Abstract:With over RM11 billion already stolen by scams, which is a shocking amount equal to 0.58% of the nation’s GDP last year, Malaysia is moving to crush unlicensed brokers and rogue finfluencers before more investors lose everything.

Malaysia is stepping up its fight against scams and unlicensed trading platforms as losses reach levels that threaten public trust in the financial system. In just five years, from 2020 to 2024, Malaysians lost RM11.23 billion to scams, which is a shocking amount equal to 0.58% of the nations GDP last year.

The Securities Commission Malaysia (SC) has begun direct negotiations with social media giants to close off one of the most common gateways used by scammers: online advertisements. The regulator is pressing for only whitelisted entities to be allowed to promote investment products on platforms such as Meta, TikTok and others. The aim is to choke off the supply of fraudulent ads before they reach unsuspecting retail investors.

This initiative mirrors action taken in India earlier this year, when the Securities and Exchange Board of India ordered intermediaries to verify their identities before advertising on platforms like Google and Meta. The move came after scammers in India flooded digital channels with fake testimonials and promises of risk-free returns. Malaysia is now preparing to follow suit, recognising that unchecked advertising on social media is fuelling a surge in financial crime.

The SCs own statistics highlight the scale of the problem. Almost half of all complaints and enquiries about scams in Malaysia come from Telegram, followed by fraudulent websites and content on Facebook and Instagram. TikTok, while accounting for a smaller share, is also increasingly targeted. Even with cooperative takedown efforts by platform operators, the volume of fraudulent material continues to climb.

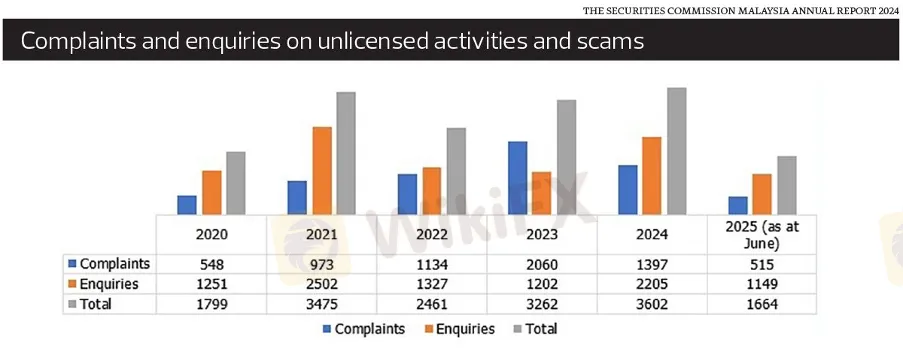

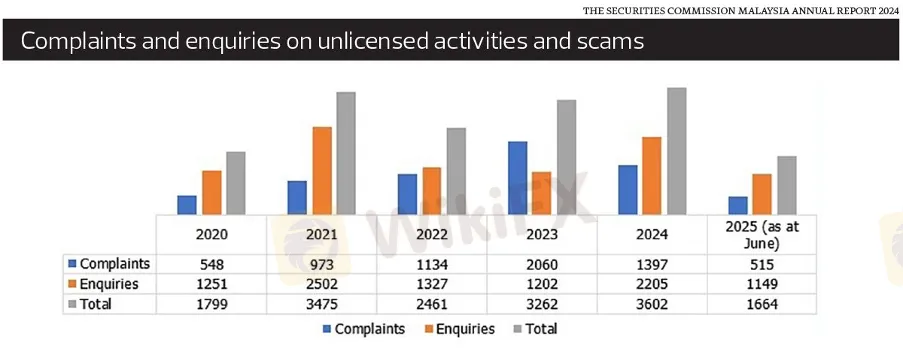

Despite spending over RM3 million annually on scam prevention and public awareness campaigns, the SC admits the numbers are moving in the wrong direction. Complaints have doubled since 2020, with more than 3,600 lodged last year alone. The first half of 2025 has already seen a further 23% increase, signalling that scams are evolving faster than the tools available to fight them.

Fraudsters are no longer relying solely on romance scams or cloned investment firms. They now deploy deepfake videos and AI-generated voices to impersonate legitimate financial institutions. Stolen funds are funnelled through mule accounts and converted via cryptocurrency exchanges, making recovery virtually impossible. The Royal Malaysia Police reported over 35,000 scam cases last year, with losses totalling RM1.6 billion, and blocked more than 3.1 billion scam calls. In just the first four months of this year, over 30,000 scam-related posts were removed from online platforms.

The SC recognises that this is an arms race. In 2022, it created a dedicated Surveillance of Unlicensed Activities unit to hunt for emerging threats. The regulator is now testing AI tools to predict and disrupt scams before they spread, acknowledging that traditional manpower is no match for criminals equipped with advanced technology.

These measures are only part of a wider crackdown. From 1 November 2025, anyone caught promoting unlicensed brokers, including traders, influencers or affiliate marketers, can face fines of up to RM10 million, jail terms of up to 10 years, or both. Even a single post on social media linking followers to an unlicensed broker could soon trigger criminal prosecution. Read this article to find out more about this: https://www.wikifx.com/en/newsdetail/202508158474928915.html

For Malaysian investors, the message is stark: scams are growing in scale and sophistication, and regulators are preparing to hit back harder than ever. But no regulatory framework can substitute for public vigilance. The next scam could be only one click away, and scepticism remains the most powerful defence.

On this note, traders and investors can also use a free mobile application called WikiFX, which serves as a valuable tool for verifying the legitimacy of brokers and financial platforms. WikiFX offers an extensive database of global broker profiles, regulatory status updates, and user reviews, helping users make informed decisions before committing to any investment. Its risk ratings and alerts on unlicensed or suspicious entities can highlight potential red flags, including brokers flagged by the SC. With just a few clicks, investors can see a broker's background in full transparency, which is an important step that could save both money and peace of mind.