Punteggio

CLC

Hong Kong | 5-10 anni |

Hong Kong | 5-10 anni |https://www.clchk.com/

Sito ufficiale

Indice di valutazione

Influenza

Influenza

D

Indice di influenza NO.1

Australia 2.38

Australia 2.38 Contatto

Nessuna licenza di trading sul forex trovata. Si prega di essere consapevoli dei rischi.

- Questo broker non è soggetto a una regolamentazione valida per il mercato forex. Si prega di essere consapevoli del rischio!

Informazioni di base

Hong Kong

Hong Kong Gli utenti che hanno visualizzato CLC hanno visualizzato anche..

GO Markets

XM

FXCM

fpmarkets

Sito web

clchk.com

23.236.62.147Posizione del serverStati Uniti

Registrazione ICP--Principali paesi/aree visitati--Data di validità del dominio2014-07-07Nome del sitoWHOIS.WEBNIC.CCAziendaWEB COMMERCE COMMUNICATIONS LIMITED DBA WEBNIC.CC

Relazioni Genealogia

Società collegate

Domande e risposte Wiki

What are the primary advantages and disadvantages of trading through CLC?

Drawing from my years of experience as an independent forex trader, I approach every broker with careful scrutiny, and CLC is no exception. One advantage I noticed is that CLC has been established for over five years and operates under the regulatory framework of the Hong Kong Securities and Futures Commission (SFC). This oversight theoretically suggests some degree of compliance with local financial regulations, which is generally a minimum expectation for safety in this industry. I also appreciate that they offer a range of account-opening and trading platforms (mobile, PC, and web), as well as access to various investment services such as securities trading, margin financing, and IPO subscriptions. However, I have substantial reservations about CLC. There are several noteworthy disadvantages that cannot be ignored. First, the broker’s regulatory history appears problematic: comments indicate some SFC licenses have been revoked, including those related to futures contracts, and there are specific risk alerts and cautionary labels such as "Medium potential risk" and "Suspicious Overrun." The lack of clear public information about basic trading conditions—such as spreads, leverage, asset lists, and account types—complicates informed decision-making for traders like me. Most concerning are the numerous negative user reports about withdrawal difficulties and accusations of fraudulent activity, including scam and Ponzi scheme allegations. These are extremely serious matters in the trading world, and I believe no trader should ignore them. For me, transparency and reputation are critical, and CLC currently has too many warning signs for me to feel comfortable trading real funds through them. I would advise anyone considering this broker to conduct significant due diligence and remain exceptionally cautious.

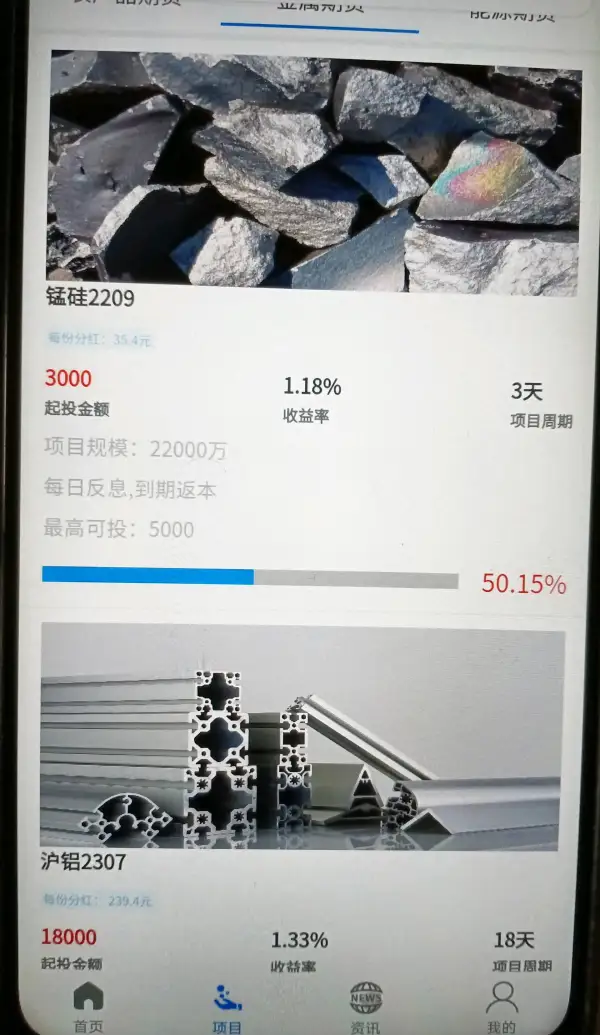

Which types of trading instruments does CLC offer, such as forex, stocks, indices, cryptocurrencies, and commodities?

