简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

TradeFxP User Reputation: Looking at Real User Reviews and Common Problems

Abstract:You are here because you want to know something important: Is TradeFxP Safe or Scam? Let's answer this directly. After carefully checking all the facts, TradeFxP shows serious dangers to anyone's money. The main reason for this conclusion is that it has no proper financial regulation, which is absolutely necessary for any trustworthy broker. This article will break down the proof step by step. We will look at official regulatory checks, company transparency problems, TradeFxP Complaints and what real users are saying. Our goal is to give you complete, fact-based information so you can make a smart and safe choice about your money. The evidence strongly suggests you should be extremely careful.

You are here because you want to know something important: Is TradeFxP Safe or Scam? Let's answer this directly. After carefully checking all the facts, TradeFxP shows serious dangers to anyone's money. The main reason for this conclusion is that it has no proper financial regulation, which is absolutely necessary for any trustworthy broker. This article will break down the proof step by step. We will look at official regulatory checks, company transparency problems, TradeFxP Complaints and what real users are saying. Our goal is to give you complete, fact-based information so you can make a smart and safe choice about your money. The evidence strongly suggests you should be extremely careful.

Understanding The Warning Signs

A Major Regulatory Problem

The most important thing to check when looking at a broker is whether it follows proper rules or Is TradeFxP Safe or Scam. For TradeFxP, this is the biggest warning sign. The broker does not follow any proper, high-level financial rules. Good regulatory groups, like the Financial Conduct Authority (FCA) in the UK or the Australian Securities and Investments Commission (ASIC), have strict rules to protect traders. These rules include keeping client money separate from company money, so the broker cannot use your money for their business costs. They also require participation in protection programs that can protect your investment if the broker goes out of business. Since TradeFxP does not have this oversight, your money has no protection. If you have a problem or cannot withdraw money, you have no official organization to help you, putting your entire investment at the company's mercy.

A Network of Suspicion

A broker's company structure and physical location show how transparent and responsible they are. Here, TradeFxP raises multiple serious concerns and TradeFxP Complaints. The company, TradeFxP Ltd, is registered in the United Kingdom. However, its listed working address is in Dubai, United Arab Emirates. This distance between where it's registered and where it operates is a common trick used by risky companies to hide their true location and make legal action harder. It tells you directly Is TradeFxP Safe or Scam. Even worse are the results of on-site verification surveys. These investigations have repeatedly confirmed that TradeFxP has “No Physical Presence Found” at its registered UK address. A real financial services company does not operate from a fake office. This lack of a real physical location strongly suggests the broker is not the established company it claims to be and is actively avoiding responsibility.

Official Warning Signs

Independent verification platforms collect data to create an objective risk score, and the assessment for TradeFxP is terrible. The broker receives an extremely low score of 1.58 out of 10, a clear sign of widespread, severe problems. This score combines its regulatory status, business practices, and other risk factors. The official findings are clear and serve as a direct warning to potential users and directly answers the question Is TradeFxP Safe or Scam?

| Risk Factor | Assessment | What This Means for Traders |

| Overall Score | 1.58 / 10 | Extremely low, showing critical failures. |

| Regulatory Status | Suspicious Regulatory License | The broker lacks any credible oversight. |

| Business Scope | Suspicious Scope of Business | Operations are not transparent or legitimate. |

| Risk Level | High potential risk | There is a high probability of losing money. |

This data leads to a clear, direct warning that should not be ignored: “Warning: Low score, please stay away!” When a broker is marked with such a low score and a direct alert, it means that working with them is gambling, not investing.

Looking at User Reputation

The Strange Case of One Review

When investigating TradeFxP complaints and user feedback, a strange pattern appears: almost no public discussion about Is TradeFxP Safe or Scam. The available record shows a single positive comment from late 2022, which praises how easy it is to deposit and withdraw money using Skrill. From an expert view, one isolated, undated positive comment has almost no value against the mountain of structural warning signs. In fact, it can be part of the trap. Many risky operations are known to process small, early withdrawals smoothly to create a false sense of security. This encourages the user to deposit larger amounts. The real test of a broker's honesty is not whether you can deposit easily, but whether you can withdraw a significant profit or your entire balance without problems. This single review does not provide any such proof and should be viewed with extreme doubt.

