Punteggio

24five

Regno Unito | 2-5 anni |

Regno Unito | 2-5 anni |https://24five.com/en/

Sito ufficiale

Indice di valutazione

Influenza

Influenza

D

Indice di influenza NO.1

Paraguay 2.59

Paraguay 2.59 Contatto

Licenza Forex

Licenza Forex

Nessuna licenza di trading sul forex trovata. Si prega di essere consapevoli dei rischi.

- Questo broker non è soggetto a una regolamentazione valida per il mercato forex. Si prega di essere consapevoli del rischio!

Informazioni di base

Regno Unito

Regno Unito Gli utenti che hanno visualizzato 24five hanno visualizzato anche..

MiTRADE

HANTEC MARKETS

XM

IC Markets Global

Sito web

24five.com

172.67.204.168Posizione del serverStati Uniti

Registrazione ICP--Principali paesi/aree visitati--Data di validità del dominio--Nome del sito--Azienda--

Relazioni Genealogia

Società collegate

Domande e risposte Wiki

What trading platform does 24Five offer?

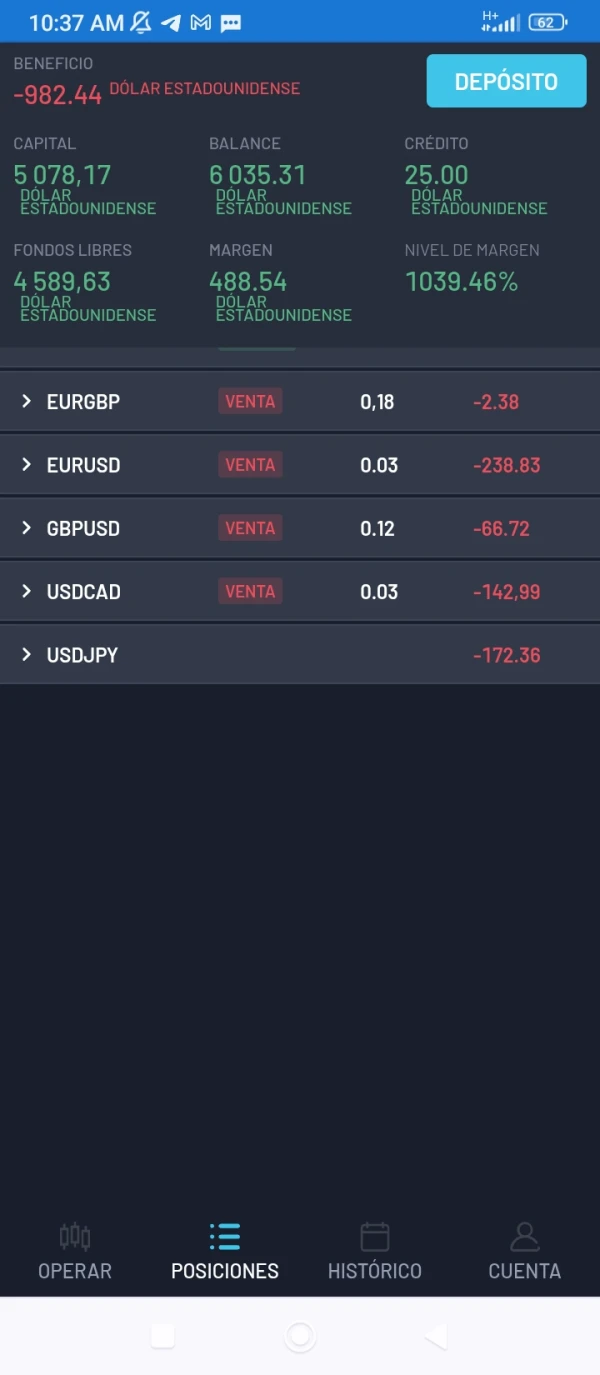

24Five offers its proprietary trading platform, which is accessible via mobile, tablet, and PC. While this platform is web-based and provides flexibility for trading, it lacks support for MT4 and MT5, which are widely used and trusted by experienced traders like myself. MT4 and MT5 are known for their advanced charting features, automated trading capabilities through Expert Advisors (EAs), and customizable interfaces. The absence of these platforms limits the trading tools available to me. For those who are familiar with MT4 or MT5, the proprietary platform may feel less intuitive.

What payment methods does 24Five support for deposits and withdrawals?

24Five supports several payment methods, including bank transfers, Visa, Mastercard, and cryptocurrencies. The option to use cryptocurrencies for deposits and withdrawals is a positive for me, as it allows for faster processing and lower fees compared to traditional payment methods. However, I would like to see more e-wallet options, as they tend to offer even faster and more flexible transactions. The availability of bank transfers and credit cards is convenient, but I prefer brokers who offer a wider range of payment methods, including popular e-wallets like Skrill or Neteller.

What account types does 24Five offer?

24Five offers several account types, including CLASSIC, Standard, ECN, and PRO. The CLASSIC and Standard accounts have a low minimum deposit requirement of $10, which is ideal for beginner traders like myself. The ECN and PRO accounts require higher deposits, with the PRO account having a $10,000 minimum deposit, which might be out of reach for many traders. The ECN account is attractive for traders who want tighter spreads and better execution speeds, but the higher deposit requirement may deter some. From my perspective, the CLASSIC and Standard accounts offer a good starting point for those who want to explore the platform with minimal risk.

What are the fees at 24Five?

24Five offers relatively low fees with forex spreads starting from 0.0 pips, which is appealing to traders like me who want to minimize costs. Tight spreads help reduce trading expenses, especially if I plan on executing high-frequency trades. However, the platform does not provide enough information regarding transaction fees for commodities, stocks, or cryptocurrencies. This lack of transparency is concerning, as I want to fully understand all costs associated with trading. Additionally, there’s no mention of potential hidden fees, like withdrawal or inactivity fees. As a cautious trader, I would want to clarify these details with customer support before making any deposits. Full transparency about fees is essential for making informed decisions, and I always prioritize brokers that provide clear, upfront information.

Recensioni utenti1

Cosa vuoi valutare

inserisci...

Commento 1

TOP

TOP

Chrome

Estensione Chrome

Inchiesta sulla regolamentazione del broker Forex globale

Sfoglia i siti Web dei broker forex e identifica accuratamente i broker legittimi e fraudolenti

Installa ora