Drawing from my experience as a trader and after thoroughly reviewing CLC’s available information, I must proceed with caution in assessing the range of trading instruments they offer. The broker presents itself as an investment firm based in Hong Kong with a focus on securities trading, margin financing, asset management, and IPO subscription services. However, CLC does not provide clear, detailed lists or specifications regarding available asset classes like forex, indices, cryptocurrencies, or commodities on its website or in other official communications. This lack of transparency is a significant concern for me, as I rely on precise instrument lists to determine if a broker aligns with my trading preferences and risk management practices. The materials mention "dealing in and advising on securities and futures contracts," which implies that access to Hong Kong stocks and possibly some futures contracts is available. Yet, without explicit documentation of product offerings, I cannot verify whether CLC’s platform truly supports broader markets, such as spot forex, international equities, cryptocurrencies, or commodities contracts. In my opinion, this ambiguity makes it challenging to assess whether CLC can meet a trader’s needs—especially if one seeks to diversify across multiple asset classes. Given these gaps and considering user complaints about withdrawal issues and suspected business risks, I would advise any trader, myself included, to demand specific, written confirmation from customer support about exactly which assets can be traded—and to exercise heightened due diligence before considering any form of account funding or trading.

Could you give a comprehensive summary of CLC’s fees, covering their commissions and spread charges?

Drawing from my own experience analyzing brokers, evaluating CLC’s fee structure has proven difficult due to a conspicuous lack of clear and publicly available details. While CLC positions itself as a Hong Kong-regulated investment firm offering securities and futures services, I found no explicit mention of commissions, spreads, minimum deposits, or other trading costs on their official materials or platform summaries. This absence is a critical consideration for me, as transparent fee information is foundational for making calculated, risk-managed trading decisions. Furthermore, the limitations are especially notable regarding forex trading: there are no specifics about bid/ask spreads, commission per lot, overnight financing rates, or even basic account types that would help gauge what a typical trade might cost. For a trader, this makes cost estimation—potentially a decisive factor in strategy—virtually impossible ahead of time. The scant information forces prospective clients to contact support directly to inquire about costs, which leaves too much room for ambiguity. Given these uncertainties in CLC's disclosures, I would advise proceeding with extreme caution, as fee transparency is a core indicator of trustworthiness. Until CLC provides clear, upfront documentation on spreads and commissions, I would personally avoid allocating significant funds for trading on their platform.

Is it possible to use Expert Advisors (EAs) for automated trading on CLC’s platforms?

In my experience, determining whether I can use Expert Advisors (EAs) or automated trading tools is a key factor when evaluating any broker. After thoroughly reviewing CLC’s available information, I found that while they offer trading on their proprietary platform—accessible via mobile, PC, and web—they do not explicitly mention support for MetaTrader platforms (MT4 or MT5), which are the industry standards for EA deployment. Their materials describe a user-friendly interface and basic trading functionalities, but there is no clear detail about support for third-party trading algorithms, script-based automation, or EAs. In my own due diligence, I always look for brokers that transparently state their compatibility with automated trading tools, since this directly affects my trading strategies. The absence of such information—and the lack of technical details about API integration or script execution environments—raises some uncertainty for me regarding the use of EAs on their platform. Because clarity on allowable technology is fundamental for risk management and strategy execution, I have to be cautious. Until CLC provides comprehensive documentation or direct confirmation regarding EA support, I would not expect seamless use of automated trading systems with them. For anyone reliant on EAs, I would stress the importance of verifying platform capabilities directly with CLC before committing funds. In my view, prioritizing transparency and technological compatibility is essential for protecting one's capital and trading ambitions.

Recensioni utenti4

Cosa vuoi valutare

inserisci...

Commento 4

TOP

TOP

Chrome

Estensione Chrome

Inchiesta sulla regolamentazione del broker Forex globale

Sfoglia i siti Web dei broker forex e identifica accuratamente i broker legittimi e fraudolenti

