Abstract:While many brokers boast about their awards and regulatory licenses, the reality facing traders on the ground can offer a much darker picture. ThinkMarkets currently holds an "A" influence rank and displays a high score of 7.90 on WikiFX, yet our records recognize a disturbing surge in trader distress signals. In just the last three months, WikiFX has received 75 complaints, painting a stark contrast between the broker's public image and the private struggles of its clients.

While many brokers boast about their awards and regulatory licenses, the reality facing traders on the ground can offer a much darker picture. ThinkMarkets (智汇) currently holds an “A” influence rank and displays a high score of 7.90 on WikiFX, yet our records recognize a disturbing surge in trader distress signals. In just the last three months, WikiFX has received 75 complaints, painting a stark contrast between the broker's public image and the private struggles of its clients.

Anonymity Disclaimer: All cases cited in this report are based on real records submitted to the WikiFX Support Center. Trader identities have been obscured to protect their privacy.

The Regulatory Mirage: Safe on Paper, Risky in Practice?

For African traders, regulatory safety is the first line of defense. On the surface, ThinkMarkets appears robust. WikiFX records show they are regulated by top-tier authorities, including the FCA (UK) and ASIC (Australia). They also hold a license with CySEC (Cyprus) and an offshore license with the Seychelles FSA.

However, for our African readers, there is a critical red flag. The broker's status with the FSCA (South Africa) is listed as “Exceeded.” This regulatory status often implies that a broker may be operating beyond the scope of their permitted financial services in that region. Additionally, their regulation with the FSA (Japan) is currently listed as “Unverified.” While the tier-1 licenses exist, the high volume of complaints suggests that operational compliance might be failing where it matters most: releasing client funds.

The “Forwarded to Finance” Excuse: A Dead End for Withdrawals

The most consistent pattern in recent reports is the breakdown of communication regarding withdrawals. Traders are not just facing delays; they are facing silence. Is ThinkMarkets safe if you cannot access your own capital?

