Abstract:For traders who want a well-known and powerful platform, having MetaTrader 4 (MT4) available from a broker is very appealing. Uniglobe Markets says it provides this industry-standard software, along with different account types, high leverage, and many trading options. These features seem designed to work for all kinds of traders, from beginners to experts.

However, a trader's success and safety depend on more than just platform features. The trustworthiness and legal standing of the broker are extremely important. This review gives a complete analysis of the uniglobe markets mt4 platform, its trading conditions, and most importantly, a detailed look at the serious safety concerns about the broker's legal status. We will examine the platform's abilities, analyze the fee structure, review official legal actions, and summarize reported user experiences to give a complete picture for anyone thinking about this broker.

For traders who want a well-known and powerful platform, having MetaTrader 4 (MT4) available from a broker is very appealing. Uniglobe Markets says it provides this industry-standard software, along with different account types, high leverage, and many trading options. These features seem designed to work for all kinds of traders, from beginners to experts.

However, a trader's success and safety depend on more than just platform features. The trustworthiness and legal standing of the broker are extremely important. This review gives a complete analysis of the uniglobe markets mt4 platform, its trading conditions, and most importantly, a detailed look at the serious safety concerns about the broker's legal status. We will examine the platform's abilities, analyze the fee structure, review official legal actions, and summarize reported user experiences to give a complete picture for anyone thinking about this broker.

Company Background and Structure

To understand any broker, you must first look at its business foundation. This gives context for how it operates and can show early signs of whether it's legitimate.

Here are the basic details of Uniglobe Markets based on publicly available information:

· Founded: 2014

· Stated Registered Region: United Kingdom

· Company Name: Uniglobe Markets Ltd

· Physical Address: Ground Floor, The Sotheby Building, Rodney Village, Rodney Bay, Gros-Islet, Saint Lucia

A clear problem immediately appears between the stated registration in the United Kingdom and the physical address in Saint Lucia, an offshore location known for less strict financial oversight.

Furthermore, an investigation shows a related company, `UNI SMART SOLUTIONS LTD`, which was registered in the United Kingdom (Registration No. 13579888). According to official records, this company's status has been “Deregistered” since 2021. The connection between these companies adds another layer of complexity to the broker's business history.

*The following information is based on publicly available data. Traders are advised that business structures can be complex and details may change. Always verify before investing money.*

The MT4 Platform Offering

The main attraction for many traders to Uniglobe Markets is its support for the MetaTrader 4 (MT4) platform. We can confirm that the broker provides access to MT4 for Windows, Android, and iOS devices, making it accessible across computers and mobile platforms.

MT4 is recognized worldwide for its strong feature set, which remains an industry standard even years after its introduction. Its user-friendly interface makes it particularly good for beginners, while its advanced capabilities serve experienced traders well. Key features include:

· Advanced Charts: A complete set of tools for technical analysis, with multiple timeframes, drawing tools, and a large library of built-in technical indicators.

· Automated Trading: Full support for Expert Advisors (EAs), allowing traders to use automated trading strategies and custom scripts.

· Customization: A highly customizable interface where traders can arrange windows, save chart templates, and create a workspace tailored to their needs.

Uniglobe Markets holds a “Full License” for the MT4 software from its developer, MetaQuotes. It is important to understand what this means. This license confirms that the broker is using a legitimate, non-pirated version of the trading software. This is a software license and should not be confused with financial regulation from a government authority. A software license ensures the platform works as intended, but it offers no protection for client funds or guarantees fair trading practices.

Server data shows the presence of both MT4 and MT5 servers, with some located in Germany. The performance of these servers, measured by factors such as ping or latency, directly affects trade execution speed. High latency can lead to slippage, where the price at which a trade is executed differs from the price requested.

For traders seeking more advanced features, the broker also offers the MetaTrader 5 (MT5) platform, often positioned as a successor to MT4 with additional timeframes, indicators, and asset classes.

Critical Regulatory Concerns

This is the most important section of any broker review, as it directly relates to the safety of your money. Based on a thorough verification of records as of 2025, it has been confirmed that Uniglobe Markets currently holds no valid financial regulation from any major, reputable regulatory body.

