简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Verbo Capital Review: Traders report Locked Accounts and "Fabricated" Losses

Abstract:URGENT ALERT: Our investigation into Verbo Capital confirms severe risks, including sudden account deletions and widespread withdrawal blockades reported by over 30 traders. With a safety score of just 1.28 and no valid regulation, this entity poses an immediate threat to client funds.

By WikiFX Special Investigator

Tracking the truth behind the charts.

Our investigation reveals a disturbing pattern of events surrounding Verbo Capital. In just three months, the WikiFX Support Center has been flooded with over 31 complaints against this South African-based entity. Traders are not just losing trades; they are losing access to their accounts entirely.

If you are currently trading with this Verbo Capital broker, or considering opening an account, this report contains critical evidence regarding fund safety and Verbo Capital login failures.

The Trader's Nightmare: “Account Deleted While Trading”

Imagine depositing $1,500, executing trades, and suddenly being kicked out of your platform. You try to log in, but your credentials no longer work. This is not a hypothetical scenario; it is the exact experience reported by multiple users in our database.

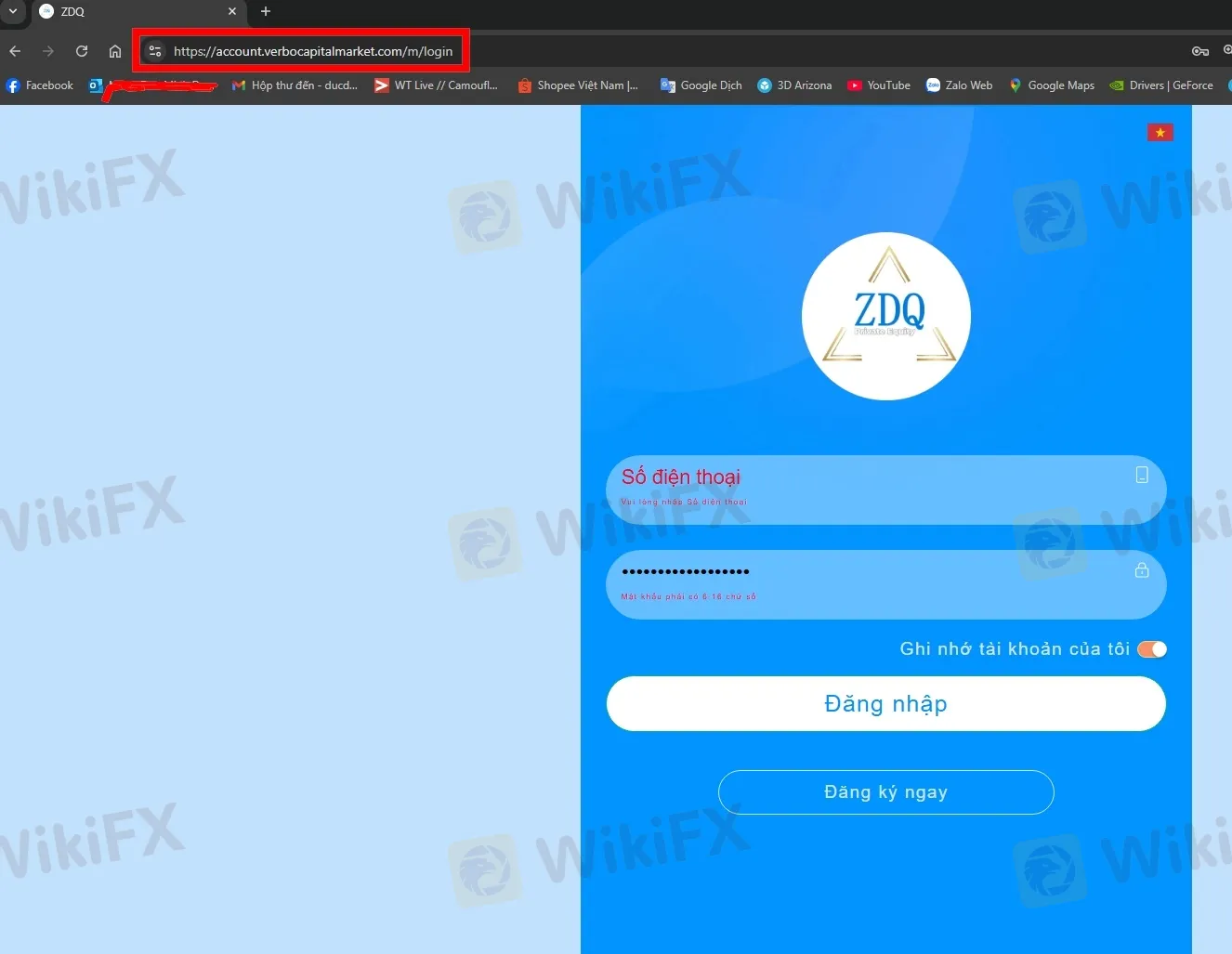

One victim reported a harrowing experience where their account was unilaterally deleted while they still had open positions. Another trader described a chaotic loop: “It worked fine for three months. Then, in month four, I was redirected to a different website demanding a login. My Verbo Capital login credentials failed, and my funds vanished.”

This isn't a technical glitch. It is a recurring narrative where the Forex Verbo Capital platform allegedly shuts down communication channels the moment a client attempts a significant withdrawal.

Verbo Capital Regulation: The Empty Table

The primary line of defense for any trader is regulatory oversight. We conducted a deep audit of the Verbo Capital regulation status to see who is protecting your capital.

The results are alarming.

Regulatory Reality Audit

| Regulator | License Type | REAL STATUS |

|---|---|---|

| South Africa (FSCA) | N/A | UNREGULATED |

| Global Tier-1 | N/A | NO LICENSE FOUND |

| Offshore | N/A | UNAUTHORIZED |

Verbo Capital holds no valid regulation. They operate without oversight, meaning there is no legal segregation of funds and no compensation scheme if the broker insolvent. With a WikiFX score of 1.28/10, the risk level is critical.

Verbo Capital Login Issues Exposed

Data from recent user complaints explicitly highlights a tactic we rarely see so aggressively: the denial of access.

