简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Toyar Carson Limited Regulatory Status: A Complete Guide to Their Licenses and Business Registration

Abstract:If you're looking up information on Toyar Carson Limited Regulation, you probably want to know if they're safe and legitimate. Let's get straight to the point. Our detailed research shows that Toyar Carson Limited works without any supervision from trusted financial regulators. This lack of regulation is the biggest warning sign any trader can see. Public records show they have a business rating of only 1.46 out of 10, which means they have serious problems with how they operate and keep clients safe. In this article, we'll share facts based on evidence from public business records, visits to their location, and feedback from users. Our aim is to give you the clear facts you need to understand the major risks of working with this company and help you make a smart decision to protect your money.

If you're looking up information on Toyar Carson Limited Regulation, you probably want to know if they're safe and legitimate. Let's get straight to the point. Our detailed research shows that Toyar Carson Limited works without any supervision from trusted financial regulators. This lack of regulation is the biggest warning sign any trader can see. Public records show they have a business rating of only 1.46 out of 10, which means they have serious problems with how they operate and keep clients safe. In this article, we'll share facts based on evidence from public business records, visits to their location, and feedback from users. Our aim is to give you the clear facts you need to understand the major risks of working with this company and help you make a smart decision to protect your money.

Complete Lack of Regulation

For any financial services company, especially a forex broker, regulation isn't just nice to have – it's absolutely necessary for keeping clients safe. Regulatory bodies like the UK's Financial Conduct Authority (FCA) or the Cyprus Securities and Exchange Commission (CySEC) create and enforce strict rules. These rules make sure trading is fair, require client money to be kept separate from company money, and provide legal ways to solve disputes. Without this supervision, clients have no protection and no way to get help if there's fraud, manipulation, or if the company goes out of business.

Our complete search of global financial regulatory databases confirms that Toyar Carson Limited is not authorized or licensed by any recognized financial authority. The broker has no valid Toyar Carson Limited Regulation that would give you any protection. This isn't a small problem – it's a major flaw in how they operate that puts clients at the highest level of risk. The table below shows this serious lack of supervision across major regulatory areas.

| Regulatory Authority | License Status | Verification |

| FCA (UK) | Not Licensed | Unverified |

| CySEC (Cyprus) | Not Licensed | Unverified |

| ASIC (Australia) | Not Licensed | Unverified |

| FINMA (Switzerland) | Not Licensed | Unverified |

| *Any Reputable Body* | Not Licensed | Unverified |

The consequences of trading with an unregulated company are serious. Your money is not protected by any safety programs, meaning you could lose everything if the company stops operating. There's no authority to make sure pricing is fair or that you can withdraw your money when you want to. You're basically operating in a situation where the broker makes all the rules without being held accountable. Toyar Carson Limited Regulation Tells, you need to stay constantly alert. For the most current, real-time information on any broker's regulatory status, it's important to check a dedicated verification platform like WikiFX before putting any money in.

Checking Out The Registered Address

A broker's trustworthiness often shows in its physical location. A legitimate financial company operates from a real commercial office that you can verify. Toyar Carson Limited Regulation lists its registered business address as FLAT 43 PERKINS HOUSE WALLWOOD STREET LONDON ENGLAND UNITED KINGDOM E14 7AH. To check if this claim is true, our investigation team went to this location in person. What we found from this visit is very concerning and completely contradicts the image of a professional financial services company.

Our team went to the address and immediately saw that Perkins House is a residential apartment building, not a commercial office building. The area felt like a residential neighborhood, without the typical features and signs you'd see in business districts. There were no company logos, directories, or information about Toyar Carson Limited on the building's outside or entrance. This lack of professional presence is a major departure from normal business practice.

Because the building was a private apartment building, we couldn't get inside. There was no public lobby, reception desk, or security staff we could talk to about our visit. Without a business-facing presence, it was impossible to get inside or check if any business activities were happening in any of the private apartments. The address points to a private home, not a place of business.