Installa ora

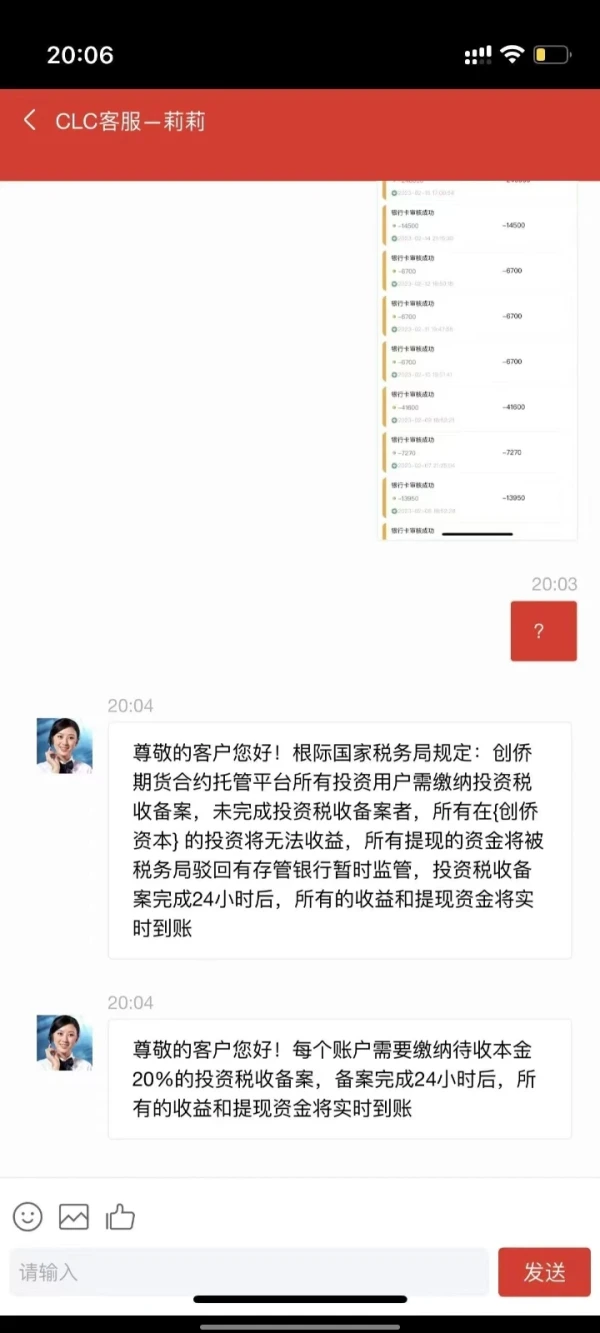

零度寂寞

Hong Kong

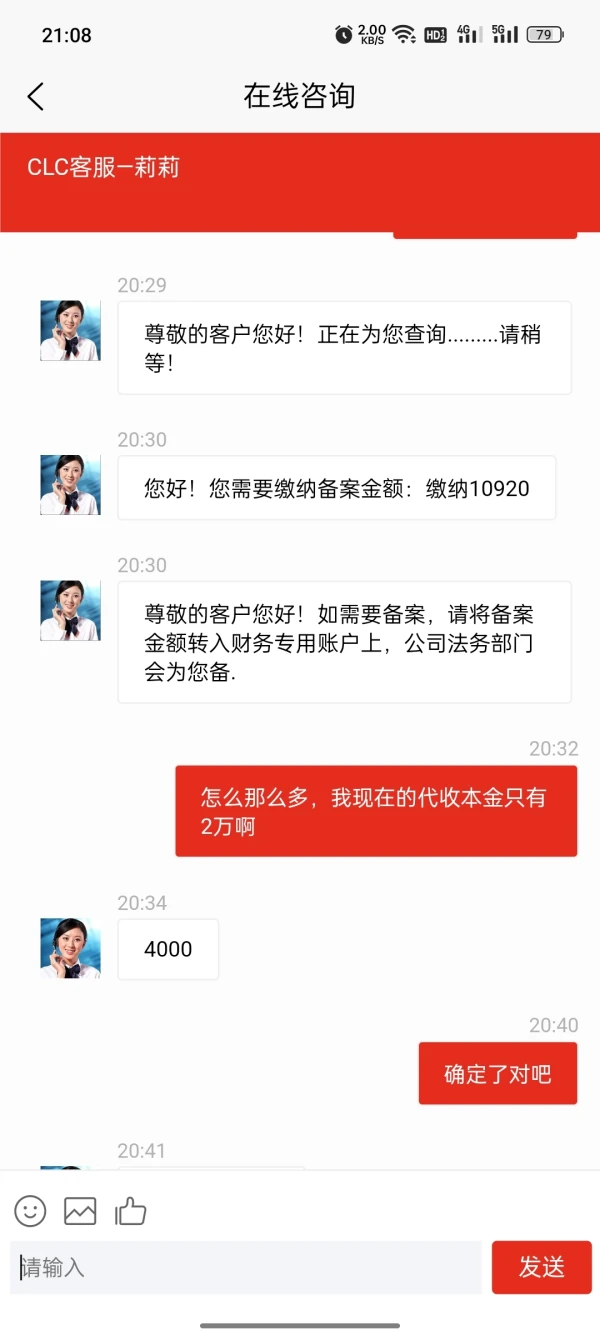

Piattaforma truffa. Si sono rimescolati di nuovo anche se sono fuggiti. Persone così spudorate. Ora non è possibile accedere all'app. Spero che la piattaforma possa risolverlo e restituirmi i soldi.

