Aman A

1-2 años

Does A&C charge any undisclosed fees when making deposits or withdrawals?

Based on my thorough review of A&C, I must emphasize that using this broker comes with notable uncertainties, specifically regarding their fee structure. As someone who relies on clear, upfront cost disclosures to manage my trading risk, I find it concerning that A&C does not provide any publicly detailed information about deposit or withdrawal fees. The lack of transparency is particularly worrying to me, as it introduces unpredictable costs that are difficult to factor into my trading decisions.

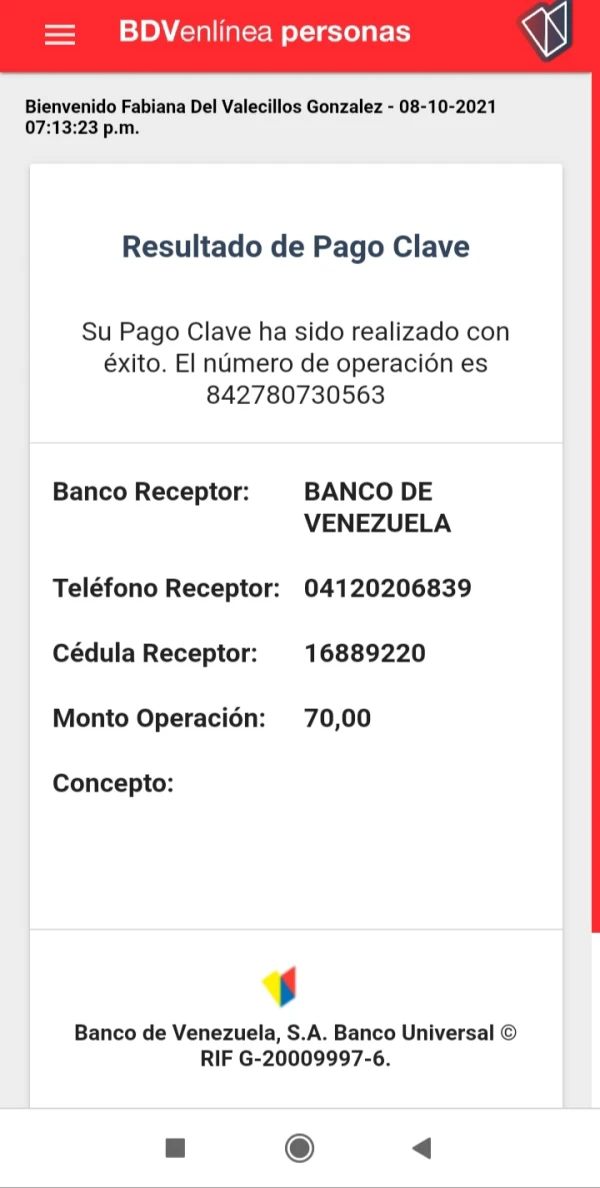

Beyond the absence of clear fee guidelines, my caution is heightened by A&C’s unregulated status and the user feedback indicating difficulty in withdrawing funds. For example, I noticed a report from another user who struggled to access their profits, which for me is a significant red flag in terms of both trust and financial security. In regulated environments, brokers are usually held accountable for providing transparent and fair fee disclosures, but A&C operates outside such oversight.

Personally, until all fees are explicitly disclosed and independently verified—especially for deposits and withdrawals—I would be hesitant to risk any capital with them. Financial safety starts with transparency, and for me, this is non-negotiable.

Broker Issues

Fees and Spreads

Nali5689

1-2 años

What’s the smallest withdrawal I can make from my A&C account in a single transaction?

Based on my thorough research into A&C, I found no clear information regarding the minimum withdrawal amount from their accounts. This lack of transparency raises some concerns for me, personally. In my experience, regulated brokers usually disclose such critical details openly, which helps traders plan their cash flow and set realistic expectations about accessing their funds. However, in A&C’s case, not only is the withdrawal policy ambiguous, but the platform also operates without any valid regulatory oversight.

