Abstract:Hong Kong Monetary Authority warns of fraudulent websites imitating major banks, urging the public to stay alert and verify official banking portals.

The Hong Kong Monetary Authority (HKMA) has released a public warning about deceptive websites and

fraudulent online banking login screens that impersonate legitimate institutions, aiming to extract sensitive user information. This comes after reports from the Bank of East Asia, Shanghai Commercial Bank, Chiyu Banking Corporation, and OCBC Bank (Hong Kong) Limited, all of which have distanced themselves from these schemes and reported them to the authority. The HKMA has now incorporated these sites into its consumer warning list to help protect the public from falling victim.

Nature of the Scams

These fraudulent platforms replicate the appearance of official banking portals, complete with familiar logos and layouts, to trick users into entering login credentials, one-time passwords, or other personal details. Often disseminated through unsolicited SMS or emails promising urgent account updates or exclusive offers, the scams exploit trust in well-known banks. The affected institutions have reiterated that they never initiate such communications requesting sensitive data.

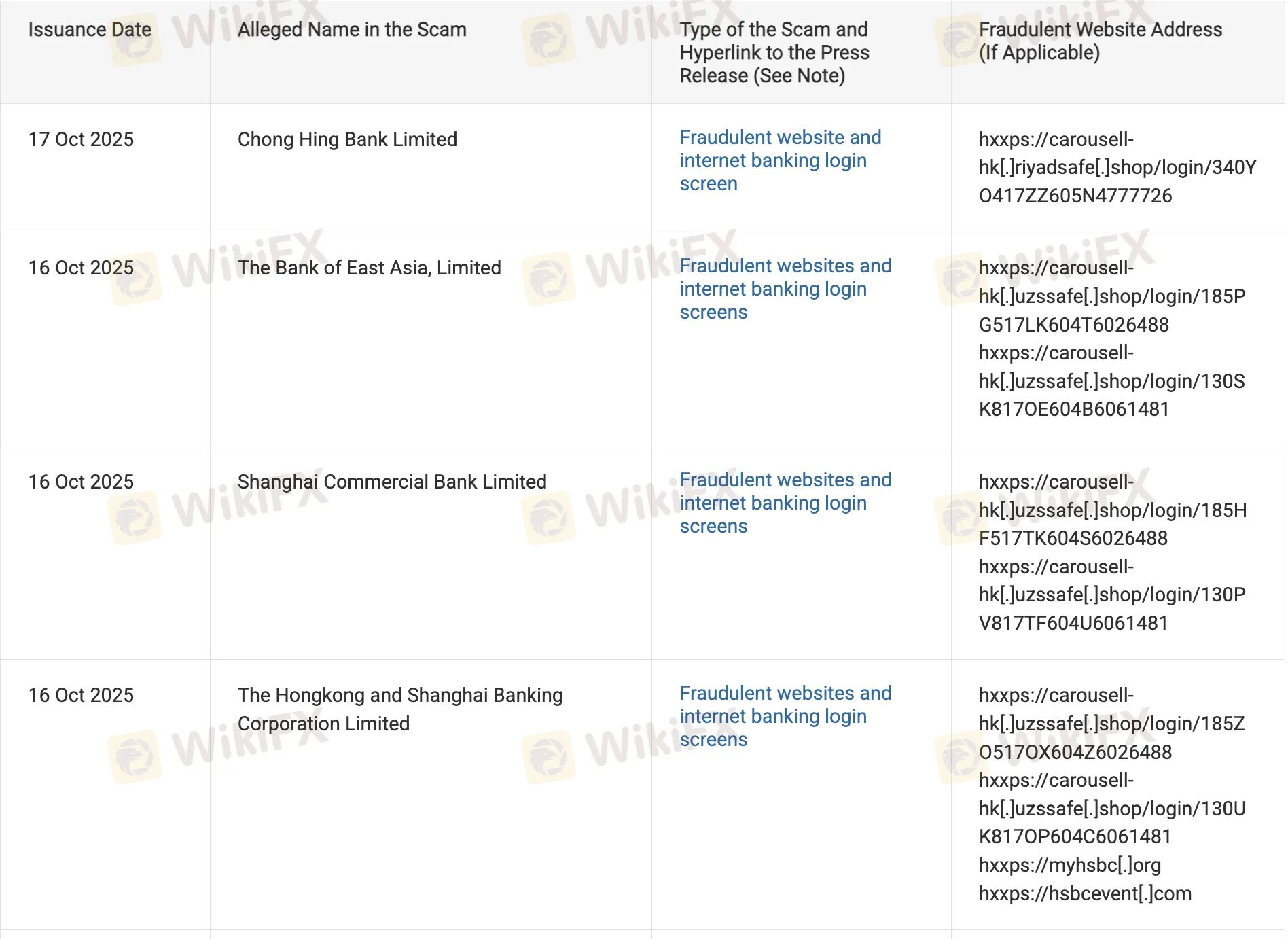

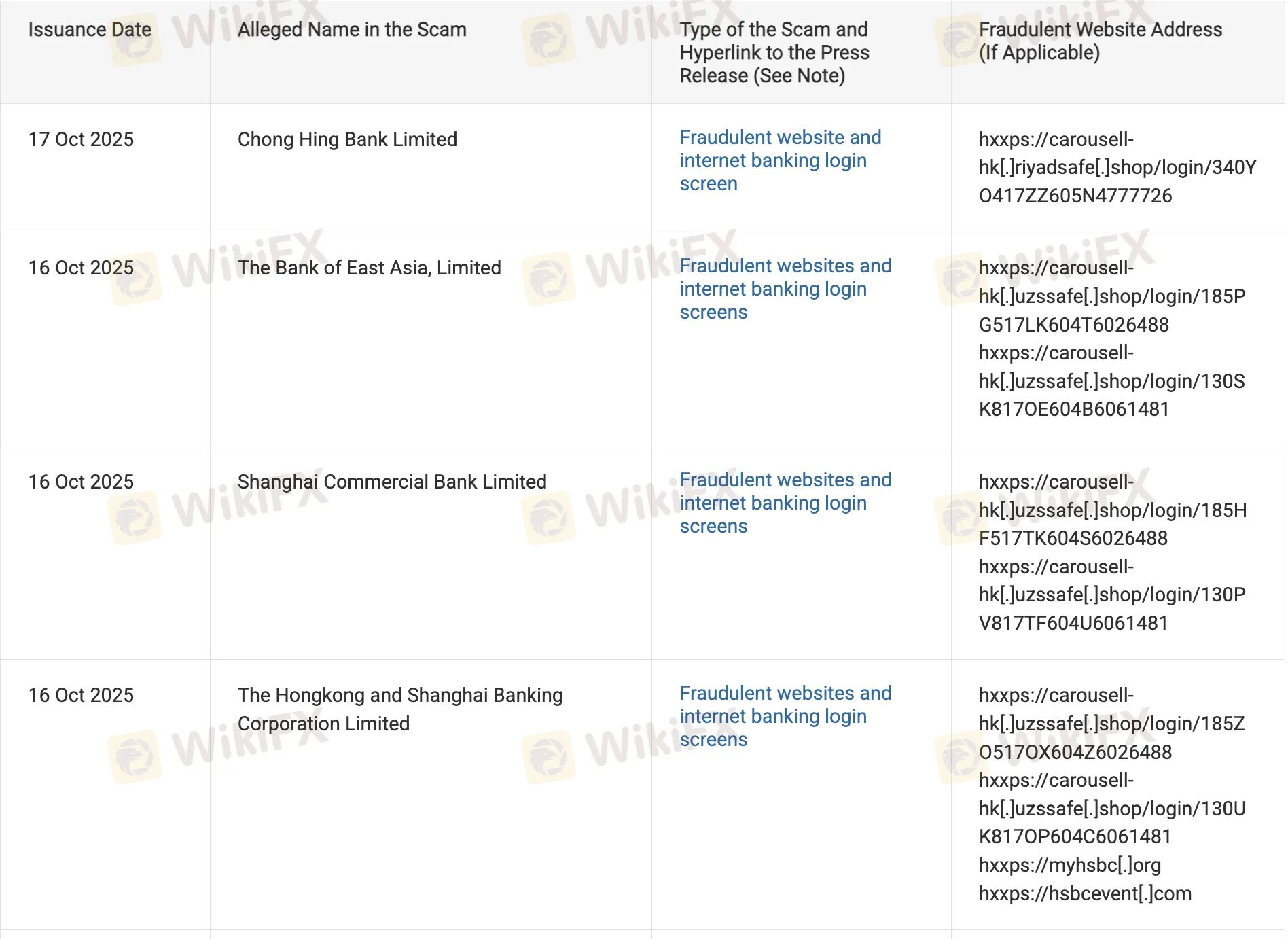

To illustrate the scope, the HKMA's updated list from October 16 and 17 highlights specific instances tied to each bank, focusing on counterfeit interfaces designed for data theft.

Rising Trend in Digital Fraud