Esposizione

小白2933

Hong Kong

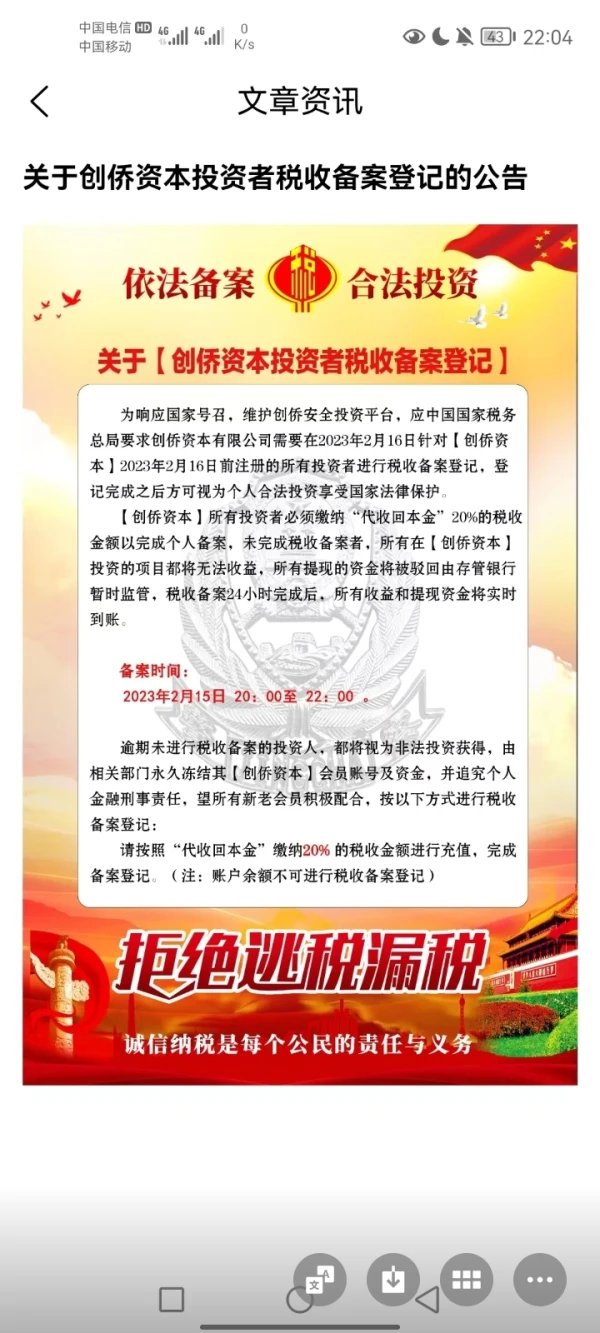

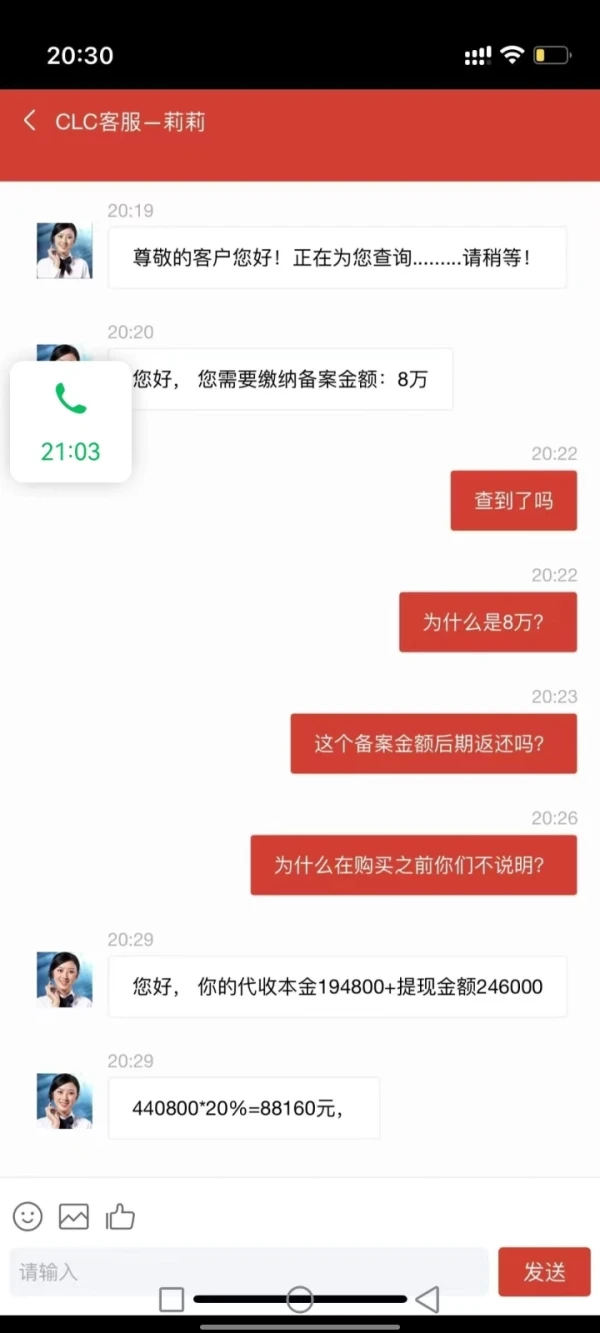

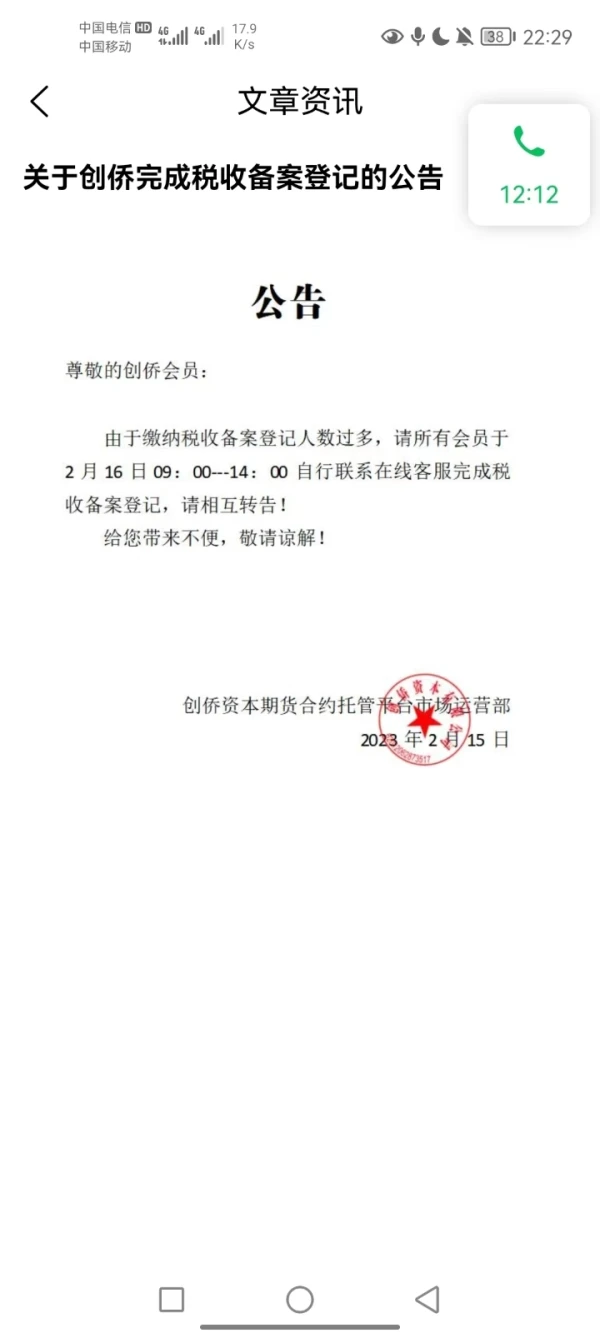

Impossibile prelevare e richiedere la tassa. Su questo sta indagando la polizia. Fermati se vedi questo.

Esposizione

风沙610

Hong Kong

Schema Ponzi. Stai lontano. Se hai molti soldi, puoi fare trading qui e darli a truffatori.

Esposizione

FX1391372709

Hong Kong

CLC è una società di investimento regolamentata che offre vari servizi finanziari tra cui negoziazione di titoli, finanziamento a margine e servizi di sottoscrizione IPO. Tuttavia, recentemente ci sono troppe recensioni negative che rivelano che non sono in grado di ritirarsi. Come con qualsiasi istituto finanziario, è importante condurre ricerche approfondite e due diligence prima di investire i tuoi soldi o lavorare con loro.

Neutro