Buod ng kumpanya

| YM Securities Buod ng Pagsusuri | |

| Itinatag | 2007 |

| Nakarehistrong Bansa/Rehiyon | Hapon |

| Regulasyon | FSA |

| Mga Produkto sa Paghahalal | Mga Stock, Bonds, at Investment trusts |

| Plataporma ng Paghahalal | / |

| Minimum na Deposito | / |

| Suporta sa Customer | / |

Impormasyon Tungkol sa YM Securities

Ang YM Securities ay isang kumpanya ng securities sa ilalim ng Yamaguchi Financial Group (YMFG) ng Hapon, na may punong tanggapan sa Hapon. Pangunahin itong nag-aalok ng paghahalal sa mga stock, bonds, at investment trusts.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| Regulado ng FSA | Kumplikadong istraktura ng bayad |

| Mahabang kasaysayan ng operasyon | Mataas na threshold ng membership |

| Sistema ng benepisyo sa miyembro (80% diskwento para sa mga pre-depositong ari-arian higit sa 10,000,000 JPY) | Karamihan ng nilalaman ay Hapones |

| Limitadong uri ng mga produkto sa paghahalal | |

| Hindi malinaw na mga channel ng suporta sa customer |

Tunay ba ang YM Securities?

Ang YM Securities ay isang legal na rehistradong brokerage ng securities sa Hapon, na nireregulang Financial Services Agency (FSA). Ang numero ng rehistrasyon nito ay 中国財務局長(金商)第8号.

Ano ang Maaari Kong I-trade sa YM Securities?

Nag-aalok ang YM Securities ng domestic at foreign stocks, bonds, at investment trusts (funds) na nag-iinvest sa mga tema tulad ng domestic at foreign stocks, bonds, at real estate, at sumusuporta sa mga regular na plano ng pag-iipon (investment trust accumulation).

