简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Valutrades Reports Rising Revenue—But Is the Broker Reliable?

Abstract:Valutrades revenue is on the rise. With FCA and Seychelles licenses, does it offer real security? Discover broker performance, regulation, and client views.

From Rising Revenue to Regulatory Questions

Valutrades recent financial filings reveal a business that is expanding in revenue but still grappling with profitability. In 2024, the broker reported £1.94 million in revenue, a 27% rebound from the previous year. Yet despite this growth, the firm booked a net loss of £2.59 million, reflecting rising costs and the lingering impact of a sharp 2023 downturn. For comparison, back in 2022 Valutrades generated more than £6.5 million in revenue and posted a modest net profit of £271,000.

This pattern tells two stories: on one hand, revenue growth signals resilience and ongoing client activity; on the other, the losses raise questions about operational sustainability. That is why traders should not view revenue numbers in isolation. A broker‘s financial results matter, but they must be weighed alongside its regulatory framework, business model, and—crucially—how clients experience its services. This makes an examination of Valutrades’ licensing and regulatory safeguards the logical next step.

Regulatory Framework: Dual Licenses Under Scrutiny

Valutrades operates with a dual-license setup that shapes its global presence. According to WikiFX, Valutrades Limited is regulated by the UK‘s Financial Conduct Authority (FCA) under license number 586541, holding a Market Maker (MM) authorization since 2013. The FCA’s oversight is regarded as one of the strictest in the industry, ensuring strong standards on fund segregation, reporting, and compliance.

At the same time, the broker also operates through Valutrades (Seychelles) Limited, licensed by the Seychelles Financial Services Authority (FSA) under number SD028.

This offshore license provides more flexibility but comes with weaker investor protection compared to the FCA. For traders, this dual framework means that the level of safeguards depends heavily on which entity their account falls under.

Reputation and Client Complaints: Red Flags in User Feedback

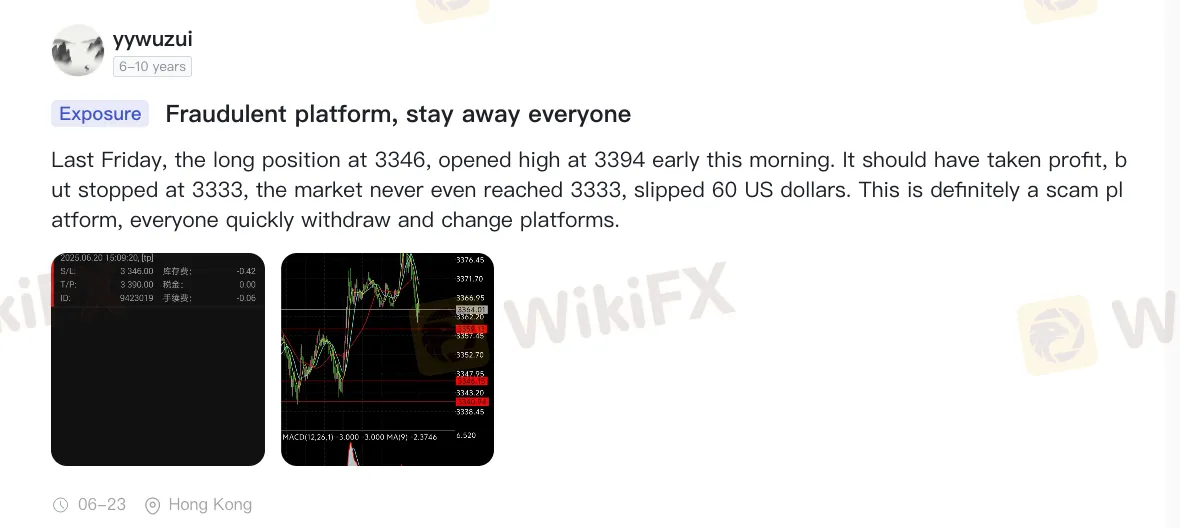

On WikiFX, Valutrades has accumulated a notable number of user reviews, with exposure reports raising consistent concerns. One Hong Kong-based trader alleged that a long position should have closed in profit but was instead slipped by nearly 60 USD, calling the platform “fraudulent” and urging others to withdraw.

Another complaint from the US described a stop-loss order being executed at a far less favorable price than expected, with the user claiming the platform systematically benefits from slippage.

These accounts highlight recurring issues around trade execution and fund security, signaling that despite regulatory coverage, client trust is fragile.

