简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Zenstox Review: The Seychelles Shell Game and the $70,000 Withdrawal Wall

Abstract:Zenstox is a regulatory mirage, masking a high-pressure scam operation behind a flimsy Seychelles license while systematically blocking withdrawals and liquidating client funds. With a dismal 2.25 WikiFX score and a surge of 18 fraud reports, this broker is a financial trap disguised as a trading platform.

The data doesn't lie, even if the account managers do. A zenstox review reveals a predatory pattern that would make a shark look apathetic. Operating since 2022, this firm has managed to rack up a staggering volume of complaints that far outpaces its short lifespan. From Oman to Mexico, the narrative is identical: deposits go in with the speed of light, but money never comes out.

We aren't talking about technical glitches or “market volatility”—we are looking at systemic, documented financial entrapment. One victim from Oman reported watching their balance hit $70,000, only to find it functionally impossible to withdraw a single dollar. This isn't a broker ; its a black hole for capital.

The Regulation Smoke Screen

While Zenstox leans heavily on its “authorized” status to lure in the unsuspecting, a look at the regulation reality tells a different story. Being registered in the Seychelles (FSA) is the equivalent of a “participation trophy” in the world of financial oversight. It offers offshore leniency, which Zenstox clearly exploits to operate without the oversight of more stringent Tier-1 jurisdictions.

| Regulator | License Type | Status |

|---|---|---|

| Seychelles FSA | Retail Forex License | Regulated (Offshore) |

The Zenstox regulation is the only thing standing between them and a total collapse of credibility, but for the 18 victims who have filed formal complaints in the last 90 days, that license number is worth less than the paper its printed on.