I approached this with particular caution because, when trading with unregulated brokers, every undocumented policy represents potential risk. Additionally, there is at least one user report mentioning issues with withdrawing profits, which reinforces my wariness. Whenever I encounter a broker that does not specify withdrawal thresholds, fees, or timelines—and also lacks regulatory supervision—I become more vigilant about the safety of my capital. For me, accessible and reliable withdrawal processes are a non-negotiable aspect of choosing where to trade. In this instance, I would strongly advise reaching out to their support for clarification, but I remain conservative about engaging significant funds until withdrawal conditions are fully clear and satisfactory.

Broker Issues

Withdrawal

Deposit

Interbank Trader

1-2 años

Can I trust A&C as a reliable and secure broker for trading?

Speaking frankly as an independent trader who has evaluated many brokers over the years, I would exercise substantial caution regarding A&C. The most critical issue for me is the complete lack of regulation—A&C is not overseen by any recognized financial authority. In my experience, regulatory oversight is essential because it provides a system of checks and accountability that can offer some protection if disputes arise or if something goes wrong with funds or execution. Without such regulation, there are significantly higher risks, including the potential for unfair practices or difficulty withdrawing funds.

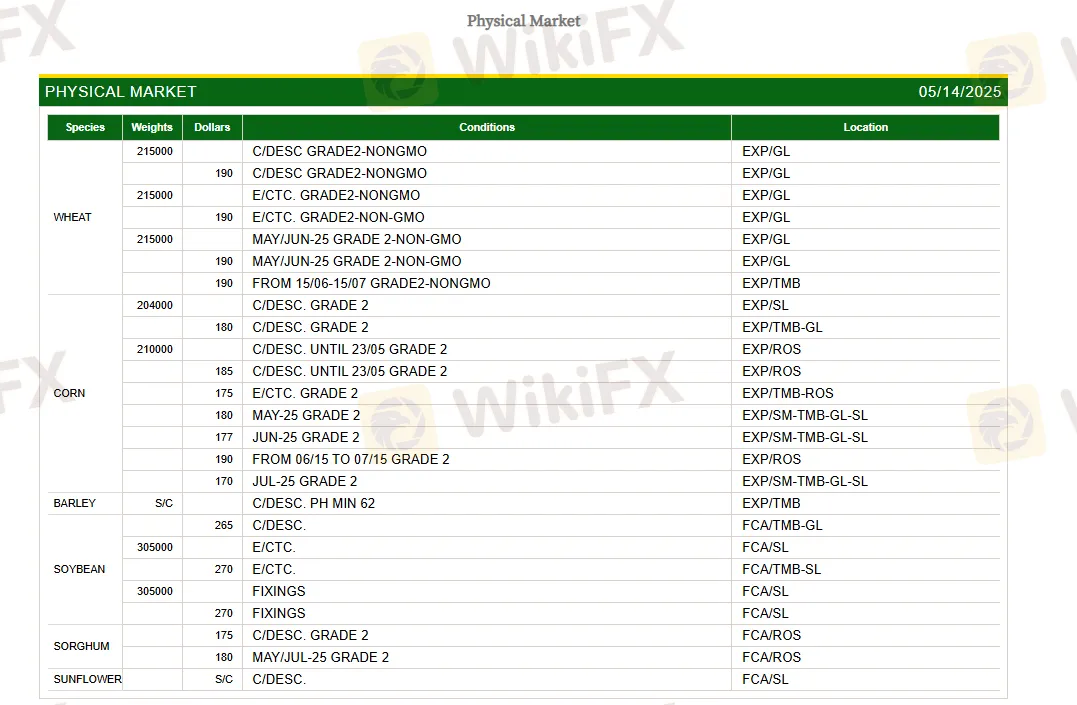

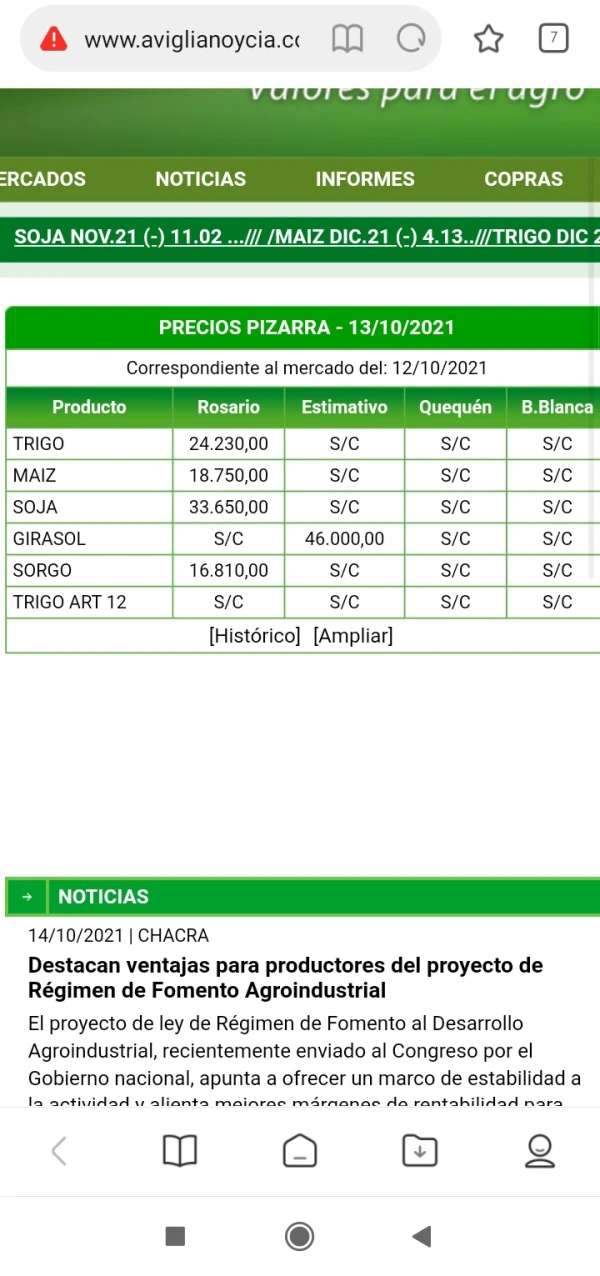

Looking at A&C’s business model, it focuses exclusively on agricultural commodities like wheat, corn, and soybeans, and does not offer forex, indices, or other popular assets. This limited scope means it isn't suitable for traders seeking diversified portfolios. Moreover, I found key information to be either unavailable or unclear—there is no transparent fee structure, no mention of minimum deposits, leverage, or trading platforms. For me, transparency is a non-negotiable aspect of trustworthiness, and those omissions raise red flags about what a client might face after funding an account.

