简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

NOZAX Review 2026: Comprehensive Safety Assessment

Abstract:NOZAX is a Montenegro-based financial provider established in 2022, offering MetaTrader 5 access under SCMN regulation. However, a low WikiFX score of 3.87, combined with recent user complaints regarding withheld deposits and a lack of advanced authentication measures, suggests traders should exercise caution.

Executive Summary

In this in-depth review, we analyze the key metrics, safety protocols, and trading conditions offered by NOZAX. As the financial landscape evolves, selecting a trustworthy partner is paramount. NOZAX is a global broker established in 2022, headquartered in Montenegro. It aims to provide digital-first trading solutions through the MetaTrader 5 platform. However, despite its modern interface and multiple account types, the broker faces scrutiny due to its relatively short operating history and mixed user feedback.

Our assessment assigns NOZAX a WikiFX score of 3.87, placing it in a lower tier of reliability compared to industry giants. This review 2026 aims to clarify whether the entity's regulatory framework and operational standards are sufficient for the average trader's safety.

1. Regulation & Safety Protocols

The most critical aspect of our audit is the regulation NOZAX operates under. Unlike brokers overseen by top-tier authorities like the FCA (UK) or ASIC (Australia), NOZAX is regulated by the Securities and Exchange Commission of Montenegro (SCMN), holding license number 03/2-5/5-21. While this confirms the entity is not unregulated, Montenegro is considered a minor jurisdiction in the global financial hierarchy.

The implications of this regulation status are significant for fund safety. Emerging regulatory bodies often lack the stringent enforcement mechanisms found in major financial hubs. For instance, they may not mandate the same level of segregated accounts or provide substantial compensation schemes in the event of insolvency. Traders must weigh the benefits of a regulated entity against the reality that SCMN oversight may not offer the robust protection found elsewhere.

2. Forex Trading Conditions

For traders focusing on Forex instruments, NOZAX offers competitive but high-risk conditions. The broker provides access to FX, Gold, Silver, and Indices through three distinct account types: CENT, CORE, and ZERO. A defining feature is the leverage cap, which sits at a substantial 1:500. While high leverage can amplify gains, it simultaneously increases exposure to rapid losses, a factor that novice traders must approach with caution.

The “ZERO” account claims spreads starting “from 0.0,” which is attractive for scalpers and automated traders. However, one must ask: Does Forex pricing compete with top-tier providers when hidden costs or commissions are factored in? The availability of the MetaTrader 5 platform supports expert advisors (EA) and complex analysis, making it a viable environment for technical traders, provided they are comfortable with the jurisdiction's risk profile.

