简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

FIBO Group Review: After Surrendering Its CySEC License, Is It Still Trustworthy?

Abstract:Is FIBO Group still trustworthy? CySEC license surrendered, FCA authorization terminated, and operations tied to a BVI offshore license. See WikiFX scores and client feedback.

Company Overview

FIBO Group has been in operation for more than 15 years and is registered in the British Virgin Islands. It offers CFDs on forex, precious metals, and crypto, supports MT4/MT5, and provides multiple funding options such as bank transfer, Skrill, and Neteller. While the product menu and platform coverage are decent, the groups core operating footprint sits within an offshore structure, which naturally differs from the investor-protection standards seen in top-tier jurisdictions.

Regulation & Licensing Status

CySEC license surrendered and published: FIBO Group‘s Cyprus investment firm authorization (Fibo Markets Ltd) was voluntarily surrendered and is now publicly reflected on CySEC’s lists. Practically, this removes the firm from the EU MiFID II retail framework for leveraged derivatives.

FCA authorization also terminated: Historical UK authorization has likewise been withdrawn/terminated and is no longer active, meaning the firm is not covered by the UKs domestic protections.

Current status: The groups active oversight is primarily tied to an offshore license in the BVI. Offshore permissions typically involve lighter ongoing supervision and more limited restitution schemes than those found under FCA/ASIC/NFA-CFTC, so traders should factor this into their risk assessment.

Ratings & Sentiment Signals

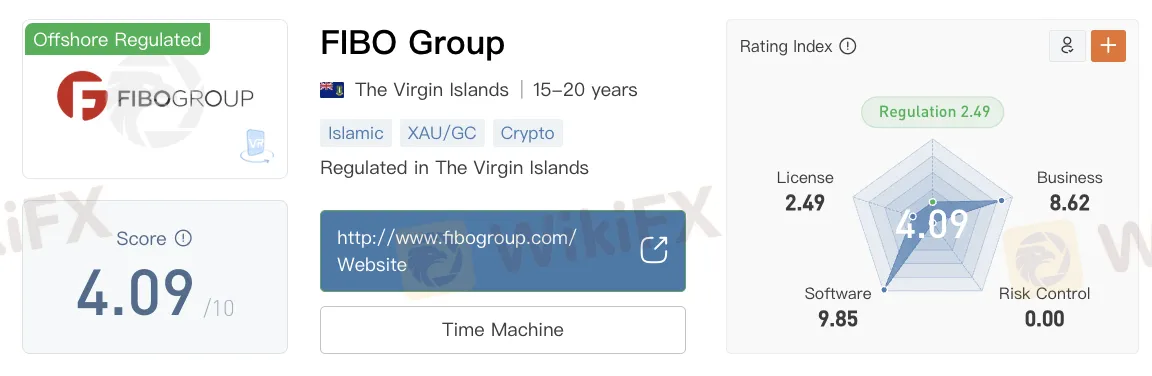

1) WikiFX Composite Score

- Overall score:4.09 / 10

- Regulation index:2.49 (weak regulatory protection)

- Business index:8.62 (market activity/coverage is relatively strong)

- Software index:9.85 (platform connectivity and tools score well)

- Risk control index:0.00 (no clear public signals of robust, transparent safeguards)

This profile reads as “sound access and tooling, but soft regulation and risk governance,” which implies a higher personal risk premium for clients.

2) Client Feedback Snapshot

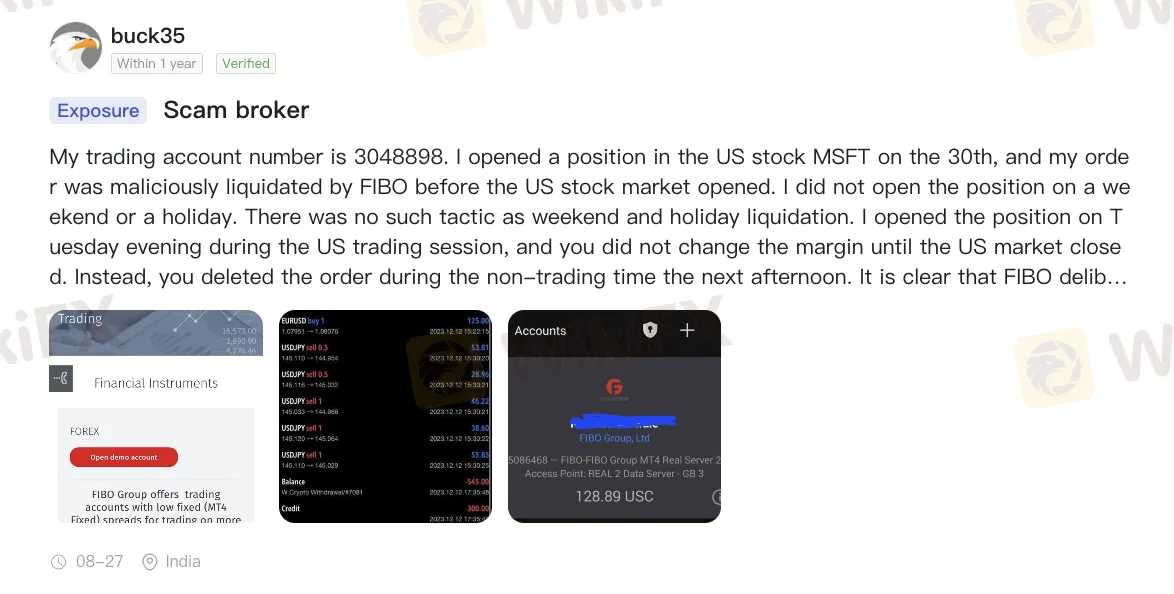

Recent public comments highlight several recurrent themes: some users describe slow or document-heavy withdrawals, others report material slippage or price deviation on executions, and there are disputes around order handling.

More reviews: https://www.wikifx.com/en/dealer/0001861869.html#

Verdict

Post-CySEC exit and without an active FCA authorization, FIBO Group now operates mainly under an offshore framework. On the numbers, its business and software capabilities score well, yet regulatory strength and risk-control transparency are weak.

Traders who prioritize strong restitution schemes, strict client-money rules, and frequent supervisory audits will generally be better served under top-tier regulators (FCA/ASIC/NFA-CFTC). If you still consider FIBO Group, be deliberate about position sizing, funding limits, and withdrawal frequency, and keep monitoring any updates to the groups licensing footprint and client-fund arrangements.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

RM115 Million Lost in a Month: Are Malaysians Underestimating Investment Scams?

Invest RM300, Make RM10,000? Police Say It’s a Scam

Middle East Tensions Rattle Risk Sentiment: Airspace Closures Signal Supply Fears

War in the Middle East: Oil Spikes and Stocks Tumble as Conflict Enters "Uncharted Territory"

CySEC Withdraws CIF License of OBR Investments Ltd (OBRInvest)

Investment Scams That Could Be Targeting Malaysians Right Now

Geopolitical Conflict Drives Gold Rally as Insurers Cut Gulf Coverage

FX Markets: King Dollar Reigns Amid Chaos; BoJ Eyes "Neutral" Rates

Oil Markets Rally as Escalating Middle East Conflict Threatens Supply Lines

XBTFX Review: Beware of Offshore Regulated Forex Traps

Currency Calculator