简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

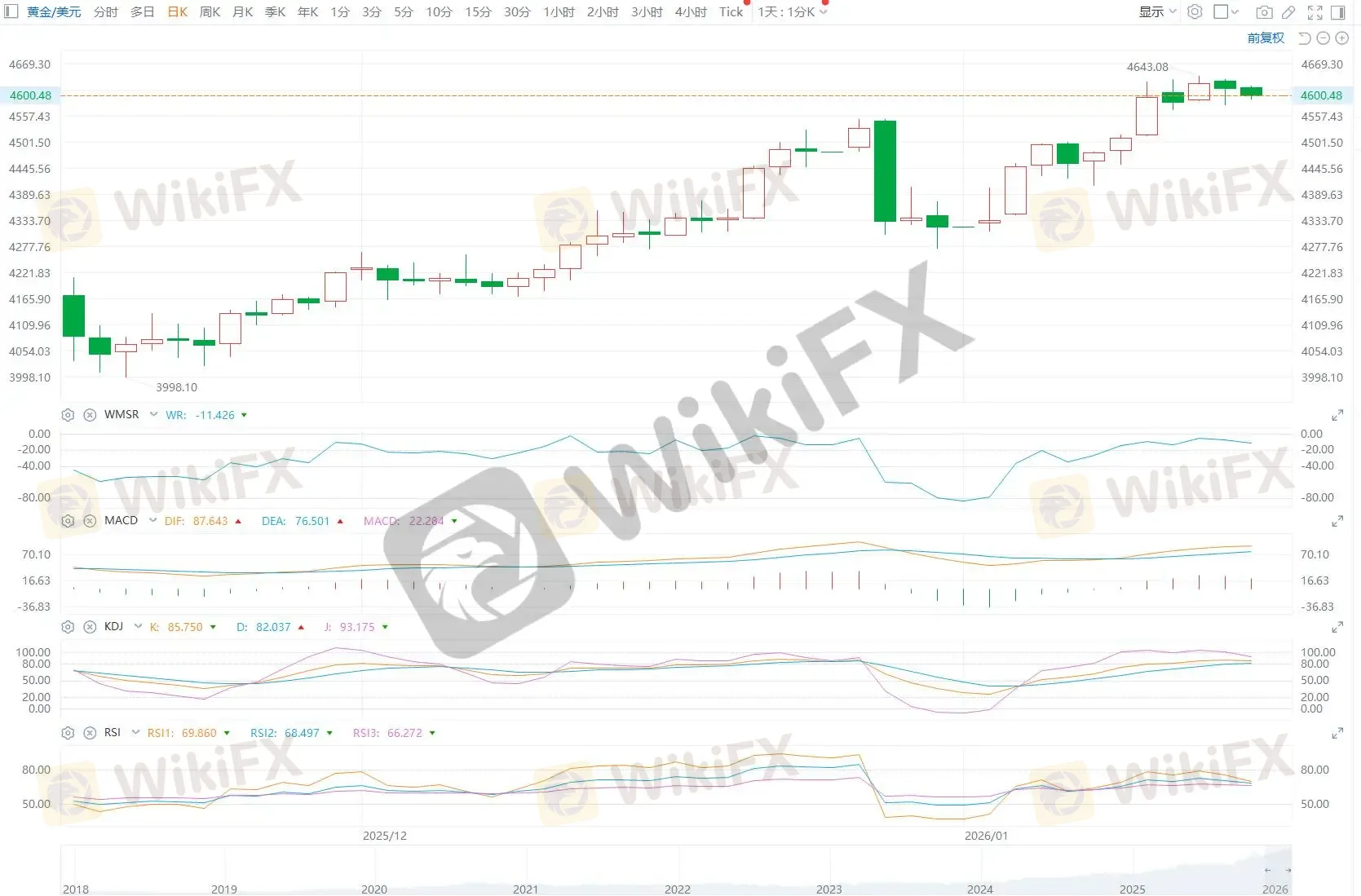

ETO Markets Global Pulse: Gold Dips 0.2%, Holds $4,600

Abstract:Market Review According to ETO Markets monitoring, on January 15 (Thursday), spot gold pulled back after printing a fresh record in the prior session. Gold closed at USD 4,615.73 per ounce, down about

Market Review

According to ETO Markets monitoring, on January 15 (Thursday), spot gold pulled back after printing a fresh record in the prior session. Gold closed at USD 4,615.73 per ounce, down about 0.2%, as a firmer U.S. dollar and profit-taking weighed on prices.

