Profil perusahaan

| AS-TEM Ringkasan Ulasan | |

| Dibentuk | 1962 |

| Negara/Daerah Terdaftar | Jepang |

| Regulasi | Tidak Diatur |

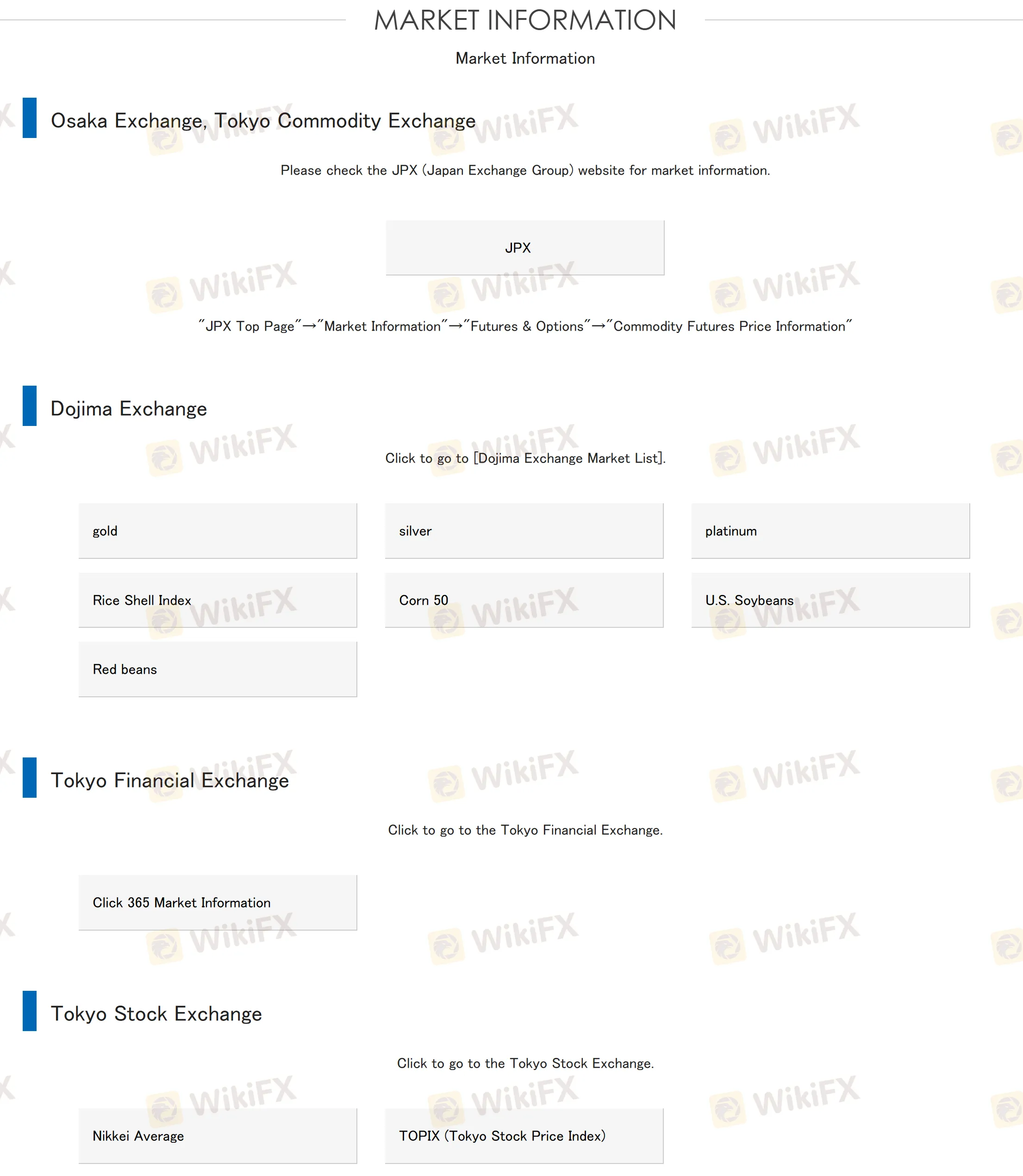

| Instrumen Pasar | Emas, perak, platinum, Indeks Kerang Beras, Jagung 50, Kedelai AS, Kacang Merah, Rata-rata Nikkei, TOPIX (Indeks Harga Saham Tokyo) |

| Akun Demo | ❌ |

| Platform Perdagangan | / |

| Deposit Minimum | / |

| Dukungan Pelanggan | Formulir Kontak |

| Telepon: +81 06-4790-3401 | |

| Alamat: 1-7-31 Otemae, Chuo-ku, Osaka OMM Gedung Lantai 8 | |

AS-TEM adalah perusahaan Jepang yang tidak diatur yang didirikan pada tahun 1962. Perusahaan ini menawarkan beragam instrumen pasar, termasuk logam mulia seperti emas, perak, dan platinum, komoditas pertanian seperti Indeks Kerang Beras, Jagung 50, Kedelai AS, dan Kacang Merah, serta indeks pasar saham Jepang seperti Rata-rata Nikkei dan TOPIX.

