Abstract:Cloudflare outage causes widespread disruption to broker websites and crypto platforms, highlighting risks in web infrastructure reliance.

Cloudflare Outage Disrupts Broker Websites and Crypto Platforms

A significant Cloudflare outage on Tuesday, November 18, 2025, brought parts of the internet to a standstill for nearly three hours, triggering widespread disruptions across various industries. The outage hit major broker websites, including Monaxa, Skilling.com, Xtrade, and FXPro, while also affecting popular crypto platforms, social media services like X (formerly Twitter), and AI tool ChatGPT. This unprecedented service degradation raised fresh concerns about the overreliance on a handful of web infrastructure providers that underpin the modern online ecosystem.

Broker Websites Affected by the Cloudflare Outage

Several online brokers reported temporary outages and service interruptions linked directly to the Cloudflare outage. Monaxa, Skilling.com, Xtrade, and FXPro were among the most prominent affected platforms, experiencing downtime or degraded website functions during the incident. These brokers depend heavily on Cloudflares content delivery network (CDN) and cybersecurity solutions to ensure secure, low-latency access for traders and clients worldwide.

Ran Strauss, CEO of Leverate, noted the outage as a stark reminder of Cloudflares critical role in FX and CFD broker infrastructure. “Cloudflare is not merely a CDN provider but a vital component in the security frameworks of serious brokers,” he said. “This global outage illustrates why protection at this level is mandatory, not optional.” Strauss further underscored that while outages of this scale are rare, they serve as learning opportunities for the entire trading industry, including Cloudflare itself.

The disruption extended beyond just broker websites, impacting broker-related regulatory bodies like the UK‘s Financial Conduct Authority (FCA), which also reportedly faced technical difficulties during the outage. Alongside operational interruptions, Cloudflare’s stock price reacted sharply, dropping approximately 5% in premarket trading as investors responded to the extensive service degradation.

Despite the outage, many brokers managed to keep most operations intact, though some reported challenges related to processing transactions and accessing analytical tools. The incident highlighted both Cloudflares indispensable infrastructure role and the inherent risks brokers face from concentration in web service providers.

Crypto Platforms Experience System-Wide Failures

The Cloudflare outage also swept across the cryptocurrency sector, causing widespread service failures and blocking user access to critical platforms and tools. Several high-traffic crypto websites, including Toncoin, Arbiscan (Arbitrums block explorer), and DefiLlama, experienced major downtime or intermittent “500 internal server errors,” signals that backend servers failed to process requests.

Toncoin declared a “major outage” during the incident that raised alarms over the blockchain network‘s stability and accessibility. Arbiscan went dark shortly after, disrupting blockchain transaction searches and analytics. DefiLlama, a popular decentralized finance data aggregator, also tweeted about intermittent errors, undermining traders’ ability to track market metrics in real-time.

Social media platform X, heavily utilized by crypto traders for information and discourse, similarly faced access issues. Users attempting to reach these services were met with failures that blocked dashboards, trading analytics, and transaction histories — core functions for daily market activities.

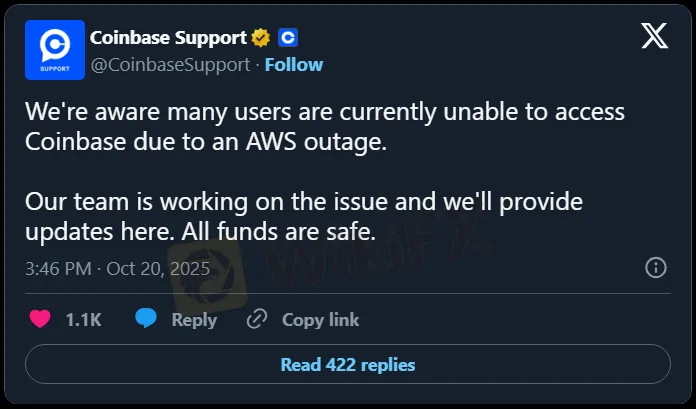

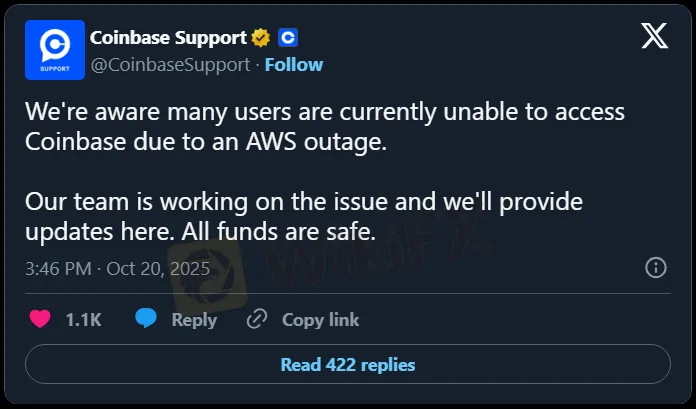

This incident followed closely on the heels of another significant outage last month caused by an Amazon Web Services (AWS) disruption that temporarily crippled major platforms like Robinhood and Coinbase. The repeated infrastructure failures have raised industry-wide debates on the precarious dependence on limited cloud service providers and the urgency for diversified, resilient web infrastructure.

Technical Cause and Response to the Cloudflare Outage

Cloudflares official post-mortem revealed that the root cause of the outage was a bug triggered by an unexpected spike in internet traffic that corrupted their Bot Management configuration file. This error cascaded within the core proxy system, responsible for processing and routing customer traffic, causing it to return widespread HTTP 5xx errors — the standard server error indicating failure to fulfill requests.

Initially, Cloudflare suspected a hyper-scale distributed denial-of-service (DDoS) attack, but investigations quickly pinpointed the faulty configuration file as the source. The faulty file caused the bots module to fail, impacting related services, including Workers KV (key-value storage) and Access, which are integral to Cloudflares security and authentication functionalities.

Cloudflare engineers rolled back to an earlier stable version of the configuration file and implemented mitigations that progressively restored normal operations. The main impact was resolved within approximately three hours, but the company continued to manage residual issues as traffic surged back to normal levels.

Cloudflare‘s communication stressed apologies for the disruption’s scale and acknowledged the importance of their service in the internet ecosystem. The incident underscored both the sophistication of modern web infrastructure and its vulnerability to software configuration errors that can propagate rapidly.

The outage disrupted millions of users globally, illustrating how critical Cloudflares CDN and security services are to the seamless delivery of online content and protection against cyber threats. It also serves as a reminder for companies reliant on such third-party infrastructure to prepare contingency plans for rare but impactful incidents.