Doctor loses RM285k in phone scam

The victim, who works at a hospital in Pahang, received phone calls from several individuals on December 31.

简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Abstract:A Kuching woman lost RM91,000 after being lured into a fake investment scheme advertised on Telegram, where scammers promised high returns but disappeared after receiving multiple bank transfers. Police are investigating the case under Section 420 for cheating and have warned the public to stay alert to online investment scams.

A 35-year-old woman in Kuching has lost RM91,000 after being duped by a fake investment scheme promoted through the Telegram messaging app.

According to Kuching police chief ACP Alexson Naga Chabu, the victim lodged a police report on Jan 11 after realising she had been cheated. She was first approached by an unknown individual on Telegram who introduced what appeared to be a high-return investment opportunity. Enticed by the promise of quick and lucrative profits, she agreed to participate.

Following the instructions given, the woman transferred money in stages to several bank accounts provided by the scammer. In total, she made five separate transactions to five different accounts, amounting to RM91,000. At the time, she believed the transfers were part of the investment process.

Her suspicions were raised when she later tried to withdraw her capital and the promised returns but was unable to do so. Repeated attempts to contact the individual failed, and she eventually realised the investment scheme did not exist.

Police have classified the case under Section 420 of the Penal Code for cheating, and investigations are ongoing. Authorities continue to remind the public to be cautious of investment offers circulating on social media and messaging platforms, especially those promising unusually high returns.

