简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

TopWealth Trading Review: A Complete Look at Its Strengths, Weaknesses, and Warning Signs

Abstract:This review will break down the main problem at the center of this broker. While it offers good trading conditions and has received some positive feedback from users, we have found major warning signs about its regulation, openness, and how it operates. The goal of this analysis is to present the available information clearly and fairly, helping you make a smart decision that puts your financial safety first. Before putting money with any broker, doing a complete background check is absolutely necessary. We strongly recommend that traders use independent checking platforms to verify any broker's claims.

Finding a trustworthy broker in today's busy market is a tough challenge for any everyday trader. Our goal today is to answer an important question: “Is TopWealth Trading a reliable broker?” This article gives you a careful, fact-based review to answer that question. TopWealth Trading says it is a forex and CFD broker with many features that seem attractive. However, our detailed analysis shows a complicated and worrying picture.

This review will break down the main problem at the center of this broker. While it offers good trading conditions and has received some positive feedback from users, we have found major warning signs about its regulation, openness, and how it operates. The goal of this analysis is to present the available information clearly and fairly, helping you make a smart decision that puts your financial safety first. Before putting money with any broker, doing a complete background check is absolutely necessary. We strongly recommend that traders use independent checking platforms to verify any broker's claims.

Key Facts and Figures

To give you a quick but complete overview, we have gathered the most important information about TopWealth Trading in an easy-to-read format. This factual foundation is essential for understanding the detailed analysis that follows.

| Feature | Details |

| Overall Score | 6.83/10 (Better than 68.30% of brokers) |

| Regulation | Two Regulations: ASIC (Australia - STP License) & VFSC (Vanuatu - Offshore) |

| Years in Operation | 2-5 years |

| Trading Platforms | Conflicting Information: Full MT4 License listed, but other data suggests a 'Mobile app' only. This important difference is a major concern. |

| Minimum Deposit | $50 |

| Maximum Leverage | 1:500 |

| Tradable Assets | Forex, Metals, Cryptocurrencies, Energies, Stocks, Indices, Bonds |

| Company Address | Port Vila, Vanuatu |

Looking at Regulation and Trust

The single most important factor when checking a broker is its regulatory standing and trustworthiness. This section provides a detailed investigation into TopWealth Trading's licenses and other important signals that directly affect trader safety. Our findings here are the most important part of this entire review.

The Two-License Problem

TopWealth Trading claims to hold two licenses, which needs careful examination. An ASIC (Australian Securities and Investments Commission) STP license is a top-level credential. ASIC is one of the world's most respected regulators, known for setting high standards, requiring client fund separation, and offering strong investor protection. This license gives a broker a powerful appearance of legitimacy.

In sharp contrast, a VFSC (Vanuatu Financial Services Commission) license represents offshore regulation. Regulators in offshore areas like Vanuatu are known for their much lower oversight, weaker enforcement abilities, and minimal to no protection for traders' funds. If there is a dispute or broker failure, help for clients under a VFSC-regulated company is extremely limited.

This brings us to the important point. While the ASIC license provides a surface of respectability, the broker's registered physical address and contact phone number are located in Port Vila, Vanuatu. This raises an important question: are clients actually signed up under the secure Australian company or the high-risk Vanuatu one? It is a common and misleading industry practice for brokers to heavily promote their strongest license while directing international clients to their offshore company. This move effectively removes the protections that traders think they have, exposing them to huge risk without their full knowledge. The physical presence in Vanuatu strongly suggests that client accounts and funds are likely held under the much weaker VFSC jurisdiction.

A Major Clone Firm Warning Sign

Our investigation found an extremely serious warning sign. Data checks show that TopWealth Trading is connected with suspected clone firms, specifically `Sky Alliance Markets` and `NiuNiu Securities`. A “clone firm” is a fake company created by scammers. They illegally use the name, registration details, and address of a legitimate or semi-legitimate company to convince people that they are real. The goal is to trick traders into putting in funds, which are then stolen.

The connection with known clone firms is one of the most serious warning signs a broker can have. It raises serious questions about the broker's system, its security measures, and potentially its own integrity. It suggests that the broker's details are being used by criminals, or worse, that the broker may be involved in or part of a larger fake network. For any trader, this finding alone should be a reason for extreme caution.

Your First Line of Defense

Given the serious concerns about regulatory confusion and the alarming connection with clone firms, relying on the broker's own claims is not enough and dangerous. It is essential for every potential trader to independently verify TopWealth Trading's complete regulatory status and any active warnings on a trusted third-party platform. We urge you to use a complete verification tool like WikiFX to cross-check licenses, look for alerts, and read unfiltered user reviews before proceeding with any broker. This step is your first and most important line of defense against potential scams and financial loss.

A Look at Trading Conditions

Beyond regulation, the practical aspects of trading—such as account types, platforms, and available assets—determine if a broker fits a trader's strategy. Here, we present the facts about TopWealth Trading's offerings, while also highlighting a significant contradiction we discovered.

