Buod ng kumpanya

| Krungthai Buod ng Pagsusuri | |

| Itinatag | 2022 |

| Rehistradong Bansa/Rehiyon | Thailand |

| Regulasyon | Hindi Regulado |

| Mga Produkto sa Paghahalal | Mga Ekitya, Deribatibo |

| Platform ng Paghahalal | / |

| Suporta sa Customer | Telepono: (+66) 02-695-5555, (+66) 02-695-5559, (+66) 02-695-5556 |

| Fax: (+66) 02-695-5173 | |

| Email: technicalsupport@krungthaixspring.com, Digital@krungthaixspring.com | |

| Social Media: Line, YouTube, Twitter, Instagram, Facebook | |

| Address ng Kumpanya: 8th, 15th-17th Floor, Liberty Square Bldg., 287 Silom Road, Bangrak, Bangkok, Thailand 10500 | |

Impormasyon Tungkol sa Krungthai

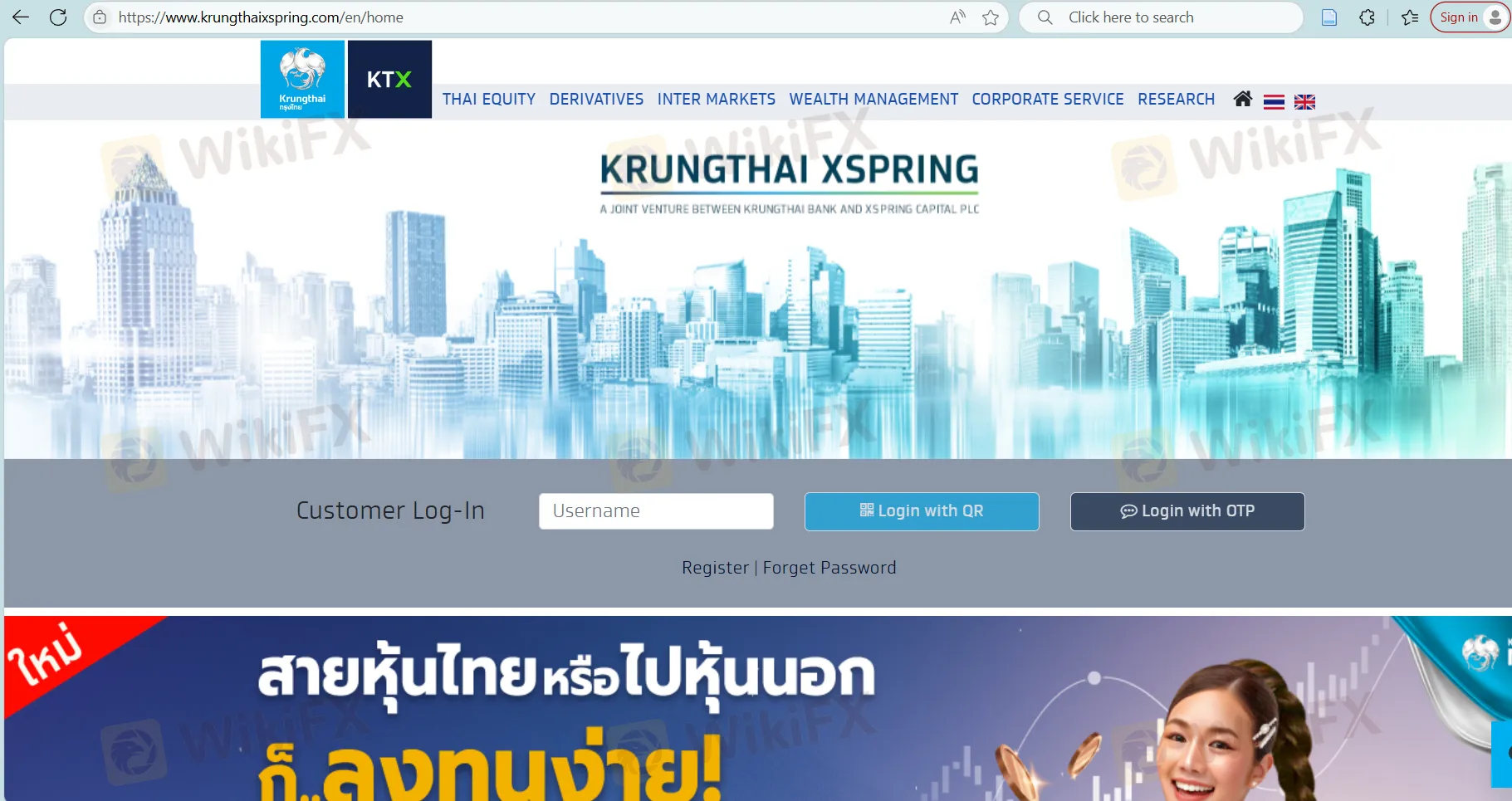

Ang Krungthai XSpring Securities ay isang Thai brokerage firm na nakabase sa Bangkok. Nag-aalok ang kumpanya ng iba't ibang serbisyong pinansiyal, kabilang ang securities brokerage, derivatives trading, securities borrowing and lending, underwriting, financial advisory, wealth advisory, private fund management, at international markets securities trading.

Mga Kalamangan at Disadvantages

| Mga Kalamangan | Mga Disadvantages |

| / | Hindi Regulado |

| Minimal na alok sa merkado | |

| Di-malinaw na istraktura ng bayad | |

| Kawalan ng impormasyon sa deposito at pag-withdraw |

Tunay ba ang Krungthai?

Hindi. Ang Krungthai ay kasalukuyang nag-ooperate nang walang pagsusuri ng regulasyon. Ang pagtitingin sa platform na ito ay maaaring magdulot ng panganib.

Ano ang Maaari Kong I-trade sa Krungthai?

Ang mga mangangalakal sa Krugthai ay may access sa mga instrumento sa merkado tulad ng Ekitya at Deribatibo.

| Asset sa Paghahalals | Available |

| ekwities | ✔ |

| deribatibo | ✔ |

| forex | ❌ |

| komoditi | ❌ |

| indices | ❌ |

| cryptocurrencies | ❌ |

| obligasyon | ❌ |

| opisyon | ❌ |

| ETFs | ❌ |

| pondo | ❌ |