Company Evaluation

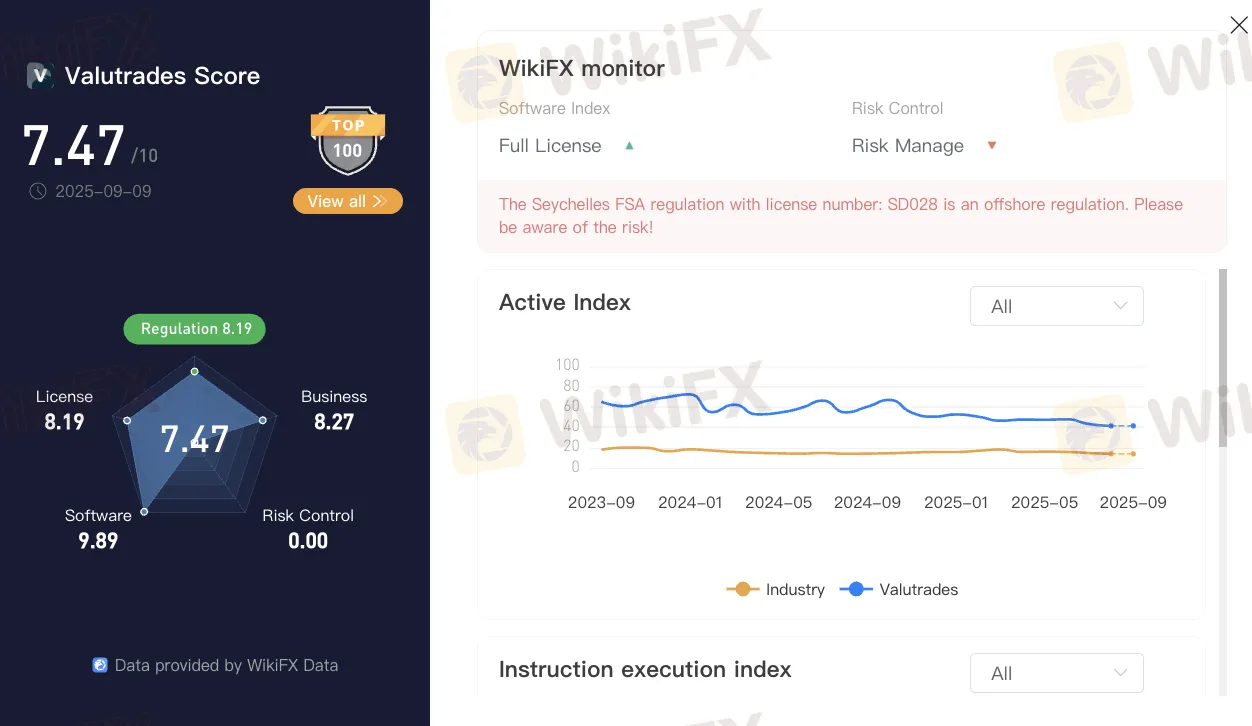

According to WikiFXs rating system, Valutrades currently scores 7.47/10, reflecting a mid-range standing in the forex industry. The score breaks down across several dimensions:

- License Index: Strong due to FCA regulation, though offset by the weaker offshore license.

- Business Index: Average, reflecting modest market presence.

- Risk Control Index: Lower, driven by user complaints and inconsistent client feedback.

- Software Index: Adequate, with support for MT4 and MT5 platforms.

- This mixed evaluation shows that while Valutrades operates under recognized licenses, its reputation among traders is less stable, with the client experience dragging down overall trust.

Conclusion

Valutrades presents a broker with formal regulation in the UK and Seychelles, but the gap between regulatory promise and user experience remains noticeable. WikiFXs scoring indicates a platform with compliance credentials yet surrounded by persistent questions over execution quality and reliability. For investors considering Valutrades, the prudent step is to weigh regulatory strengths against the very real concerns reflected in user feedback.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

CySEC Withdraws CIF License of OBR Investments Ltd (OBRInvest)

RM115 Million Lost in a Month: Are Malaysians Underestimating Investment Scams?

Invest RM300, Make RM10,000? Police Say It’s a Scam

XBTFX Review: Beware of Offshore Regulated Forex Traps

FX Markets: King Dollar Reigns Amid Chaos; BoJ Eyes "Neutral" Rates

War in the Middle East: Oil Spikes and Stocks Tumble as Conflict Enters "Uncharted Territory"

Geopolitical Conflict Drives Gold Rally as Insurers Cut Gulf Coverage

Middle East Tensions Rattle Risk Sentiment: Airspace Closures Signal Supply Fears

Oil Markets Rally as Escalating Middle East Conflict Threatens Supply Lines

Investment Scams That Could Be Targeting Malaysians Right Now

Currency Calculator