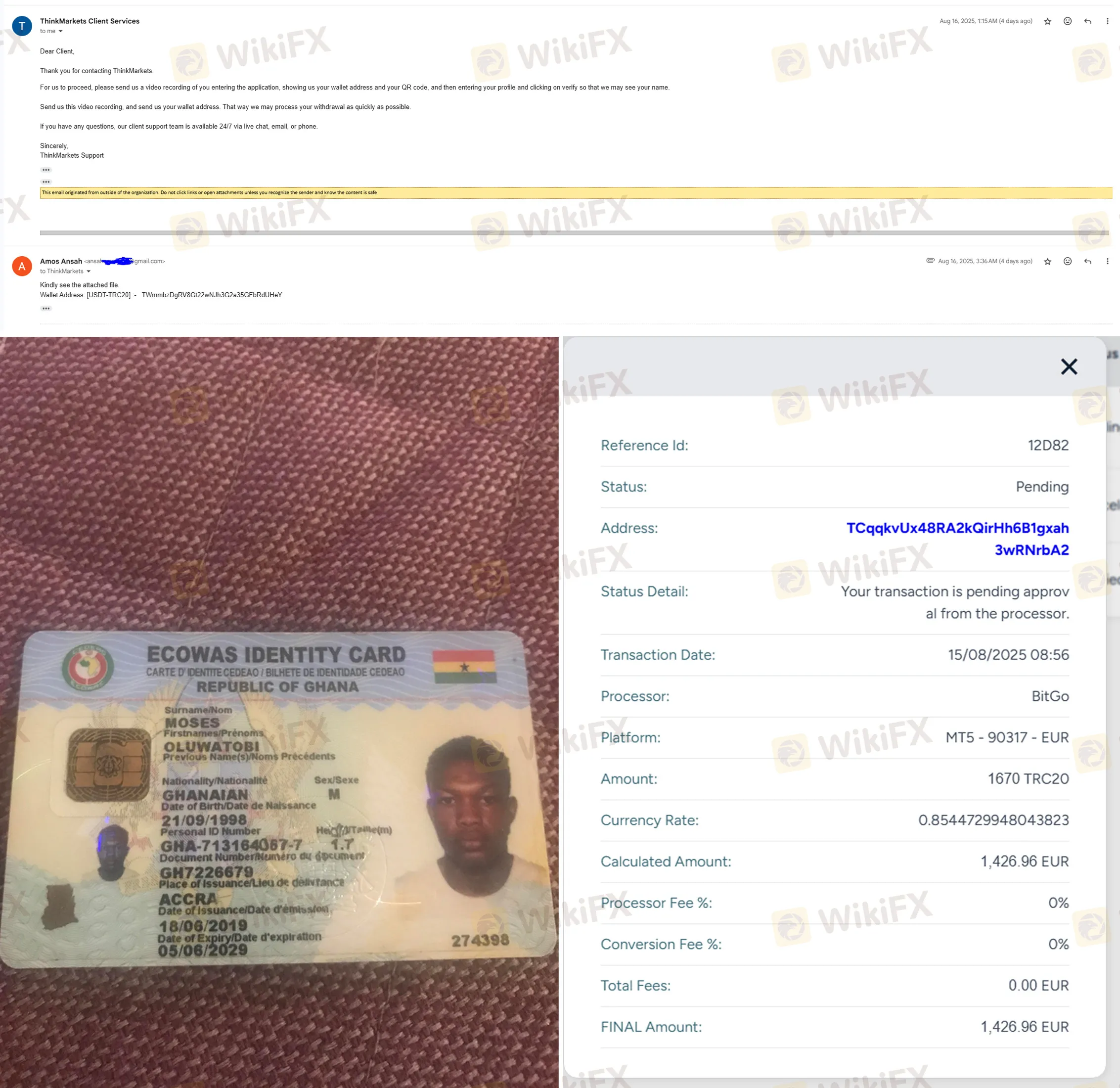

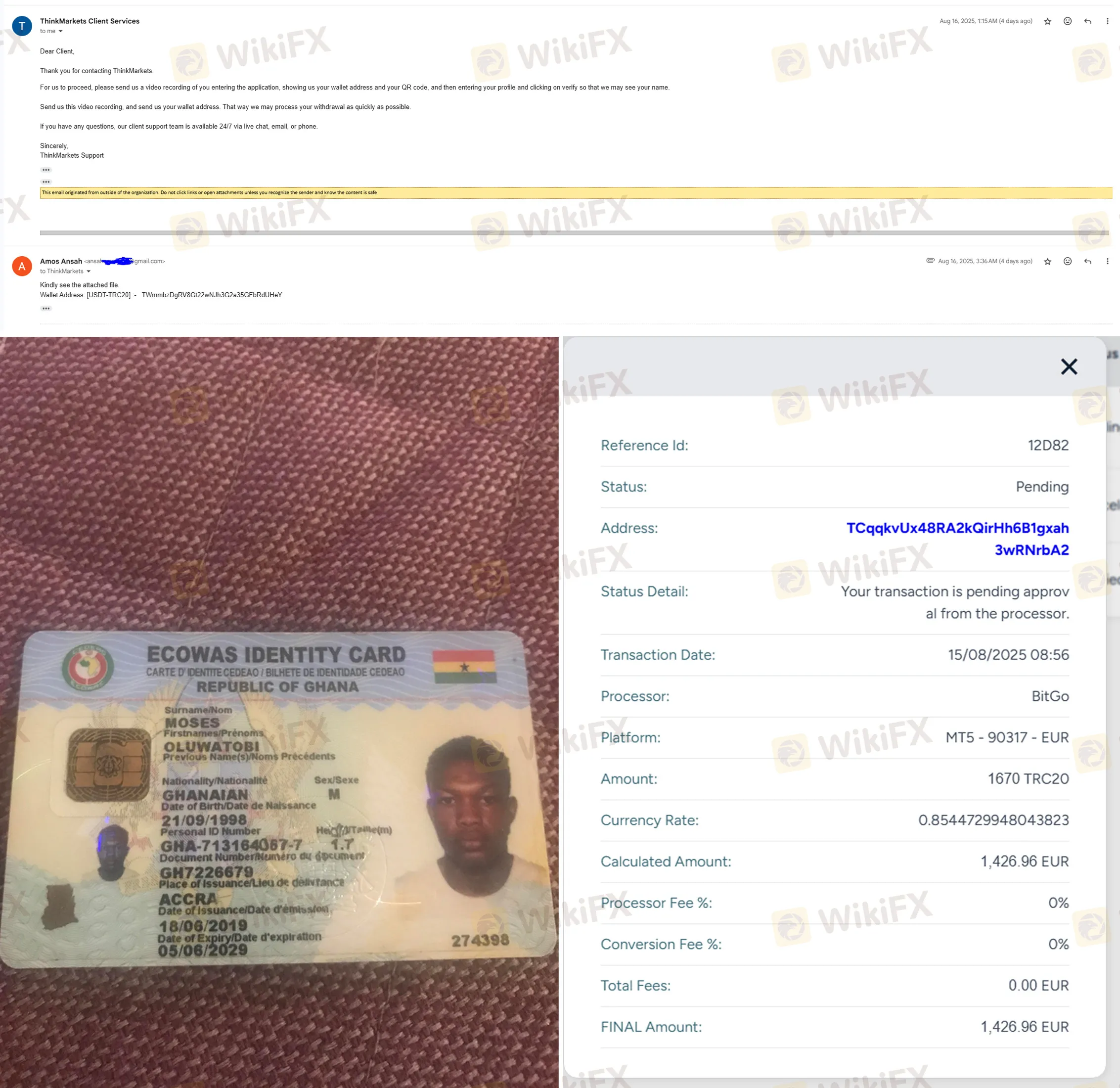

In August 2025, a trader from Ghana reported a harrowing experience regarding a crypto withdrawal. The trader submitted a request (ID: 12D82) which remained pending for days without processing. Despite providing all requested recordings and evidence, the trader was told by live chat support that the issue had been “forwarded to finance.” However, the finance team reportedly ignored countless emails, and the assigned account manager, identified as Rivash Gudar, ceased all communication.

The issue creates a “black box” scenario where support staff blame the finance department, but the finance department is unreachable. This tactic effectively walls the trader off from their money.

Similar issues are plaguing traders globally. In September 2025, another trader reported depositing $200 and attempting to withdraw $188 shortly after due to poor trading conditions. Twenty-two days later, not a single cent had been returned. The support team merely repeated that the request was “processing,” eventually leading the trader to believe their principal was being withheld indefinitely.

System Glitches and “Phantom” Management Fees

Beyond withdrawal problems, recent data points to irregular account activities that erode trust. Traders are reporting system failures that conveniently result in losses, as well as the sudden appearance of questionable fees.

