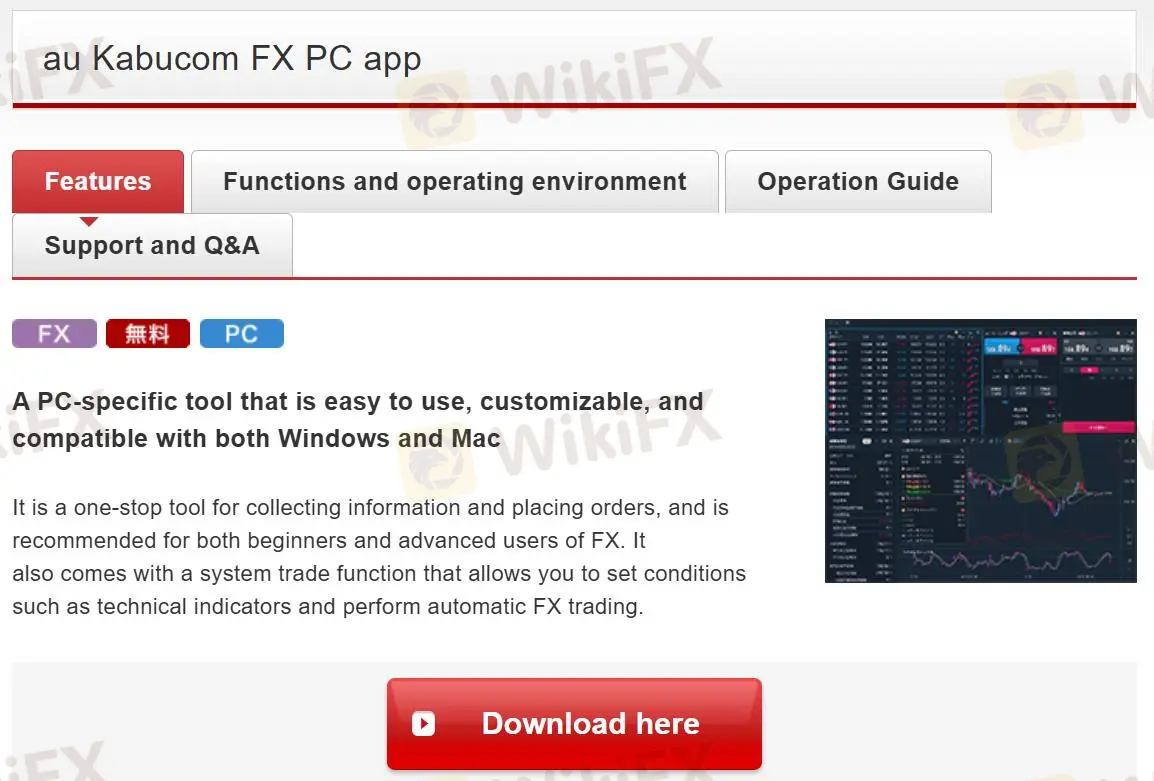

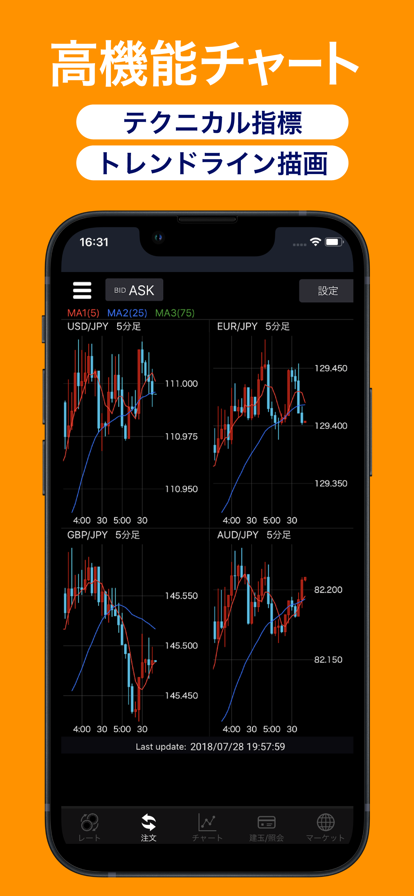

거래 플랫폼

Au Kabucom Securities는 PC 및 모바일 플랫폼에서 모두 사용할 수 있는 Au Kabucom 앱을 제공합니다.

| 거래 플랫폼 | 지원 | 사용 가능한 장치 | 적합 대상 |

| Au Kabucom FX 앱 | ✔ | 데스크톱, 모바일 | / |

| MT5 | ❌ | / | 경험 있는 트레이더 |

| MT4 | ❌ | / | 초보자 |