简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Huge Surge In New Orders Sends US Manufacturing Activity Near 4 Year Highs

Abstract:With 'hard' data sustaining signs of solid growth (e.g. factory orders and jobless claims), 'soft' s

With 'hard' data sustaining signs of solid growth (e.g. factory orders and jobless claims), 'soft' survey data has been bouncing back since the start of the year

This morning we get the final Manufacturing PMI data from S&P Global and ISM for January.

A solid and stronger improvement in US manufacturing sector operating conditions (52.4 vs 52.0 exp) was signaled by Januarys S&P GlobalPMI data amid the joint-sharpest upturn in production since May 2022.

However, growth was in part driven by inventory buildingas new orders, despite returning to expansion in January, increased only modestly.

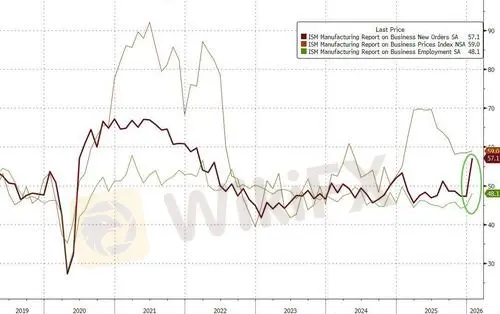

ISM's Manufacturingwas expected to rise from 47.9 to 48.5 in January but instead it soared to 52.6 - its highest since Aug 2022. This is the first print above 50 since January 2025.

Source: Bloomberg

This was the biggest MoM surge in the ISM print since April 2020 (COVID rebound), led by ahuge surge in new orders and rise in employment (highest in a year) and prices (though elevated) are stable...

says Chris Williamson, Chief Business Economist at S&P Global Market Intelligence.

This highly unusual situation is clearly unsustainable, hinting at risks of a production slowdown and a potential knock-on effect on employment, unless demand improves markedly in the coming months.

Williamson adds that sluggish sales and order book growth are being commonly linked to customer resistance to high prices,in turn often blamed on tariffs, as well as increased uncertainty over the economic outlook.

While just below trend, business growth expectations for the year ahead are, however, holding upas firms anticipate improving demand, “thanks in part to lower interest rates, reduced import competition due to tariffs, and more government support.”

However, as Williamson concludes,

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

ECB and BoE Set to Hold Rates Amid Inflation Jitters

Gold Reclaims $4,800 After Historic Rout; Volatility Persists

Binary.com Review — Missing Trades & Reporting Issues Investigated

OpoFinance Withdrawal Issues: Traders Warn Others

Macro Strategy: Hard Assets Favored Over Consumption in Inflationary Environments

Central Bank 'Super Week': ECB, BoE, and RBA to Test FX Volatility

Precious Metals Capitulation: Gold Plunges 12% to Break $5,000 Support

EZINVEST Review: The Financial Abattoir Behind the CySEC Mask

SARB Pauses Rate Cycle at 6.75% Amid Lingering Uncertainty

Eurozone Resilience: Economy Defies Gloom as Germany Rebounds

Currency Calculator