Account Types Breakdown

TopWealth Trading offers three different account levels, all of which are accessible with a low minimum deposit. This structure appears to serve a wide range of traders, from beginners to experts.

| Account Type | Minimum Deposit | Spread Structure | Commission |

| Standard | $50 | Standard Spread | $0 |

| Pro | $50 | Low Spread Markup | Low Commission |

| ECN | $50 | Raw Spread | To Be Determined |

It is worth noting that a $50 minimum deposit for a true ECN (Electronic Communication Network) account is very unusual. ECN accounts, which offer direct market access and raw spreads, typically require a much larger capital commitment. This unusually low entry point could suggest that the account is not a genuine ECN feed, and traders should be careful about the quality of execution and the true cost of trading.

The Platform Problem

Our analysis found a confusing and deeply concerning contradiction about the broker's main trading platform. This difference is a key finding that signals a serious lack of transparency.

On one hand, our data clearly shows that TopWealth Trading holds a Full License for MetaTrader 4 (MT4). We identified two active servers under the name “TopwealthBullion-Live” and “TopwealthBullion-Demo,” which confirms the existence of an MT4 infrastructure. MT4 is the industry-standard platform, valued by traders for its reliability, advanced charting tools, and support for automated trading (Expert Advisors).

However, other official summaries and data points provided for the broker clearly state that MT4 and MT5 are not supported. Instead, this information claims that the only available platform is a proprietary “Mobile app.” This is a clear contradiction. It could be a case of outdated information, but more worryingly, it could be a bait-and-switch tactic, where the broker advertises the reputable MT4 platform to attract clients but then directs them into a proprietary app where trade execution and conditions are not transparent. This lack of clarity on such a basic component of a brokerage service is unprofessional and a major warning sign.

Instruments and Leverage

TopWealth Trading offers a broad selection of tradable instruments, which is an attractive feature for traders looking to diversify their portfolios across different markets.

• Forex: Major, Minor, and Exotic currency pairs.

• Metals: CFDs on precious metals like Gold and Silver.

• Indices: CFDs on major global stock market indices.

• Energies: CFDs on energy commodities like Oil and Natural Gas.

• Stocks: CFDs on a variety of individual company shares.

• Cryptocurrencies: CFDs on popular digital currencies.

• Bonds: CFDs on government bonds.

The broker provides a maximum leverage of 1:500. While high leverage can significantly increase potential gains, it is a double-edged sword. It equally and dramatically increases the risk of rapid and large losses, often exceeding the initial deposit. High leverage is not recommended for inexperienced traders, and even seasoned traders should use it with extreme caution and strong risk management strategies.

User and Service Experience

To provide a balanced perspective, we have combined real-world user feedback and examined the broker's customer support infrastructure. This offers insights into the day-to-day operational reality of trading with TopWealth Trading.

Positive Feedback Highlights

Several users have reported positive experiences, with repeating themes emerging from their reviews. These comments suggest that, for some, the operational aspects of the brokerage have been satisfactory.

• Users have noted prompt and responsive customer service.

• Multiple reviews highlight smooth and fast withdrawal processing, with some claiming funds arrived on the same day of the request.

• Feedback includes mentions of stable spreads and smooth transaction execution without significant issues.

• One user specifically mentioned that a “new management” team proactively reached out to resolve a problem to their satisfaction.

Neutral and Critical Feedback

Alongside the positive comments, other users have raised points of concern or provided a more neutral assessment of their experience. These reviews paint a more mixed picture of the broker's performance.

• A common neutral point is that spreads can sometimes be higher than expected, affecting trading costs.

• While some praise customer service, others note that replies can be slow, particularly during busy market hours.

• One user described the withdrawal processing speed as merely “average,” which contrasts with the more enthusiastic reviews.

• A complete neutral review from 2025 states that while the platform is “generally ok,” there is still “room for improvement.”

Available Contact Channels

For the sake of completeness, we have listed the contact methods publicly provided by TopWealth Trading. The geographic details of this information align with the broker's offshore registration.

• Email: info@topwealthtrading.com

• Phone: +678 24404 (This is a Vanuatu country code)

• Address: P.O. Box 1498 Port Vila, Efate, Republic of Vanuatu

TopWealth Trading Pros and Cons Verdict

To help you weigh the good against the bad, we have combined our entire analysis into a clear, side-by-side summary. This reinforces the most important takeaways from our investigation.

The Apparent Advantages

• Wide Range of Trading Products: The broker offers a diverse selection of instruments across seven major asset classes, including Forex, Metals, Indices, Energies, Stocks, Cryptos, and Bonds.

• Accessible Account Levels: Three different account types (Standard, Pro, ECN) are all available with a low $100 minimum deposit, making it accessible to traders with smaller capital.

• High Leverage Available: A maximum leverage of up to 1:500 is offered, which may appeal to experienced traders using high-risk strategies.

• Positive User Feedback: A portion of users have reported positive experiences, specifically citing fast withdrawal speeds and helpful customer service.

The Significant Risks

• Major Regulatory Concerns: The primary reliance on a weak offshore (VFSC) license is a critical risk. This offers minimal to no protection for trader funds in case of disputes or failure.

• Severe Trust Issues: The documented connection with suspected clone firms is an extremely serious warning sign that raises fundamental questions about the broker's integrity and security.