During the Asian session on January 16 (Friday), spot gold stayed rangebound at elevated levels and is trading near USD 4,613.90 per ounce. Strong U.S. labor signals capped upside momentum, while geopolitical risks kept a floor under sentiment.

Global Headlines

1) Jobless Claims Beat Expectations

The U.S. Department of Labor reported initial jobless claims fell by 9,000 to a seasonally adjusted 198,000, beating expectations of 215,000. The data lifted the U.S. dollar index to an intraday high of 99.49, a six-week peak, before it settled around 99.35. A stronger dollar raised the cost of USD-priced assets and pressured gold in the short term.

2) IMF Defends FED Independence

IMF Managing Director Kristalina Georgieva stressed the importance of central bank independence and voiced support for FED Chair Jerome Powell amid political scrutiny. She said data-driven decisions help maintain economic stability. Trump said he has no immediate plan to remove Powell, but argued the president should have a stronger say in monetary policy, keeping independence concerns in play.

3) FED Messaging Remains Split

Richmond FED President Barkin said the DOJ investigation amounts to an attack on FED independence. He noted inflation remains elevated, while the labor market is stabilizing. Barkin added that the policy outlook is still unclear and requires more data confirmation.

4) U.S. Reinforces Middle East Posture

As U.S.-Iran tensions rose, the U.S. moved additional forces to the Middle East, including an aircraft carrier, and strengthened missile defense deployments. The U.S. military said the moves expand the president‘s options should action against Iran be considered, supporting gold’s medium-term risk premium.

5) U.S. Expands Iran Sanctions

The U.S. Treasury announced new sanctions on Iranian individuals, entities, and related foreign firms tied to oil and petrochemical exports. Irans top security official Ali Larijani was also named. The measures added to regional tension.

6) Russia Warns On Foreign Troops

Russias foreign ministry spokesperson Maria Zakharova said any foreign military forces stationed in Ukraine would be treated as legitimate targets. She accused Western military and financial support of undermining the peace process, raising spillover risk.

ETO Markets Analyst View (Spot Gold)

From an intraday structure perspective, gold has shifted into a high-level pullback after the recent rapid rally. Prices are still holding around the USD 4,600 zone, so the broader uptrend has not been broken.

The market is now rebalancing, and the battle around USD 4,600 will likely decide whether gold consolidates or attempts another push higher. If prices regain traction above USD 4,600, upside room remains toward USD 4,640 and USD 4,660. If USD 4,600 fails, the retracement could accelerate.

RSI signals remain mixed. Momentum has cooled, but there is no clear bearish divergence yet. Macro forces are pulling in both directions. Strong labor data and a stronger dollar are near-term headwinds, while geopolitics and policy uncertainty remain structural support.

With data and headlines crossing frequently, gold is more likely to digest volatility through range trading. Stay attentive to evolving market dynamics.

Disclaimer

The information contained herein is for general reference only and does not constitute investment advice, a solicitation, or an offer to buy or sell any financial products.

ETO Markets does not guarantee the accuracy, completeness, or timeliness of the information and shall not be liable for any losses incurred from reliance on such content.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Understanding Dbinvesting Deposit and Withdrawal: What Traders Should Know

TradeEU Global Review 2026: Is this Forex Broker Legit or a Scam?

Emerging Markets: South African Fiscal Strains in Focus Amid Calls for SOE Reform

China Economic Watch: PMI Divergence and "Two Sessions" Signal Structural Shift

Is Tradier a trustworthy broker? A Tradier review and licensing overview based on WikiFX data.

Oil Spikes 9% and Shipping Rates Soar as Middle East Logistics Fracture

AssetsFX Review 2026: Is this Broker Safe?

Fed Beige Book: Stagflation Risks Rise as Growth Stalls While Prices Stick

Asia Market Volatility: KOSPI Stages Historic 12% Rebound as Capital Flows Pivot

Evest Broker Review: Regulated, but Complaints Persist

Currency Calculator