Kelebihan dan Kekurangan

| Kelebihan | Kekurangan |

| Berbagai produk perdagangan | Tidak diatur |

| Informasi terbatas mengenai akun | |

| Tidak ada akun demo | |

| Kurangnya informasi mengenai platform perdagangan |

Apakah AS-TEM Legal?

Saat ini, AS-TEM tidak memiliki regulasi yang sah. Domainnya didaftarkan pada 19 Mei 2024, dan status saat ini adalah “client Transfer Prohibited”. Harap perhatikan dengan seksama keamanan dana Anda jika memilih broker ini.

Apa yang Bisa Diperdagangkan di AS-TEM?

Di AS-TEM, Anda dapat berdagang dengan emas, perak, platinum, Indeks Kerang Beras, Jagung 50, Kedelai AS, Kacang Merah, Rata-rata Nikkei, TOPIX (Indeks Harga Saham Tokyo).

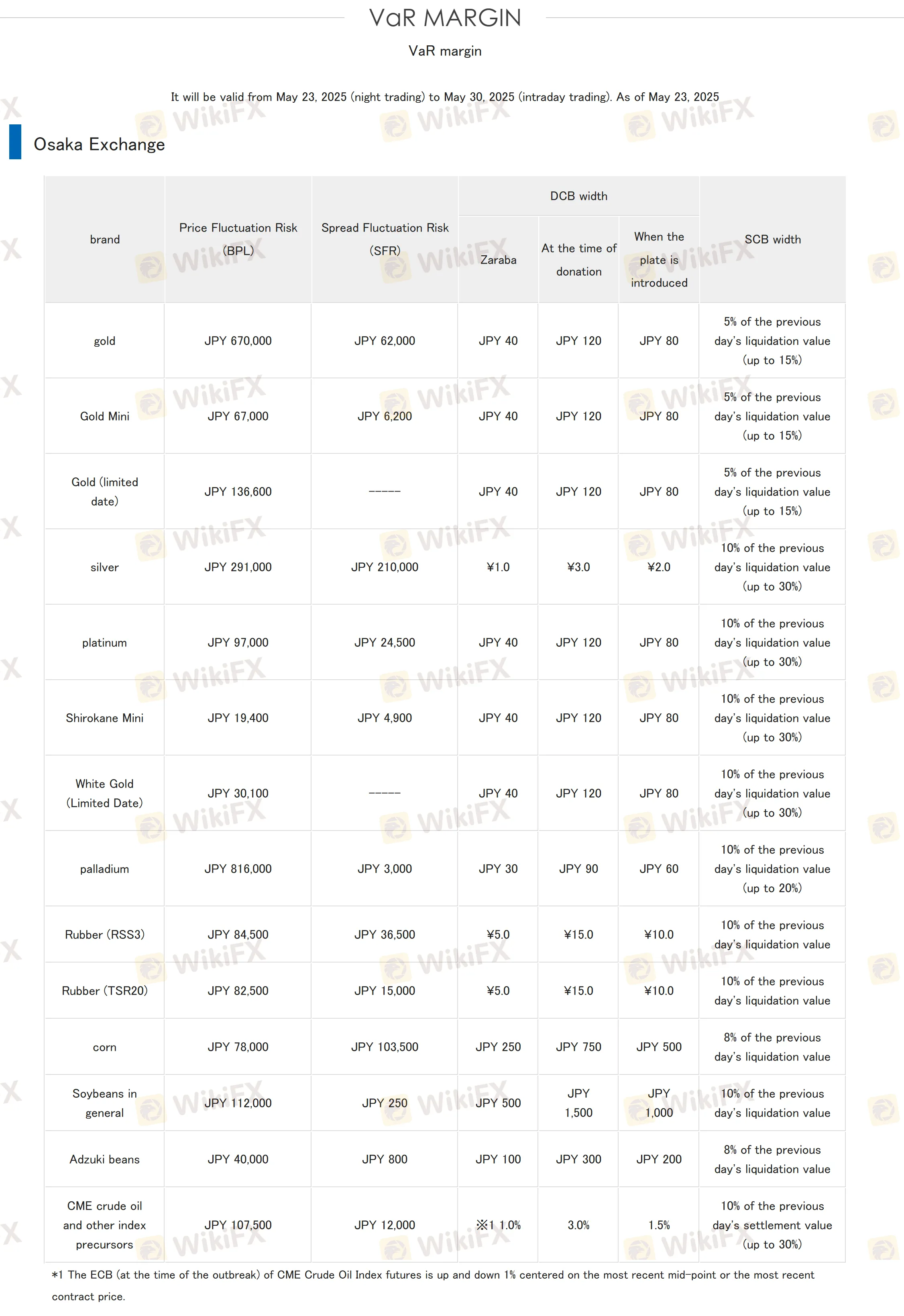

Biaya

Untuk informasi terperinci mengenai Persyaratan margin Nilai pada Risiko (VaR) untuk berbagai komoditas, Anda dapat merujuk ke situs web mereka.