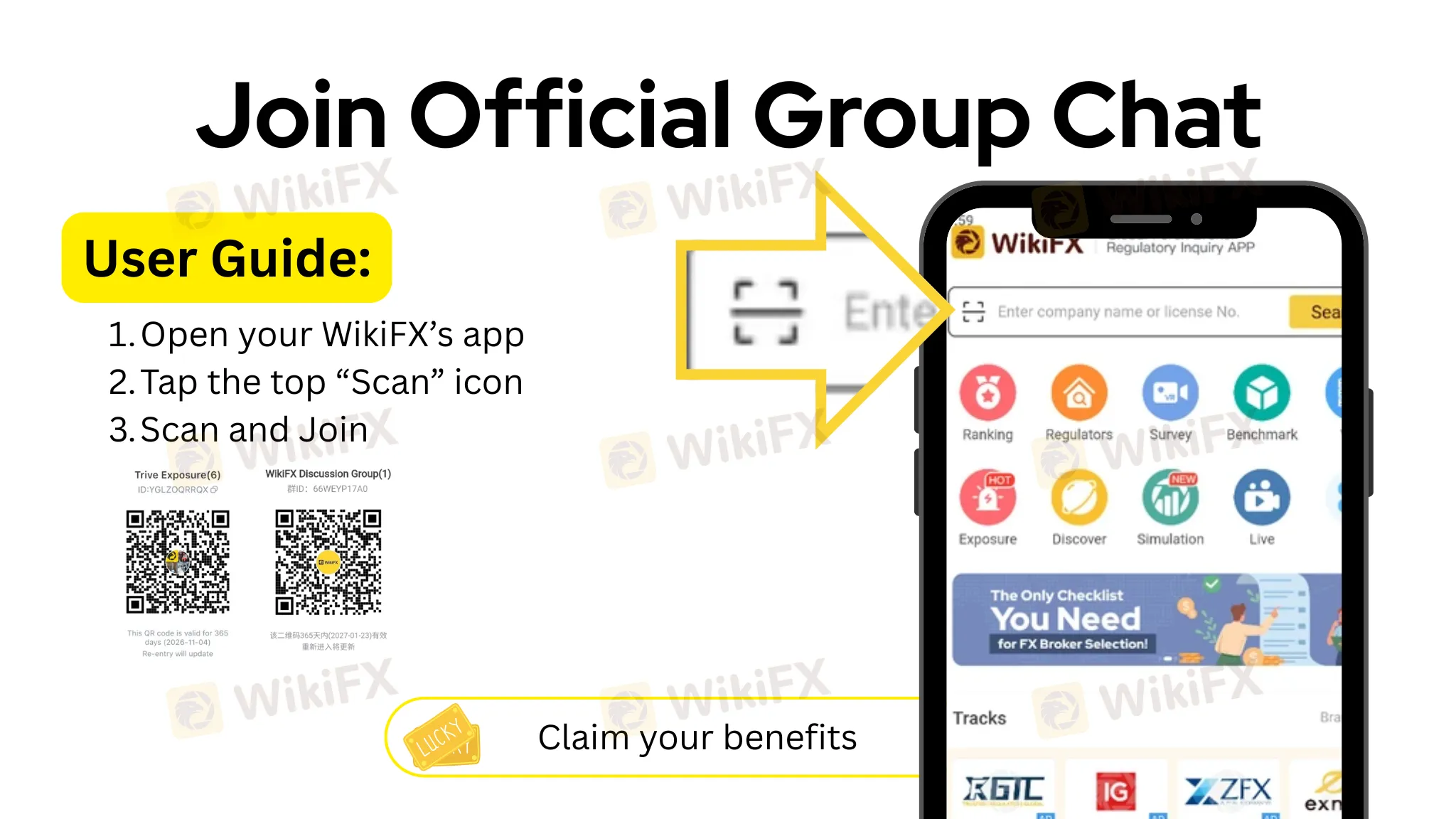

To reduce the risk of falling victim to such scams, investors are encouraged to verify the legitimacy of brokers and platforms before committing any funds. WikiFX provides tools that allow users to check regulatory status, broker backgrounds, risk ratings and user feedback, helping investors identify red flags early and protect their savings from fraudulent schemes.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

The victim, who works at a hospital in Pahang, received phone calls from several individuals on December 31.

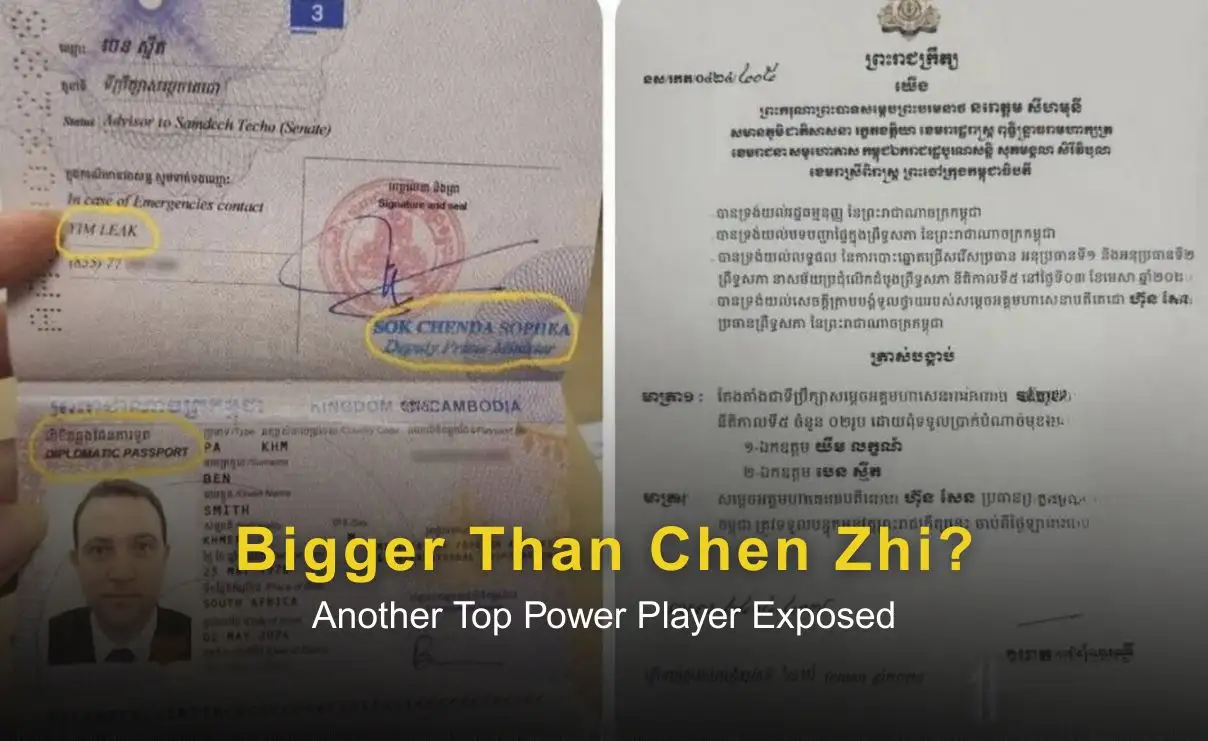

Amid ongoing scrutiny over Chen Zhi’s Cambodian citizenship, a separate case involving alleged money-laundering figure Benjamin Moberg has raised fresh concerns. Reports that Moberg held a Cambodian diplomatic passport and advisory role despite links to criminal investigations have prompted questions about possible high-level protection and systemic misuse of citizenship and diplomatic status. Analysts warn the case may reflect deeper governance and enforcement challenges rather than isolated incidents.

Belgian consumers lost over €23M to crypto and WhatsApp investment scams in late 2025, financial regulator warns amid rising fraud cases.

Growing warnings surround HTFX after losing its European licenses and being flagged by WikiFX as a Ponzi-style platform, with repeated reports of withdrawal problems.