Abstract:Are the trading habits you barely notice the very ones quietly destroying your profits, and could a single overlooked mistake be costing you far more than you realise?

Be honest with yourself for a moment. How many times have you clicked into a trade even though you knew you should not? How often have you watched a losing position spiral out of control because you were too stubborn to close it? And how many times have you told yourself that the next trade would be different, only to repeat the same mistake? If any of this sounds familiar, you are not alone. Countless traders repeatedly fall victim to the same destructive habits. These are not minor slip-ups. They are costly behaviours that quietly drain trading accounts and sabotage long-term success. Before you continue risking another pound in the market, it may be time to confront the habits that might already be undermining your progress.

Trading Without a Clear Plan

One of the most widespread issues among retail forex traders is the tendency to trade without a structured plan. Without clear entry and exit rules, traders rely on instinct rather than logic, resulting in inconsistent decisions and avoidable losses. A well-defined trading plan introduces discipline and removes emotion from the decision-making process, which is essential in markets that reward consistency far more than guesswork.

Risking Too Much on a Single Position

Another dangerous habit is risking an excessive portion of capital on a single trade. Whether driven by excitement or the hope of striking a quick win, traders often expose their accounts to unnecessary volatility. A responsible approach to risk limits exposure to a small percentage of total capital, ensuring that no single trade has the power to inflict devastating losses.

Revenge Trading After a Loss

Revenge trading is one of the most damaging behaviours a trader can develop. After a painful loss, many feel compelled to jump back into the market in an attempt to recover quickly. These emotional decisions usually lead to poor judgment, oversized positions, and even bigger losses. The most successful traders recognise the importance of stepping away after a difficult session and returning only when they have regained their composure.

Overtrading Out of Boredom or Excitement

Forex markets operate around the clock, offering endless opportunities and temptations. Many traders fall into the trap of trading too frequently, driven either by boredom or the thrill of activity. Overtrading increases transaction costs, reduces the quality of decisions, and exposes traders to unnecessary risk. Patience is often the most profitable strategy, and waiting for strong, well-justified setups is a skill that separates professionals from novices.

Ignoring Stop Losses

Neglecting stop losses is another bad habit that can cause severe damage. Some traders claim they prefer to monitor trades manually, but when the market moves rapidly, hesitation or panic often leads to deeper losses. A properly placed stop loss is a vital safeguard against sudden volatility and should form part of every traders risk management toolkit.

Letting Winners Turn Into Losers

Traders frequently struggle with the emotional imbalance between fear and hope. Many close profitable trades too early, afraid of losing unrealised gains, while holding on to losing trades much longer than they should because they hope the market will turn. This behaviour destroys risk-to-reward ratios and prevents traders from capitalising on their most promising setups.

Failing to Review Trading Performance

A trading journal is one of the most valuable tools available, yet many traders neglect it. Without documenting and reviewing decisions, mistakes go unnoticed and improvements remain unexplored. Reviewing a journal helps identify patterns, behavioural weaknesses, and growth opportunities. Even minor adjustments informed by past performance can have significant long-term impact.

Changing Bad Habits Matters, But Choosing the Right Broker Matters Even More

Correcting poor trading habits is vital, but there is an even greater danger that many traders overlook. No amount of discipline or skill can protect you if you are trading with an unreliable or unregulated broker. Issues such as withdrawal complications, slippage, unfair execution, or lack of transparency can destroy an account faster than any trading mistake.

