简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Oron Limited Safety Review: A Complete Risk Analysis for Traders

Abstract:Checking if a broker is trustworthy is the most important thing a trader can do before putting their money at risk. When looking at Oron Limited, the main question is whether it's safe and legitimate. After carefully reviewing all available information, the answer is clear: Oron Limited operates without proper financial regulation, which immediately puts it in the high-risk category for all traders. Without oversight from a respected financial authority, traders lose the basic protections they depend on, creating serious risks that cannot be ignored. This complete Oron Limited risk analysis gives you a clear, fact-based review. We will examine the broker's operations step by step to provide the information you need to make a smart financial decision. This 2025 review will look at:

Checking if a broker is trustworthy is the most important thing a trader can do before putting their money at risk. When looking at Oron Limited, the main question is whether it's safe and legitimate. After carefully reviewing all available information, the answer is clear: Oron Limited operates without proper financial regulation, which immediately puts it in the high-risk category for all traders. Without oversight from a respected financial authority, traders lose the basic protections they depend on, creating serious risks that cannot be ignored.

This complete Oron Limited risk analysis gives you a clear, fact-based review. We will examine the broker's operations step by step to provide the information you need to make a smart financial decision. This 2025 review will look at:

• Regulatory status and what it means for your money.

• Warning signs in operations, including company background and website problems.

• A breakdown of account types, leverage, fees, and trading conditions.

• An analysis of verified and unverified user experiences, including serious complaints.

Checking Regulatory Status

The most important factor in any broker's safety is its regulatory status. This isn't just a preference but a basic requirement for protecting trader funds and ensuring fair practices. For Oron Limited, this is a major area of concern.

The Main Warning Sign

Our analysis confirms that Oron Limited has no valid regulatory information. This is the most serious warning sign a trader can see. For you as a client, this means:

• No investor compensation fund to protect your money if the broker goes bankrupt.

• No independent dispute resolution system to help with conflicts over trades, withdrawals, or account problems.

• No government or official body watching over the broker's financial stability, ethical behavior, or business practices.

This lack of oversight shows up in extremely low ratings from independent review platforms, which include clear warnings like “High potential risk” and direct advice to “please stay away!” This isn't just an opinion but a conclusion based on the missing safety measures.

The Saint Lucia Registration

Oron Limited is registered in Saint Lucia, an offshore location. Traders need to understand the difference between being “registered” as a company and being “regulated” as a financial services provider. Company registration is a simple paperwork process, while financial regulation involves strict, ongoing monitoring of a broker's financial strength, client fund protection, and business practices.

Offshore registrations like the one in Saint Lucia don't provide the same level of protection as top-tier regulators. To understand this better, consider the standards set by authorities in major financial centers:

• Financial Conduct Authority (FCA) in the UK: Enforces strict client money rules and offers the Financial Services Compensation Scheme (FSCS).

• Australian Securities and Investments Commission (ASIC): Requires strict licensing conditions and capital requirements.

• Cyprus Securities and Exchange Commission (CySEC): Provides access to the EU market under MiFID II regulations and includes an Investor Compensation Fund.

Oron Limited's registration doesn't give traders any of these protections. The “Suspicious Regulatory License” label often associated with such companies further highlights the unclear and potentially risky legal status.

Related Companies

The data shows a related company, ORON LIMITED, established in 2023. However, this separate company doesn't give any regulatory status or protection to the main trading company, Oron Limited, which operates from Saint Lucia. Traders must understand that they are dealing with the Saint Lucia-based company, which, as we've established, is unregulated.

Looking at Operational Risks

Beyond regulation, a broker's operational stability and professionalism provide more clues about its reliability. In this area, Oron Limited shows several warning signs that add to the risks identified in its regulatory profile.

Company Background

Oron Limited has been operating for an estimated 2 years. Its registered physical address is Ground Floor, TheSotheby Building, Rodney Village, Rodney Bay, Gros-Islet Contact details include a phone number (+971 42956005) and an email address (info@orontrade.com). While these details exist, they must be viewed alongside the broker's other operational problems.