The Psychological Meat Grinder

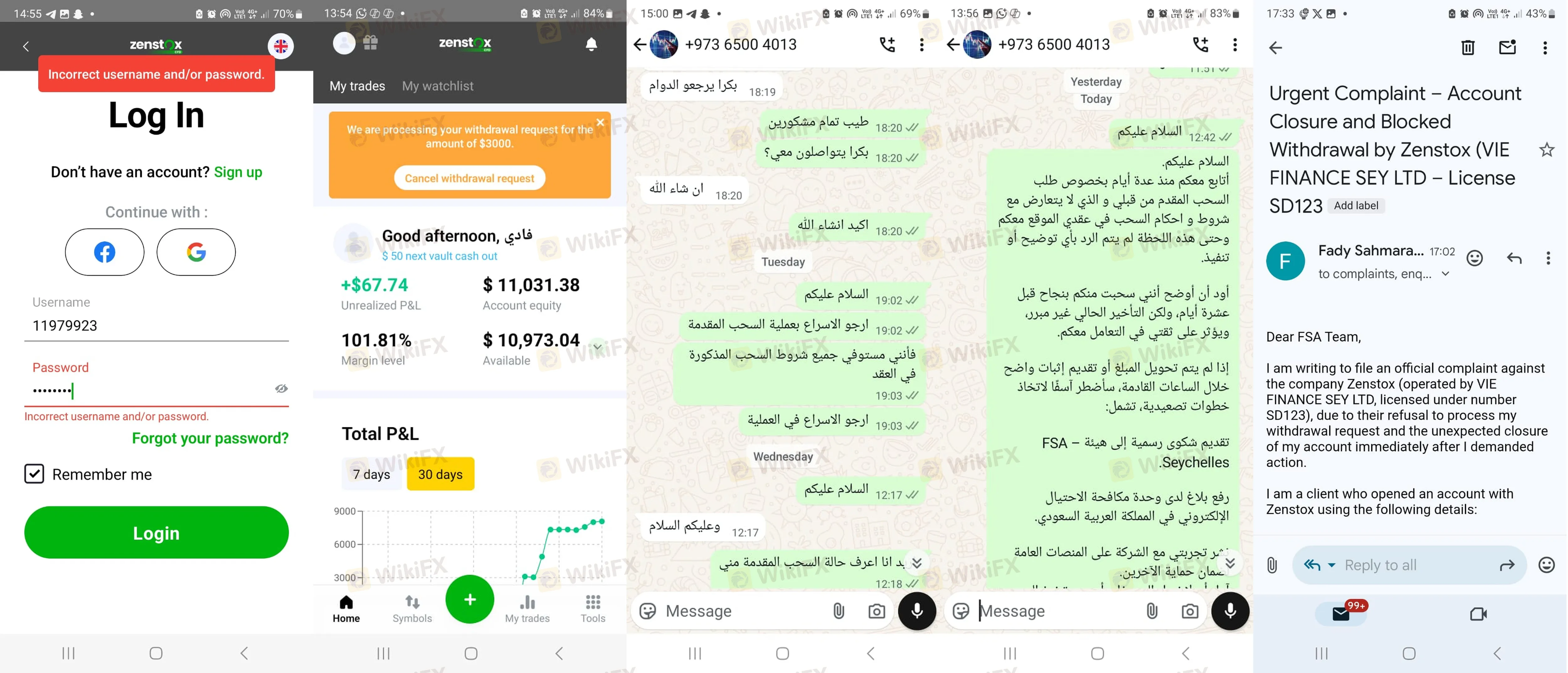

The investigative trail leads to a brutal “boiler room” tactic. Traders report being wooed by account managers like “Sarai Chavez” or “Mr. Chaker,” who initially act as helpful guides. Once you make that first $200 deposit, the script changes. They use high-pressure psychological tactics—shouting, insulting, and even moral blackmail—to force more deposits.

In Mexico, one client was convinced to take out personal loans to “leverage” their account with a promised 300% return. Instead of returns, they received a total wipeout. Another victim in Egypt documented audio and video evidence of account managers blackmailing them into signing documents under duress just to apply for a withdrawal that never arrived.

The Login Trap and the Terminal Freeze

The zenstox login screen eventually becomes a gateway to nowhere. Multiple users report that once they became “too insistent” on withdrawing their funds, their access was suddenly revoked.

One trader from Saudi Arabia found their login blocked with “Incorrect username/password” errors immediately after demanding action on a ignored withdrawal. No notification, no refund, just a digital ghosting. This isn't a system error; it is a calculated liquidation of the client's presence on the platform.