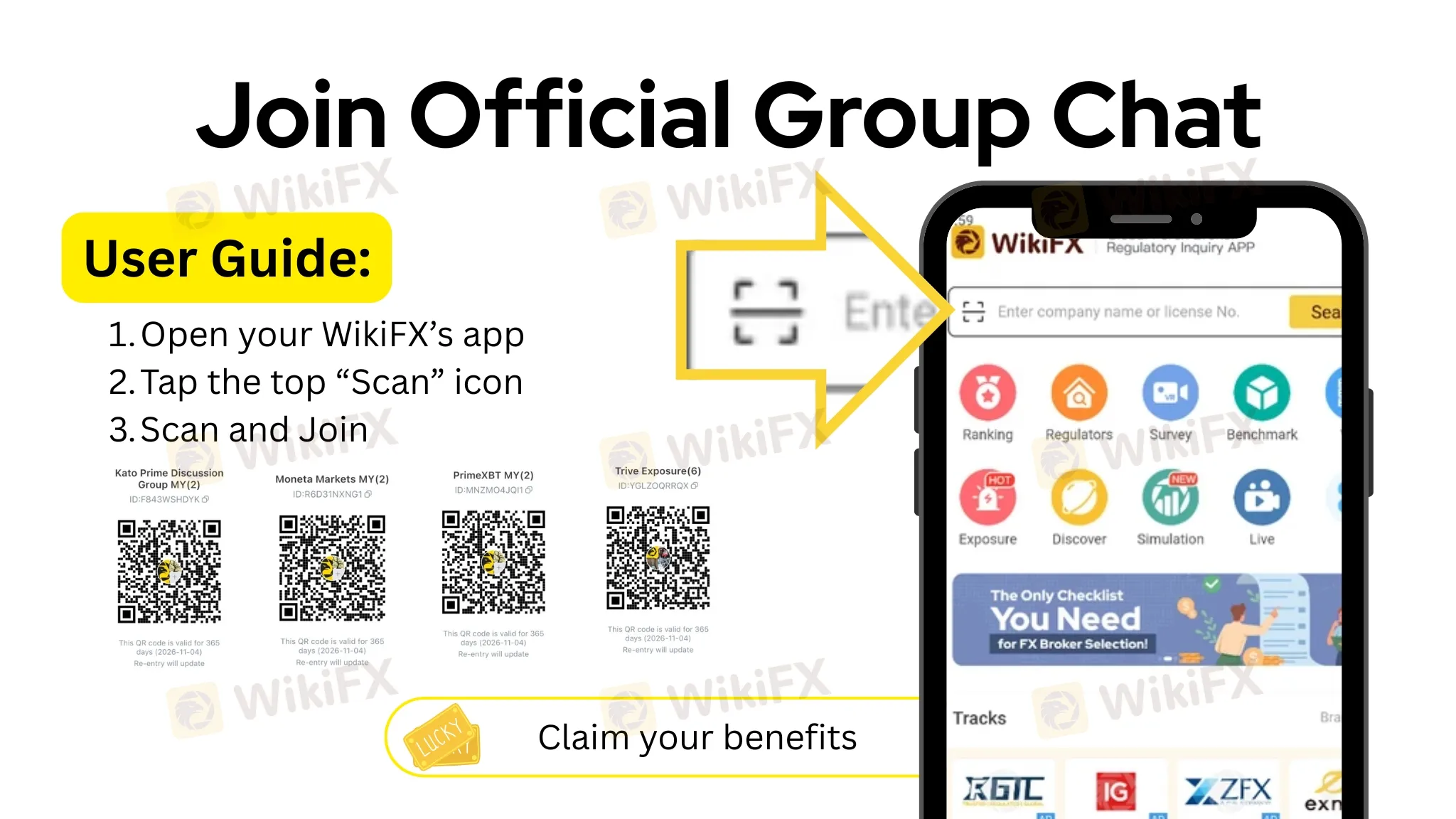

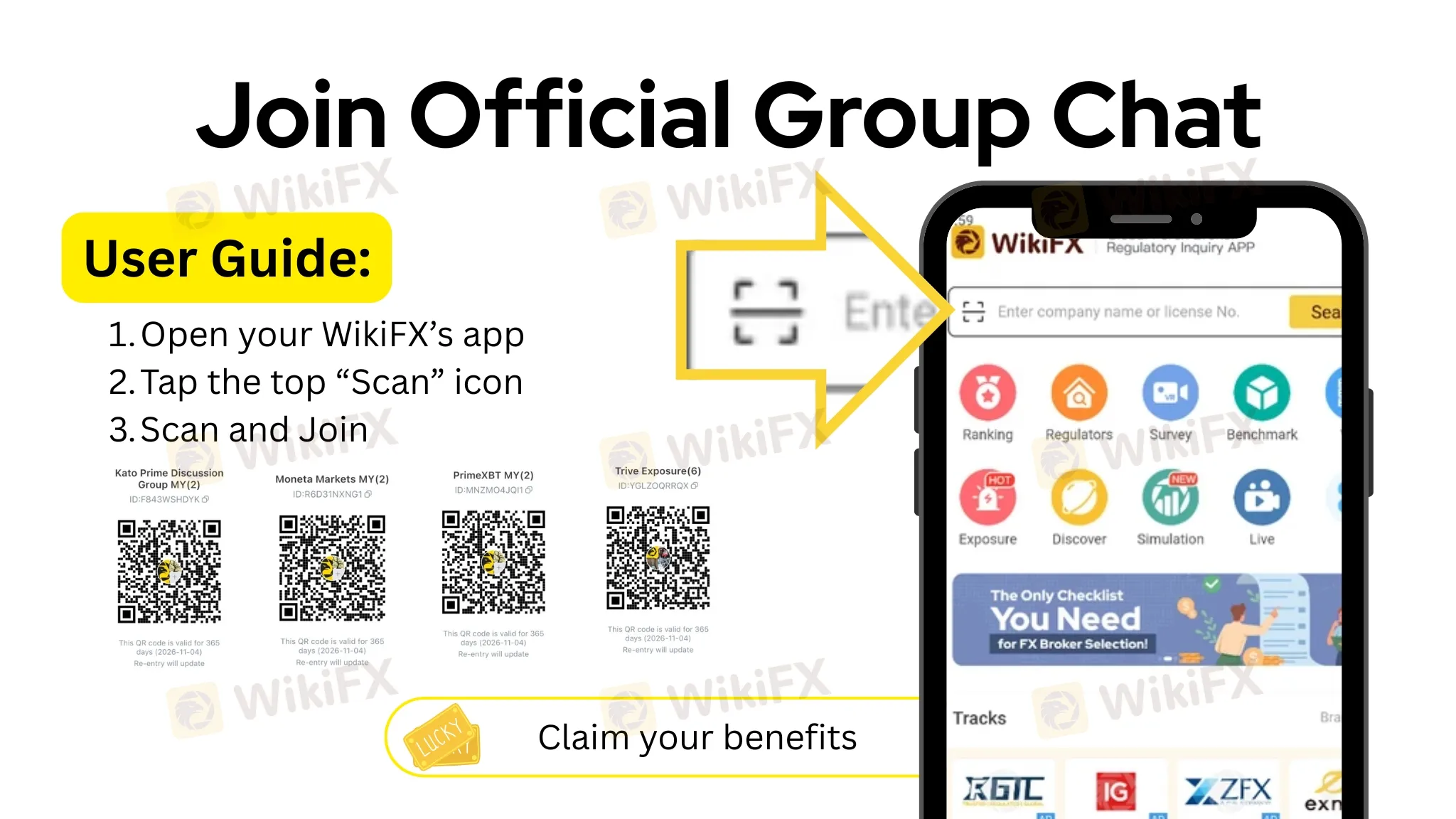

This is where WikiFX becomes an essential ally for traders. WikiFX is a global broker verification platform that provides regulatory information, credibility assessments, trader reviews, and risk alerts for thousands of brokers. Before depositing funds or committing to a platform, traders can use WikiFX to examine the brokers regulatory status and operational reliability. In an industry where trust and transparency are critical, this level of due diligence is indispensable.

Final Thoughts

Every trader has habits, but not all of them lead to success. Recognising and correcting the behaviours that damage your performance is crucial for long-term growth. Yet even more important is the decision of where you place your capital. By developing stronger habits and partnering with a trustworthy broker, you position yourself for greater consistency, control, and resilience in the demanding world of forex trading.