The Sound of Silence

For a company that claims to have been operating for “5-10 years”, the digital silence is loud and deeply suspicious. A real brokerage operating for over seven years, as of 2026, would definitely build up a substantial digital history. This would include discussions, both positive and negative, on independent forums like Reddit, Trustpilot, and Forex Peace Army. Clients would be sharing experiences, asking questions, and logging complaints about Is TradeFxP Safe or Scam-. The near-complete absence of this natural history suggests several possibilities, all of them negative. It could mean the broker is not nearly as established as it claims, has very few real clients, or is aggressively removing negative feedback from the internet. In the world of online finance, a lack of credible history is as alarming as a history of complaints.

Finding Real Exposure Data

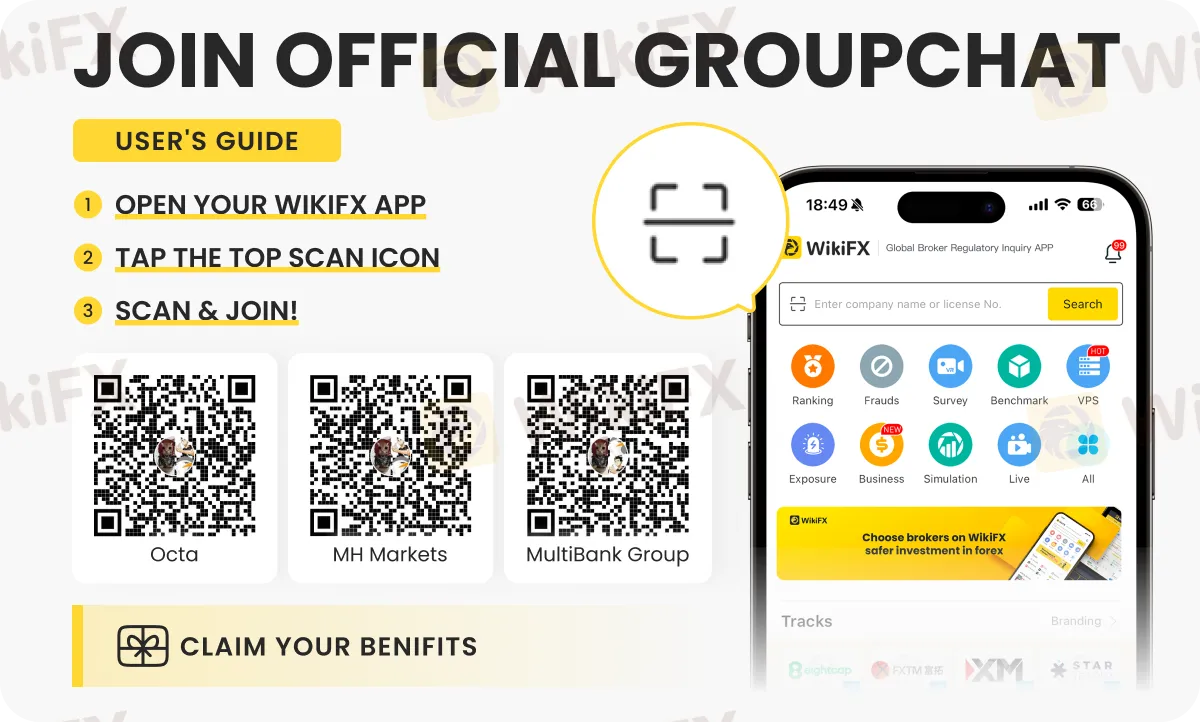

Individual online reviews can be easily manipulated, both by the broker to create a false positive image and by unhappy users. It confuses to know Is TradeFxP Safe or Scam. To get a more reliable picture, it is important to move beyond scattered comments and look at combined data from verification platforms. These platforms collect user-submitted reports, exposure data, and official regulatory information into a single, verifiable profile. This approach helps to filter out the noise and identify consistent patterns of behavior. To cut through the noise and see a combined view of user-submitted reports and exposure data for TradeFxP, checking a specialized broker verification platform is essential. For a clear example, the TradeFxP profile on WikiFX https://www.wikifx.com/en/dealer/5631721170.html brings this information together, offering a more reliable picture than scattered, unverified comments.

