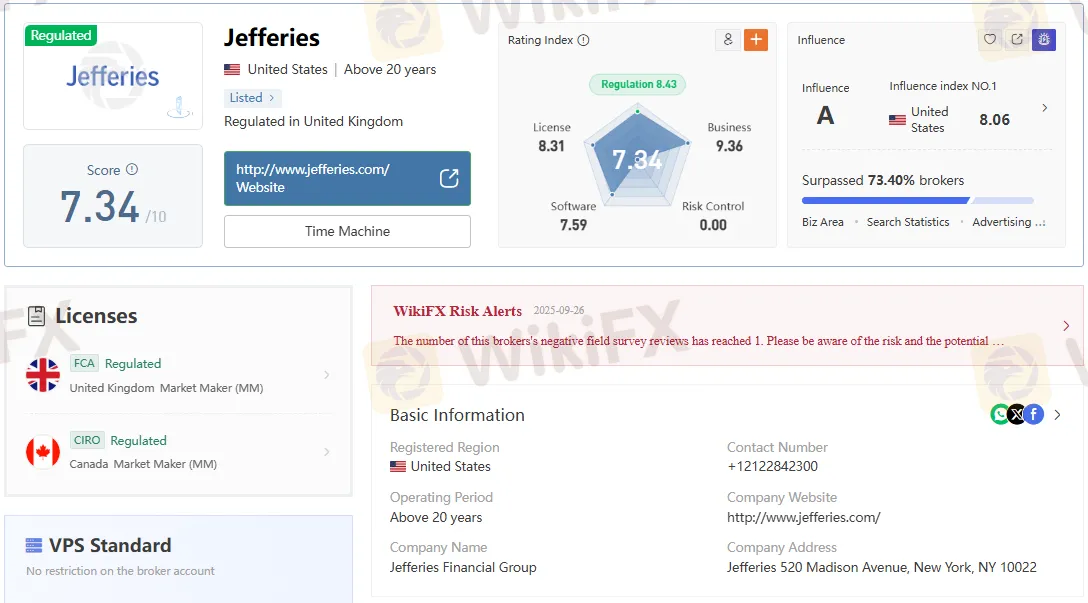

Abstract:Jefferies is a regulated broker under FCA oversight with the license 139253, CIRO oversight in Canada, core services, address at 100 Bishopsgate, London, and risk notes in one guide.

Introduction

Jefferies is a regulated global broker-dealer and investment banking firm whose UK operations are authorized by the Financial Conduct Authority under Market Maker permissions with license number 139253, effective since 2001, and whose Canadian unit is overseen by CIRO, indicating multi‑jurisdictional supervision that supports client due diligence and regulatory verification needs. Jefferies International Ltd is the primary UK licensed entity, with a listed office address at 100 Bishopsgate, London EC2N 4JL, while Jefferies Securities, Inc. is indicated as the Canadian entity supervised by the Canadian Investment Regulatory Organization for market-making activity, aligning with typical cross‑border structures among diversified financial services firms. Corporate information traces to Jefferies Financial Group in the United States, with headquarters contact details at 520 Madison Avenue, New York, reflecting the groups long operating history and global footprint across brokerage, research, and capital markets services.

What is Jefferies

Jefferies is a full‑service financial services platform combining investment banking, equities, fixed income, and prime brokerage with research and client technology, operating for more than two decades under recognized regulators in the UK and Canada, according to the provided dossier. The materials show Jefferies International Ltd, authorized by the FCA as a Market Maker, and Jefferies Securities, Inc., regulated by CIRO, framing Jefferies as a multi‑entity group that intermediates markets and supports institutional and professional clients across regions. The firms public website is listed as www.jefferies.com, and the group parent is referenced as Jefferies Financial Group in the United States, aligning the broker‑dealer entities with a broader corporate structure that houses research and events alongside execution and clearing.

UK FCA license details

The UK section lists Jefferies International Ltd as the licensed entity with FCA authorization type “Market Maker (MM),” a license number of 139253, and an effective date of 2001‑12‑01, indicating long‑standing authorization in the UK market. The registered address is given as 100 Bishopsgate, London EC2N 4JL, with a switchboard number in the +44 0207 range and a contact email noted as abreslin@jefferies.com, providing multiple verification touchpoints for compliance checks and KYC vendor screening. The license is categorized as “Regulated” under the UK jurisdiction and includes mentions of “Licensed Institution Certified Documents” labeled Annex 1 and Annex 2, suggesting that formal regulatory documents or summaries are recorded within the dossier or linked archives.

Canada CIRO regulation

For Canada, the documentation lists Jefferies Securities, Inc. under the Canadian Investment Regulatory Organization with current status “Regulated” and license type Market Maker, which matches the profile of a dealer with trading and market‑making permissions in Canadian markets. The Canadian address is given as 40 Temperance Street, Suite 1910, Toronto, with a listed phone number of 416‑847‑7410 and the organization website shown consistently as www.jefferies.com, which aligns with cross‑entity branding and client portal references. The Canadian license number is noted as “Unreleased” in the provided materials, so direct regulator database lookup would be the next verification step for a compliance team confirming registration details beyond the summary.