Unreachable Official Website

A critical and alarming finding is that the broker's official website, https://www.orontrade.com/, has been noted as “currently inaccessible normally.” For any online financial service, especially a brokerage, a working website isn't a luxury—it's absolutely necessary.

The problems with an unreachable website are serious:

• Loss of Access: Clients may not be able to log into their accounts, manage funds, or start withdrawals.

• Lack of Transparency: Access to important legal documents, such as terms and conditions, client agreements, and risk disclosures, is cut off.

• Sign of Problems: It can indicate serious technical failure, a stop in operations, or a deliberate move by the company to become unreachable.

This operational failure is a major warning sign. A legitimate broker maintains its digital systems perfectly, as it is the main way to interact with clients. An unreachable site destroys all trust and suggests serious operational problems.

Platform and Technology

Oron Limited offers trading on the MetaTrader 5 (MT5) platform. MT5 is a globally recognized and respected third-party platform known for its advanced charting tools, order execution options, and overall stability. The broker holds a “Full License” for MT5, which shows a certain level of financial and technical investment, as these licenses are expensive.

However, this positive point must be carefully considered. While a good trading platform is important for user experience, it does absolutely nothing to reduce the basic risks of dealing with an unregulated broker. The platform is just a tool; the security of your funds and the fairness of your trades depend on the integrity and regulatory standing of the broker using that tool. A powerful engine is worthless if the car has no brakes or safety features.

Looking at Trading Conditions

A broker's trading conditions—accounts, leverage, and costs—are often used as marketing tools to attract clients. While Oron Limited presents some appealing features on the surface, they must be weighed against the overall safety concerns.

Account Structure Details

Oron Limited offers different account types, seemingly designed for different levels of traders. The low entry point for the Micro account is a common tactic to attract beginners.

| Account Type | Minimum Deposit | Spreads (from) | Commission |

| Micro | $20 | 1.5 pips | None |

| Standard | $1,000 | 1.0 pips | None |

| Swap free | $2,000 | 1.5 pips | None |

The $20 minimum deposit for the Micro account is clearly attractive for new traders wanting to test the platform with minimal money. However, there is a big jump to the Standard ($1,000) and Swap free($2,000) accounts. This structure can pressure inexperienced traders who start small to deposit much more money to access better trading conditions, all while operating in an unregulated environment.

The Risk of High Leverage

The broker offers a maximum leverage of 1:500. High leverage is risky. It can increase potential profits from small price movements, but it equally and severely increases losses. A 1:500 leverage means that a trader's position is 500 times their margin. A small market movement against the position can lead to a quick and complete loss of all invested money.

Top-tier regulators in places like the UK, EU, and Australia have recognized this danger and have limited leverage for retail traders (often to 1:30). An unregulated broker offering 1:500 leverage isn't providing a professional tool; it is promoting an extremely high-risk environment, especially for the new traders it attracts with its low minimum deposit.

Spreads and Commissions

The cost of trading at Oron Limited varies. The spreads for the Micro account (from 1.5 pips) and the Standard account (from 1.0 pips) are not considered particularly competitive within the broader industry, where spreads on major pairs are often well below 1 pip for standard-type accounts.

The ECN account offers a raw spread from 0 pips, which is standard for this account type, but it comes with a commission of $7 per lot. This commission structure is on the higher end of the industry average.

Deposit and Withdrawal

Oron Limited provides many payment methods, which adds convenience.

| Method | Type | Minimum Amount | Fee |

| Wire Transfer | Deposit/Withdrawal | $20 | free |

| Credit Cards | Deposit/Withdrawal | $100 | free |

| e-Wallets | Deposit/Withdrawal | Varies | 1% |

| BinancePay | Deposit/Withdrawal | $20 | free |

| Bitcoin | Deposit/Withdrawal | Varies | free |

| Phone Pe | Deposit/Withdrawal | $20 | free |

*Disclaimer: This information is based on available data and may not reflect the current terms. Fees and processing times can change without notice.*

While the broker lists these options, traders should always verify the current terms and check for any new user-reported issues on platforms like WikiFX before putting in funds. The theoretical availability of withdrawal methods is meaningless if, in practice, they are not honored.

