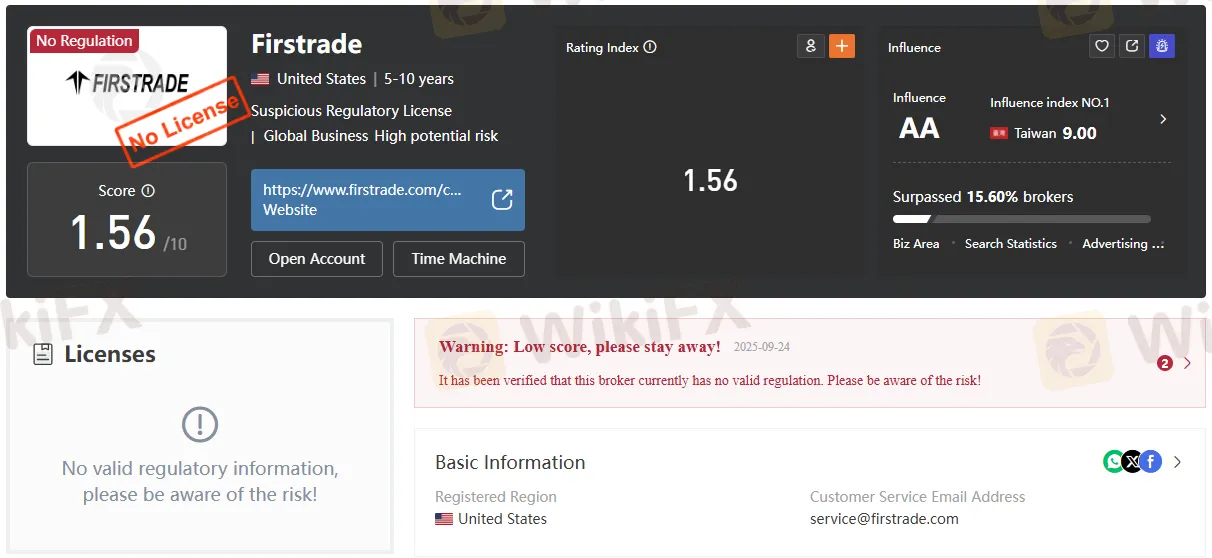

Abstract:Firstrade broker operates as an unregulated broker despite being based in the United States since 1985. The platform lacks formal licensing from major financial agencies, including the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), earning a concerning 1.56/10 safety score.

Regulatory Concerns Challenge Platform's Appeal

Firstrade operates as an unregulated broker despite being based in the United States since 1985. The platform lacks formal licensing from major financial agencies, including the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), earning a concerning 1.56/10 safety score. This regulatory gap raises significant questions about investor protection, particularly when FINRA continues to strengthen oversight requirements for member firms through its 2025 Annual Regulatory Oversight Report.

The absence of FINRA regulation means Firstrade customers miss critical protections typically available through registered brokers. While the platform maintains standard customer service channels and operational infrastructure, the lack of regulatory oversight creates inherent risks for retail investors seeking secure trading environments.

Platform Features and Account Structure

Firstrade provides two primary account categories designed for different investment objectives. The Investment Account accommodates individual or joint ownership structures for stocks, ETFs, options, and various securities trading. The Retirement Account offers traditional IRA, Roth IRA, and rollover options with tax-advantaged benefits for long-term savings strategies.

The platform eliminates minimum deposit requirements and account maintenance fees, removing traditional barriers for new investors. However, the absence of demo accounts limits risk-free strategy testing capabilities that many regulated competitors provide.

Commission-Free Trading Structure

The Firstrade broker implements zero-commission policies across major trading categories. Stocks, ETFs, options, and mutual funds execute without transaction fees or per-contract charges. This commission-free trading approach aligns with industry standards established by major regulated competitors like Charles Schwab, Fidelity, and Interactive Brokers.

Wire transfer services incur standard fees of $25 for domestic and international transfers. Account transfer services through ACAT systems range from $55 to $75, depending on transfer type and scope. These ancillary fees remain competitive within industry benchmarks.

Technology Platform and Trading Tools

The US stock trading platform operates through web-based interfaces and mobile applications for iOS and Android devices. The OptionsWizard Tool provides algorithmic strategy selection based on market forecasts and volatility expectations. This options trading broker's capability mirrors sophisticated tools offered by established platforms like Interactive Brokers.