A Critical Trading Review

TradeFxP offers leverage up to 1:300. For an inexperienced trader, this might seem like an attractive feature, a way to control a larger position with a smaller amount of money. However, when offered by an unregulated broker, high leverage is a recipe for disaster. Top-level regulators in major markets have imposed strict leverage limits specifically to protect everyday traders from rapid, catastrophic losses. In Europe and Australia, leverage is capped at 1:30 for major forex pairs; in the United States, it is 1:50. These limits are an important safety measure. An unregulated broker like TradeFxP has no such obligation to protect you. Know you can get an idea Is TradeFxP Safe or Scam to avoid . High leverage increases losses just as it increases gains. For a broker that may be trading against its clients, encouraging high-leverage trades can lead to clients losing their accounts faster, which directly benefits the broker. It is not a feature; it is a danger.

Accounts and Deposits

The broker structures its accounts to appeal to a wide range of traders, a classic trick for casting a wide net. It offers an STP account with a minimum deposit of just $100 and an ECN account requiring a much larger $3,000 deposit. This immediately raises the question many traders should be asking: Is TradeFxP Safe or Scam when such entry barriers are designed more for attraction than protection?

Once they have made a deposit and started trading, they are inside the broker's system and more likely to be pressured to deposit more. The $3,000 requirement for a supposed “ECN” account is a significant amount of money to trust to an entity with no regulation, no physical office, and no accountability. Furthermore, the claim of offering a true ECN environment from an unregulated broker is highly questionable, as this model requires transparency that fundamentally conflicts with their unclear operational structure.

The Illusion of Convenience

TradeFxP lists a wide variety of payment methods, including VISA, Skrill, Neteller, Bitcoin, and Bank Transfers. This creates an illusion of legitimacy and convenience, making it appear as though they are a well-integrated, global operation. However, the critical issue with unregulated brokers is never about depositing funds; it is always about withdrawing them. The internet is full of complaints against similar entities detailing a consistent pattern of withdrawal problems. These problems often include endless verification loops where new documents are constantly requested, support tickets that go unanswered for weeks, and outright refusal to process withdrawal requests. The inclusion of cryptocurrency as a payment method is another red flag, as crypto transactions are largely irreversible, making it nearly impossible to recover funds once they have been sent. Since crypto transactions are largely irreversible, it once again forces traders to ask: Is TradeFxP Safe or Scam when it encourages payment methods that make fund recovery nearly impossible?

The Final Verdict & Protection

The Verdict on TradeFxP

After a complete review of the evidences, TradeFxP Complaints. Question for Is TradeFxP Safe or Scam? is unavoidable.The combination of a complete lack of valid regulation, a suspicious company structure with a fake UK office, a terrible risk score from verification platforms, and a near-total absence of a credible user reputation makes it an exceptionally high-risk choice. While we refrain from the legal designation of “scam,” TradeFxP shows all the characteristics of an untrustworthy operation that traders should avoid entirely. Working with this broker carries a significant risk of total money loss. The potential for financial harm far outweighs any perceived benefits of its trading conditions.

The Golden Rule of Trading

Let this analysis serve as a powerful lesson. The golden rule of selecting a forex broker is simple: regulation is non-negotiable. A broker's regulatory status should be the very first thing you verify. If a broker is not licensed and overseen by a reputable, top-level financial authority, all other features—leverage, spreads, platforms, bonuses—are completely irrelevant. They are merely marketing tools designed to distract you from the fundamental lack of safety and accountability. Do not proceed with any broker that fails this initial, critical check.

Your Most Important Next Step

Protecting your money begins with proactive research. You must make it an unbreakable habit to verify every broker before you even consider opening an account. Before depositing a single dollar with *any* broker, make it an unbreakable habit to use a comprehensive verification tool. Independent platforms like WikiFX are designed for this exact purpose, providing detailed regulatory checks, license verification, and real user feedback that you won't find on the broker's own website. This simple step can save you from immense financial and emotional distress.

You can see this protective process in action right now. We strongly recommend you examine https://www.wikifx.com/en/dealer/5631721170.html. This will not only strengthen your understanding of the risks associated with this specific broker but also demonstrate the power of a proper background check. Make verification your first step, every time.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Naira Rallies to Start February as Government targets Fiscal Consolidation

SNB Strategy: Intervention Preferred Over Negative Rates as Inflation Flatlines

Italy’s Financial Regulator Expands Crackdown on Unauthorised Investment Websites

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Toyar Carson Limited Review: A Detailed Look at a Risky Broker

USD Resilience: Strong Data Cushions Political Volatility as Trump Targets Fed

Currency Calculator