| Mga Produkto sa Paghahalal | Supported |

| Stocks | ✔ |

| Bonds | ✔ |

| Investment Trusts | ✔ |

| Forex | ❌ |

| Commodities | ❌ |

| Indices | ❌ |

| Cryptocurrencies | ❌ |

| Options | ❌ |

| ETFs | ❌ |

| Mutual Funds | ❌ |

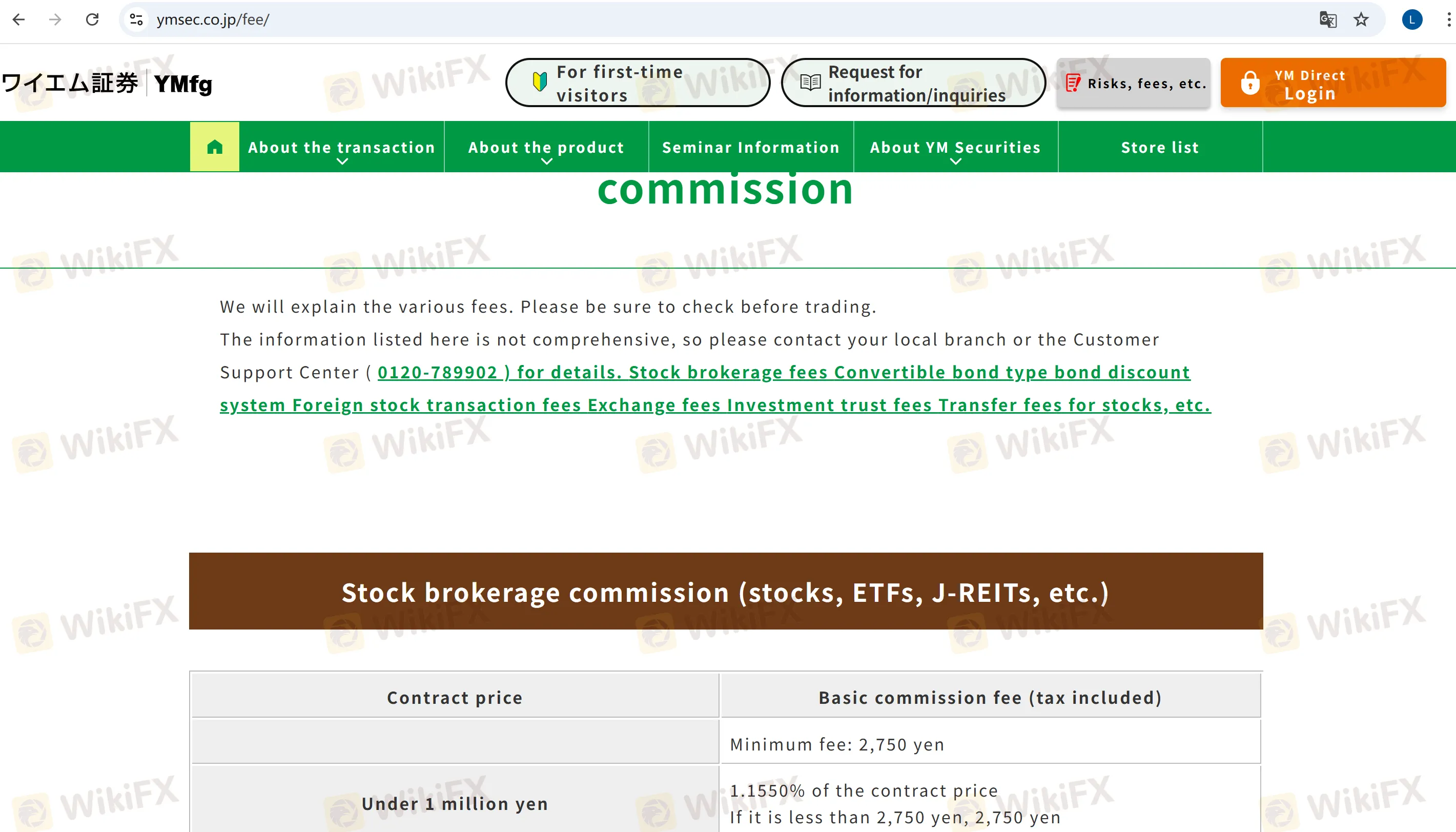

Mga Bayad sa YM Securities

Ang pangunahing bayad ng YM Securities ay ang mga sumusunod:

Mga Bayad sa Paghahalal ng Stock (Domestic Stocks, ETFs, atbp.): Minimum na 2,750 JPY (kasama ang buwis), singilin sa mga antas batay sa halaga ng transaksyon (hal., 1.155% para sa halagang hindi hihigit sa 1,000,000 JPY; 0.88% + 2,750 JPY para sa 1,000,000–5,000,000 JPY). May 20% na diskwento para sa mga miyembro.

Mga Bayad sa Pag-trade ng Dayuhang Stock: Kasama ang mga lokal na bayad (hal. bayad sa palitan) at mga bayad ng lokal na ahensya (hal. 1.43% para sa halagang hindi hihigit sa 1,000,000 JPY).

Mga Bayad sa Pag-trade ng Obligasyon: Ang mga produkto ng uri ng convertible bond ay may minimum na bayad na 2,750 JPY, singilin ayon sa mga antas batay sa halaga ng transaksyon (hal. 1.1% para sa halagang hindi hihigit sa 1,000,000 JPY).

Iba pang mga Bayad: Bayad sa paglipat ng account: Nagsisimula sa 1,100 JPY bawat yunit, may maximum na 6,600 JPY.