The results from our visit are clear:

• Address Type: Residential Apartment

• Company Signage: None

• Business Presence: Not Found

• Conclusion: The broker does not have a real physical business location at its registered address.

This finding is a huge red flag. Using a residential apartment as a registered address, especially without any actual business presence, is a common trick used by fake companies or entities trying to create a false appearance of legitimacy. It suggests the broker has no real operations in the UK and is just using the address for registration purposes, a practice that seriously damages its credibility.

Looking at Key Risk Factors

Beyond the serious issues of Toyar Carson Limited Regulation and a fake office, a deeper look at Toyar Carson Limited shows a consistent pattern of risk across its entire operation. These warning signs, when viewed together, create a complete picture of an untrustworthy company.

Unclear Corporate Background

As of early 2026, this gives the company a very short operating history of just under three years, which isn't enough to build a reliable track record in the financial industry. More worryingly, the identities of its management team and key staff are not shared publicly. This secrecy prevents any background checking into the experience and credibility of the people managing client money.

Most importantly, public records from the UK's Companies House show the company's status as “active — active proposal to strike off.” This isn't a minor administrative issue. A proposal to strike off is a formal process started by the registrar to close down a company. It's typically triggered by failing to meet basic legal requirements, such as filing annual accounts or confirmation statements. For a financial company, this is a serious sign of operational failure and ignoring legal compliance, signaling the company may soon be dissolved.

Unclear Trading Conditions

A transparent broker provides clear, detailed information about its trading costs. This includes specific spreads for various trading instruments, commission structures, and swap or overnight financing rates. Toyar Carson Limited fails to meet this basic standard of transparency. Its website and documents lack clear and easy-to-find information on these important costs. This lack of clarity creates a high risk of hidden fees that can reduce a trader's profits. Without a clear fee schedule, traders can't accurately calculate the cost of a trade, making it impossible to manage their strategy effectively. This lack of clarity is often a deliberate tactic to hide unfavorable or exploitative trading conditions.

Serious Client Fund Concerns

The most important job of a trustworthy broker is to protect client funds. Our investigation found no evidence that Toyar Carson Limited follows standard fund safety protocols. There's no mention of segregated client accounts, which is a legal requirement in most regulated areas. Toyar Carson Limited Regulation seems Risky. This means your money is likely mixed with the company's operational funds, putting it at extreme risk. If the company gets into debt or becomes insolvent, your money could be taken by creditors. Furthermore, there's no mention of negative balance protection, which prevents you from losing more than your initial deposit, or participation in any investor compensation program that could pay you back if the broker fails.

Troubling Customer Experiences

The ultimate test of a broker's honesty is the experience of its clients, particularly when it comes to withdrawing money. A review of user feedback and public forums shows a disturbing pattern of complaints against Toyar Carson Limited. The most frequently reported and serious issues are related to withdrawals. Clients have documented significant difficulties and delays in accessing their funds, with some reporting that their withdrawal requests go completely unanswered. Other common complaints include unresponsive or unhelpful customer service and a general lack of transparency in communication. A consistent pattern of withdrawal issues is one of the most serious warnings. You can cross-check Toyar Carson Limited Regulation by Clicking on this https://www.wikifx.com/en/dealer/1680376250.html.

Our Final Decision and Your Protection

After a thorough investigation on Toyar Carson Limited Regulation. Our decision on Toyar Carson Limited is clear and definitive. The evidence points overwhelmingly to a company that operates with an extremely high level of risk and shows all the classic signs of an untrustworthy, and potentially fraudulent, operation.

Let's summarize the definitive findings:

• No Regulatory License: It operates completely outside the oversight and protection of any recognized financial authority, leaving clients fully exposed.

• Fake Business Address: Our on-site investigation confirmed that the broker has no physical office at its registered UK address, which is a residential apartment.

• Serious Operational Red Flags: The company has a short, unclear history, an anonymous management team, and a pending “proposal to strike off” from the UK's Companies House, showing serious compliance failures.

• Negative User Feedback: There is a documented pattern of serious customer complaints, most critically concerning the inability to withdraw funds.