3. User Feedback & Complaints

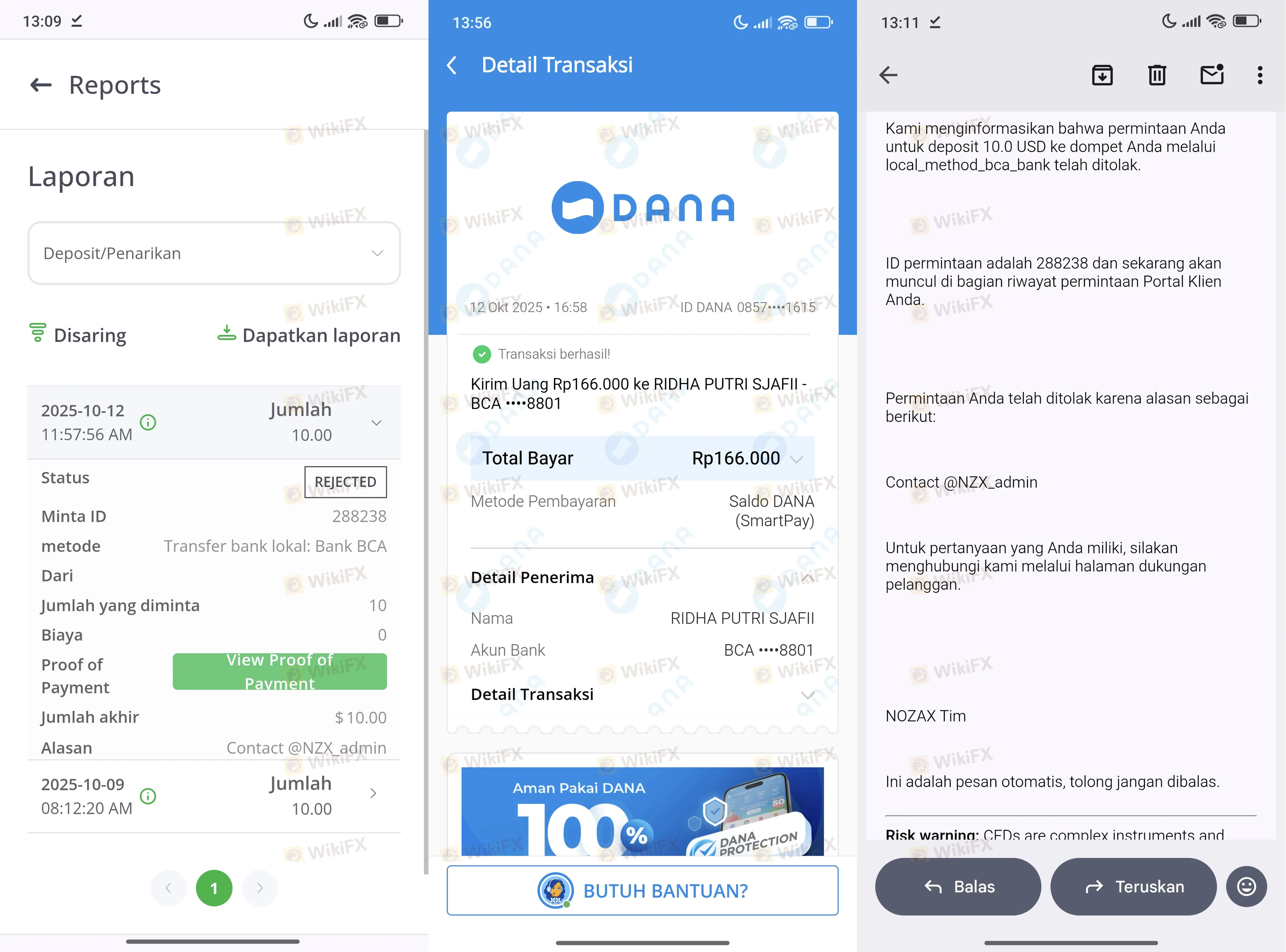

A closer look at user sentiment reveals concerning patterns that potential clients should not ignore. In our analysis of recent activity, we identified a serious complaint from an Indonesian user dated October 13, 2025. The user reported a specific issue where a deposit was rejected by the system, yet the funds were detained and not returned to the source account. The user stated, _“Deposit di reject tapi dana di tahan... tidak ada jawaban sama sekali”_ (Deposit rejected but funds detained... no answer at all), indicating a breakdown in customer support channels.

The user provided evidence suggesting that despite submitting reports via email and the application, communication remained unresponsive. When a broker fails to resolve funding issues promptly, it creates significant trust deficits.

4. Software & Access

NOZAX utilizes the MetaTrader 5 (MT5) platform, a market standard known for its depth and customizability. However, our technical audit of the software highlighted specific security gaps. To access the platform, traders must complete the login security steps, but the system reportedly lacks modern safeguards. Specifically, the software information indicates a valid deficiency: it misses two-step verification and biometric authentication for a more secure entry.

While the trading interface itself is robust, the login process is the first line of defense against unauthorized account access. In an era where cybersecurity is paramount, the absence of Multi-Factor Authentication (MFA) or biometric login options is a disadvantage. Traders should ensure they use strong, unique passwords to mitigate the risk of account compromise, especially given the reported lack of advanced security features.

Final Verdict

NOZAX presents itself as a modern, accessible trading provider with high leverage and a reliable MT5 engine. However, the combination of a low WikiFX score (3.87), offshore regulation in Montenegro, and unresolved complaints regarding fund withholding paints a complicated picture.

Pros:

- Regulated by Montenegro SCMN.

- Access to MT5 with high leverage (1:500).

- Zero spread account options available.

Cons:

- Lack of top-tier licensing (FCA/ASIC).

- Software lacks 2FA for the login process.

- User reports of unresponsive support regarding trapped funds.

For real-time updates on regulation status or to verify the official login page, consult the WikiFX App to ensure you are accessing the legitimate domain and avoiding clones.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Currency Calculator