Additionally, customer support seems to be available, but the website is only in Spanish. This further limits accessibility, particularly for international clients. Notably, there's a concerning user report describing difficulty with withdrawals—again, this is something I factor heavily, as ease of withdrawal is a basic expectation and essential to security.

Based on these observations, I cannot personally trust A&C as a reliable or secure broker. The combination of being unregulated, the lack of transparency, and user complaints all suggest a very conservative approach is warranted with this firm. For safeguarding my capital and interests, I would look for a broker with clear regulation, a transparent offer, and a proven track record.

Sanford

1-2 años

Are there any inactivity fees with A&C, and under what circumstances do they apply?

Based on my review of the available information, I have not found any clear details about inactivity fees at A&C. As someone who values transparency in broker relationships, this lack of clarification is concerning. In my experience, when a broker does not provide specific information about its fee structure—especially regarding potential inactivity fees or other account maintenance charges—it introduces an additional layer of risk for traders like myself. This is particularly relevant given that A&C is an unregulated entity, meaning there is no financial authority holding them accountable for transparent and fair business practices.

The absence of information on inactivity fees leaves me cautious, as unexpected charges can negatively impact a trader's experience and profitability. I always prioritize working with brokers who set out their terms clearly, so the unknowns here would make me hesitant to commit any significant funds or to leave my account dormant for any period of time. For anyone considering this broker, I recommend confirming all potential charges directly with their customer service before opening or funding an account, and proceeding with extra vigilance due to the unregulated status and lack of disclosure on critical policies.

Broker Issues

Fees and Spreads