Based on this evidence, we conclude that working with Toyar Carson Limited is not a calculated risk; it's an unjustifiable gamble with your money. We strongly advise against putting any funds with this broker.

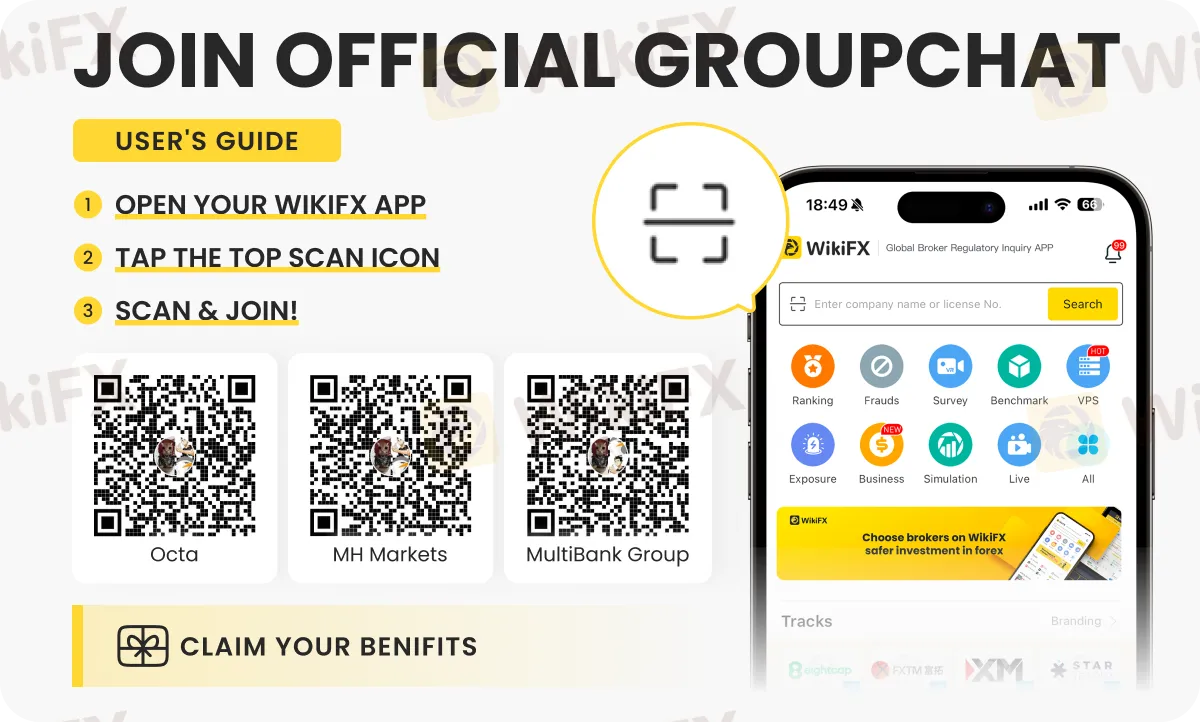

The most important step you can take before trusting any broker is to do independent verification. Never rely only on the claims a broker makes on its own website. The best practice is to use a comprehensive, third-party tool designed for this exact purpose.

We strongly advise all traders to use a comprehensive broker verification tool. Visit WikiFX to check the Toyar Carson Limited Regulation status and review the full investigation details, including user complaints and on-site survey photos. This practice should be a mandatory step in your research process for any broker you consider in the future to protect your investments.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

XeOne Complete Review: Is It Unregulated and Risky? A Detailed Look

Geopolitical Risk Radar: Russia Nuclear Treaty Expiry Looms; Iran Weighs Diplomacy

Kudotrade Review: Safety, Regulation & Forex Trading Details

Global Markets Rattle: Commodities and Crypto Slump as 'Trump Trade' Fades

Why Opofinance’s Dual Licensing Looks Weak, Not Reassuring

Is Toyar Carson Limited Legit? A 2026 Investigation into Scam Allegations

Wall Street Giants Pivot: The "Reflation Trade" Returns

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

Currency Calculator