Looking at User Experiences

Theoretical risk analysis is important, but real-world user experiences provide valuable context. The feedback on Oron Limited is mixed, but it contains a deeply worrying complaint that aligns perfectly with the risks of using an unregulated broker.

The Most Serious Complaint

A “Verified” negative review from a user named Kuldip Zapadiya details the single greatest fear for any trader: the inability to access their funds. The user makes several critical claims:

> “not make trust on this broker, because this broker not give your money back and when u withdraw your money company complete block your account and than you have no longer any access of your account. And when you talk to customer support the only answer is we don't know about it you account is blocked by LP(liquidity provider) that's it no more answer.”

This complaint is a direct accusation of fund theft and a refusal to process a withdrawal, followed by blocking the client's account. The reported customer service response, which blames a “Liquidity Provider” without offering a solution, is a classic tactic used by dishonest operators to avoid responsibility. This single, verified claim of withdrawal failure is more significant than dozens of positive reviews.

Positive and Neutral Feedback

For a balanced view, it's important to acknowledge other feedback. Several “Unverified” positive reviews exist:

• One user praised the “competitive spreads and a low minimum deposit.”

• Another highlighted the low “$20 to open an account” and “smoothly on MetaTrader” performance.

There is also neutral feedback. One user noted that a change to the copy trading system made it more difficult for new clients to join, as the minimum required fund became too high compared to the master trader's fund.

*Disclaimer: Please note that user reviews, while insightful, represent individual experiences and may not be universally applicable. The positive reviews listed here are marked as 'Unverified' and should be evaluated with caution.*

Understanding the Feedback

The collection of reviews presents a telling picture. The positive comments focus on early-stage experiences: easy account opening, low initial deposit, and smooth platform performance. These are the “honeymoon” phase aspects of a broker relationship.

However, the most critical test of a broker's integrity is not the deposit process, but the withdrawal process. The verified, serious complaint about withdrawal failure and a blocked account directly targets this crucial moment. It suggests that while it may be easy to put money into Oron Limited, getting it out may be a different story. User reviews can change frequently. We encourage readers to review the latest user comments and exposure claims on the Oron Limited page on WikiFX to get the most current picture.

Final Decision on Safety

Looking at all the available data—regulatory, operational, financial, and experiential—allows us to form a final decision on Oron Limited safety. The conclusion is clear and points to an extremely high-risk environment.

Summary of Key Risks

This Oron Limited risk analysis has identified several critical, non-negotiable risk factors that any potential trader must consider.

• Regulatory Risk: There is no valid regulation from any respected financial authority. This means no investor protection, no oversight, and no help for traders. The company operates from an offshore location known for weak financial supervision.

• Operational Risk: The broker's official website is noted as being unreachable. This is a catastrophic failure for a digital financial services firm and a major warning sign for its operational stability and long-term viability.

• Financial Risk: The offering of 1:500 leverage is an indicator of a high-risk model that exposes traders, especially beginners, to the potential for quick and total loss of their money.

• User-Reported Risk: There is a serious, verified complaint from a user claiming a failure to process a withdrawal, followed by the blocking of their account. This is the most direct evidence of potential wrongdoing.

Weighing Pros and Cons

The few potential “pros”—a low $20 minimum deposit, a diverse range of assets, and the use of the MT5 platform—are surface-level conveniences. They address the ease of getting started but don't address the safety of your funds once they are deposited. These features are easily outweighed by the basic and serious risks associated with an unregulated broker that has an unreachable website and faces credible complaints of withholding client funds.

Our Final Recommendation

Based on the overwhelming evidence, trading with Oron Limited carries an extremely high level of risk. The lack of regulation is a deal-breaker for any trader who prioritizes keeping their money safe. The operational warning signs and the serious user complaint about withdrawals serve to confirm the dangers inherent in this lack of oversight.

We advise traders to be extremely careful. For those considering this broker, the risks appear to far outweigh any potential benefits. In the financial markets, safety is most important, and the first line of defense is always strong regulation. We recommend that traders, particularly those new to the markets, choose brokers who are authorized and regulated by top-tier financial authorities.

The financial markets are always changing, and a broker's status can evolve. For the most up-to-date regulatory information, user reviews, and operational status of Oron Limited, we strongly recommend checking its profile directly on WikiFX.