• Lack of Transparency: There is clearly contradictory information about its core trading platform, with claims of both a Full MT4 License and a mobile-app-only offering.

• Regional Restrictions: The service is not available to traders in key, well-regulated markets, including the United States, United Kingdom, Australia, and Singapore.

• Offshore Base: The company's physical address and contact number are based in Vanuatu, aligning its operations with the weaker regulatory body, not the reputable ASIC license it promotes.

Our Final Recommendation

Our complete review of TopWealth Trading shows a broker with a deep and troubling conflict. On the surface, it presents an appealing appearance with its wide product range, accessible accounts, and some positive user reviews.

However, these potential pros are completely overshadowed by severe and undeniable warning signs. The reliance on a weak offshore license in Vanuatu, the alarming connection with suspected clone firms, and the confusing lack of clarity on its fundamental trading platform are issues that cannot be ignored. In the world of trading, the security of your funds and the protection provided by strong regulation should always be the number one priority.

Due to the significant risks and lack of transparency identified in this review, we cannot recommend TopWealth Trading as a safe or reliable choice for traders. The potential for financial loss due to inadequate regulation and questionable business practices is too great to ignore. We strongly urge every trader to prioritize brokers with top-level regulation from respected authorities and a long, proven history of transparency. Before ever depositing funds, perform your own complete due diligence on an independent platform like WikiFX to ensure a broker is legitimate, trustworthy, and worthy of your capital.

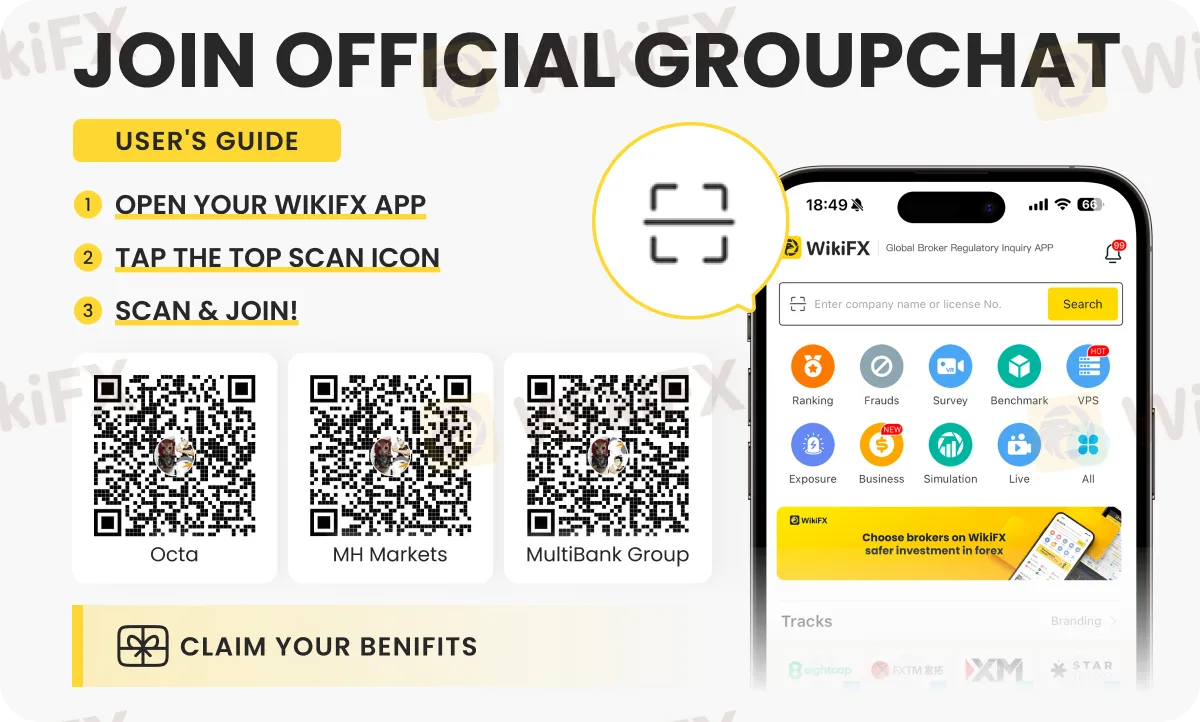

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Admiral Markets Review: Regulation, Licences and WikiScore Analysis

1,789 Victims, Nearly $300 Million Lost: Gold High-Return Scam Exposed

UPFOREX Regulatory Status: A 2026 Deep Dive into Its Licenses and Risks

HKEX Profit Surge Signals Massive Chinese Capital Inflow and Asian Market Resilience

The micro-documentary "Let Trust Be Seen" is officially launched today!

Understanding FX SmartBull Withdrawal & Deposit: Essential Information Before You Start Trading

ProMarkets Review: Total Forex Scam Alert

Clone Broker Alert: Darwinex, AIM & Spreadex Targeted

Understanding UPFOREX Money Transfers: Important Facts You Need to Know

TradingMoon Review: Offshore Regulated Fraud Risk Exposed

Currency Calculator