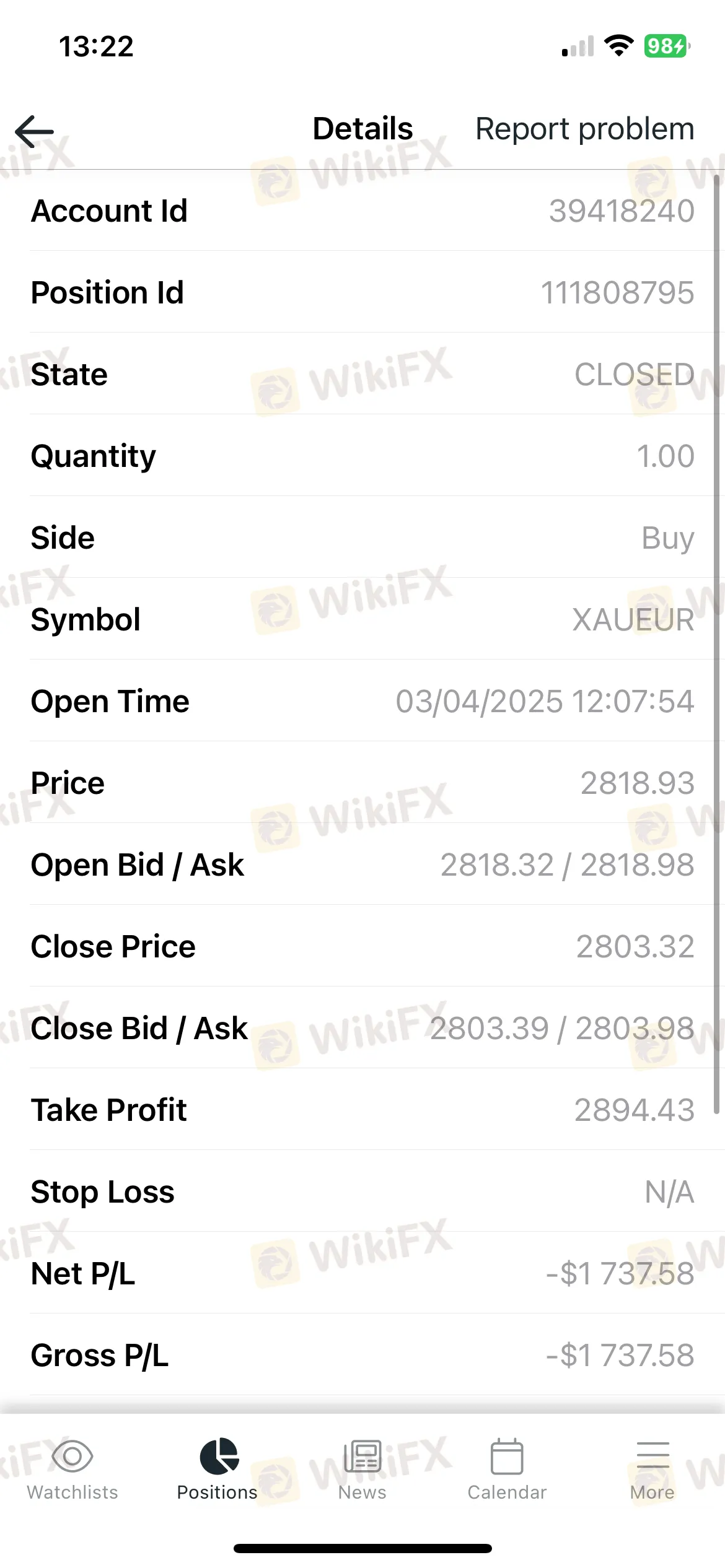

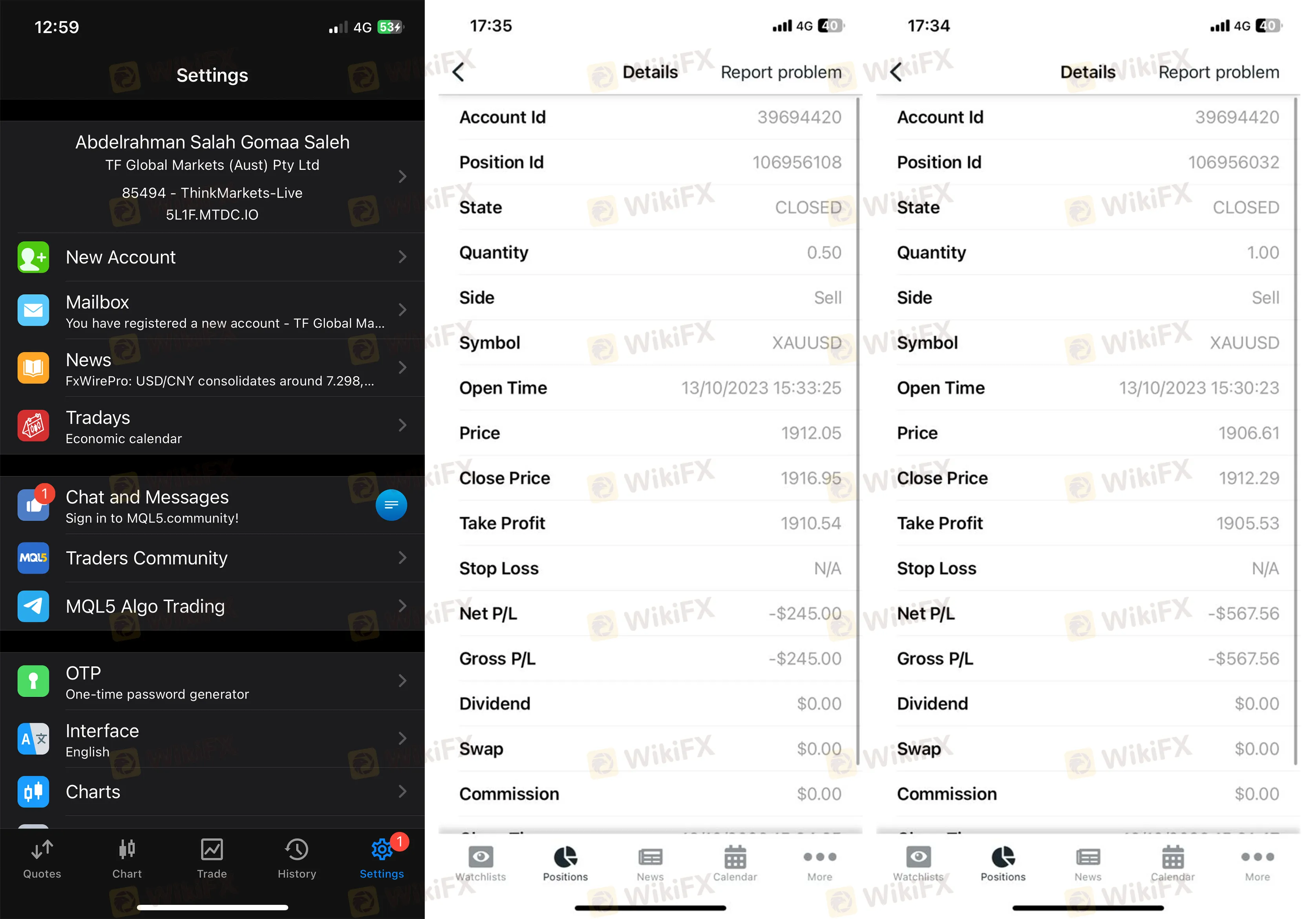

In April 2025, an Egyptian trader reported a serious anomaly where the platform allegedly manipulated leverage and introduced intentional “lagging.” The trader described a situation where the charts on the localized app refused to move correctly, preventing the closure of orders and resulting in financial loss.