The absence of regulation has serious implications for traders:

· No Investor Protection: Client funds are not kept separate in protected accounts as required by top-tier regulators. If the broker goes out of business, there is no guarantee that clients will be able to get their money back.

· No Compensation Schemes: Traders are not covered by investor compensation funds (like the UK's FSCS or Cyprus's ICF), which protect clients up to a certain amount if a regulated broker fails.

· No Operational Oversight: There is no independent authority monitoring the broker's trading practices, ensuring fair pricing, or managing conflicts of interest. Disputes must be handled directly with the broker, with little to no recourse.

Making the lack of regulation worse, multiple financial authorities have issued official warnings against the company.

Official Regulatory Warnings

The following is a list of warnings issued by European financial regulators concerning Uniglobe Markets:

· Financial Conduct Authority (AMF), France: On February 27, 2020, the AMF added Uniglobe Markets to its blacklist of unauthorized companies and websites offering forex services to French residents.

· Comisión Nacional del Mercado de Valores (CNMV), Spain: On February 10, 2020, the CNMV issued a public warning regarding Uniglobe Markets for operating as an unauthorized firm.

· Cyprus Securities and Exchange Commission (CYSEC), Cyprus: CYSEC has issued multiple warnings flagging the entity. Records show warnings dated October 26, 2023, and August 14, 2025. The future date is noted from the source data and may represent a clerical error, but its presence in the record is a significant flag.

These official warnings from respected European bodies are very serious. They represent a significant risk. Traders considering this broker should check the complete and most up-to-date regulatory profile and any new warnings for Uniglobe Markets on WikiFX before proceeding.

Trading Conditions Explored

Beyond the platform, the specific trading conditions determine the cost and risk of every trade. Uniglobe Markets offers a tiered account structure designed to appeal to different deposit levels.

Leverage Analysis

The broker offers leverage up to 1:500 on its entry-level account. High leverage is a double-edged sword. While it allows traders to control a large position with a small amount of capital, thereby increasing potential profits, it equally increases potential losses. A small market movement against a highly leveraged position can wipe out an entire account balance. This risk is greatly increased when trading with an unregulated broker, where there is no oversight to prevent practices that could be harmful to the client. Regulators in major jurisdictions, such as Europe, the UK, and Australia, have capped retail leverage at much lower levels (typically 1:30) for this very reason.

Spreads and Commissions

The advertised spread “from 0.0 pips” is typically reserved for ECN-style accounts, which usually involve a fixed commission charge per trade. For the entry-level Micro account, the spread starts from 1.3 pips, which is not particularly competitive compared to leading regulated brokers. Traders should be aware that the “from” spread is the best-case scenario and actual trading spreads can be wider, especially during volatile market conditions.

Tradable Instruments

Uniglobe Markets provides access to a standard range of asset classes through Contracts for Difference (CFDs):

· Forex (Foreign Exchange currency pairs)

· Stock CFDs

· Indices

· Metals (Such as Gold and Silver)

· Commodities (Such as Oil)

Based on the available data, trading in Cryptocurrencies is not offered.

While the account variety and instrument list seem appealing, the actual trading experience can differ significantly from marketing claims. It is wise to explore user reviews and feedback on the Uniglobe Markets page on WikiFX to understand real-world performance regarding spreads, execution speed, and overall service quality.

Reported User Experiences

An essential part of any broker assessment involves analyzing the experiences of actual users. Publicly available reports and user feedback paint a concerning picture of the operational practices at Uniglobe Markets. Summarizing these reports reveals several recurring themes.

· Withdrawal Denials: A significant number of traders have reported severe difficulties when attempting to withdraw their funds. These reports often detail a pattern of the broker providing numerous excuses, delaying the process, or outright denying withdrawal requests. This is one of the most serious red flags for any financial services company.

· High Slippage: Multiple users have expressed frustration with high slippage. This occurs when the price at which a trade is executed is significantly worse than the price quoted when the order was placed. While some slippage is normal in fast-moving markets, consistent and excessive slippage can systematically reduce profits and suggest poor execution quality or even manipulation.

· Unexpected Account Blockage: There are also reports of client accounts being blocked or frozen without clear justification, preventing them from accessing their funds or closing positions.