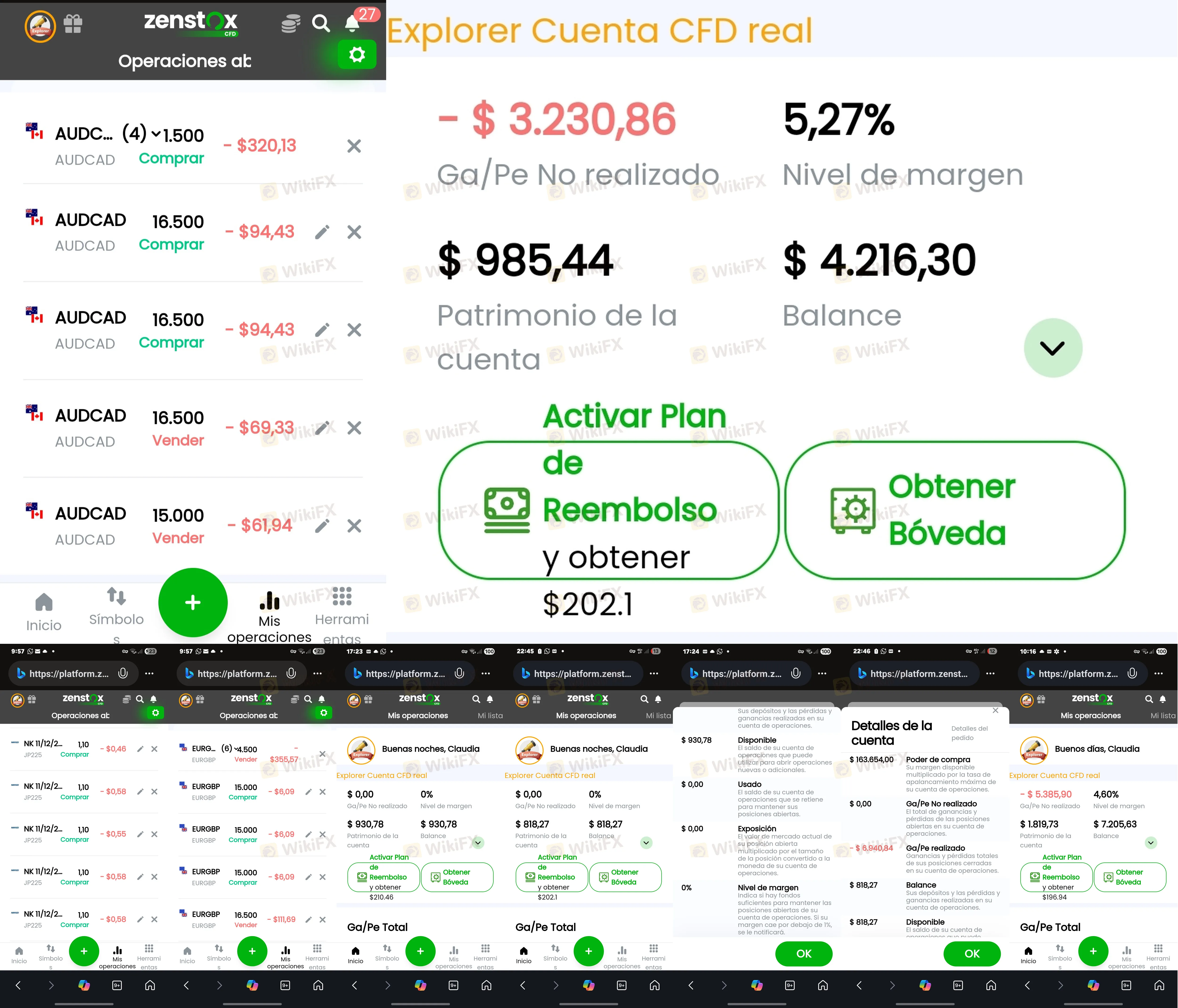

Forex Carnage: Total Balance Manipulation

Within the Forex markets they claim to provide access to, Zenstox appears to be playing with rigged dice. Clients report “manipulated account balances” and “fabricated profits.” The platform shows you the numbers you want to see—tens of thousands in gains—as a bait to solicit the “VIP fees” or “withdrawal taxes” that never end.

One victim transferred $23,000 in less than 20 days. When they closed their trades in profit, the broker simply rejected the request and shuttered the account. This is the Forex equivalent of a carnival game where the pins are glued to the table.

Verdict: A Predatory Ghost

A review of this scale usually finds at least one redeeming quality. Here, there are none. The customer service, while supporting English and Portuguese, is noted for its “long wait times”—likely because they are too busy soliciting new deposits from the next batch of victims.

If you have money inside Zenstox, the data suggests you have already lost it. If you are looking at their broker platform as a potential investment vehicle, turn around. The WikiFX score of 2.25 is a generous assessment for a firm that treats its clients like ATM machines.

Anonymity & Risk Warning: Trading with offshore brokers like Zenstox carries extreme risk. There is no compensation fund, no ombudsman, and no way to claw back funds once they hit a Seychelles bank account. Prioritize safety over promised “VIP” returns.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Winter Storm Fern To Lower Q1 GDP By 0.5% To 1.5%

Central Bank Watch: Fed Policy in Gridlock as Inflation Fighters Clash with Growth Doves

Belgian Investors Lost €23M to Scams in 2025 Surge

Transatlantic Fracture: European Capital Flight Emerges as Key Risk to Wall Street

Japanese Premier Vows Action on Speculative Yen Moves Amid Policy Jitters

Gold Elephant Review: Safety, Regulation & Forex Trading Details

Weltrade Review 2025: Is This Forex Broker Safe?

ONE ROYAL Review 2026: Is this Forex Broker Legit or a Scam?

Intervention Watch: NY Fed 'Rate Check' Signals US-Japan Alliance Against Yen Weakness

Dollar Under Siege: Fiscal Gridlock and Foreign Divestment Weigh on Greenback

Currency Calculator