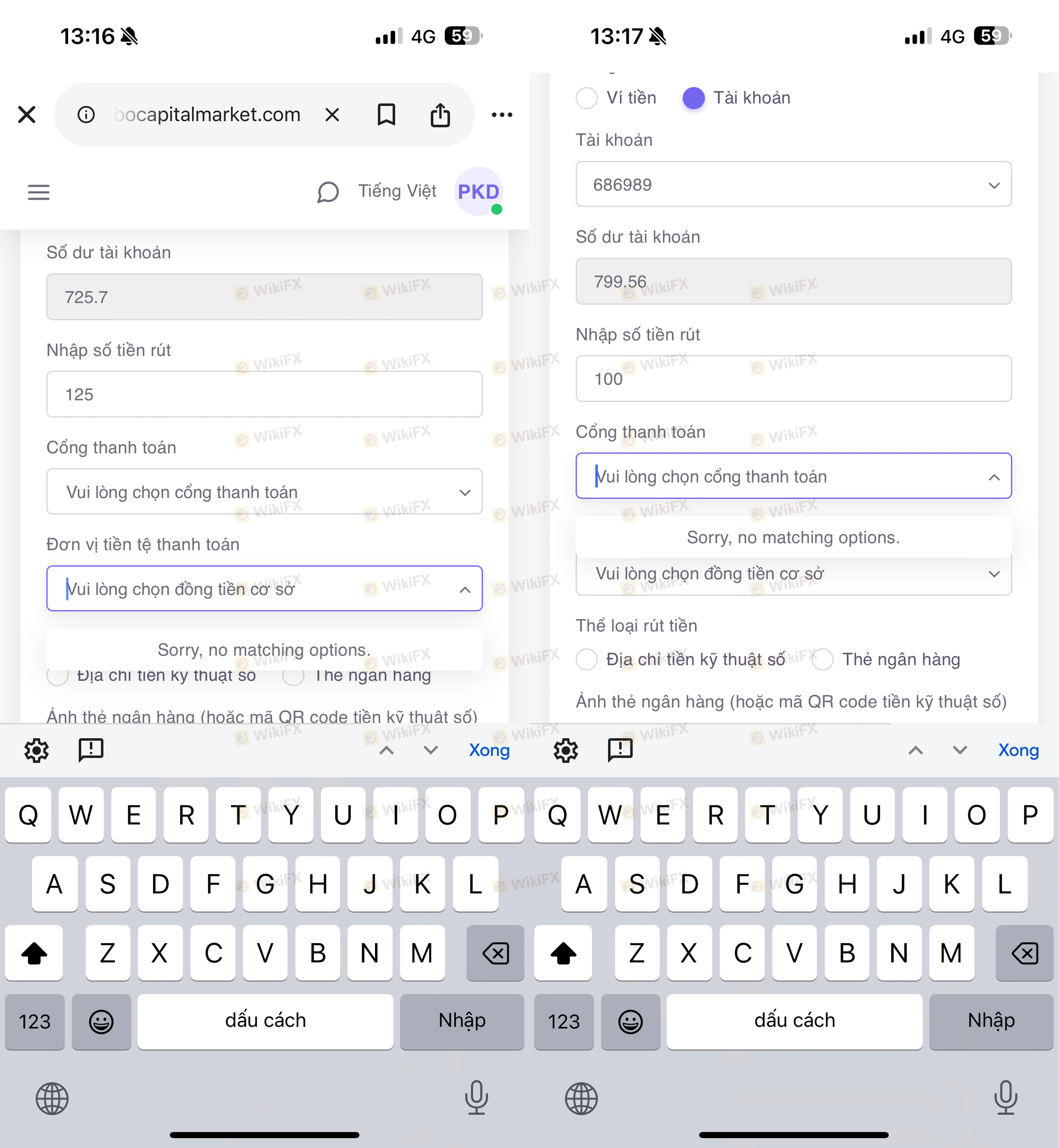

While standard Verbo Capital review requests usually focus on spreads or commissions, our data points to a more fundamental failure. Users reporting in April and May 2025 state that after depositing funds, the Verbo Capital login portal becomes inaccessible.

- Case ID 8: “I cannot withdraw money and cannot login to the account.”

- Case 9: “Deposited $1.5k into 2 accounts. The authorized platform kicked me out of MT5 immediately.”

- Case 2: “Redirected to another page demanding login credentials that do not work.”

If you cannot access the platform, you cannot close trades or request withdrawals. This is a severe “kill switch” tactic often used to trap liquidity inside the broker's possession.

Evidence of Price Manipulation

Beyond access issues, active traders are reporting severe market anomalies. A Forex Verbo Capital trader (ID 683568) provided detailed evidence of price manipulation on the XAUUSD (Gold) pair.

According to the complaint, at 12:40 on October 15, the broker Verbo Capital unilaterally adjusted the price of Gold from 2653.4 down to 2648.65—a massive drop not reflected on any standard liquidity provider or TradingView.

- The Result: The artificial price spike triggered stop-losses, wiping out $13,188 in a single moment.

- The Aftermath: Once the positions were liquidated, the price “returned to normal.”

This suggests the operation may be running a “B-Book” hybrid model where they profit directly from client losses, potentially using plugins to create artificial slippage.

Key Red Flags Detected

- Zero Regulatory Protection: The entity is unregulated and unauthorized to offer financial services.