The HKMA notes that these incidents reflect a broader pattern in financial cybercrime, where scammers leverage advanced tools to create convincing replicas of banking systems. This wave builds on earlier warnings, such as the September alert about bogus AI investment apps falsely claiming regulatory approval. Factors contributing to the increase include Hong Kong's widespread adoption of mobile banking, which has inadvertently expanded the attack surface for cybercriminals. Experts suggest that international networks may be coordinating these efforts, using low-barrier technology to target regions with high digital transaction volumes.

Recommended Actions for Consumers

The authority advises immediate caution: Legitimate banks do not send hyperlinks for transactions or request OTPs via phone, email, or SMS. If exposed, users should contact their bank to lock accounts and monitor for unauthorized activity. Reporting to the Hong Kong Police Force's Commercial Crime Bureau is also crucial for aiding investigations and preventing further spread.

To prevent such incidents, the HKMA recommends enabling two-factor authentication, verifying website URLs before inputting data, and regularly checking the official warning list for updates. Institutions like PAObank and WeBank are piloting AI-based fraud detection under the HKMA's sandbox initiative, which could soon offer enhanced safeguards.

Implications for Financial Security

This alert highlights the evolving challenges in maintaining trust within Hong Kong's robust financial ecosystem. As digital services grow, so does the need for collaborative efforts between regulators, banks, and consumers to stay ahead of threats.