These individual reports are supported by user Q&A, where traders voice their concerns. One user noted that the primary drawback is the lack of regulation, making trading with the broker inherently “riskier.” Another expressed deep caution, stating the absence of oversight means there is nothing to “ensure the safety of my funds.” These first-hand accounts provide a valuable counterpoint to the broker's marketing materials.

Bonuses and Promotions

Unregulated brokers often use aggressive bonus campaigns to attract new clients, and Uniglobe Markets is no exception. It offers a wide array of promotions, each with its own set of terms.

· 100% Deposit Bonus: Requires a $100 minimum deposit and caps leverage at 1:200. The bonus is capped at $5,000 and is valid for 60 days.

· 200% Deposit Bonus: Also requires a $100 minimum deposit, with a 60-day expiry.

· 20% Tradable Bonus: Available for deposits over $100, capping leverage at 1:300.

· Refer a Friend Program: Offers a 10% commission on the initial deposit of a referred client.

· Trade to Win: A loyalty program where traders earn prizes based on their trading volume (lots traded).

While these offers may seem like free money, they come with a significant catch. As an expert in this field, we must issue a strong warning. Bonuses from unregulated brokers almost always come with complex and restrictive terms and conditions. These often include impossibly high trading volume requirements that must be met before the bonus—or sometimes, even the initial deposit—can be withdrawn. This is a common tactic used to lock in client funds, making withdrawals extremely difficult.

Conclusion and Final Verdict

In summary, Uniglobe Markets presents a classic case of appealing surface-level features hiding deep-seated structural risks. On one hand, the broker provides access to the world-class MT4 and MT5 platforms, a tiered account structure, and high-leverage options that may attract traders with a high-risk appetite.

On the other hand, the evidence against the broker is overwhelming and cannot be ignored.

Pros:

· Full support for the popular MT4 and MT5 platforms.

· Multiple account tiers to suit different deposit sizes.

· High leverage options available (up to 1:500).

· Variety of tradable instruments across Forex, indices, and commodities.

Cons:

· A complete and verified lack of any valid financial regulation.

· Multiple official warnings from respected European regulators (AMF, CNMV, CYSEC).

· A business history that includes a deregistered related company in the UK and an offshore physical address.

· Significant and recurring user-reported issues, particularly concerning fund withdrawals, high slippage, and account blockages.

· Use of aggressive bonus promotions with terms that can lock in client funds.

Ultimately, while the features of the uniglobe markets mt4 platform are standard for the industry, they are overshadowed by the substantial risks documented in this review. The combination of no regulation and official government warnings creates an environment where trader funds are critically exposed. Before investing, doing thorough personal research is not just recommended—it is essential. We strongly encourage traders to review the full, detailed profile of Uniglobe Markets on a verification platform like WikiFX to get a complete and unbiased picture.