- Access Denial: Multiple confirmed reports of Verbo Capital login credentials being disabled post-deposit.

- Withdrawal Blockade: Over 30 active cases of funds being withheld without explanation.

- Market Manipulation: Documented evidence of “phantom candles” used to liquidate client equity.

Verdict

The evidence against this entity is overwhelming. Verbo Capital exhibits the classic characteristics of a high-risk trap: they aggressively recruit effectively, allow small initial wins, and then appear to disable access or manipulate prices when the stakes get high.

Our investigation concludes that the Verbo Capital broker environment is unsafe for retail traders.

Risk Warning: The WikiFX score for Verbo Capital is 1.28. Your capital is at extreme risk. We strongly advise traders to cease deposits immediately and seek regulated alternatives.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

White House-Backed Firm Secures Strategic Stake in Glencore’s DRC Assets

Commodities Wrap: Oil Sinks on Geopolitical Optimism, Gold Defies Dollar Strength

USD/ZAR Analysis: Rand Tests 16.00 Resilience Amid Commodity Rebound

New Year, New Rewards | Year of the Horse Gifts Now 30% OFF

Fed’s Hidden Constraint: Why Monetary Tightening is Hitting Stability Limits

Global FX: Yen Volatility Spikes as US-India Trade Defrosts

ZarVista Legitimacy Check: Addressing Fears: Is This a Fake Broker or a Legitimate Trading Partner?

Gold's Historic Volatility: Liquidation Crash Meets Geopolitical Deadlock

Treasury Yields Surge as Refunding Expectations Dash; Warsh 'Hawk' Factor Looms

The Warsh Dilemma: Why the New Fed Nominee Puts Fiscal Plans at Risk

Currency Calculator