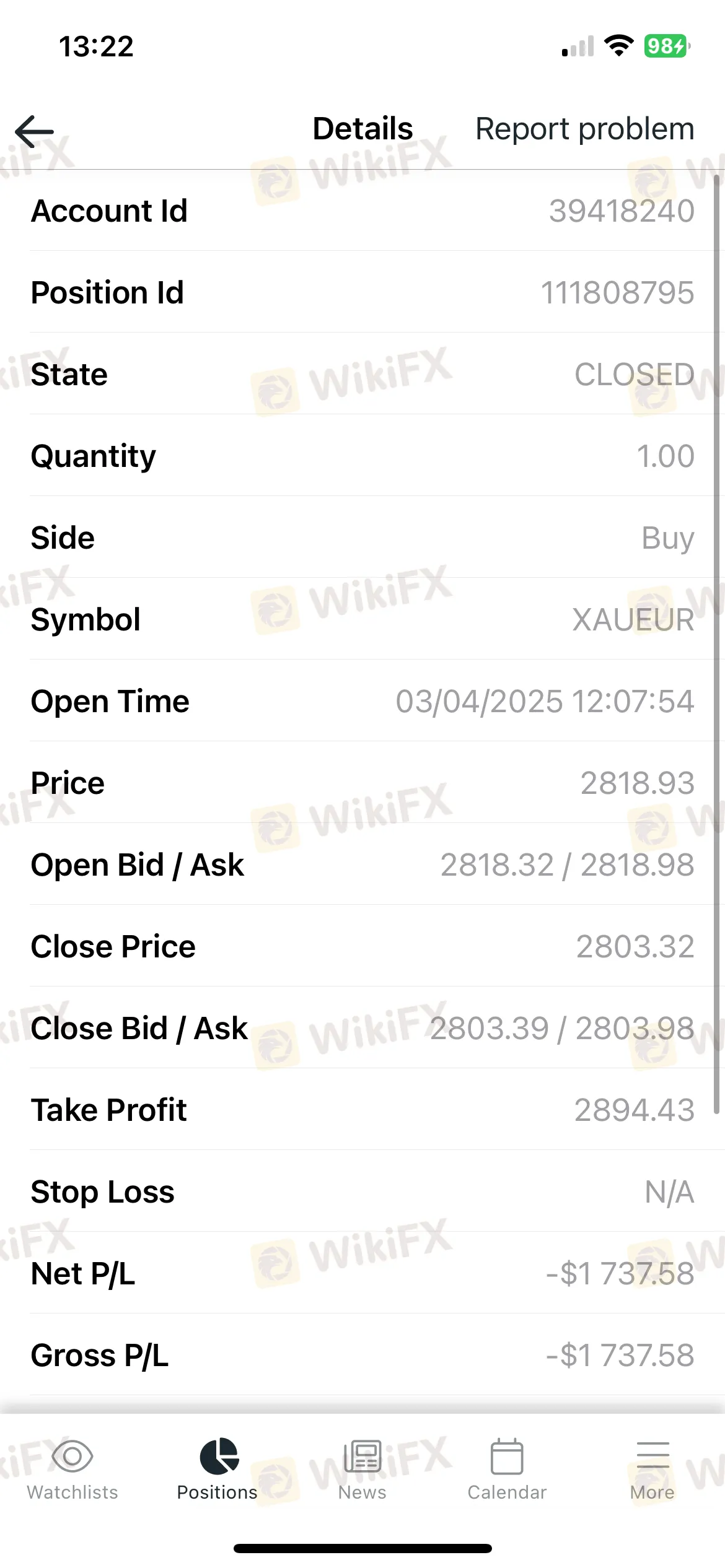

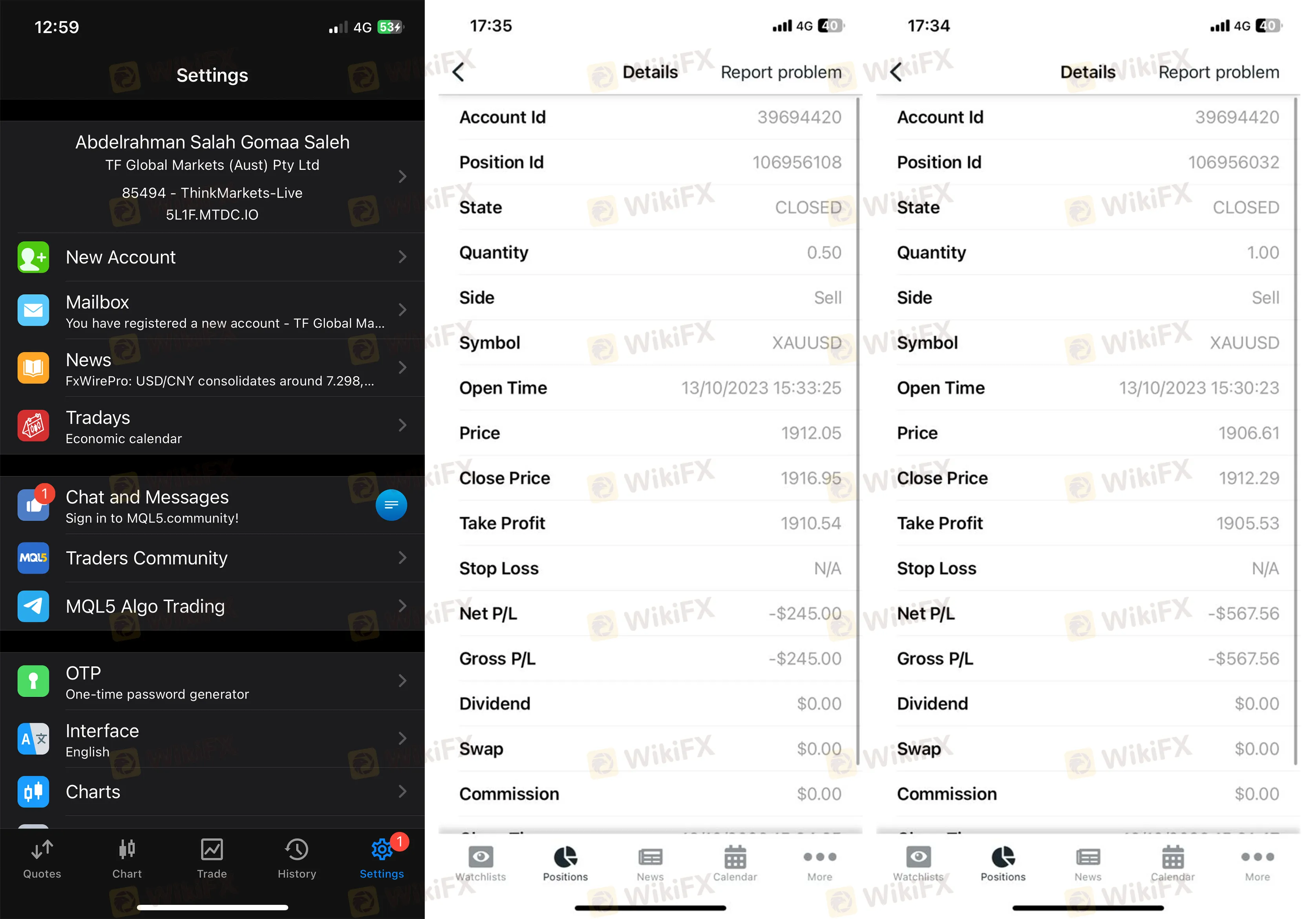

These technical “glitches” are not isolated to the current year. Historical data from late 2024 (Case 8 and Case 18) records similar instances where traders in Egypt witnessed trades opening with massive immediate losses or were unable to close positions until their accounts were wiped out. However, the persistence of these reports into 2025 suggests the technical environment has not improved.

Even more alarming are reports of retroactive fees. In September 2025, a long-term client reported that after holding an account since 2016, the broker began deducting funds under the guise of “management fees” without prior notification. When the trader demanded a refund, they were allegedly told they needed to deposit an additional $1,000 to trigger the return of the fees—a classic pressure tactic often seen in high-risk scenarios.

The Silence of Support

A distinct characteristic of these complaints is the aggressive silence that follows a dispute. Whether the trader is in Ghana, Egypt, or Asia, the ending of the story is often identical: emails go unanswered, and live chat agents provide generic, scripted responses.

One trader from Hong Kong reported in August 2025 that after depositing in June and requesting a withdrawal in July, the broker simply stopped replying to emails entirely.

Verdict: Proceed with Extreme Caution

While ThinkMarkets holds reputable licenses, the sheer volume of recent complaints regarding withdrawal problems and unresponsive support cannot be ignored. A regulatory license is a rulebook, but 75 complaints in three months suggest that the broker may not be following it.

Traders particularly in Africa should be wary of the “Exceeded” business scope in South Africa and the reported difficulties in retrieving funds. If you are currently trading with ThinkMarkets, we advise documenting all correspondence and monitoring your account balance closely.

WikiFX Risk Warning:

Forex and CFD trading involves a high level of risk and may not be suitable for all investors. The data provided in this article is based on current regulatory records and user complaints. Market conditions and broker statuses can change rapidly. Please prioritize the safety of your principal.