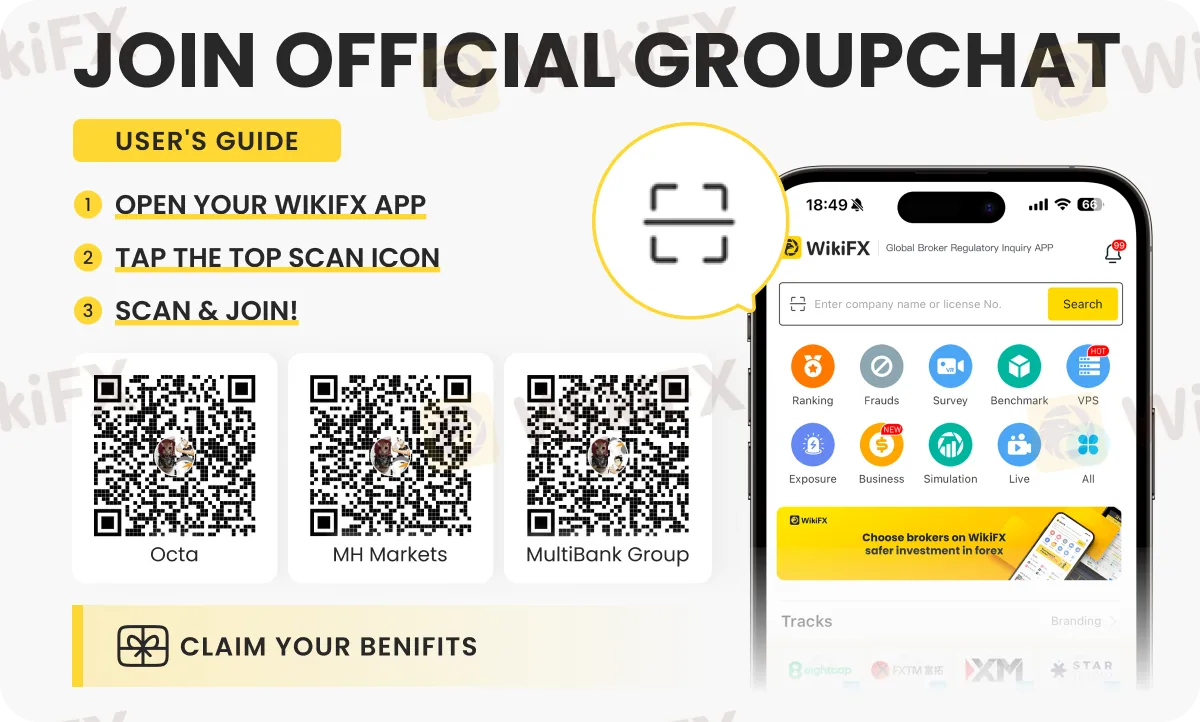

Join official Broker community! Now

You can join the group by scanning the QR code below.

Benefits of Joining This Group

1. Connect with passionate traders – Be part of a small, active community of like-minded investors.

2. Exclusive competitions and contests – Participate in fun trading challenges with exciting rewards.

3. Stay updated – Get the latest daily market news, broker updates, and insights shared within the group.

4. Learn and share – Exchange trading ideas, strategies, and experiences with fellow members.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

New AI laws to arrest deepfakes

Global Macro: Real Wage Growth Expected to Return by 2026

XAU/USD: Gold Rally Signals 'Paradigm Shift' as Middle East Tensions Simmer

MONAXA Review 2026: Comprehensive Safety Assessment

BoC Preview: Macklem to Hold at 2.25% Amidst Trade Anxiety

Fed Holds Rates as Political Storm Intensifies; Trump to Name New Chair Imminently

Meta and Samsung Fuel AI Capex Boom, Keeping Risk Sentiment Alive

Gold Smashes $5,600 Record on Shutdown Fears; Analysts Flash Crash Warning for Silver

FxPro Enhances MetaTrader 5 Execution with New LD4 Cross-Connect

Fed Holds Rates Amidst Political Siege; Dollar Sinks to Four-Year Lows

Currency Calculator