The mobile trading app integrates portfolio management functions with real-time market data access. Advanced charting capabilities and research tools support both novice and experienced trader requirements. However, the platform limits access exclusively to US markets, restricting international diversification opportunities.

Investment Account Types and Services

Firstrade accommodates general investment accounts and retirement IRA structures without Islamic account alternatives. The platform supports over 11,000 mutual fund options alongside comprehensive stock and ETF selections from major US exchanges, including NYSE, NASDAQ, and OTC markets.

Customer support operates through multiple channels, including toll-free US numbers, international lines for Taiwan and China, plus standard email and WeChat communications. Support hours align with Eastern Standard Time trading sessions Monday through Friday.

Fee Structure Analysis

Non-trading fees remain minimal with free electronic services and standard charges for specialized transactions. ACAT account transfers cost $75 for full transfers and $55 for partial movements. These pricing structures compete favorably against regulated alternatives.

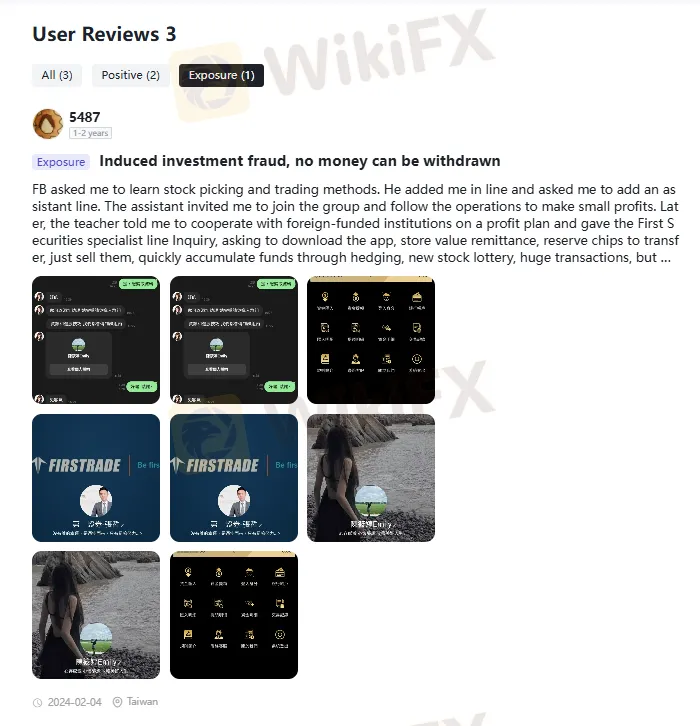

Risk Assessment and User Experiences

User reviews present mixed experiences with concerning fraud allegations documented in 2024. One detailed complaint describes investment fraud schemes involving platform recommendations that resulted in withdrawal restrictions. These incidents highlight risks associated with unregulated broker operations lacking FINRA oversight.

The platform's FINRA regulation creates vulnerability to potential misconduct without standard regulatory recourse mechanisms. Recent FINRA enforcement actions against various brokers demonstrate ongoing regulatory scrutiny that Firstrade avoids through its unregulated status.

Market Position Among Competitors

Commission-free trading has become standard among major US brokers, including Robinhood, Fidelity, and Interactive Brokers. Firstrade competes primarily on pricing while lacking the regulatory credibility that institutional investors typically require. The platform's 40-year operational history provides some legitimacy despite regulatory gaps.

Established competitors offer similar zero-commission structures with additional regulatory protections, advanced research capabilities, and broader international market access. Firstrade's limitations in the US markets and regulatory concerns position it unfavorably against comprehensively regulated alternatives.

Bottom Line

Firstrade‘s $0 commissions, broad mutual fund access, and options-focused tooling make it attractive for cost‑conscious U.S. stock and options investors, but the file indicates no verified regulatory license and flags a low risk score, which materially elevates counterparty and withdrawal risk. For traders prioritizing ultra‑low fees and a simple web/mobile workflow, the platform’s pricing and OptionsWizard can be compelling; however, those who value formal oversight, broader asset classes, demo or Islamic accounts, and clearer dispute‑resolution pathways may find the trade‑offs unacceptable. A prudent approach in 2025 is to verify current licensing directly, test support and withdrawals with minimal capital, and maintain an exit plan via ACAT/DTC transfers before committing meaningful funds.