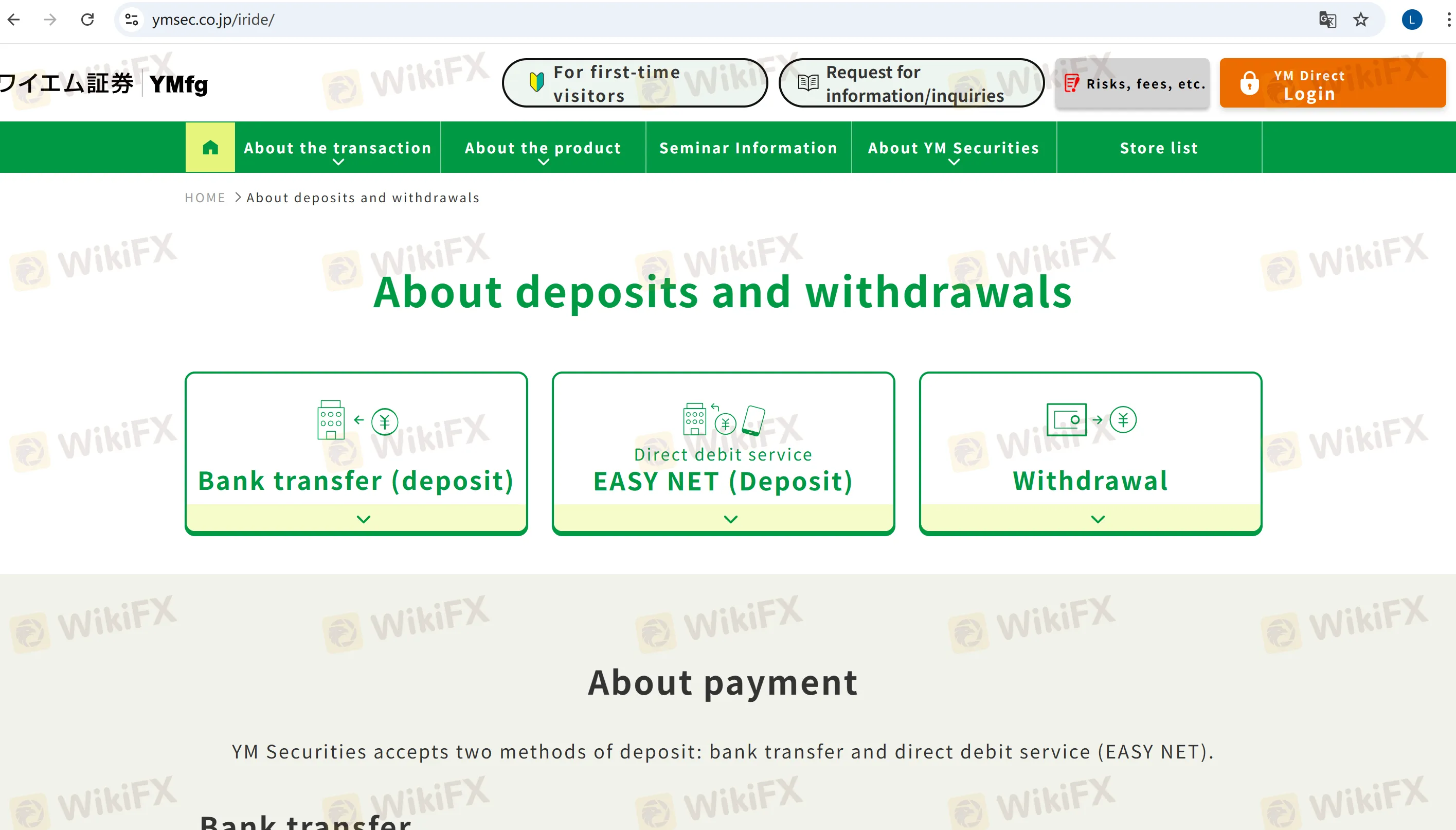

Deposito at Pag-withdraw

Deposito

Bank Transfer: Sumusuporta sa mga account sa Yamaguchi Bank, Momiji Bank, at Kitakyushu Bank. Karaniwan nang saklaw ng brokerage ang mga bayad sa pagproseso.

EASY NET: Isang libreng instant fund transfer service na konektado sa mga group banks, maaaring gamitin sa online platform o sa pamamagitan ng mga tagubilin sa telepono.

Withdrawal

Maaaring mag-request sa pamamagitan ng online platform o telepono, at ang pondo ay awtomatikong ililipat sa pre-registered bank account. Maaari kang magtukoy ng isang araw sa susunod na araw para dumating ang pondo.