Services and business areas

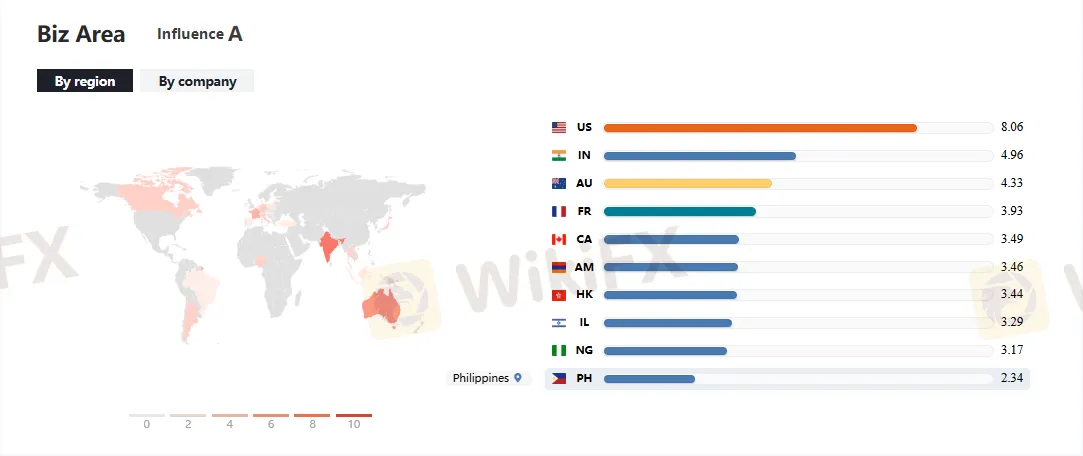

The dossier aligns Jefferies services with prime brokerage, client portals, conferences and events, wealth management interfaces, and institutional tools—consistent with a broker‑dealer supporting execution, financing, and research distribution in addition to corporate access programming. References to “Jefferies JPrime,” “Prime Brokerage,” “Client Portal,” and conference applications suggest a technology and events ecosystem that complements trading, clearing, and securities financing workflows for institutional clients and advisers. Together with investment banking and research under the broader group, the profile fits a capital markets franchise serving issuers and investors in equities and fixed income with distribution supported by market-making permissions where applicable.

Offices and addresses

The UK license address is presented as 100 Bishopsgate, London EC2N 4JL, which is a modern City of London tower frequently associated with financial institutions, aligning with Jefferies‘ European hub narrative in the materials. The parent company address is listed as 520 Madison Avenue, New York, NY 10022, consistent with a Midtown Manhattan presence for a U.S. financial group and facilitating investor relations and corporate headquarters contact. The Canadian office is located at 40 Temperance Street, Suite 1910, Toronto, placing Jefferies’ Canadian dealer within Torontos financial district, which is typical for registered investment dealers under CIRO oversight.

Risk notes and independent checks

The provided dossier includes a risk alert dated 2025‑09‑26, noting one negative field survey review tied to Jefferies, which should be interpreted as a prompt for independent validation rather than a definitive risk conclusion given the single‑instance notation. A separate field note references “A Visit to Jefferies in UK — Finding No Office” dated 2021‑07‑23, which conflicts with the 100 Bishopsgate address and therefore underscores the importance of verifying current tenancy or reception listing directly with the firm or building management when conducting on‑site checks. For due diligence, best practice would be to reconcile any discrepancies via regulator registers, corporate filings, and direct switchboard confirmation using the contacts provided in the regulated entity profiles.

Experience and expertise signals

The UK authorization has been effective since 2001, and the multi‑region regulated status suggests a seasoned operating history often associated with deep market connectivity, counterparty relationships, and institutional‑grade risk frameworks. The materials reference a long operating period, “Above 20 years,” and a U.S.-listed corporate parent, supporting experience claims that matter to institutional allocators and treasury teams assessing execution quality and balance sheet resilience. The combination of market-making permissions, prime brokerage services, and research distribution typically indicates capabilities across liquidity provision, financing, and insight generation, reflecting a comprehensive broker‑dealer offering.

How Jefferies compares

A regulated Market Maker authorization in the UK and CIRO oversight in Canada place Jefferies among globally supervised dealers that can provide liquidity, execution, and financing across regions, which is often a differentiator versus lightly regulated offshore brokers. The presence of a client portal, events platform, and wealth interfaces demonstrates a broader service stack beyond pure execution, potentially enhancing client engagement through research access and corporate access programming. Prospective clients evaluating counterparty risk should weigh the groups regulated status and history against any noted field survey anomalies by confirming office occupancy and current permissions directly in official registers and via listed contacts.

Practical verification steps

Confirm the FCA authorization for Jefferies International Ltd by searching the UK Financial Conduct Authority register using license number 139253, cross‑checking the Market Maker permission set, and 100 Bishopsgate address. For Canada, query CIROs investment dealer member directory for Jefferies Securities, Inc., validating active status, approved business lines, and the Temperance Street office details alongside the listed 416‑847‑7410 number. As a final step, call the UK +44 0207 029 8000 switchboard or the Canadian office to verify day‑to‑day contact details, reception listings, and any client onboarding instructions, documenting outcomes for the due diligence file.

Bottom‑line assessment

Based on the provided documentation, Jefferies operates as a regulated broker‑dealer group with FCA authorization in the UK under Jefferies International Ltd and CIRO oversight in Canada under Jefferies Securities, Inc., supported by a U.S. parent at 520 Madison Avenue and a service stack that includes market making, prime brokerage, research, and client portals. The long‑standing authorization dates, address and contact listings, and multi‑region oversight collectively support a credible compliance profile, though any isolated field survey discrepancies should be addressed with direct confirmations and regulator register checks as part of a standard counterparty risk process. For brokerage decision-making, these attributes position Jefferies as a globally supervised option for institutional and professional clients seeking execution, liquidity, and financing under recognized regulatory frameworks.