简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Trive Review: Is This Regulated Broker Safe for Your Funds?

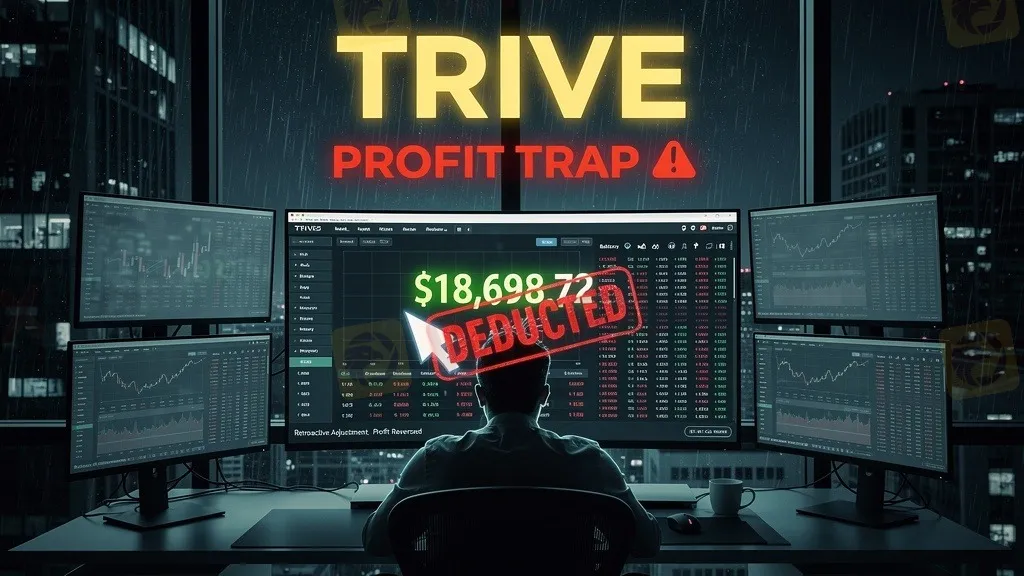

Abstract:Our investigation reveals a critical pattern where Trive broker systematically voids profits under vague 'abuse' clauses, with one user reporting over $18,000 confiscated. Despite holding multiple licenses, the simultaneous surge in withdrawal denials poses an immediate threat to capital.

Imagine turning a losing trading streak into a significant victory, only to wake up and find your account balance wiped clean by the very platform supposed to protect it. For traders using Trive, this nightmare is becoming a documented reality.

Our investigation into Trive broker activities reveals a disturbing disconnect between its regulatory status and its treatment of profitable clients. While the platform boasts valid licenses, a flood of user reports exposes a pattern of retroactive profit cancellations and unauthorized fund deductions.

exposure: The $18,000 “Abuse” Trap

The most visceral example of this injustice comes from a user named Wu Siyu. According to complaints filed in late 2024, Wu initially suffered losses but continued to deposit funds to maintain margin. When the market turned and the account finally became profitable, Wu attempted to withdraw.

Instead of processing the payout, Trive broker allegedly froze the request. Following a standoff, the platform deducted $18,698.72 directly from the account, citing “unreasonable behavior” or abuse of trading conditions without providing concrete evidence. This is not an isolated incident.

Another case involves user Xie Huaying, who reported a similar trajectory. After a month of trading, a profit of $5,951.26 was summarily deducted. The platforms justification often hinges on vague “hedging” or “swap abuse” claims, yet users report that losing accounts engaged in the exact same strategies are left untouched. This suggests a Forex environment where you are allowed to lose, but penalized if you win.

Trive Regulation and License Reality Check

Traders often assume that “Regulated” means “Safe.” However, our deep dive into Trive regulation records shows a complex picture. While they are regulated in top-tier jurisdictions like Australia and Malta, they also hold “Unverified” statuses in other regions, creating a patchwork of accountability that may leave global clients exposed.

Regulatory Reality Audit

| Regulator | License Type | REAL STATUS |

|---|---|---|

| Australia ASIC | MM (Market Making) | Regulated |

| Malta MFSA | MM (Market Making) | Regulated |

| South Africa FSCA | Financial Service | Regulated |

| Virgin Islands FSC | Retail Forex | Offshore Regulated |

| UK FCA | EEA Authorized | Unverified |

| Indonesia BAPPEBTI | Retail Forex | Unverified |

The danger lies in which specific entity you are onboarded to. If you are a global client falling under the BVI (Virgin Islands) entity, your protections are significantly lower than those under ASIC. The “Unverified” status with the UK FCA is a severe anomaly that demands immediate caution for UK-based or European traders expecting top-tier protection.

Reviewing the “Profit Tax”: Why Withdrawals Fail

Our analysis of Trive review data indicates a systemic issue with how the broker handles successful accounts. The complaints outline a specific modus operandi:

1. The Bait: Traders are welcomed, sometimes with interest-free (swap-free) account options.

2. The Switch: If the trader loses money, the trade is deemed valid.

3. The Trap: If the trader profits, the risk management department flags the account for “abuse” of the interest-free policy or trading style.

4. The Execution: Profits (e.g., $11,318 in Case 10) are deducted, while the initial deposit might be returned to avoid total theft accusations.

This behavior creates a “No-Win” Forex ecosystem. In one shocking report from September 2024, a user claimed their entire balance of $2,155, plus agent fees, was transferred out with zero notice.

Key Red Flags Detected

- Selective Enforcement: Validating losing trades while voiding winning trades under the same strategy.

- High-Value Deductions: Confirmed reports of five-figure sums ($18,698, $11,318) being removed from user accounts.

- Opaque Communication: Users report being told their trading was “abusive” without receiving specific timestamps or violation details.

- Regulatory Gaps: Operating with “Unverified” status in strict jurisdictions like the UK.

Final Verdict

Is Trive broker a safe operational hub for your investments? The evidence suggests a high risk for profitable traders. While the platform maintains regulatory licenses, the aggressive removal of client profits under vague terms undermines the very trust those licenses are meant to inspire.

If you are currently trading with Trive, we strongly advise documenting all trade history immediately. For those looking to open a new account, the volume of substantiated profit-cancellation complaints makes this Trive review a severe warning: your capital may be safe only as long as you are losing it.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

FINRA Fines Cetera $1.1 Million Over Compliance Lapses

Upway (JRJR) Review: A Deep Dive into Safety and Regulation

Coinbase Banks Push Advances Crypto Rules

RM668K Gone Overnight: Factory Supervisor Trapped in Fake Investment Scam

Dollar Softens as Fed Signals Shifts; Warsh Leads Nomination Race

Safe-Haven Supercycle: Gold Hits $4,690 as Silver Squeeze Intensifies

Trans-Atlantic Rupture: Markets Brace for Trade War as Trump Issues Greenland Ultimatum

China Delivers 5% Growth Target, Yet December Data Reveals Deepening Consumption and Property Cracks

Italy’s Consob Blocks Five Unauthorized Investment Websites in New Enforcement Action

Currency Calculator