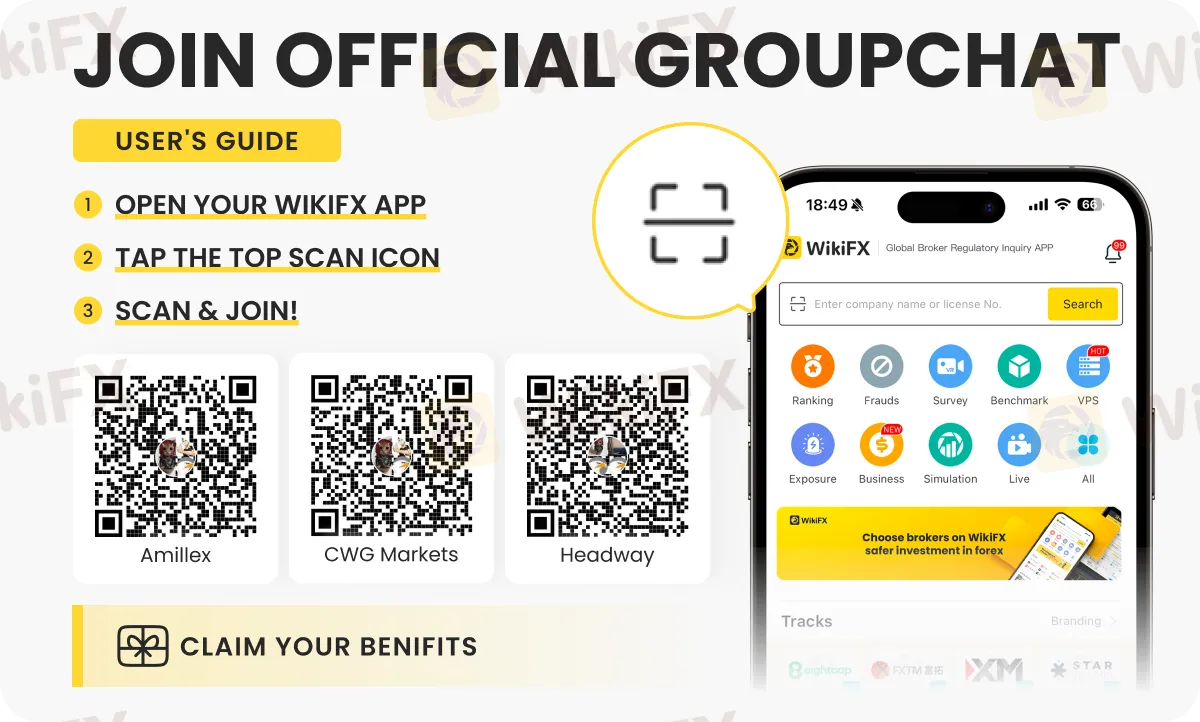

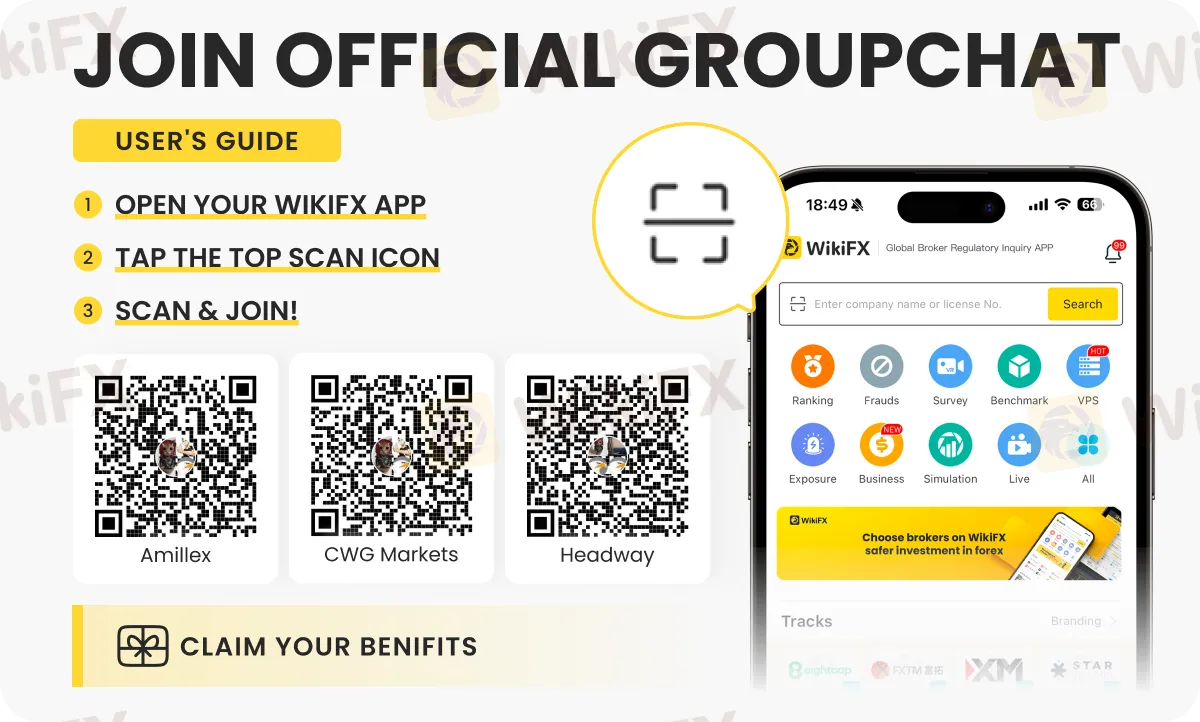

For more details about different forex brokers, join any of these special chat groups (OIFSYYXKC3, 403M82PDMX or W2LRJZXB7G) by following the simple path discussed below.